What you should know about the Discounted Cash Flow Valuation Method

Table of Content

- Why use the Discounted Cash Flow Valuation Method for valuation purposes?

- A Discounted Cash Flow Valuation Example – Step by Step

- Projecting Free Cash Flows

- Determining the Discount Rate

- Calculating the Terminal Value

- Calculating the present values of the annual cash flows

- Calculating Enterprise Value and Equity Value

- Some more Tweaks regarding the Discounted Cash Flow Valuation Method

Starting a business will always have its accompanying risks and opportunities. For a business owner who will have to assume all the financial risk, it is important to understand how the discounted cash flow valuation method for business valuation purposes works. Only by obtaining a solid understanding of how one of the most common business valuation methods works is it possible to make informed decisions and target to create value for shareholders and stakeholders.

As the name says, the discounted cash flow valuation method (or DCF method) values companies or assets by discounting their future projected free cash flows to their present values. This requires the availability of a 3 to 5-year financial plan from which future expected free cash flows could be derived.

Why is the cash flows discounted? This is to reflect the logic that cash in the future is less valuable compared to cash at hand. Therefore, expected cash flows in the future are an estimation and subject to inherent business risks. The discounting procedure factors this in and adjusts the free cash flows for those risks. The more the cash flows lie in the future, the higher the risk and the larger the discount (by increasing the discount rate) to be applied.

How is the risk measured? Risk is measured as the opportunity cost of capital. Instead of investing in a company or an asset, the funds could be invested in a project with similar risks in the stock market. Discounted cash flow valuation uses the Weighted Cost of Capital (WACC) as the discount rate in the DCF method.

In the following, we will review the basics of the discounted cash flow valuation method and will also go through a discounted cash flow valuation example.

Why use the Discounted Cash Flow Valuation Method for valuation purposes?

The discounted cash flow valuation method (or also the DCF method) is an income-based valuation approach that derives the value of a business or an asset from its expected future free cash flows.

The discounted cash flow valuation method is one of the most solid valuation methods which can be used to value a business when applied correctly since it is focused on expected income in form of cash flows which also considers the required investments (CAPEX and Net Working Capital). However, one should use the DCF method correctly as otherwise, its result can also easily be misleading. See also this article which explains the 10 Top Mistakes in DCF valuations. This is why it is important to understand a bit more about how to use discounted cash flow for valuation techniques.

Compared to the market multiples valuation method, which bases on comparable data, the DCF method can be more precise as it allows one to focus on the specific circumstances of a company and its financial outlook as well as value drivers. When correctly used, it’s a bottom-up valuation method starting from the drivers of revenues, costs, capital expenditures, and net working capital. The beauty of using discounted cash flow for valuation lies in its logical argumentation and the underlying analysis, which can become a powerful and convincing argumentation to substantiate a valuation estimate.

When to apply discounted cash flow for valuation?

The discounted cash flow valuation technique is a comprehensive valuation method that can be used to value publicly-traded companies as well as privately-held businesses. Very often, the method of using discounted cash flow for business valuation purposes is also used in combination with other business valuation methods.

The prerequisite to using the discounted cash flow valuation method is the availability of a financial plan which contains 3- 5 years of financial projections. In case no plan is available, one very often has to create one.

So when is the discounted cash flow valuation method being used? – Here are some common use cases where normally the DCF method is being used for valuation purposes:

- Valuation of real estate assets such as commercial buildings or other rental properties

- Business valuation (publicly traded stocks as well as privately held companies)

- Valuation of intangible assets such as patents, brands, trademarks, and customer relationships

When valuing a business, you normally have the choice between using discounted cash flow for valuation or alternative valuation methods such as market and recent transaction multiples, replacement cost approach, capitalized earnings valuation, etc. So in which cases would you opt to use the discounted cash flow valuation method?

Preference for the discounted cash flow valuation method is given when

- Quantifying the valuation impact of synergies in the context of business acquisitions

- More precision is needed than other valuation methods can give (e.g., multiples valuation or capitalized earnings valuation)

- Your business/asset is very specific, and there exist no comparable valuation benchmarks to use

- If you are dealing with massive pending investments which will affect the value of the business

- You like to compare different business scenarios and their valuation impact

The other question is, in which cases would it not be a good idea to use the discounted cash flow valuation method:

- If you feel the business plan or its assumptions cannot be relied upon

- If other valuation methods lead to a faster or simpler way to value a business or an asset

- If the target audience of your valuation result does not understand the discounted cash flow valuation method or feels the assumptions are subjective and one-sided.

