What You Need to Know About Private Company Valuation

Private companies play an important role in the global economy. Mars, Inc. the maker of M&Ms, Mars, Milky war bars, Skittles, Snickers, and Twix is ranked 6th in Forbes America’s largest private companies for 2018 with $35b in revenue. It was founded in 1911 and this 106-year-old company remains to this day privately held and family-owned. Other well-known, large, and successful private companies are Sweden’s furniture maker Ikea, Germany’s household appliance and power tools maker Bosh, and UK’s professional services firm Ernst & Young. Private company valuation can be a challenging and complex process. Valuing control of the majority of shareholders can shed light on its true value.

Factors in Private and Public Company Valuation

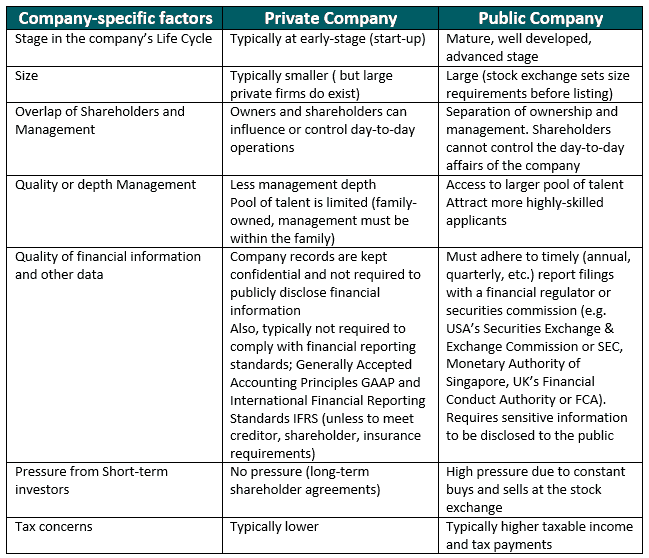

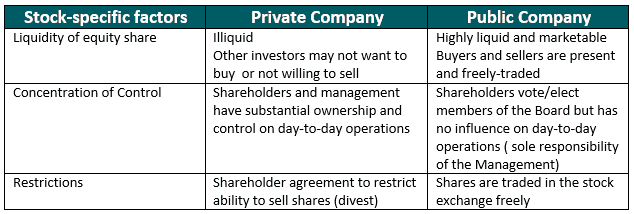

A private company, privately-held or closed company is simply a company under private ownership. Private companies do issue shares of stock to their shareholders however these are offered (“private offering”), owned (usually by a limited number of individuals predominantly by founders), and exchanged or traded privately (not at a stock exchange).

On the other hand, a public company, publicly traded or publicly listed company is a company whose ownership is made available to the general public. Public companies issue their shares via an Initial Public Offering (IPO) and are freely traded on the stock exchange or over-the-counter markets.

To better appreciate the process of private company valuation, there are two (2) factors to be considered to mark the key differences between a private vs. public company: Company-specific factors and Stock-specific factors.

Reasons for a Private Company Valuation

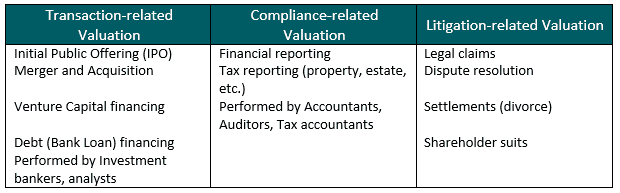

There are three main reasons for conducting a private company valuation:

Just as there are various reasons for performing a private company valuation, the value determined by the process can take on a different perspective or meaning.

- Fair Market Value FMV. The price represents what a willing buyer will pay to a willing seller (value in exchange). With respect to GAAP, fair value is mostly associated and used interchangeably with FMV.

- Investment Value. It is the subjective value based on an investor’s requirements and expectations (value in use). The investment value can either be lower or higher compared to the fair market value depending on the specific facts and circumstances of an investor.

