5-year Financial Projections

Multifamily Rehab Model (Includes Investor Returns Waterfall)

Introducing the Multifamily Rehab Flip Model with Investor Returns Waterfall…

EV Charging Station Finance Model

Provides a comprehensive analysis of the financial viability and potential…

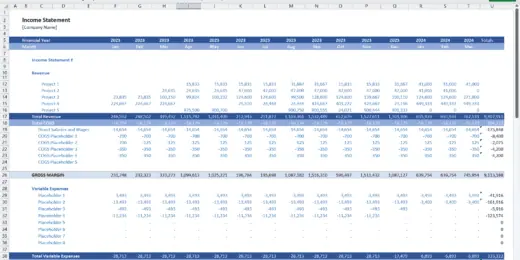

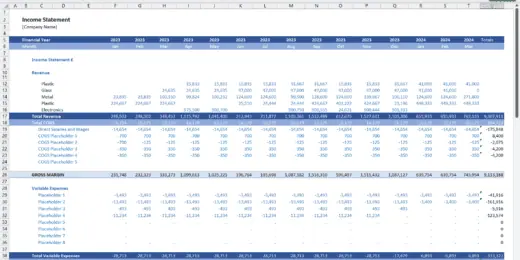

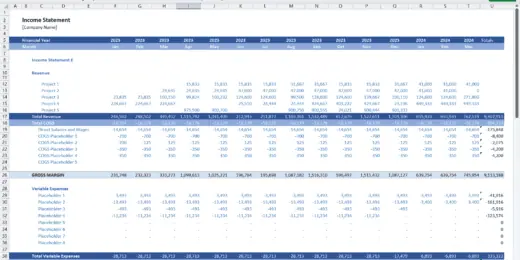

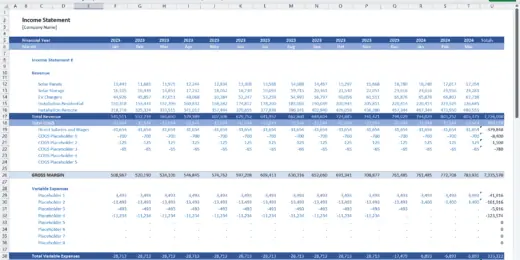

Startup Company Financial Model – Dynamic 3 Statement Financial Projections up to 8-Years

Highly Dynamic and Easy-to-Navigate Excel Financial Projections Model that allows…

Advanced Financial Model – Dynamic 3 Statement 10-Year Financial Model with DCF Valuation

Advanced, Dynamic and Easy-to-Use Excel Financial Projections Model that allows…

Veterinary Imaging Center Financial Model

The Veterinary Imaging Center financial model is designed to analyze…

Dental Imaging Center Financial Model

The Dental Imaging Center financial model is a comprehensive tool…

Diagnostic and Analysis Center Financial Model

It is excel financial model for financial forecasting of a…

Mobile Imaging Center Financial Model

This Excel model facilitates mobile imaging services by providing equipment…

Private Aircraft Rental Business Financial Model

"The Private Aircraft Rental business financial model is a versatile…

Radiology Center Financial Model

The Radiology Center financial model is a comprehensive and versatile…

B2B SaaS FInancial Model & Valuation Template

Unlock your B2B SaaS venture's full potential with our B2B…

Biomethane Producer Financial Model (Renewable Natural Gas)

Create a detailed pro forma with this biogas financial model.…

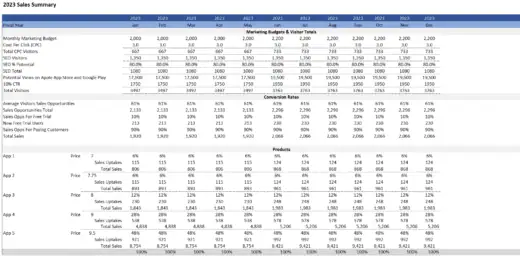

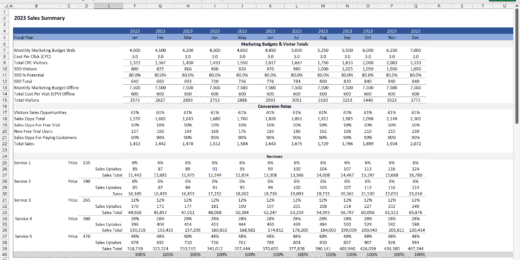

Fintech Mobile App Financial Model

A comprehensive editable, MS Excel spreadsheet for tracking Fintech Mobile…

Indoor Golf Centre Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking Indoor Golf…