- If market prices paid in your industry vary heavily from the results of a discounted cash flow valuation.

- If the net present value of a discounted cash flow valuation becomes negative. Then the question is raised if it actually would not be better to liquidate and shut down the company

As you can see, the discounted cash flow valuation method – like any other valuation method – needs to apply to a suitable situation. Let’s now have a look in detail at a discount cash flow valuation example.

A Discounted Cash Flow Valuation Example – Step by Step

Doing a discounted cash flow valuation can be tricky, especially with all the factors that should be considered when applying it. Below is a simplified version of each step to guide you if you’re still new to the approach. While you’re at it, you can also download the following DCF templates to act as your guide for each step. We even provided a sample template for a restaurant business so you can see how to actually apply it.

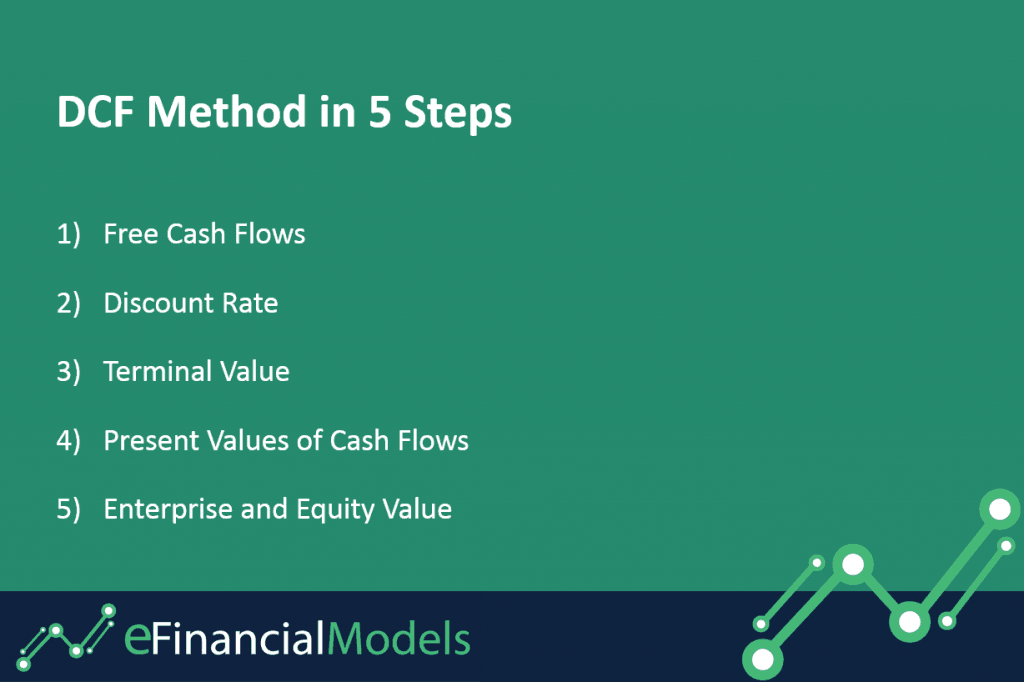

The following graphic explains the 5 calculation steps of the DCF method:

The five steps for using discounted cash flow for valuation are the following:

- Projecting free cash flows

- Determining the discount rate

- Calculating the terminal value

- Calculating the present values of the annual cash flows

- Calculating Enterprise and Equity Value

Projecting Free Cash Flows

The basis of any DCF method form the free cash flow projections from a multi-year financial plan or business plan. As a role of thumb, for using the discounted cash flow valuation method, you will need a planning horizon of about 5 years.

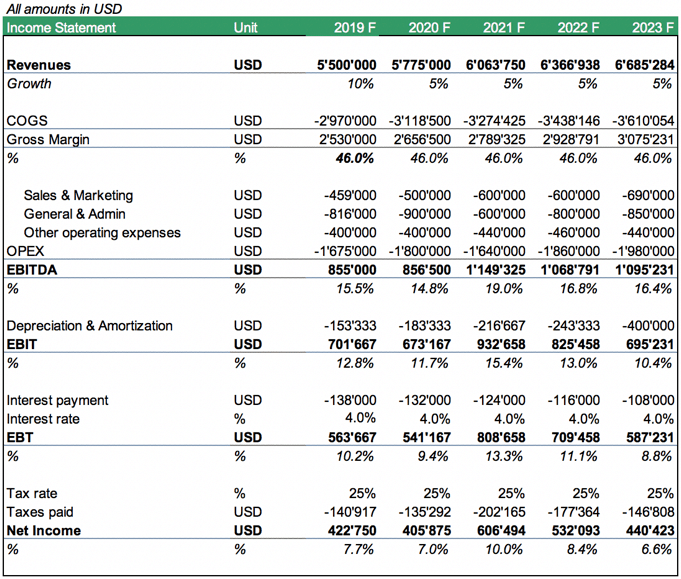

The best way to develop a financial plan is to start with the income statement. What will your income statement look like in the next five years? – So you need to develop a financial model (preferably in Excel or also in Google Sheets). The following topics need to be addressed and developed:

Forecasting the income statement:

- Revenues

- Costs

- Depreciation

- Interest

- Taxes

Here is what the financial forecast of your income statement might look like:

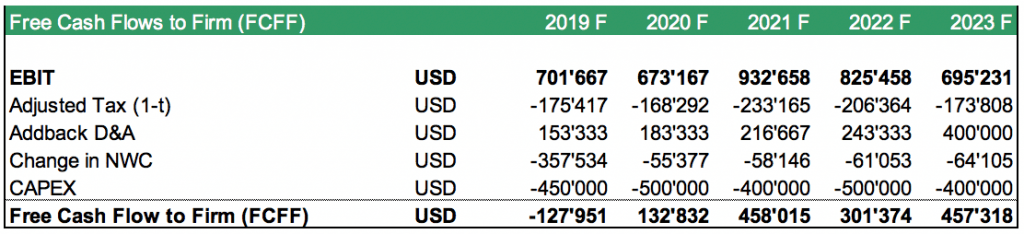

Discounted cash flow valuation requires to develop the Free Cash Flows. Normally these are the free cash flows available to firm (FCFF). Please note, the definition of these cash flows is different from the standard Cash Flow Statement as we exclude all cash flows from Financing Activities, and we “simulate” how the cash flows would look without taking into account the effects of the financing structure. Therefore, in our discounted cash flow valuation example, we apply the income tax rate on EBIT (Earnings before Interest and Taxes).

Determining the Discount Rate

After identifying the future free cash flows, the next step is to determine which discount rate to use to discount these free cash flows to their present values. As per finance theory, the discount rate should reflect the opportunity costs of the alternative of investing in a business with a similar risk profile. Here normally, the Weighted Average Cost of Capital (WACC) is used. In short, the WACC weighs the cost of debt, and the cost of equity financing used and comes up with the average cost of the capital.

Please refer to this article here which explains how to calculate the discount rate when using the DCF method, and also check out one of the WACC Calculator Templates here.

WACC Calculator | Discount Rate Estimation

Unlock the power of informed financial decision-making with our WACC…

For our discounted cash flow valuation example, we are going to use a discount rate of 12%.

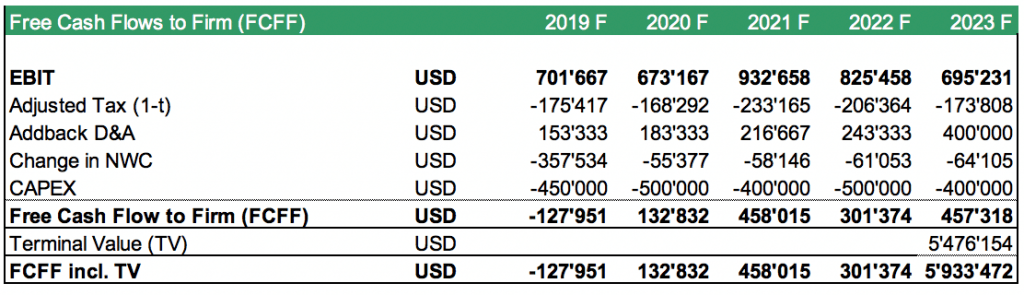

Calculating the Terminal Value

So far, we have defined the cash flows up to year 5 and also have determined the discount rate, which will be used to determine the present value of those cash flows.

Now the problem when using discounted cash flows for valuation purposes is that a company (or also an asset) will produce cash flows beyond a 5-year time horizon. Companies with solid business models have been around for many years (e.g., Wells Fargo since 1852, UBS of Switzerland dates back to origins in 1862, Coca Cola 1886, 3M 1902). This means we need to attribute value for the time period from year 6 up to an infinite end.

