Financial Services

Diagnostic and Analysis Center Financial Model

It is excel financial model for financial forecasting of a…

Venture Capital Fund Financial Projection Model with Distribution Waterfall

Highly versatile venture capital fund financial projection model with equity,…

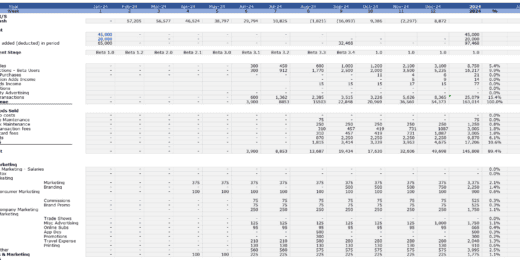

Fintech Mobile App Financial Model

A comprehensive editable, MS Excel spreadsheet for tracking Fintech Mobile…

Private Equity Fund Financial Projection Model with Distribution Waterfall

Highly versatile private equity fund financial projection model with calculations…

Accounts Receivable Dashboard

Enhance Accounts Receivable Management with Excel Spreadsheet Template

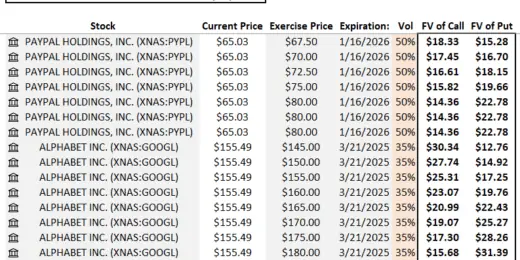

Equity Options Fair Value Calculator (Black-Scholes)

The Equity Options Fair Value Calculator (Black-Scholes) is your go-to…

Comprehensive 3-Statement Financial Model for Banking Business

The Comprehensive financial model for Banking is an interactive, flexible,…

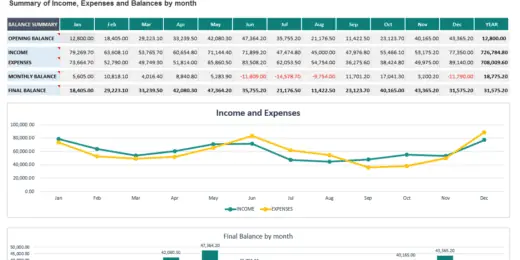

Income and Expenses Excel Dashboard

The Monthly Income and Expenses spreadsheet provides a comprehensive insight…

Crypto Token Valuation Model

A cutting-edge crypto token valuation model, designed to provide comprehensive…

Buy Now Pay Later DCF Model & Valuation (10 Year DCF Model)

The Buy Now Pay Later (BNPL) Company financial model is…

Letter of Intent for Business Acquisition Template (Share Deal)

Seize the opportunity to streamline your business acquisition process with…

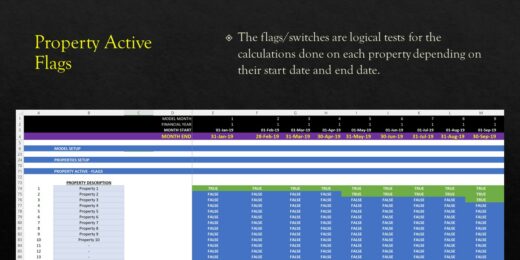

Leasing Company 5-Year Financial Projection Model

5 year rolling financial projection Excel model for a leasing…

Crypto Trading Platform – 5 Year Financial Model

Financial Model presenting an advanced 5-year financial plan of a…

IFRS 16 Lease Accounting For Lessors Excel Calculation Model

Excel calculation model to calculate accounting movements and balances for…

Microfinance Platform – 5 Year Financial Model

Financial Model presenting an advanced 5-year financial plan for a…

Buy Now Pay Later (BNPL) Platform – 5 Year Financial Model

Financial Model presenting an advanced 5-year financial plan for a…

Online Payments Platform – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for a…

Amortization Schedules Template (Loans, Mortgages, LC, Bonds, Leases)