- Intrinsic Value. Considered as a true or fundamental value. Company value is determined in isolation (excludes external factors) and based on its present and future performance over a selected time horizon. Value investors employ analytical measures to find companies whose intrinsic value is greater than their market value.

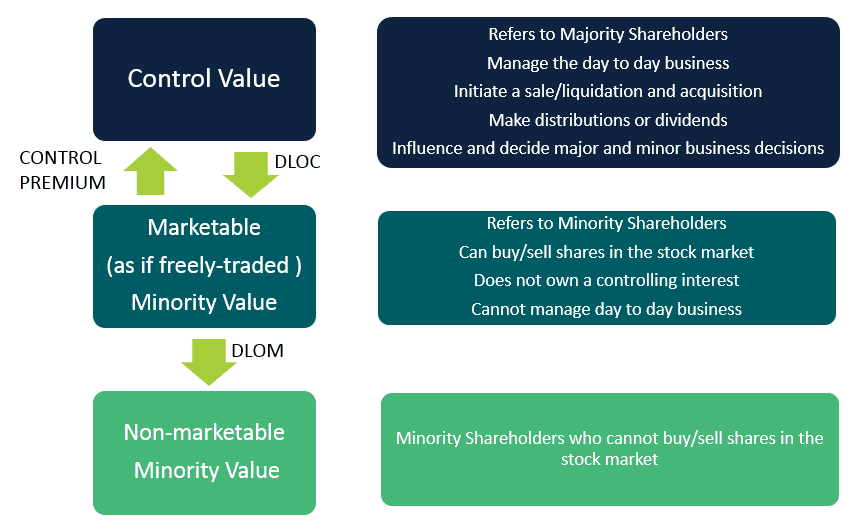

The Levels of Value

One critical key to understanding private company valuation (as well as a public company) is that not all values are created equal. There are different levels of value and it has a corresponding interest (majority shareholder, minority shareholder) in the company.

These levels of value can be adjusted, it can be increased by applying a premium and lowered by applying discounts to arrive at a value corresponding to the interest in a company. These adjustments are called Control Premium, Discount for Lack of Control (DLOC), and Discount for Lack Marketability (DLOM).

An investor who wants to have a say in the day-to-day operations of the business and exercise his influence pays an additional price, a Control Premium, to obtain a high level of control (at least a 51% controlling interest) in the company and become a majority shareholder.

To reflect the level of control of a minority shareholder, discounts are applied- Discount for Lack of Control (DLOC) and Discount for Lack Marketability (DLOM).

Premium and Discount Adjustments

Control Premium

The success of a company is determined by the decisions made using its assets and resources, decisions regarding investment opportunities and how these investments were funded, and decisions on how much the return is for the owner of the company. Whoever has control of at least a 51% controlling interest or (a majority shareholder) can direct the management, policies, strategies, operations, and investments can steer the company in any direction and reap the benefits.

A control premium is used in a private company valuation when the aim is to determine the value of a controlling interest. In other words, the control premium is appropriate when the valuation method used results in a value of the non-controlling interest.

When using comparable company analysis “Comps”, the resulting value of the private company is based on pricing multiples of the minority or non-controlling interest (small block) of the comparable public companies. So adding a control premium is appropriate to determine the controlling interest. Historically, control premiums were estimated using transactions involving the acquisition of public companies.

Careful consideration of some factors is important when estimating the control premium based on the acquisition of public companies.

- Type of transaction involved.

- Strategic transaction. A transaction where the buyer would benefit from certain synergies associated with owning the targeted private company such as market expansion, complementing products and services, cost reduction, revenue increase, etc.

- Financial transaction. A transaction where the buyer has no material synergies with owning the targeted private company. One example is acquiring a private from an unrelated industry.

- A Control Premium for a strategic transaction is generally higher due to the projected synergies.

- The acquisition activity within an industry (Industry factor). The pricing multiples of the public companies used in the comparable company analysis may reflect some part of a potential control premium in their share prices.