Cannabis Grow and Dispensary Pro-Forma Model

The Cannabis Grow and Dispensary Pro-Forma Model is a comprehensive…

Mobile App Development Financial Model

A comprehensive editable, MS Excel spreadsheet for tracking Mobile App…

Food Truck Monthly Financial Model Template

The Food Truck Financial Model Template is a comprehensive solution…

Bookkeeping Agency Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Bookkeeping services…

Manufacturing Start up Feasibility Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for forecasting and tracking…

Start Up Company Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking start-up company…

B2B Services Company Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking B2B Services…

Medical Spa (MediSpa) Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Medical Spa…

Medical Clinic Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking private Medical…

Physiotherapy Clinic Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Physiotherapy Clinic…

Fast Food Restaurant Financial Model Template

Maximize fast food financials with our user-friendly financial model template.…

Food Bar Financial Model 5 year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Food Bar…

Restaurant Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Restaurant finances,…

Virtual Reality Software Company Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Virtual Reality…

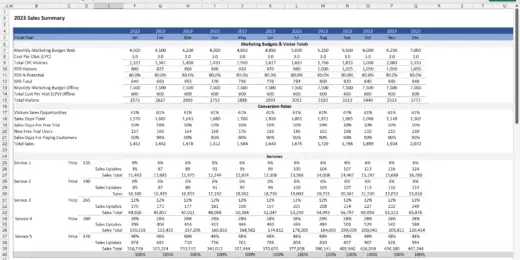

Budget vs Actual Forecasts 5 Years Excel Template

MS Excel spreadsheet for tracking budget finances. Can be used…

Social Media Marketing Agency Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Social Media…

Affiliate Marketing Agency Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Affiliate Marketing…

Web Hosting Company Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking web hosting…

5 Year 3 Statement Recycling Centre Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Recycling Centre…

5 Year 3 Statement Construction Company Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking construction company…

5 Year 3 Statement Solar Energy Solutions Company Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking Solar Energy…

Digital Advertising Agency Finance Model Excel Template

A comprehensive editable 5 Year 3 Statement, MS Excel spreadsheet…

5 Year 3 Statement Virtualization Software Company Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Virtualization Software…

5 Year 3 Statement Cyber Security Software Company Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Cyber Security…

Graphic Design Company Finance Model Excel Spreadsheet

A comprehensive editable, MS Excel spreadsheet for tracking Graphic Design…

5 Year 3 Statement Private Mental Health Care Centre Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking private Mental…

5 Year 3 Statement Alpaca Farming Finance Model Excel Template

A comprehensive 3 Statement 5 Year editable, MS Excel spreadsheet…

5 Year 3 Statement Architect Company Finance Model Excel Template

A comprehensive 5 Year 3 Statement editable, MS Excel spreadsheet…

Swimming School Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Swimming School…

CBD Personal Care Financial Model and Valuation Template

CBD Personal Care Financial Model and Valuation Template, a comprehensive…

3 Statement 5 Year SAAS HR Software Development Company Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking SAAS HR…

CRM Software Development Company Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking CRM software…

Pig Farming Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking pig farming…

3 Statement Indoor Rock Climbing Gym Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking Indoor Rock…

3 Statement Car Hire Company Financial Model

A comprehensive editable, MS Excel spreadsheet for tracking car hire…

3 Statement Van Hire Company Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking van hire…

Comprehensive 3 – Statement Financial Model for a Midstream Oil and Gas (Refinery with 7- Years Forecast)

