Venture Capital

Our models provide a solid foundation for crafting compelling fundraising proposals, evaluating new ventures, and unlocking the full potential of your business strategy. Set your venture on the path to success—equip yourself with the financial insights to make informed, strategic decisions. Explore our sophisticated, industry-specific templates today and take the first step towards a more prosperous future. Your journey to financial mastery starts here!

Comprehensive 3- Statement Financial Model (7- years Forecast) for a Beauty SPA & Wellness Centre

A comprehensive, interactive, flexible, easy to update and understand financial…

Venture Capital Fund Financial Projection Model with Distribution Waterfall

Highly versatile venture capital fund financial projection model with equity,…

Biomethane Producer Financial Model (Renewable Natural Gas)

Create a detailed pro forma with this biogas financial model.…

VC Startup Portfolio Financial Forecasting Model

Elevate your venture capital strategy with the VC Startup Portfolio…

B2C eCommerce Financial Model & Valuation Model

Tailored ecommerce financial model Model for startups. Forecast revenue, integrate…

Crypto Token Valuation Model

A cutting-edge crypto token valuation model, designed to provide comprehensive…

Complete Private Equity (LBO) Financial Model

This is a professional financial model which performs a thorough…

Daycare Service Facility Financial Simulation – Up to 10 Year

Dynamic assumptions to create pro forma financial statements for a…

Cleaning Service Pro Forma Template (Commercial / Residential)

A pro forma template for any home service or general…

Zero Down Seller Financing Strategy for Real Estate Investment

A tool to estimate expected risk and cash flow of…

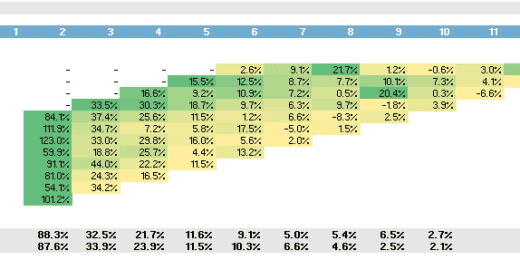

Store Vintage Analysis | Same Store Sales Analysis | Cohort Analysis

This comprehensive Excel model has been meticulously crafted to facilitate…

User Cohort Analysis | User Subscription Analysis

This meticulously crafted Excel model is designed for in-depth user…

Data-as-a-Service Financial Feasibility Study

This model is built for data-as-a-service startups. If you have…

Private Equity Fund Financial Model & Economics

Comprehensive financial model covering projections and key economics for a…

Educational Courses: Financial Feasibility and Capacity Model

Model up to 3 course types that have scaling logic…

Online Travel Agency Financial Feasibility Model

Create up to 72 months of financial projections based on…

Blue Ammonia using Natural Gas – 3 Statements, Cash Waterfall & NPV/IRR Analysis

An integrated and comprehensive Blue Ammonia Production Plant Model that…

Blue Hydrogen using Natural Gas – 3 Statements, Cash Waterfall & NPV/IRR Analysis

An integrated and comprehensive Blue Hydrogen Production Plant Model which…

Private Equity and Venture Capital Financial Model – BUNDLE DEAL

This is a Combo of Private Equity and Venture Capital…

Venture Capital Return Analysis Template (Cap Table, IRR, CoC)

Unlocking Potential Returns: Venture Capital Return Analysis Simplified - Financial…

Subscription Box Financial Model – Up to 72 Months

Test many variables in this financial model for a subscription…

Consulting Industry Impact Measurement Tool

Supports the demonstration of difference made for Consultants, Accountants, advisors…

Scaling Multiple Rental Properties: Up to 100

Configure up to 100 rental property acquisitions and view the…

Food and Beverage Financial Model Template

Elevate your food and beverage business with our plug-and-play financial…

Condo Development Model (Build and Sell)

A financial forecasting model specifically designed for the economics of…

WACC Calculator and DCF Analysis with Sensitivity Tables

A simple tool that walks the user through all the…

Custom Manufacturing (Build to Order) 10-Year Financial Model

Unique logic to plan out the feasibility and cash requirements…

SDE, EBITDA, DCF Business Valuation Matrix Template

Includes all helper calculations and a sensitivity table for up…

IRR Sensitivity Real Estate Model

Isolate and sensitize IRR based on changing occupancy rates, exit…

Apartment Building / Self-Storage / Multi-Family Acquisition Model: 15 Year

This real estate model works great for acquisitions of apartment…

Cash Flow Waterfall with GP / Sponsor Catch-up Provision

Offers logic to demonstrate the option to catch up the…

Laundromat Financial Model – 10 Year

This template allows the user to produce financial statements based…

Economic Model for Oil and Gas Extraction Feasibility

This model runs for 20 years and makes it easy…

Property Management Business Financial Model

Create a wide range of scenarios for the financial forecasting…

Wind/Solar Power Generation (Renewable Energy) Financial Model

Financial Model to calculate Profit/Loss, accurately forecast financial statements and…