User friendly template including Amortization Schedules for Loans, Mortgages, Operating…

Simple Mutual Non-Disclosure Agreement Template

Protect your business secrets with ease using our Simple Mutual…

Crowdlending (P2P) Platform – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for a…

Stock Option Plan for Managers

Common practice stock options plan for companies and company managers.…

Financial Advisor / Financial Planner Financial Projection Model

5-Year 3-Statement Excel projection model for Financial Advisor / Financial…

Consortium Agreement for Professional Services Template

A Financial and Professional Services Consortium Agreement - Actual Example…

Merger & Acquisition (M&A) Simple Financial Model

The model is great financial tool used to evaluate the…

Financial Feasibility Study – Investment Funds

This model is Financial Feasibility Study for investment funds or…

Investment Holding Company 3 Statement Financial Projection Model

3 statement 5 or 8 year rolling financial projection Excel…

Insurance Company Financial Model – 5YR DCF & Valuation

The insurance financial model is a comprehensive tool designed to…

Leasing Company Financial Model – 5 Year Forecast

Financial Model providing a 5-Year Financial Forecast of a Leasing…

Integrated Financial Statements and Financial analysis in Power BI

The Integrated Financial Statements, Financial analysis is a comprehensive solution…

IFRS 17 GMM Insurance Financial Projection Model

IFRS 17 General Measurement Model (GMM) Insurance 5 year quarterly…

Bundle – Business Financial Forecasting Models

The purpose of this Bundle of Business Forecasting and Financial…

Insurance Technical Analysis Model

Financial model to compute the underwriting result / operating result…

Asset Management Company – Closed End Fund Model

Financial Model providing analysis of a Closed-End Fund hosted by…

Pricing Excel Model – Van Westendorp Price Sensitivity Meter

The Van Westendorp Price Sensitivity Meter (PSM) is a market…

Dynamic Lender Debt Investment Model

Pro Forma Models created this financial model to calculate and analyze…

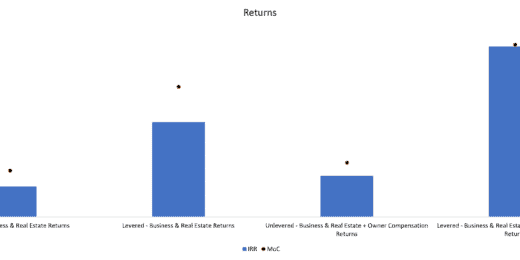

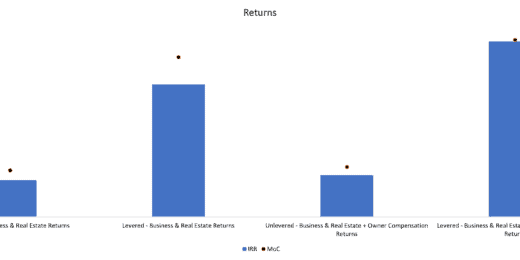

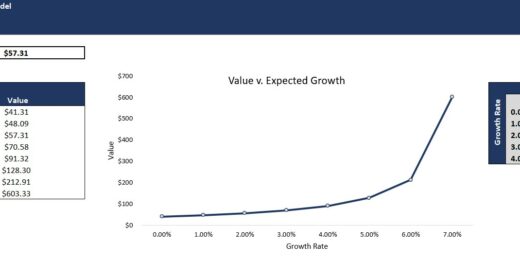

Real Estate Brokerage Business Plan with Return Calculation

Pro Forma Models created this model to analyze the financial return…

Property Manager Plan with Return Calculations & M&A Model

Pro Forma Models created this model to analyze the financial return…

Leveraged Buyout (LBO) Financial Projection Model

User-friendly financial model to project and analyse the financial outcomes…

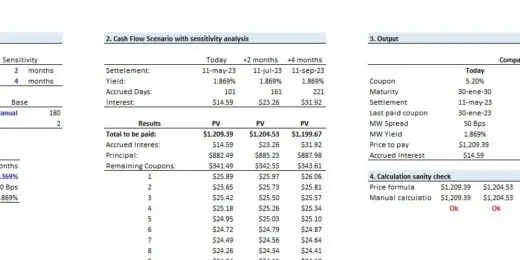

Bond, Loan or Note Make Whole Calculator

The model is designed to evaluate a make-whole calculator for…

Equity Portfolio Investment Return Calculator

Excel model to calculate the expected value and return for…

Crypto Currency Portfolio Investment Return Calculator

Excel model to calculate the expected value and return for…

Investment Fund Preferred Return Tracker: Up to 30 Members

Track preferred returns for investors in a fund with this…

Savings Bank Financial Model Excel Template

Savings Bank Budget Template There's power in Cash Flow Projections…

Retail Bank Financial Model Excel Template

Retail Bank Financial Model There's power in Cash Flow Projections…

Offshore Bank Financial Model Excel Template

Offshore Bank Financial Model Enhance your pitches and impress potential…

Mortgage Bank Financial Model Excel Template

Mortgage Bank Budget Template Create fully-integrated financial projection for 5…

Private Equity Profit Distribution Waterfall Model

The model allows for the distribution of funds between the…

Land Development Bank Financial Model Excel Template

Land Development Bank Pro Forma Template Enhance your pitches and…

