Stock Option Plan for Managers

Common practice stock options plan for companies and company managers. Returns analysis model intended to calculate potential proceeds that could be payable to managers with a stock option plan. Companies owned by institutional financial investors often offer company managers incentive plans in the form of stock options. This model includes a common practice option plan allowing to do sensitivities by changing main inputs in order to be used as negotiation tool and as an annex to the managers’ contract. Contract wording is included.

| Asset Management, Investing, Professional Services & Advisory |

| Employee Performance, Investor Cash Flows, IRR (Internal Rate of Return), Private Equity |

Common practice stock options plan for companies and company managers.

Companies owned by institutional financial investors (private equity or infrastructure funds) often offer company managers incentive plans in the form of stock options.

This model includes a common practice option plan allowing to do sensitivities by changing main inputs in order to be used as negotiation tool and as an annex to the managers’ contract.

This returns analysis model is intended to calculate potential proceeds that could be payable to managers with a stock option plan. The model has two tabs, one with calculation example and another with the relevant text to be included in the managers’ stock options contract.

The model compares the Stock Options vested amount to be paid to the managers with a standard carry to be received by the fund managers and calculates a dilution for fund managers in terms of basic points conceded to Managers. This is a relevant indicator observed by funds when signing stock options plans with managers.

The model includes the relevant information to serve its purpose in a manageable format.

Similar Products

Other customers were also interested in...

Multi-Member Investment Fund Portfolio and Distrib...

A fund management tool to track many positions over time as well as distributions to up to 20 member... Read more

Financial Advisor / Financial Planner Financial Pr...

5-Year 3-Statement Excel projection model for Financial Advisor / Financial Planner business generat... Read more

Savings Bank Financial Model Excel Template

Savings Bank Budget Template There's power in Cash Flow Projections and the insight they can provide... Read more

Legal Services Financial Model Excel Template

Buy Legal Services Financial Plan. Based on years of experience at an affordable price. Generates 5-... Read more

Private Equity Fund Model (Investor Cashflows)

Private Equity Financial Model to analyze fund cashflows and returns available to Limited Partners (... Read more

Consulting Firm Financial Model – Dynamic 10 Yea...

Financial Model providing a dynamic up to 10-year financial forecast for a startup or existing Consu... Read more

Alternative Investment Company Valuation Template

Alternative Investment Company Valuation: All-In-One Model for Private Equity, Asset Management, and... Read more

Asset Management Company – Closed End Fund M...

Financial Model presenting a scenario of a Closed-End Fund managed by an Asset Management Compan... Read more

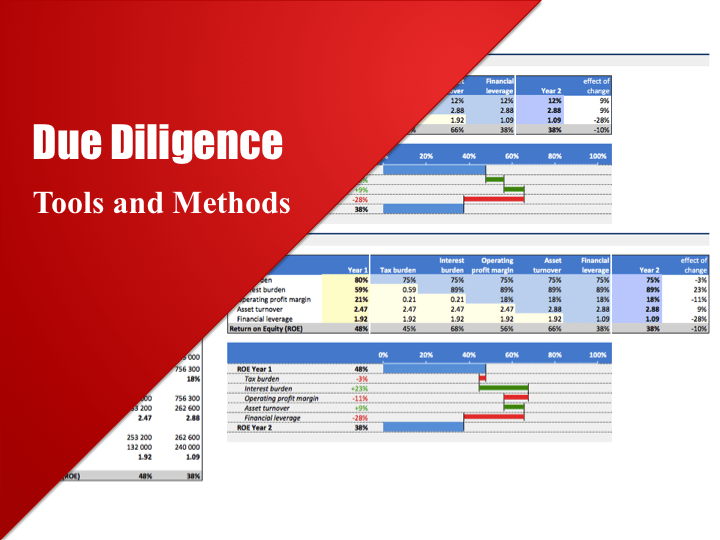

Due Diligence Tools and Methods

A suite of best practices to perform financial and commercial due diligence. Use it if you are consi... Read more

Investment Fund Preferred Return Tracker: Up to 30...

Track preferred returns for investors in a fund with this template. Premium joint venture tracking t... Read more

You must log in to submit a review.