Understanding Valuation vs Pricing: Weighing Value vs Price can make a BIG difference

Table of Content

The stock market is a complex environment where millions of people purchase and sell shares and at the same time millions of dollars exchange hands in seconds. Retail investors, institutional investors, bankers, brokers, money managers and other participants in the stock market often debate and analyze the difference between a stock’s price and value. Identifying differences in a stock’s value and price is the key to investors’ ultimate goals, to earn a profit, achieve excess return and “beat” the market.

Valuation vs Pricing Process: How Value and Price is determined

Valuation is the financial process of determining the value of a product, service, business, company, stock or any asset based on fundamentals, theories and concepts, and quantitative estimates.

There are numerous ways to conduct a valuation depending on what is being valued.

- Listed or Public companies

- Market capitalization (market cap) method. This method is the most straightforward way to determine the listed company’s value. Simply multiply the shares outstanding by the current market price per share. For example, if a company’s stock price is currently trading at $10 per share and its outstanding shares is 100,000 shares, then the company is worth $1,000,000. The $1m reflects how much an investor would pay if he wants to buy the entire company at the current stock price. The market cap of companies is grouped into three categories according to size; small, mid and large-cap companies.

- Based on the present-day value of future cash flow or Discounted Cash flow Method (DCF). A company’s value is estimated based on the amount of present-day value of all future cash flow it generates from its business operations. Cash flow can be in the form of available cash after paying all expenses and costs of doing business (Free Cash Flow to Firm), dividends, excess income after paying the cost of equity capital (Residual Income), operating cash flow, etc. This method requires assumptions and complex calculations so it is essential to understand its limitations and advantages. It is also advisable to incorporate other valuation methods in order to get a deeper insight. For a more detailed discussion on DCF, please click here. Also available for you are the dividend and residual income valuation methods.

- Based on similar companies or Comparable Company Method. A company’s value is estimated based on using metrics, ratios or multiples of other companies in similar size and same industry. It is based on the assumption that similar companies have similar values.

- Private Companies

- Based on similar companies or Comparable Company Method. Unlike listed companies where financial data is available to the general public, private companies are not required to operate the same and be governed by reporting standards. Identifying the target company’s characteristics such as size, industry, segment, etc., establishing a “peer” group and calculating metrics and averages is a common way to value private businesses.

- Precedent Transactions or Comparable Transaction. A company’s value is estimated based on analyzing the prices paid by buyers (M&A, Buy-out, take over, etc.) of similar companies (under similar circumstances. A screening criterion is established to determine relevant transactions such as company size, industry, product mix, deal size, etc.

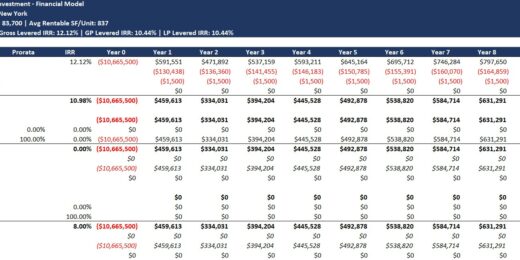

- Real Estate

- Based on Income generated by the property or Income Approach. The estimated value of the property is based on the potential income generated and expenses incurred. Net Income is calculated by deducting gross income (rentals) and property expenses (taxes, mortgage, utilities, fees, etc.). Net Income is capitalized to get the value of the property.

- Sales Comparison Method. This method uses the sales price of recent and comparable properties to estimate real estate value. Comparable properties must share similar physical features to the property being valued such as location, square footage, number of rooms, condition, and age of the building.

- Cost Method. This method takes into account the cost of the land plus the property’s construction cost. This type of valuation is suitable for properties that are unique, often with few comparables and new construction.

- Residual Land Valuation. This method is for valuing land with the potential for development. The amount is an estimate of what a developer will pay for the land considering the cost of development. This is calculated by subtracting the total value of development from all costs associated including the profit earned but excluding the cost of land. For a more detailed discussion on calculating residual land, please click here.