The Financial Services Industry

Financial Services are the economic services provided by the finance industry, which includes a broad range of businesses that manage money. Business in financial services like the firms engaged in activities such as investing, lending, insurance, securities trading, and securities issuance. Usually, their target market are individuals, businesses, nonprofit organizations and agencies of government.

Financial service business companies are everywhere in all economically developed places. They play a vital role in the economy as it moves money from entities with excess funds to those in need of funds. Helping the economy grow even more and keep the money flowing, as they help their target market with their businesses or ventures.

Although handling financial services to others is their trade, due to the number of clients they handle and the time constraint, the need to be more efficient in working in the financial service business is high. The competition in the financial services industry towards the financial service startups is tough too, so before starting a business in financial services, creating a business plan with a better fighting strategy and proper financial planning is a must.

The following are institutions or establishments involved in the financial industry:

- Banks

- Credit Card Issuers

- Insurance companies

- Investment bankers

- Securities traders

- Financial Planners

- Security exchanges

Listed below, are the demand and supply drivers for the financial service businesses:

- Potential Leads / income

- Risk Rating

- Liquidity

- Availability of information

- Access to alternatives

- Money source

- Interest rates

- Inflation

- Economic conditions

- Government regulations

Types of Businesses in Financial Services

The Financial Services as a whole is very vast and includes various companies engaged in activities. Due to its large and diverse range, it resulted in a wide range of career options to different business models such as:

Retail and Commercial Banking

Retail and commercial banking is considered as a subsector of the financial services industry that a lot of people are familiar with since they interacted and utilized this service with their everyday personal and business banking. E.g. savings account, checking accounts, deposits, loans, credit and debit cards, etc.

Investment Banking

Investment banks are usually acting as middlemen of companies in need of access to capital markets such as stocks and bond markets. Of course, they also hand individual clients but it’s only a minority base of their whole target market, since they can handle more complicated financial transactions, such as facilitating mergers and acquisitions, acting as advisors for companies, issuing shares of stocks, securities trading, debt and equity securities, financial research, etc. Financial advisors, consultants, traders, portfolio managers, analysts, etc., are the types of careers available in this type of business model.

Venture Capital and Private Equity

In venture capital and private equity business model, it involves investing money in private companies in exchange for a percentage of the profit or ownership. Usually, venture capitalists target companies that are just starting, in the hopes that in the future, it will be profitable for them once they let go. Sometimes they also take part in handling the operations of the business to help push it to succeed.

Accounting

In the financial services industry, accounting is considered as another broad subsector. As you already know, in an accounting business, you provide services to record, maintain and analyze financial accounts for clients whether big or small, private or public, profit or government entities. A classic type of financial services business that people are very familiar with.

