VOD/OTT Streaming Platform – 10 Year Financial Model

Financial Model providing a 10-year financial plan for a startup or operating Video in Demand/Over-the-top Streaming Platform.

An over-the-top (OTT) media service (also known as Streaming platforms) is a media service offered directly to viewers via the Internet. The term is most synonymous with subscription-based video-on-demand (SVoD) services that offer access to film and television content (including existing shows and movies for which rights have been acquired from the content owner, as well as original content produced specifically for the service).

With VOD, convenience is key. Viewers can choose what they want to watch, where they want to watch it, and when. As such, VOD streaming is never live, nor does it require a physical copy of the content being viewed (as with DVDs or Blu-ray Disks).

This Financial model presents a scenario of a startup or existing subscription video-on-demand over-the-top streaming platform. The model includes assumptions and calculations of Initial Investment Costs, Paid and Organic Users Acquisition, Subscription and Ancillary Revenue Direct Costs (Licensing, Production, R&D, etc.), Payroll, Operating Expenses, Fixed Assets & Depreciation, Financing through Debt & Equity and Exit Valuation assumptions in case of a potential sale of the business.

The model follows Financial Modeling Best Practices principles and is fully customizable.

Detailed instructions for the functionality of the model are included in the Excel file.

Inputs:

• User Acquisition metrics (Paid & Organic, Churn Rates, etc)

• Subscription Revenue Assumptions (3 types of subscription packages, 3 types of payment plans, subscription fees, discount % per plan, etc.)

• Ancillary Revenue Assumptions (the model provides inputs for 3 different ancillary revenue sources)

• Startup CapEx and Setup Expenses (apply only for startup businesses)

• Payroll per Department, OpEx & CapEx Assumptions

• Financing & Capital Structure – Uses & Sources of Cash analysis (Financing through Equity & Debt)

• Exit Year Scenario & Valuation Multiples

Outputs:

• Monthly Operating Budget & Budget summary per Year

• Budget vs. Actual Variance Analysis

• 10-Year Financial Forecast (3 Statement Model) & Direct Cash Flow Report

• Breakeven Analysis, KPIs and Financial Ratios (Revenue & Cost Metrics, ROE, ROIC, Profit Margins, etc.)

• Dynamic Dashboard including key business metrics & charts analyzing business performance.

• Business Valuation (incl. Enterprise & Equity Value, DCF, Terminal Value, Unlevered & Levered Cash Flow, Project Return Metrics & Sensitivity Analysis)

• Investors (PE) Distribution Waterfall Model

• Professional Executive Summary

Help & Support

Committed to high quality and customer satisfaction, all our templates follow best-practice financial modeling principles and are thoughtfully and carefully designed, keeping the user’s needs and comfort in mind.

No matter if you have no experience or are well versed in finance, accounting, and the use of Microsoft Excel, our professional financial models are the right tools to boost your business operations!

If you, however, experience any difficulty while using this template and you are not able to find the appropriate guidance in the provided instructions, please feel free to contact us for assistance.

If you need a template customized for your business requirements, please e-mail us and provide a brief explanation of your specific needs.

Similar Products

Other customers were also interested in...

Subscription Business – 10 Year Financial Model

Financial Model providing a 10-year financial plan for a startup or operating Subscription Business.... Read more

“Netflix for Gadgets” – Consumer-Tech Subscr...

An integrated, dynamic and ready-to-use financial model for Consumer-Tech Subscription/Rental Busine... Read more

Video Streaming Financial Model Excel Template (Fu...

Fully-Vetted Comprehensive Video Streaming Financial Model + Video Streaming Guide eBook + Youtube V... Read more

Youtube Content Creator Financial Model Excel Temp...

The UPtick Youtube Content Creator Template is a simple yet robust financial model that allows you t... Read more

Digital Media Financial Model Excel Template (Full...

The UPtick Digital Media Template is a simple yet robust financial model that allows you to make int... Read more

Social Media Platform – Dynamic 10 Year Financia...

Financial Model providing a dynamic up to 10-year financial forecast for a startup Social Media Plat... Read more

Film Production Financial Model

Financial Model presenting a Film Production Scenario including Production Budget, Distribution Anal... Read more

Film Production 10-Year 3 Statement Financial Proj...