Valuation and Pricing

Valuation methods can be complex and easy with each method having its own set of assumptions, formulas and advantages and disadvantages. Regardless of the valuation method used, conducting valuation is important for the following scenarios:

- Financial reporting

- Investment decisions

- Merger and Acquisition (M&A)

- Taxable events (determining tax liability)

Pricing is the process where a seller (business, company, entrepreneur, etc.) sets the amount at which a good or service is sold. It is a complex process and careful consideration must be given to all factors affecting the price. If an entrepreneur sets the price wrong it will have dire consequences; poor sales, cash flow suffers, profitability falls. If the price is right, the company will reap the benefits; boost sales, cash flow grows, profitability rises.

Pricing can be set in many ways depending on the industry, competition, consumer taste, demand, and supply, etc.

Pricing Goods and Services

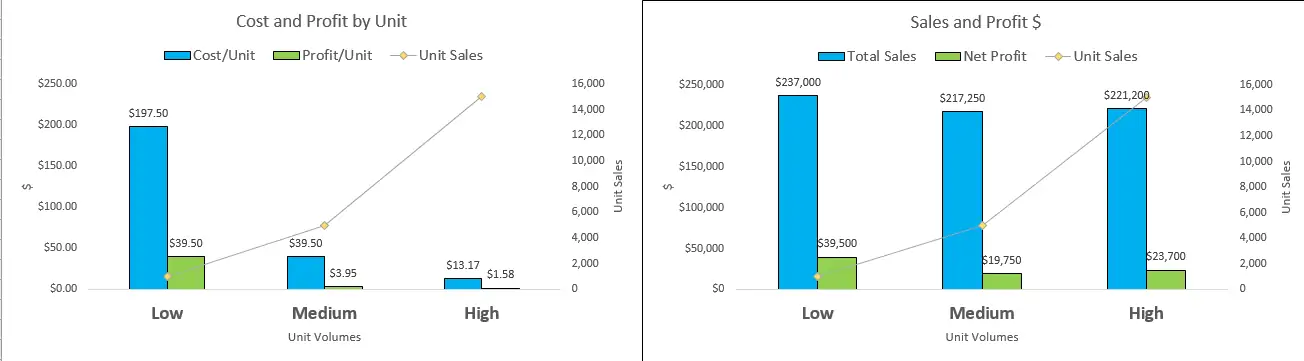

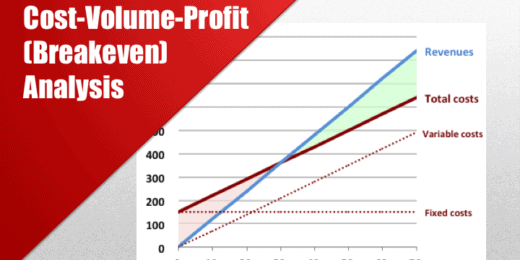

- Cost-Plus or Cost-based Pricing. It is the simplest process in pricing, simply add the total costs incurred to manufacture the product and the “markup” to determine the selling price. A “markup” can be expressed as a dollar amount of percentage and is used to cover the cost of doing business and creating profit. Simply, it determines how much money is being earned on a specific product relative to direct costs incurred.

- For example, Product A has the following manufacturing costs:

- Material cost $30

- Labor Cost $20

- Overhead Costs $8

- Total Cost is $ 58

- Retail Industry dictates an average of 20% markup used for pricing. The final price of Product A is $ 70.