Insurance

This type of business model is specially made to help individuals and businesses mitigate potential risks for financial loss. Insurance business calculates and prepares every client against certain circumstances that will lead to the loss of a huge amount of money. Thus, this kind of business model is considered to be very convenient in the time of need.

As the industry kept on growing, there will be more changes added for further development. Hence, there are even more business models starting to get recognition.

Banking – Different Types of Services

Banking is one of the most used financial services business by the public to help manage their finances. With the passing days and years of technological advancement, the competition became higher, thus, resulting in banks offering different services to keep their current clients and future leads.

To arrive on a decision of what’s best for you to manage your finances, it is beneficial to at least know what are the most basic types of services that banking businesses offer.

Individual Banking – Under this are banks offering various types of services to assist individuals in managing their finances, such as:

- Checking Accounts

- Savings Accounts

- Debit and Credit Cards

- Insurance

- Wealth Management

Digital Banking – With the help of advanced technology, banks are offering a platform to do transactions without having to go on site. Usually, one can access it as long as there's an internet connection and a device. The services offered in digital banking includes:

- Online, Mobile, and Tablet Banking

- Mobile Check Deposit

- Text Alerts

- eStatements

- Online Bill Payments

Loans – This is one of the most common banking services offered, providing loans to people. There are different types of loans that banks provide, the basic ones are the following:

- Personal Loans

- Home Equity Loans

- Home Equity Lines of Credit

- Home Loans

- Business Loans

Whether you’re planning to start a banking business or investing in one, it always helps to know what different models you want to pursue so that you can prepare a working plan that will help you yield more profits later on.

Creating Financial Services Industry Financial Models

Are you in financial services businesses such as banks, insurance companies, wealth management firms, loan providers, peer to peer lending platforms etc.? Do you plan to start your own Financial service business? Are you interested in investing in businesses in the Financial services sector? Do you need help with your financial planning and other financial analysis, such as financial services industry financial models?

Financial planning in this kind of industry will need a lot of scrutinies due to the huge money involved and the constant flow of transactions which need proper management. From Valuation, Cash Flow Analysis, Financial feasibility, other Financial Projections and Forecast, and all the calculations; the Financial models will cover all that for you.

Start building your very own financial model for a financial services business. Prepare for certain factors that will affect your business operations and avoid unwanted risks. Manage your business in a structured framework where you can get an overview of all the transactions that you need to track and see, to further strategize and earn more income for your business.

How to create a financial model? Either you hire a professional help which costs a lot of money, or you can simply create one yourself. But, a financial model is not as easy as 1-2-3 so you’re bound to hit a wall and in need of help on how to build one yourself. You will also need a lot of studying and research to do, hence it might sound tedious and too time-consuming. Worry not! We have the right solution for you.

Financial Model Templates in Excel for Businesses in the Financial Service Sector

The best thing about today’s technology is the accessibility of random things that are helpful to anyone in need. Just like acquiring or downloading Financial services Industry financial models or financial model templates in excel for businesses in the financial services sector.

The choice of working efficiently, saving time from doing all the calculations, preparation and researching will be a lot less time-consuming. All that’s left for you to do is download the template and apply the figures of your business, customizing it according to your preferences.

Above is a list of financial model templates in Excel for Financial Service businesses that you can use as a template for your business plan and financial plan. The Excel templates will serve as a medium to visualize your business’s position, proper business management and preparing for future circumstances too.

No more spending high professional fees and spending a lot of time creating a financial model from scratch, just get a copy of a financial model template in excel for businesses in the financial service sector and you’ll have a professional looking Do-It-Yourself financial model for your business.

If you are looking for a specific financial model template and couldn't find it in our inventory, feel free to comment here: Missing Financial Model Templates, so that our Vendors will pick up that project and will soon add in our still growing inventory.

If you found the template but need help with customization of your preference, we also offer financial modeling services which you can avail here: Custom Financial Modeling Service.

We would be really grateful if you also rate our products and leave a review, comments, suggestions, or any kind of feedback, about our financial model templates, for this will greatly help us shape our templates to be even better in the future.