Sports Agency Startup 3 Statement Forecasting Template

This 10-year financial forecasting template works great for any sort…

Construction Contractor Business – Cash Flow Forecast

This financial model lets the user plan out cash requirements…

Golf Course – Membership Only Model

Create a financial forecast for a members-only golf course. There…

3-in-1 Templates: Accounting System in Excel

This is an easy financial statement creator based on various…

Distribution Waterfall Models – Private Equity, Venture Capital & Real Estate

User friendly template including Distributions Waterfall Model for Private Equity,…

Preferred Return – Simple Interest – Multiple Hurdles

This is not preferred equity. It is a cash flow…

Joint Venture and Fund Cash Flow Waterfall Templates – Bundle

Here are all the spreadsheets I've built that involve cash…

Product + Subscription Financial Model

Build a strategy for adding recurring revenues services to your…

Hotel Construction and Operation Excel Modeling Template

Granular assumptions to create a financial forecast for hotel operators…

Single Family Rental Property ROI Analysis

Analyze rental property investments with this tool. Simple assumption tab…

Assisted Living Facility: 10 Year Financial Model

Full stack financial model, including financial statement outputs, cap table,…

All My Financial Models, Spreadsheets, Templates, and Tools: 120+

Lifetime access to all future templates as well! Here is…

Ethanol and Sugar Production Plant Financial Model

Fin-wiser’s Ethanol and Sugar Plant PPP project model helps users…

Hydrogen Gas- Tariff Calculator with Integrated Financial Statement and Cash Waterfall

The Perfect tool to assess the financial feasibility, proposal to…

Short-term Rentals: Investment Simulation and Analysis Financial Model

Simulate all the financial aspects that go into buying properties…

How Do Venture Capital Firms Make Money?

In the fast-paced world of venture capital firms, success stories often begin with a bold vision and an equally audacious investment. The tale of Sequoia Capital's visionary decision to back WhatsApp is one good example. Its $60 million investment decision ultimately yielded a jaw-dropping 50-fold venture capital fund returns. That was after three years when Meta Platforms Inc. (formerly Facebook) acquired the messaging giant for $3 billion. But what lies beneath the surface of this extraordinary success? To uncover how venture capital firms make money, we must journey through the labyrinthine world of venture capitalism, dissecting the strategies, insights, and financial wizardry that propelled Sequoia's VC investment into the stratosphere. Let's explore how VC firms turn innovative ideas into wealth-generating engines.

What Are Venture Capital Companies?

Venture capital companies, often VC firms, play a pivotal role in entrepreneurship and innovation. Venture capital firms specialize in providing limited partnership funds to early-stage startups with promising growth potential. The concept behind venture capital is to invest in these fledgling companies, helping them develop and expand in exchange for a stake in their ownership. Unlike traditional funding sources, VC firms offer capital in exchange for equity or ownership in the startup. It means a dilution of ownership among startup founders in return for the financial support needed to grow and scale their businesses.

Venture capital isn't just about providing money; it often involves providing valuable expertise and guidance to the startups. VC firms bring financial resources and technical or managerial know-how to help entrepreneurs navigate the challenges of building a successful company. One of the distinguishing features of a VC firm is the potential for high venture capital fund returns. VC fund returns tend to be higher than the average returns in other investment vehicles due to the significant growth potential of the startups in their portfolios. While investing in startups carries significant risks, successful investments can yield substantial profits.

Structure of Venture Capital Firms

VC firms are typically structured as limited partnership funds with two leading players: Limited Partners (LPs) and General Partners (GPs).

- General Partners (GPs) are individuals or entities that manage the VC firm. They are responsible for making investment decisions, managing the portfolio of investments, and advising the companies they invest in. GPs contribute their own capital (usually around 1% to 3% of the total fund) to align their interests with the LPs and demonstrate commitment to the fund's success.