This is a 6,000bpd financial model for refinery producing Diesel…

3 Statement Self Storage Company Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking Self Storage…

3 Statement SAAS Development Company Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking SAAS Development…

3 Statement Software Development Company Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking software development…

Comprehensive 3-Statement Financial Model for Banking Business

The Comprehensive financial model for Banking is an interactive, flexible,…

B2C eCommerce Financial Model & Valuation Model

Tailored ecommerce financial model Model for startups. Forecast revenue, integrate…

Logistics Company Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking logistic company…

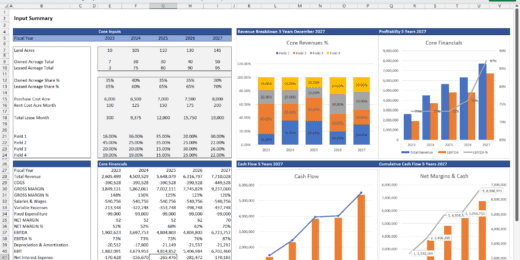

How to Create 5-Year Financial Projections

Crafting a robust blueprint for the future is crucial when embarking on a new business venture, and this is where 5-year financial projections come into play. They are numerical forecasts and visionary tools for entrepreneurs to articulate their business objectives, strategize growth, and communicate potential to investors. Business plan financial projections for five years help you anticipate financial outcomes based on various strategic decisions, making it essential for securing funding and guiding your business toward long-term success.

The core of these projections lies in financial modeling, a critical element that transforms assumptions and estimates into a quantifiable projected income statement. It is a benchmark against measuring actual performance and a roadmap to guide your business strategy. Financial modeling for your 5-year financial projections supports your vision with concrete figures and demonstrates to stakeholders that your business can thrive in the competitive market landscape.

What are Financial Projections?

Financial projections are a collection of forward-looking financial statements predicting a company's future revenues and expenses. These projections are critical for businesses as they provide insights into potential profitability and financial health over a specified period. By engaging in careful financial analysis and planning, companies can use these projections to assess the feasibility of a business strategy, forecast the impact of different scenarios, and prepare for various financial outcomes.

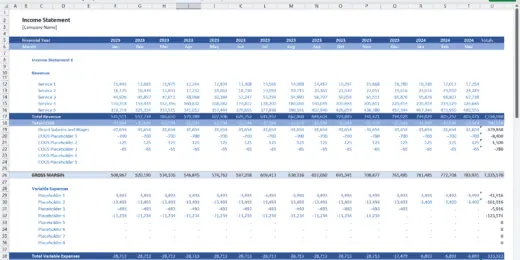

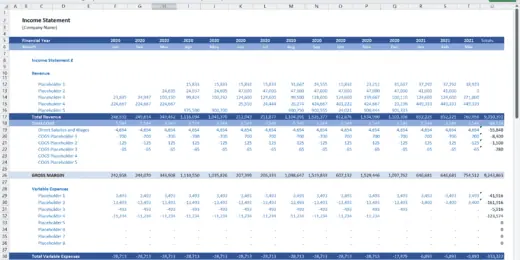

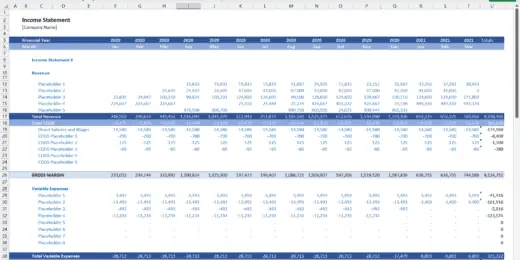

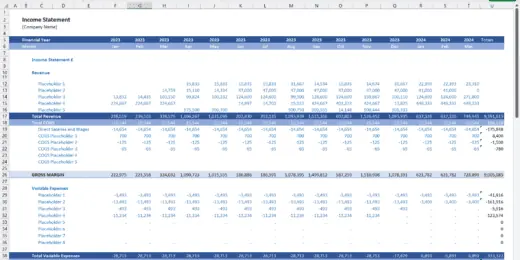

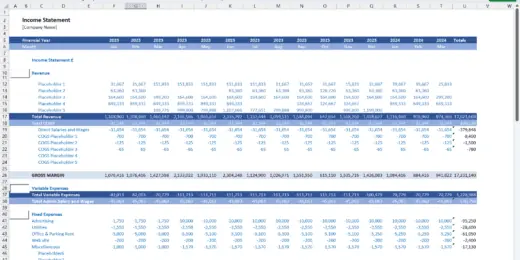

Standard Components of a 5-Year Financial Projection Template XLS

A typical 5-year financial projection template XLS includes several vital components that collectively provide a comprehensive view of the company's expected financial position. These components are:

- Startup Expenses are the initial costs involved in setting up the business, which may include legal fees, marketing, initial inventory, and other preliminary expenses.

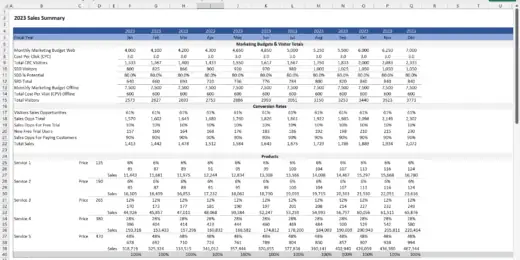

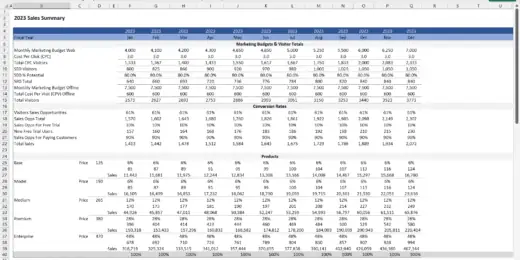

- Sales Forecast: Estimates of the revenue the business expects to generate from its sales activities.

- Cost of Goods Sold (COGS) is the direct cost of producing the company's goods.

- Operating Expenses: All recurring expenses that are necessary to run the business but are not directly tied to production, such as rent, utilities, and office supplies.

- Payroll Costs: Predictions of employee salaries, benefits, and other payroll-related expenses over the five years.

- Amortization and Depreciation are methods for incrementally reducing the value of business assets over time as they are used and age.

- Cash Flow Statement: It details the amounts of cash and cash equivalents entering and leaving the company, helping to assess the business's liquidity over time.

- Income Statement: Also known as the profit and loss statement, it shows the company's revenues, costs, and expenses during each year.

- Balance Sheet: A snapshot at the end of each year, listing the company's assets, liabilities, and equity.

- Break-even Analysis: An assessment to determine when the business can cover all its expenses with its revenues.

- Financial Ratios: Various metrics, such as the debt-to-equity ratio and return on investment, are used to evaluate a business's financial health.

Together, the components of a 5-year financial projection template XLS help paint a detailed picture of the business's projected financial trajectory, aiding stakeholders in making informed decisions.

How Many Years Should Business Plan Financial Projections Be?

Companies have the flexibility to create financial projections over any span of time they choose. However, the U.S. Small Business Administration (SBA) generally requires every company to create a business plan with financial projections for the next five years. These projections should include forecasted income statements, balance sheets, cash flow statements, and capital expenditure budgets. This standard helps ensure businesses have a robust plan for sustainable growth and demonstrate their financial viability to potential stakeholders.

Why 5-year business plan financial projections are advantageous? Adopting a five-year outlook for business plan financial projections offers several significant benefits:

- Visibility: Often, businesses have difficulties looking into their future or planning for long planning horizons. At the end of the day, who knows what will happen in the future? Therefore, looking too far ahead in the future might not be realistic as simply the assumptions are missing. But if you have to come up with a multi-year business plan, the idea of the 5-years is that’s probably the limit where managers can obtain reliable assumptions to prepare their forecast. Forecasting accuracy typically declines the longer you project into the future, stopping five-year keeps your forecasting accuracy with respect to the assumptions used still at a reasonable level.

- Anticipate Challenges and Opportunities: Long-term financial planning enables businesses to anticipate potential challenges and strengths more effectively. Understanding what might lie ahead allows management to be proactive rather than reactive, preparing strategies to leverage strengths and mitigate risks before they become critical issues.