10 year rolling financial projection Excel model for a new or existing film production business with... Read more

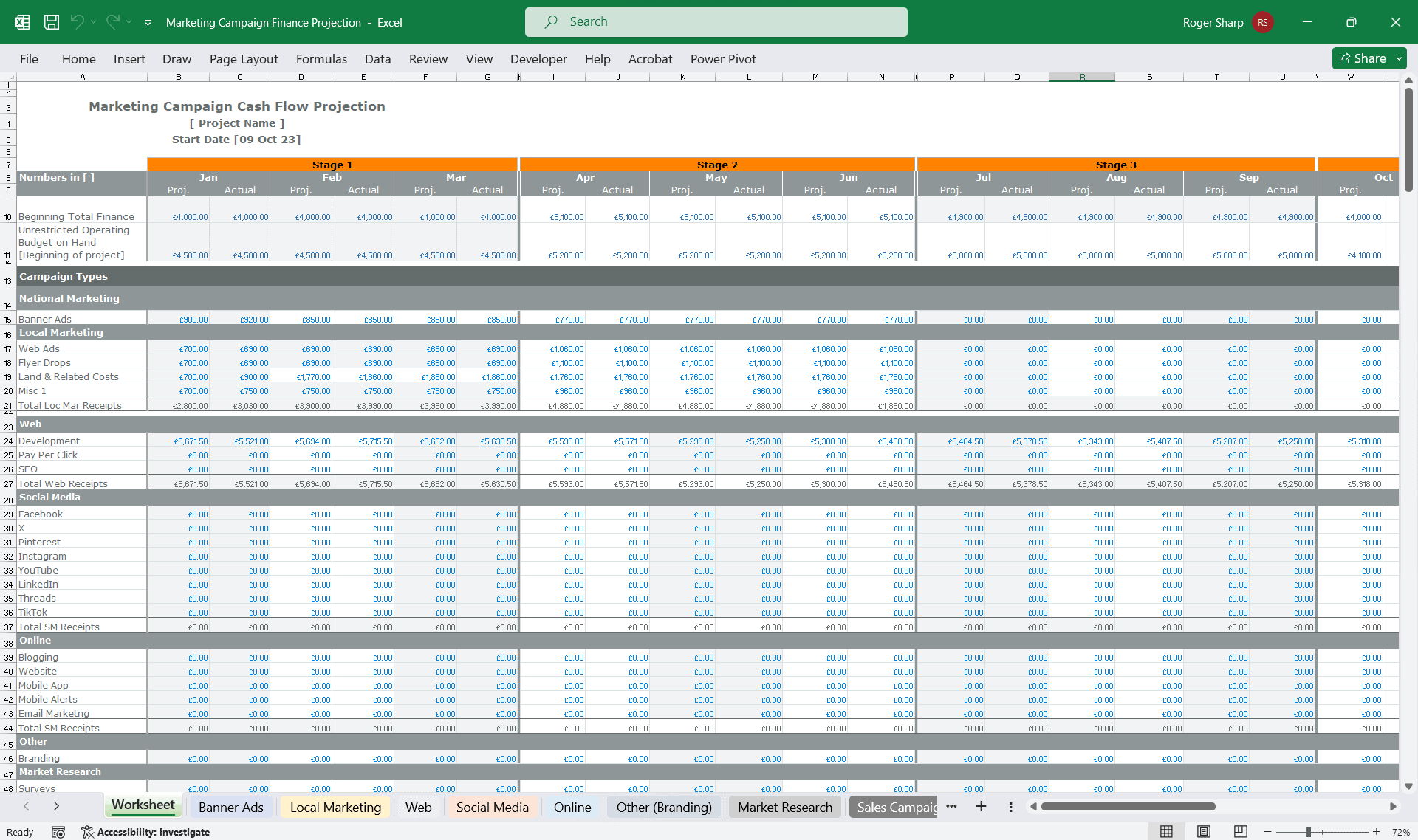

Marketing Campaign Financial Projection Model

Comprehensive editable, Excel spreadsheet for tracking marketing campaign financials in months or st... Read more

SaaS Startup Financial Model – Enterprise an...

Advanced Financial Model providing a dynamic up to 10-year financial forecast for a Software as a Se... Read more

You must log in to submit a review.