Commercial Real Estate Valuation Methods: Helping Investors in Taking Informed Decisions

As a commercial real estate investor, the bottom line in your decisions is the return on investment or the perceived profit that a deal can bring to you. You are prohibited from taking decisions based upon your emotions as they can backfire to hurt you financially. You should know the fair market value of a commercial property when agreeing to pay its price. You must remain dependent upon important commercial real estate valuation methods whether you are an experienced pro or an aspiring investor.

Let’s discuss some popular and commonly used commercial real estate valuation methods:

Cost-Based Approach

This is a valuation method that takes into consideration the cost required to build the property and deems it equal to its value that an investor should pay. In this method, the value of the land is added to the cost of construction to arrive at the total value of the commercial property. It tries to arrive at an amount that the investor requires should he decide to construct the building from scratch. This method is usually applied when comparables are not available. It is also used in the case of buildings where substantial upgrades have been undertaken adding to its overall value. Hospitals, school buildings, churches, etc., are some examples where the cost-based valuation method is applied by commercial real estate appraisers. These structures are rarely sold and as such, it is impossible for these appraisers to come up with comparable.

Sales Comparison Approach

This is a very popular valuation method adopted by commercial real estate appraisers. It considers prices of comparable properties recently sold in the area to arrive at the value of the property. It is evident that this valuation method can be used when there is enough data or comparables available to the appraiser. It is commonly used for ascertaining the value of residential buildings such as apartment complexes and buildings containing condominiums. The commercial property of which value must be found is compared with the similar buildings recently sold and the appraiser adds and subtracts the amount based on features in the property.

Sales comparison valuation approach is also referred to as a market-based approach as it is heavily dependent upon sales figures of comparable properties in the area. It only provides a rough estimate of the value of a commercial property as it is difficult to find exact comparables. Also, the appraiser must be experienced enough to identify differences in comparables and accordingly add and deduct the amount from the value of the property.

Income approach

This is another popular valuation method adopted by appraisers when finding the value of the commercial real estate. As an investor, your goal is to find out whether the project would give you profits on investment or not. This method calculates the net operating income by adding the average monthly rental incomes of all the units in the building and then deducting the operating expenses from this amount. According to this approach

Value of the property equals the ratio of the net operating income and the cap rate. However, there is a drawback in this formula in the sense that if any of the figures are inaccurate, the resulting value of the property will be incorrect. The most important variable in this ratio is the net operating income (NOI). There are many components of NOI and they vary from one property to another. As such, it is difficult for an appraiser to calculate NOI with precision or accuracy. Also, the cap rate is the assumed return on investment which is a subjective figure depending upon the objectives of the investor. The appraiser should be careful in calculating gross annual income from the property as he needs to consider the vacancy rates.

In addition to these three basic valuation methods, there are two more approaches that are commonly used by appraisers.

These are:

Value Per Door

As the name implies, Value per door considers the annual income per unit. For example, if the value of an apartment building is $1 million and there are 20 units in it, the value per door is deemed to be $50000. This method does not consider differences in the sizes of individual units.

Value per Gross Rent Multiplier

In the last method called Gross Rent Multiplier, the appraiser divides the price of the property by its gross rental income. Appraisers utilize this valuation method to identify properties that are profitable for the investors as they are low priced as compared to their potential for income generation.

Pros and Cons for Each Method

The important thing to remember is that all valuation methods are not purely scientific, and they have their own pros and cons. Each of these valuation methods is suitable for specific properties and circumstances. The method an appraiser uses depends upon the kind of property, its location, its age, and the amount of information available to the appraiser. The valuation method used by the appraiser also depends upon the objectives of the investor.

Sometimes, the appraiser must use not one but several methods of valuation. He arrives at different values of the same property and then finds a mean based upon the condition of the property and the data available to him. In the end, no matter what method of valuation is used, the value of a property remains an estimate or an approximation according to the appraiser.

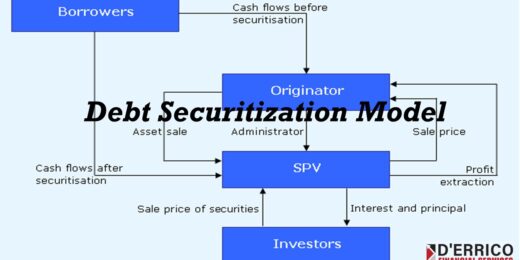

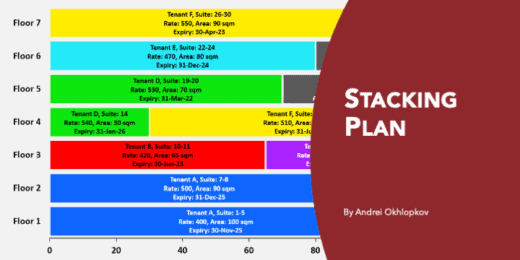

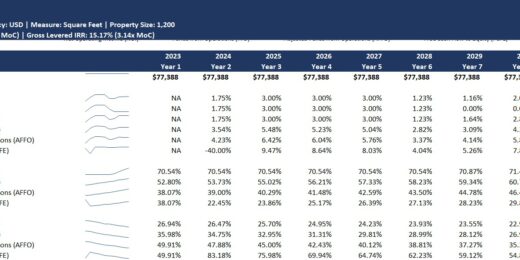

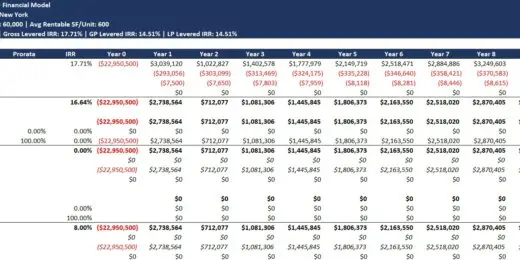

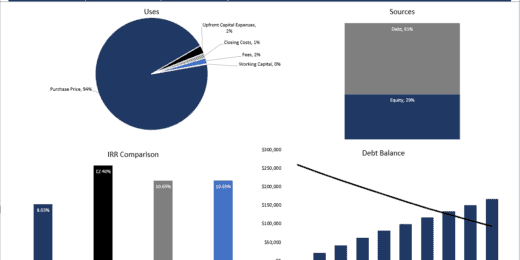

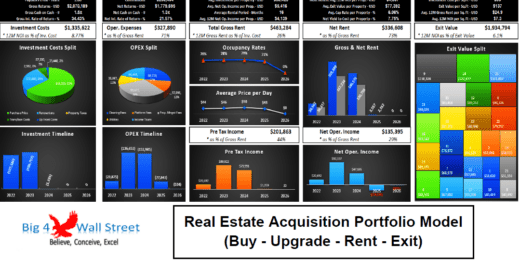

Real Estate Valuation Model Templates

eFinancialModels.com has created financial model templates for the help of investors. These templates can be used to find out the value of any commercial property. All that an investor has to do is to enter the corresponding figures in the formulae to find out the fair market value of the property. These financial models are presented in Excel templates that are easy to understand and use. We have applied our deep knowledge of finance and real estate to create these templates. It is in your own interest to make use of these templates to get an idea of the value of the commercial property that you are interested in.