- Strategic Goal Setting: 5-year financial projections allow businesses to set long-term goals and prioritize critical strategic initiatives. With a more precise timeline, companies can plan more effectively how to achieve these objectives, setting milestones along the way and allocating resources where they are most needed.

- Vision for Growth: Five-year financial projections demonstrate to potential investors and partners that the company is thinking long-term and has a concrete vision for growth. They also reassure stakeholders that the business is preparing for sustained operations rather than quick, short-term gains.

In conclusion, while businesses can choose the period for their financial projections, 5-year business plan financial projections are often considered optimal. They meet the requirements of entities like the SBA and position the business well for future success by providing a clear framework for growth, strategic planning, and proactive management.

Essential Steps to Crafting 5-Year Financial Projections

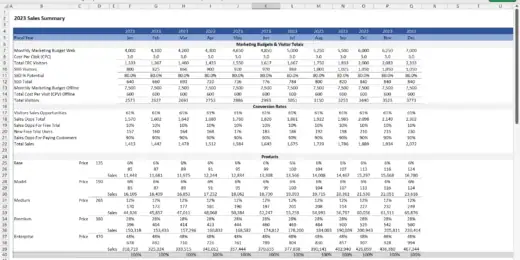

Creating 5-year financial projections involves analyzing historical financial data and market trends to predict future revenues, expenses, and profitability. This forward-looking financial model is crucial for strategic planning, investment decisions, and securing funding from investors or lenders.

Step 1 - Estimate Expenses & Revenues

The first step in crafting a 5-year financial projection template XLS is to estimate future expenses and revenues. It thoroughly analyzes past financial statements to understand trends and variability in income and expenditures. Revenue projections should consider both the historical growth rate and external market conditions, such as industry trends and economic forecasts. Expenses are projected based on past spending patterns, anticipated cost increases, and any planned strategic investments or changes in operations.

When creating 5-year financial projections, estimate startup expenses, including equipment, licensing, and initial costs. Next, project your operating expenses, including recurring costs such as utilities, rent, and supplies. Include payroll costs by estimating salaries, benefits, and taxes for employees. Calculate the cost of goods sold (COGS), which involves all direct costs associated with production or service delivery. For amortization and depreciation, estimate the reduction in value of intangible and tangible fixed assets, respectively, and how they spread over their useful life. Lastly, forecast sales revenue by analyzing market trends, historical data, and potential customer growth over the period. Each element should be estimated conservatively, accounting for possible changes in market conditions and business operations, and summarized annually to provide a clear financial trajectory over the five years.

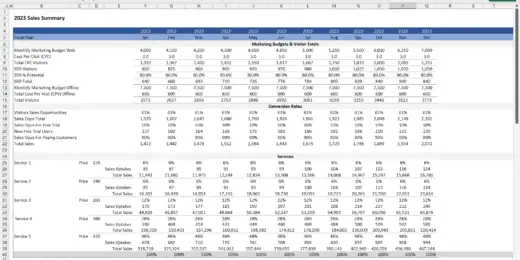

Step 2 - Create a Cash Flow Forecast

Once you have estimated revenues and expenses, the next step is to create a cash flow forecast. This projection highlights the timing of cash inflows and outflows over the next five years, providing insight into liquidity needs and financial health. It's crucial to consider the timing of revenue collection, expense payment cycles, and major anticipated capital expenditures. A cash flow forecast helps determine periods when the company might need additional cash resources or when it might have surplus cash to invest or pay down debt.

To create a cash flow forecast for a five-year financial projection:

- Establish the starting cash balance and project all cash inflows, such as sales revenue, investment income, and other funding sources.

- Detail all cash outflows, including operating expenses, payroll, inventory purchases, capital expenditures, loan payments, and other significant costs.

- Break down these estimates monthly for the first year and quarterly or annually for subsequent years.

- Subtract total outflows from inflows to calculate the net cash flow for each period.

- Accumulate the net cash flow with the opening balance to arrive at the closing balance for each period.

This approach helps identify periods of cash surplus or shortfall, enabling strategic decisions such as the timing of capital investments or the need for external financing. It's essential to include a buffer for unexpected costs and periodically revise the forecast as actual figures and market conditions evolve.

Step 3 - Conduct Balance Sheet Projections

Balance sheet projections involve estimating what the company's assets, liabilities, and equity will look like at the end of each year during the projection period. The projection should include assumptions about the growth of assets, such as inventory and equipment, changes in liabilities, like loans or accounts payable, and movements in equity, such as retained earnings or issuance of new shares. It provides a snapshot of the company's financial health and stability in future times.

To conduct balance sheet projections for a five-year financial plan, start by forecasting the end-of-period balances for all assets, liabilities, and equity accounts. Assets should include current assets like cash and receivables and long-term assets such as property, plant, and equipment, factoring in depreciation. Liabilities must encompass current liabilities, like accounts payable and short-term debt, and long-term liabilities, such as long-term loans. Equity projections should include retained earnings and any expected changes in stockholder equity, such as new equity injections or dividends. These projections should be aligned with the anticipated financial activities and results from the income statement and cash flow forecasts, such as profit retention or asset acquisition. Ensure each year’s assets are balanced against the sum of liabilities and equity to maintain the accounting equation (Assets = Liabilities + Equity). Adjust these projections annually based on the changes in business strategies, market conditions, and actual financial performance.

Step 4 – Assess the Income Statement

The income statement, or profit and loss statement, provides a detailed analysis of projected revenues, costs, and expenses, culminating in the net income for each year of the projection period. This statement helps to understand the operational efficiency and profitability of the business over time. It's crucial to factor in all potential revenue streams and direct and indirect costs. Regular assessment of the income statement can help identify trends, pinpoint areas needing cost control, and guide strategic decision-making.

Assessing the income statement for a five-year financial projection begins by projecting revenue growth based on market analysis, competitive positioning, and historical sales data. Deduct the projected cost of goods sold (COGS) to calculate gross profit, considering changes in production costs, material prices, and economies of scale. Estimate all operating expenses, including marketing, administrative fees, and other overheads. Include other income or expenses such as interest or costs, and factor in any exceptional or non-recurring items that might affect financial results—project taxes based on current and anticipated tax rates and regulations. Finally, net income is calculated by subtracting all expenses, including taxes, from total revenues. This bottom-line figure will help determine the company’s profitability over the projected period. It’s important to re-evaluate these projections periodically and adjust them based on actual performance and changes in the business environment to maintain accuracy and relevance.

Step 5 - Analyze and Set SMART Goals

The final step involves analyzing the projections to set specific, measurable, achievable, relevant, and time-bound (SMART) goals. This step ensures that the financial projections are aligned with the business's strategic objectives. By setting SMART goals, the company commits to achieving realistic and quantifiable targets that encourage growth and improve financial performance. Regular review and adjustment of these goals based on actual performance versus projections are essential to keep the business on track toward its long-term objectives.

To analyze and set SMART goals for five-year financial projections, begin by defining clear and specific financial objectives that align with the overall strategic direction of the business, such as achieving a certain revenue threshold, maintaining specific profit margins, or reducing debt to a particular level. Ensure these goals are measurable by setting precise figures to be reached, and confirm they are achievable by analyzing past performance and industry benchmarks to ensure they are realistic given the company's resources and market conditions. The goals should be relevant to the long-term success and growth of the business, contributing directly to its overarching aims. Finally, each goal must be time-bound, with precise deadlines and milestones set over five years to facilitate regular assessment and adjustments. This structured approach enables continuous tracking and evaluation of progress, helping to refine strategies and operations effectively to meet these financial targets.

Download Our 5-Year Financial Projection XLS Template Today!

Take control of your business's future using a powerful tool that simplifies complex financial forecasting. Designed to help both seasoned and aspiring entrepreneurs alike, this user-friendly template enables you to visualize possible financial outcomes and make informed decisions. Don't miss out on this opportunity to plan your success — get your copy now and start crafting a more prosperous tomorrow. Unlock your financial planning potential by downloading our comprehensive 5-Year Financial Projection XLS Template today!