- For example, Product A has the following manufacturing costs:

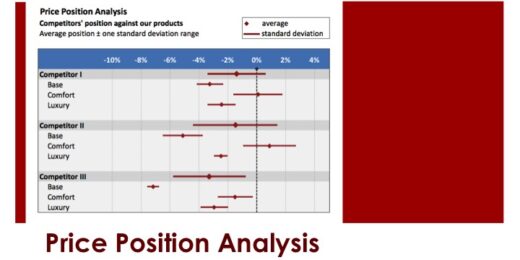

- Competitive Pricing. It is the process of setting a price at the same level as the competitors’. Unlike, cost-based pricing, competitive pricing takes into consideration the competitor’s price and focuses on competition-driven prices instead of manufacturing cost and overhead. This method is generally used for selling products that are similar (indistinguishable, not differentiated) and in a competitive market. The price set can be lower than what is sold by competitor’s or set a little higher but with added incentives (longer payment terms, longer warranty, loyalty discounts, more features, etc.)

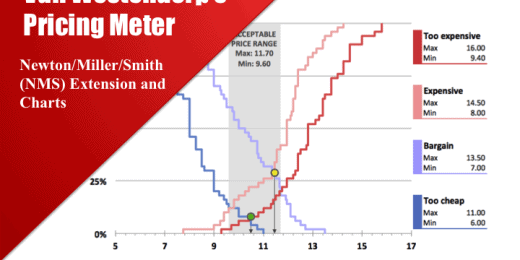

- Value-based Pricing. This process allows sellers to capture the maximum price consumers or customers are willing to pay. The price set is based on the perceived value of the product or service offers. Companies that offer unique products or highly valuable services use value-based pricing, this pricing is widely used in the fashion industry (popular brand names command higher prices due to its perceived higher quality or endorsed by a celebrity).

A video tutorial on how the pricing model works in an insurance product is available here.

Pricing in the Stock Market

The pricing of shares in the stock market is commonly set through an auction. An auction is a process of buying and selling goods (in this case shares of stock) by offering them bids, allowing people to bid and selling the goods to the highest bidder.

The bid price is simply the amount of money a buyer (or bidder) is willing to pay, this represents the highest price the buyer is willing to pay. The asking price or offer price is the amount of money a seller is willing to accept, this represents the lowest price the seller is willing to accept. When bid and ask prices match a trade transaction occurs.

The overall stock market is composed of millions of investors (retail or institutional) and traders who have differing opinions about how much a stock is worth and how much they are willing to pay for it. A stock exchange provides a platform for bid and asks prices and where buyers and sellers of stocks are matched There are currently 60 stock exchanges around the world, the Top 5 largest are: New York Stock Exchange, NASDAQ, Tokyo Stock Exchange, London Stock Exchange, and Euronext.

This auction process is highly influenced by supply and demand. If a stock has more buyers than sellers (buyers outnumber the sellers), the stock price will trend up as buyers are willing to increase their bids in order to purchase the stock. On the other hand, if a stock has more sellers than buyers (sellers outnumber buyers), the price will trend down as sellers are willing to accept lower offers for the stock and at the same time buyers will also lower their bids. This interaction between buyers and sellers is what makes the stock’s prices fluctuate.

Other factors that influence a stock’s price are:

- Overall business outlook of the economy

- Is the economy slowing down, growing?

- Is the unemployment rate rising or falling?

- Company’s current and projected financial prospects

- Are company earnings and revenue increasing every year or declining?

- Is the company taking on too much debt?

- Does the company payout dividends?)

- Level of Inflation

- Is there a sustained increase in general prices?

- Is the consumer’s purchasing power eroding?

- Level of interest rates in the economy

- Are interest rates falling or rising?

- What is the central bank’s monetary policy?

For new investors and people with limited knowledge in stock investing, the stock market can be intimidating and confusing. Add that with terrifying news headlines like losing x amount of money in portfolios, stocks falling by x amount, investors worry about “bear market”. In reality, investing in stocks like any other investment carries risk but with discipline and learning it is still one of the most efficient ways to increase one’s wealth.

Distinction between Value vs. Price: Discovering Intrinsic value vs Market price

After understanding the two processes, we can now move on to understanding its respective outcome- value and price. People often confuse value vs price and use it interchangeably but knowing the subtle distinctions can make a good investment strategy.