- Limited Partners (LPs) are external investors who provide the bulk of the capital for the VC fund. LPs typically have limited liability, meaning their potential loss is capped at their investment in the fund. They are passive investors, not involved in the day-to-day operations or decision-making of the VC firm.

What Are the Stages of VC Investment?

The stages of VC investment are often categorized based on the company's growth stage and funding needs.

- Pre-Seed Stage: At the pre-seed stage, a startup is typically in its infancy, often at the ideation or concept development phase. At the Pre-Seed Stage, entrepreneurs seek relatively modest amounts of capital to validate their business concept, conduct initial market research, and develop a minimum viable product (MVP). What sets this stage apart is its emphasis on proving the feasibility and market potential of the idea, often before generating substantial revenue or achieving significant user traction.

- Seed Funding Stage: Seed funding comes after the pre-seed stage and focuses on turning the startup's concept into a viable business. Typically ranging from hundreds of thousands to a few million dollars, seed funding aims to fuel a startup's growth by financing product development, expanding market reach, and building a customer base. In exchange for dilution of ownership, venture capital companies not only provide limited partnership funds. They also provide managerial and networking expertise for the startup to achieve critical milestones that prepare a company for more significant funding rounds and sustainable growth.

- Early-Stage Funding: The early-stage funding rounds are where the company seeks significant capital to accelerate growth and expand operations. Each subsequent round is labeled with a letter, starting with Series A and progressing to Series B, C, and so on.

- Series A funding is often the seed of growth, the first significant round of business financing. Companies that have developed a track record, usually in the form of some regular income or a solid customer base, seek Series A funding to optimize their product or service further. The amount typically ranges from $2 million to $15 million, with the company's valuation based on its potential rather than existing cash flows.

- Series B funding is for building and expansion. Companies that have passed the development stage and need to expand market reach pursue Series B. It could involve expanding production, increasing the team, or expanding into new markets. The amount ranges widely but is typically between $7 million and $30 million. Valuations are higher due to lower risk and more evident growth trajectories.

- Series C and Beyond funding are for companies looking to scale up rapidly, often to accelerate growth to a national or international level, make acquisitions, or prepare for an IPO. It often exceeds $50 million, and valuations are based on complex data, market position, and earnings.

Some companies continue into Series D, E, and beyond. These rounds are similar in purpose to Series C but might be pursued to meet higher funding needs, overcome unexpected challenges, or further solidify a market position before going public. It's important to note that as a company progresses through these stages, the level of scrutiny from investors increases. The startup is expected to demonstrate growth, traction, and a clear path to profitability at each stage. The valuation of the company also tends to increase with each funding round.

How Venture Capital Firms Work

VC firms play a pivotal role in the entrepreneurial ecosystem, acting as catalysts for innovation and growth. Gaining insights into the intricate workings of venture capital companies, dissecting how they acquire funds, conducting rigorous due diligence, and determining the value of promising startups can help business owners, entrepreneurs, and investors better navigate the dynamic landscape of VC funding, ultimately leading to informed decisions and successful partnerships.

How Venture Capital Raise Funds

Before fundraising, a VC firm must define its strategy, including the sectors, stages, and geographies it will target. This strategy is crucial in attracting LPs whose investment theses align with the firm's focus. GPs often embark on a roadshow to present their plan, track record, and team to potential investors. Interested LPs make commitments to invest a specific amount. Once enough commitments are secured, the limited partnership funds close, and the VC firm starts deploying capital into startups.

The pooling of resources from multiple investors allows VC firms to accumulate substantial capital to invest in startups. These limited partnership funds from venture capital companies typically come from various sources.

- Corporates: Some corporations invest in VC funds or create their own corporate venture arms to gain exposure to innovative startups, potentially strategic to their core business.

- Funds of Funds: These are investment vehicles that invest in a range of VC funds rather than directly in startups, providing diversification to their investors.

- High-Net-Worth Individuals: Wealthy individuals often invest in VC funds, seeking higher returns than traditional investment avenues. They bring not only their capital but sometimes valuable industry connections and expertise.

- Institutional Investors: Institutional investors are significant players in the VC world due to their substantial capital base and long-term investment horizon. These include pension funds, university endowments, foundations, and insurance companies.

- Sovereign Wealth Funds: These are state-owned investment vehicles that invest globally, including in VC funds, to achieve long-term returns and strategic objectives.