The way to do this is to calculate the terminal value. Simple formulas to calculate the terminal value are:

- Multiple-based valuation, e.g., based on EV/EBITDA multiple

- Gordon growth formula (Last Year Cash Flow *(1+g) / (WACC -g)), whereas g equals a long-term growth rate, and WACC will be the discount rate

There exist more terminal value formulas but for our purposes, what’s important is that there needs to be value attributed for the period beyond the forecast year 5. Normally, the terminal value is calculated as per the end of year 5, which means it needs to be discounted to year 0, together with the free cash flow of year 5. For our purposes, we use a 5.0x EV/EBITDA multiple to calculate the terminal value for our discounted cash flow valuation example.

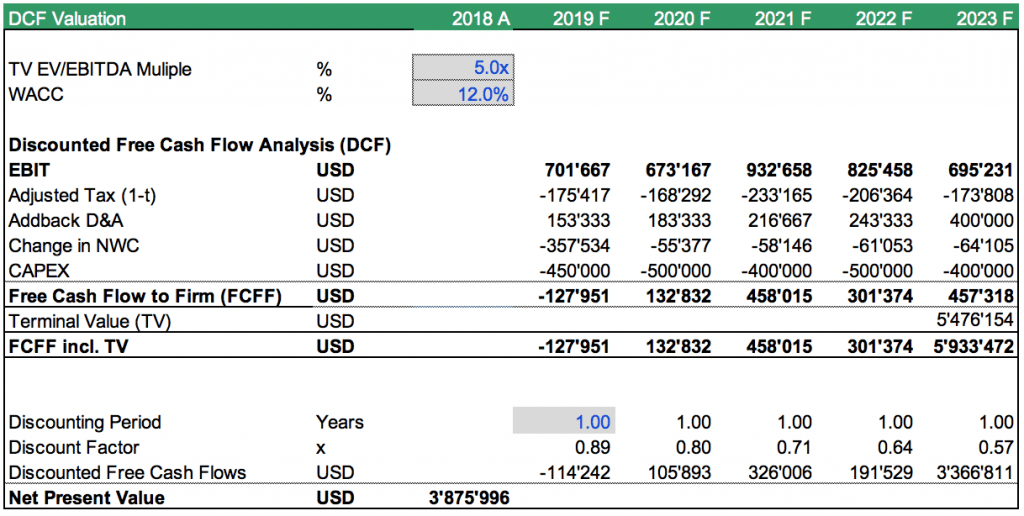

Calculating the present values of the annual cash flows

The next step of the discounted cash flow valuation is to discount all cash flows to their value as of the valuation date. Cash flows in our example will be discounted for yearly periods, but in case the valuation date is set at another data than the year-end date, one should adjust the discounting periods. Here there is a slight nuance of valuation techniques as the appraisal expert needs to decide if the cash flows are viewed as occurring mid of the year or end of the year.

- Standard Discount: Cash flow / (1 + discount rate) ^ (year – current year)

- Mid-year Discount: Cash flow / (1 + discount rate) ^ ((year – current year)-0.5)

In most cases, end-of-year discounting is used. For our example, we use this approach as well. Now the free cash flows are corrected for the factors 0.89, 0.80, 0.71, 0.64, and 0.57. The discount factors decrease the further we go into the future, reflecting the risk.