- Form of consideration for the acquisition. A cash acquisition is a more reliable basis for measuring control premium compared to a transaction where a significant amount of shares of stock is used. Acquiring companies may time the acquisition wherein their shares of stock are perceived to be overvalued in the marketplace.

Discount for Lack of Control and Marketability

Issues relating to control and marketability are elements that affect private company valuation and these should be taken into careful consideration. Minority shareholders have minimal control or influence on the company. Also, minority shareholders have no ready market for their shares, in fact, the only market is other existing shareholders.

When calculating the non-controlling or minority interest in a private company, Discount for Lack of Control (DLOC) and Discount for Lack Marketability (DLOM) are applied.

Discount for Lack of Control (DLOC)

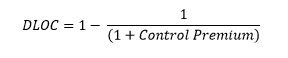

DLOC is a discount applied to the value of a controlling or majority shareholder to reflect the lack of control associated with a minority stake.

For example, private company valuation under the DCF method and using the free cash flow to the firm (FCFF) and free cash flow to equity (FCFE) will give a valuation of the controlling interest. To value the non-controlling interest of a private company, the value must be adjusted downward. To calculate the DLOC, the control premium is used since it is difficult to measure the disadvantage of the lack of control.

DLOC is related to discount for lack of marketability (DLOM) and is often used together.

Discount for Lack of Marketability (DLOM)

Marketability simply means the ability of an asset to be easily traded (buy and sell).

DLOM is a discount applied to reflect the relative lack of marketability-in other words it cannot be bought and sold easily.

There are three (3) methods to measure DLOM.

- Restricted Stock Method. DLOM is the difference between the price of a publicly-traded share and the restricted share price.

- IPO Method. DLOM is the difference between the selling price before the IPO and after IPO.

- Option Pricing Method. DLOM is the percentage difference between the put option price (right to sell) and the share price.

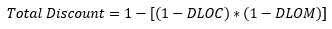

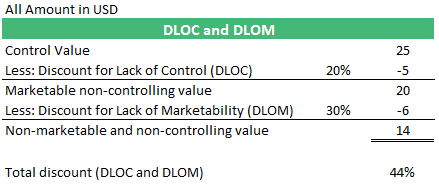

DLOC and DLOM are multiplicative and not additive thus they must be calculated in sequence. To calculate the total discount:

For example, a private company is valued at $20 per share. An investor wants to gain a controlling interest and become a majority shareholder so he acquired the business for $25. Assume DLOC is at 20% and DLOM is at 30%. What is the value of the private company’s non-controlling interest?

So, the value of the private company’s non-controlling interest is $14.

Premium for Control in Private Company Valuation

Private companies are either run by a single owner or with partners, the value of the company is reflected in the quality of decisions made by these people in control. In private company valuation, the value of control is a key factor and this is reflected in the control premium.

The value of control has two factors; the change in value once the company is under a different and better controlling ownership or majority shareholder and the probability this change will occur.

The control premium is irrelevant if the private company valuation is for liquidation or winding-up purposes. The control premium is important in the case of poorly run but profitable companies.

The value of control is higher compared to a well-run company since gaining control can influence and decide on instituting competent managers and directing better systems, policies, and strategies.

A Control Premium is also important when the business has perceived synergies and untapped resources. A majority shareholder can decide on the acquisition of a supplier and competitor as well as enter into agreements and partnerships.

Understanding the value of control and how this affects the control premium will bring about a deeper insight into the private company and importantly provide a reliable estimated value.

To help you conduct a valuation with the help of ready-made tools in Excel, feel free to check out the following templates:

- Manufacturing Company Financial Model

- Discounted Cash Flow (DCF) Excel Model Template

- DCF Model – Calculating Discounted Cash Flows for Valuation Analysis

- Valuation with Multiples and Comparable Analysis

- Other Valuation Templates for Industry-Specific business models

Please feel free to also browse our selection of financial model templates that included a Valuation Analysis here: