Lending Platform Financial Model (LaaS)

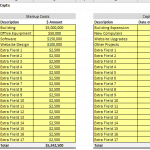

Includes all the assumptions you need to project the gross revenues and profits of a LaaS platform (Lending as a Service). 3-statement model and cap table included.

Video Overview:

Latest Upgrades: Added monthly and annual Income Statement, Balance Sheet, and Cash Flow Statement as well as a cap table and improved global controls / formatting conventions.

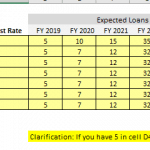

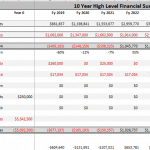

This model goes out 10 years and provides in-depth inputs for a correct and comprehensive projection of a startup Lending platform model where the platform facilitates lending/borrowing between peers. This type of business model has become popular in the cashless lending scene.

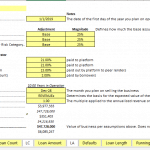

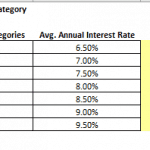

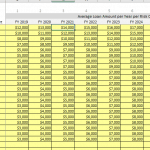

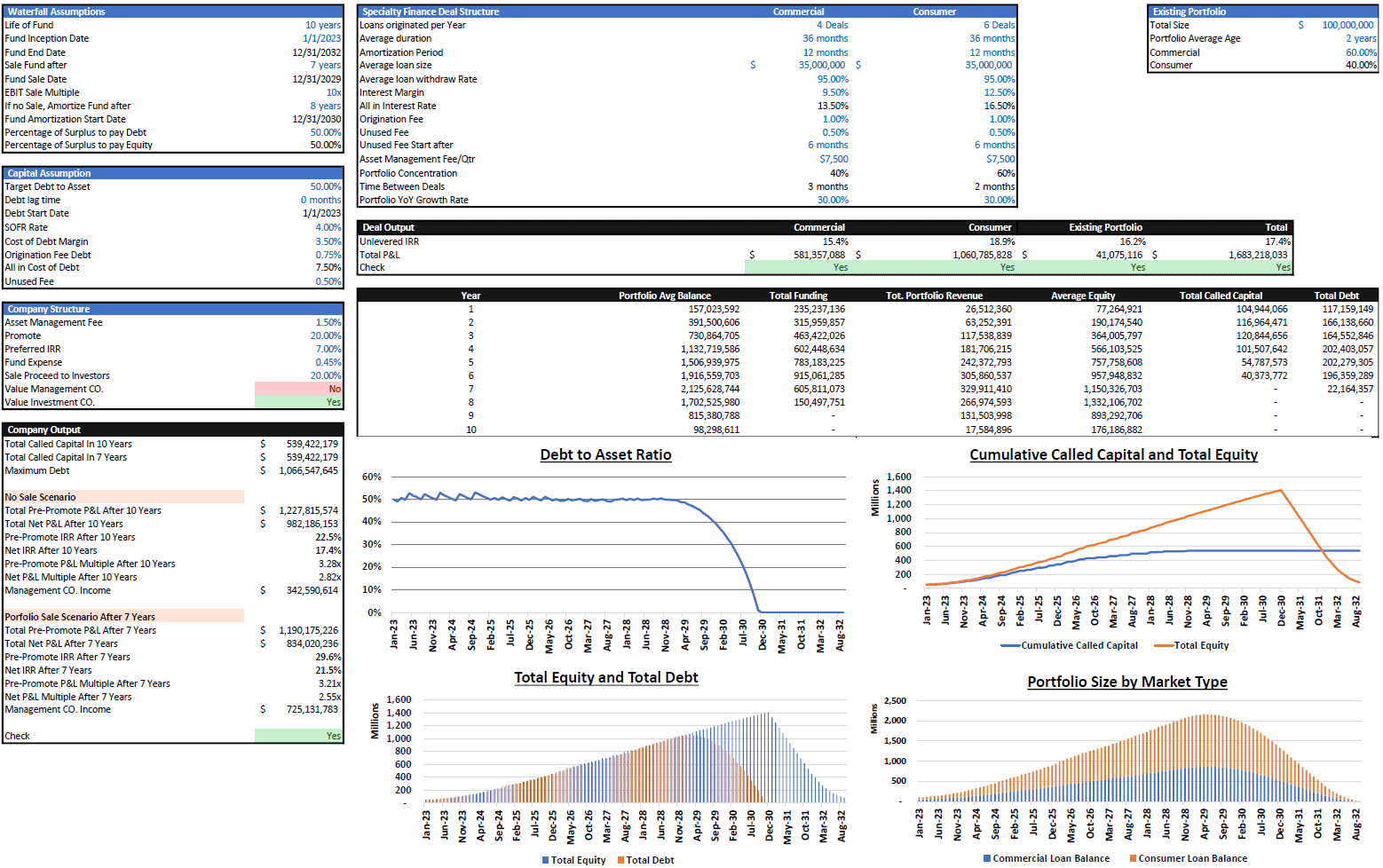

You will be able to adjust various risk grades, loan amounts per grade, avg. interest rates per grade, and % of loan count falling into each risk grade per a given term (up to 4 term lengths).

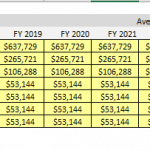

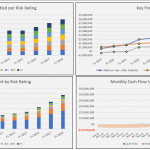

There is logic to show an exit valuation at any month within the 10-year forecast as well as IRR, cash requirements, and net cash returns / ROI figures. The model goes as granular as possible but then comes out to a high-level view of the primary revenue and expense forecasts.

Sensitivity analysis is possible, and you can change up to 3 revenue-driving variables to run a low/base/high scenario. The magnitude of how much the base assumption is affected can also be input.

Charts and visuals have also been included to show the revenue share the platform receives from gross interest, closing costs, and/or coverage of a certain % of defaults. If anything does not apply, you can simply enter a 0 in the field.

Another nice feature is the break-even month and break-even year for accumulated cash. This includes the payback of debt upon exit.

See the overview here:

Similar Products

Other customers were also interested in...

Lending Model Startup Forecast: 10-Year Scaling &#...

This is a full 10-year startup lending business financial model, including a 3-statement model. Accu... Read more

Flat Fee Lending Business: Operating Model

10-year financial model directly built for a flat fee / fixed fee lender. Includes leverage for orig... Read more

Loan Tape Analysis / KPI Dashboard

A framework that makes it easy to drop in your loan data and automatically generate analytical insig... Read more

Crowdlending (P2P) Platform – 5 Year Financi...

Financial Model providing an advanced 5-year financial plan for a startup Crowdlending (Peer-to-Peer... Read more

Debt Fund Excel Model

Explore the Debt Fund Excel Model, a comprehensive tool for evaluating new credit fund opportunities... Read more

Buy Now Pay Later DCF Model & Valuation (10 Ye...

The Buy Now Pay Later (BNPL) Company financial model is a comprehensive tool designed to analyze the... Read more

Leasing Company Financial Model – 5 Year Forecas...

Financial leasing companies engage in financing the purchase of several types of assets. Though a le... Read more

Lending Company Financial Model – 5 Year Forecas...

This Financial model template presents a business scenario of a corporation engaged in granting loan... Read more

Buy Now Pay Later (BNPL) Platform – 5 Year F...

Financial Model presenting an advanced 5-year financial plan for a startup BNPL Platform which provi... Read more

Commercial Bank Financial Model – Dynamic 10...

Financial model presenting an operating and valuation scenario for a Commercial Bank The model ca... Read more

Reviews

The model needs to include balance sheet and P2PL ratio, default rate for each loan grade, recovery rate for each loan grade, penalty fee for late payments for each loan grade

793 of 1560 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

-

Balance Sheet, cash flow statement, and income statement have been added as well as a cap table and improved general formatting.

597 of 1219 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

-

Each loan grade does have its own default rate. See ‘defaults’ tab. May add a full 3-statement model to this at some point in the future.

672 of 1321 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

You must log in to submit a review.