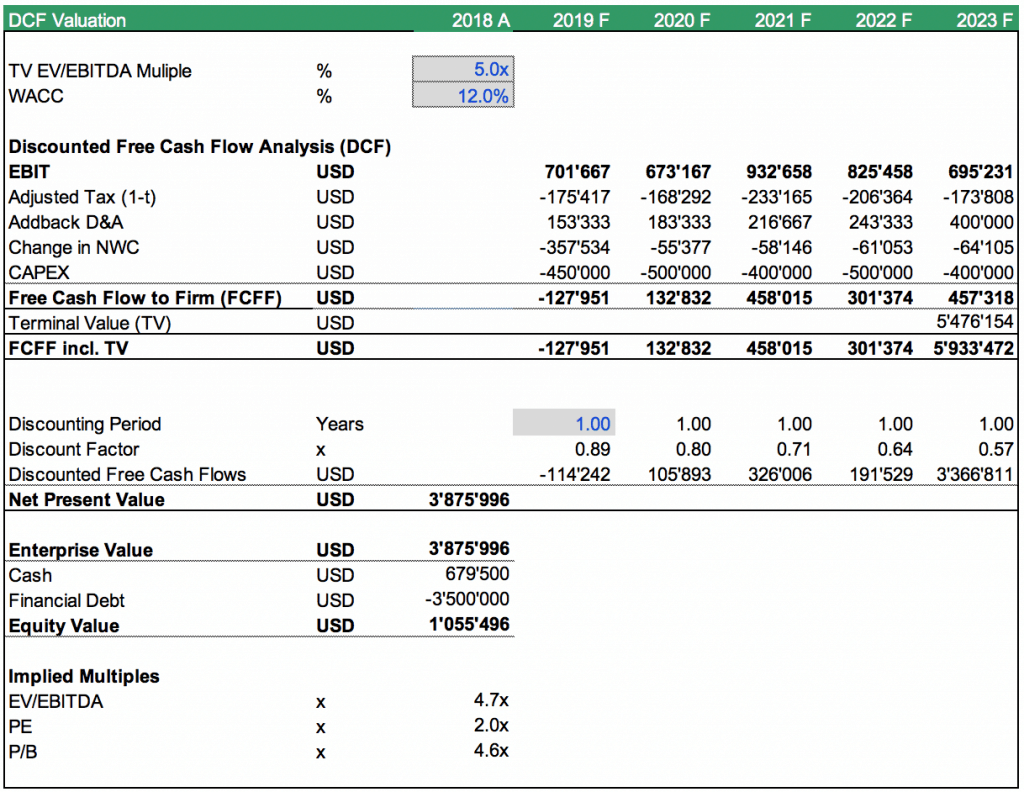

Calculating Enterprise Value and Equity Value

As the discounted free cash flows are summed up, the net present value (NPV) of all future cash flows to firm are calculated.

By using discounted cash flows for business valuation, the net present value corresponds to the enterprise value of the business, which values the company independently of the debt/equity financing structure used. This means we have to deduct financial debt and add cash (or some valuation experts only add excess cash as some of the cash might be needed to operate the business) together with net debt in order to arrive at the equity value. Now our discounted cash flow valuation model is complete.

Below is an example screenshot showing the calculations for each important component of a discounted cash flow valuation model using the DCF Model Template:

Some more Tweaks regarding the Discounted Cash Flow Valuation Method

We would like to make some additional comments on how the discounted cash flow valuation method can be tweaked to make the valuation analysis more comprehensive.

Non-Operating Assets

Normally the free cash flows to firm (FCFF) only include the operating cash flows from the business. Many times, businesses also possess assets that are not considered part of the operating business. Those assets can be separated and should be treated as non-operating assets. They are then simply added to the enterprise value (similar to cash) to arrive at the equity value (after deducting the debt and adding cash). Important here is to ensure that the cash flows from the non-operating assets are not included in free cash flows to firm as otherwise, we would double count them.

Other adjustments

Apart from financial debt, a company can have additional financial liabilities such as pension obligations, environmental liabilities, minority interests, or potential liabilities out of lawsuits. These liabilities should also be taken into consideration when calculating equity value. In a nutshell, the DCF method is adjusted by subtracting liabilities or adding assets to arrive at an adjusted fair equity value of the business.

Sensitivity Analysis

The discounted cash flow valuation method offers the advantage that it reflects a bottom-up approach based on the assumptions of the business plan, WACC, and terminal value valuation parameters. To keep in mind, these are always subjective estimates and therefore exposed to a certain degree of inaccuracy. Therefore, it can be important to understand how the discounted cash flow valuation result would be when the assumptions are changed. That’s where sensitivity analysis comes in. Sensitivity analysis checks how the valuation results are affected when important key assumptions are changed. Read more about sensitivity analysis here.

Conclusion –Discounted Cash Flow for Business Valuation matters

The discounted cash flow valuation method is widely used among financial analysts and valuation professionals, especially for business valuation purposes. It is one of the most solid valuation techniques, and it represents an income-based approach toward valuation.

AS our discounted cash flow valuation example shows, 5 calculation steps are needed: 1) projecting free cash flows, 2) determining the discount rate, 3) calculating the terminal value, 4) calculating the present values of the annual cash flows, and 5) calculating Enterprise and Equity Value.

Download the generic quick DCF Template here:

Using discounted cash flow for business valuation purposes has many practical uses in a variety of situations, starting from the valuation of properties in real estate, company valuations, valuation of intangible and other assets, as well as evaluating the valuation impact of various business scenarios.

The beauty of this method is that the valuation logic becomes very transparent and, therefore, can also trigger a constructive discussion about the most likely business scenario as it leads to questions of how important value drivers are going to behave in the future.

So now, it is your turn to get started with the discounted cash flow valuation method. Check out our many discounted cash flow valuation templates and value your business with the DCF method.