How Venture Capital Value Startups

The VC valuation method is a sophisticated and multi-staged approach that combines financial analysis, market forecasting, and strategic evaluation. This process is vital for entrepreneurs, startup founders, and investors as it sets the stage for successful partnerships and growth. Here's a detailed look at each stage:

- Submit a Business Plan: The first step involves the startup presenting a comprehensive business plan. This document should articulate the company's value proposition, market opportunity, competitive landscape, business model, management team, and detailed financial projections. VC investors scrutinize the plan to assess the financial feasibility, scalability, and potential return on investment. They are particularly keen on unique value propositions and sustainable competitive advantages.

- Perform Due Diligence: Due diligence is an in-depth review process where the venture capitalists verify the details provided in the business plan. It includes examining the financial reports, legal structure, customer contracts, intellectual property, and the management team's background. VC investors use this phase to identify potential risks and validate the startup's valuation. They might engage accountants, lawyers, and industry experts to ensure a comprehensive evaluation.

- Pledge Capital Investment: The VC will pledge limited partnership funds for capital investment once due diligence is satisfactorily completed. This commitment is typically made in rounds, contingent upon the startup meeting certain milestones. VCs determine the amount and structure of the investment. It could be in equity, convertible notes, or a hybrid. The valuation at this stage significantly impacts the ownership percentage and future fundraising.

- Participate as Active Equity Investors: Venture capitalists often take on an active role in the startup, providing not just capital but also strategic advice, networking opportunities, and operational guidance. As part of the dilution of ownership, they may seek positions on the board of directors or involve themselves in daily management to protect their investment and guide the company towards growth. Their experience and networks can be invaluable in navigating the startup through its growth phases.

- Exit Strategy: In the final stage, the VC aims to exit the investment at a significant profit. It usually occurs 4 to 6 years after the initial investment, though the timing can vary based on market conditions and the company's performance. The most common exit strategies are an initial public offering (IPO), where the company goes public, or a merger and acquisition (M&A), where the company is sold to another entity. Less commonly, exits can occur through buybacks or secondary market sales.

Venture Capital Fund Returns

Venture capital (VC) funds are critical to the start-up ecosystem, providing the necessary capital to fuel growth and innovation. Investors receive venture capital fund returns when a portfolio company exits. Exits occur through various channels, the most common of which are:

- An Initial Public Offering (IPO) is where the company goes public, and its shares are sold on the stock market.

- Through Mergers and Acquisitions, the company's value is realized and converted into cash or marketable securities through sale.

The expected VC fund returns are more than the average to compensate for the risks. This expectation of high returns compensates for the higher risk and the illiquid nature of the investment, as the money is usually locked in for several years. Venture capital is inherently riskier than traditional equity investments like stocks or bonds. A substantial number of start-ups fail, so the risk of losing the entire investment is significantly higher. According to an in-depth analysis, the upper 25% of VC firms typically generate average venture capital fund returns between 15% and 27% annually.

The "two and twenty" fee structure is a standard VC fund returns model. Here, the "two" refers to a 2% annual management fee on the total assets under management. This fee covers the fund's operational costs, including salaries, rent, and other administrative expenses. The "twenty" refers to a 20% performance fee (or carried interest) on the profits generated by the fund. This structure aligns the general partners' interests with those of the investors, incentivizing the managers to perform well since a significant portion of their income comes from the fund's profits.

In conclusion, venture capital fund returns are a complex interplay of high-risk investments, management skills, and strategic exits. The unique fee structure and the potential for high returns drive the ecosystem, making it a vital engine for innovation and economic growth.

Venture Capital Modeling: Precision Tools for Venture Capital Excellence

Venture capital firms stand at the forefront of innovation and economic growth, driving prosperity by transforming nascent ideas into thriving businesses. They make money primarily through a carried interest in the substantial gains of successful portfolio companies and management fees with the dilution of ownership. As these firms navigate the intricate landscape of risk and reward, they fuel entrepreneurial dreams and shape the future of industries. Their success hinges on a keen eye for potential, robust due diligence, and strategic exit planning, ultimately contributing to a dynamic and prosperous business ecosystem.

Fund, Growth, and Profit are the main goals of venture capital modeling. In the realm of venture capital, precision and foresight are paramount. VC modeling is an indispensable tool, offering a sophisticated framework for evaluating risks, returns, and the potential of disruptive innovations. These models are more than mere financial projections. Venture capital modeling is how savvy investors view the future of technology, markets, and consumer behavior. As such, excellence in venture capital modeling is not just about accuracy in numbers; it's about crafting a vision for the future, one investment at a time, to build a legacy of innovation and financial success.