Economic downturns are emotionally and financially trying periods. Consider the most recent recession (2007-2009) it was a harsh period driven by a US housing crisis that echoed worldwide. During this period the price of gold skyrocketed because of its status as a “safe haven” asset. A safe haven asset is a financial instrument that is expected to increase or maintain its value in times when the economy experiences a downturn. It diversifies an investor’s portfolio as it limits their exposure to losses thus making it beneficial in times of market turmoil.

When the news of the US housing problems surfaced and headline news started circulating the word “recession”, gold prices soared as its value as a “safe have asset” increases. The price of gold in 2008 reached $869 (2006: $635) and went as high as $1,087 in 2009. So, whether you bought gold in 2008 or 2009 and paid the prevailing price at those times, the value you get is the “safe haven” capability of gold. As mentioned before there are numerous valuation methods available, but the main goal for all these calculations, assumptions and theories is to estimate the stock’s intrinsic value. The gap between the estimated intrinsic value and the price set by the market is one of the most effective investing strategies. In investing, this gap is called “mispricing”.

Optimizing Value vs. Price

In a 2008 letter to the Berkshire Hathaway’s shareholders, CEO Warren Buffett wrote:

“Long ago, Ben Graham taught me that ‘Price is what you pay; value is what you get.” – Warren Buffett page 5, 2008

Not recognizing the differences (mispricing) in a stock’s value vs. price is like driving with one eye shut. The stock price of a company reflects its perceived worth, so how do you find companies that are on sale for less than their intrinsic value or are considered undervalued? It is wise to use multiple valuation methods, there is no one single valuation method that is the best of the best.

It is also prudent to evaluate stocks using a set of standards apart from the stock’s market price such as assessing the company’s management, how strong its brand recognition is, etc. This strategy will pay off over the long term as the price will approach value. That is the reason why if you purchase an undervalued stock and hold it for a long period of time eventually it will reach its true value.

Aside from price appreciation, you will earn dividends paid out to you over the course of time and giving you a good return on your investment. Therefore, it is clear to see that weighing valuation vs pricing is a significant key to earning more in the future.

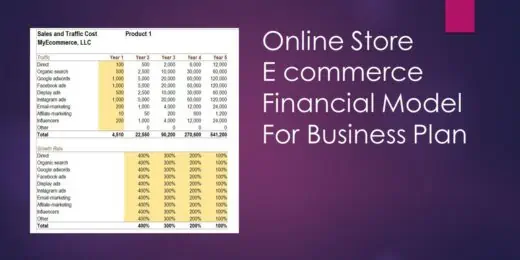

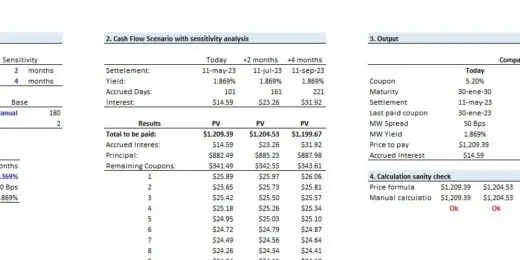

Pricing Models in Excel | Pricing Model Excel Templates

As mentioned above, weighing the real value compared to the offered price can make a big difference for your financial decision-making. Therefore, the utilization of tools to determine valuation vs pricing is a significant key. However, it is already known that valuation vs pricing tools are not easy to create and needs the expertise of individuals with the right know-how and set of skills.

One of the most commonly used tools to determine the value and price is a financial model for pricing or simply Pricing Models in Excel. To build pricing models in Excel, you will need to download pricing model Excel templates that will serve as the base to start with. This is so that you won’t have to spend too much time creating from scratch as well as save some of the hassles of hiring a financial modeler.

If you’re looking for Pricing Model Excel Templates, please feel free to check out our list of pricing models in Excel here: Pricing Models in Excel | Pricing Model Excel Templates.