Upstream Oil & Gas Project Analysis

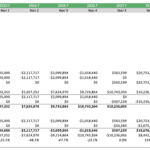

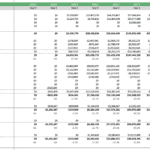

The Upstream Oil & Gas Project Financial Model Template in Excel empowers you to project and dissect your impending Oil and Gas drilling ventures. Preparing for the successful financing of oil & gas projects is the ultimate goal of this template. The spreadsheet comes with monthly production projections of a series of oil & gas wells put into operation for a projection period of up to 50 years. The model allows to assume multiple well drilling programs, accommodating 50 or 100 oil and gas wells in total. The monthly production forecast is then compiled into a comprehensive annual financial forecast spanning up to 50 years and a monthly forecast covering the first 5 years of operations.

The spreadsheet model template provides an in-depth examination of your drilling endeavors, detailing expected production, revenues, expenses, profits, and cash flows, while also computing the relevant financial metrics essential for investors and decision-makers to understand your project in detail.

The Model Template has been updated to Version 8.3. Customers who purchased a model version >8.0 can upgrade their Templates for FREE. Simply log in here, and if eligible, your upgrade discount will be applied automatically.

Dive Deep into Your Upstream Oil & Gas Project with Our Advanced Financial Model

Are you embarking on an upstream oil & gas venture? Are you looking to invest in an Oil field in Texas, Kansas, Los Angeles, or any other part of the world? Projects in oil & gas can be risky and require much capital, which in most cases will have to come from equity investors. Navigate the financial intricacies of a risky upstream oil & gas project with our state-of-the-art Excel spreadsheet template specially made for the needs of upstream oil & gas projects. The analysis of oil & gas drilling projects becomes easier using a sophisticated financial plan template.

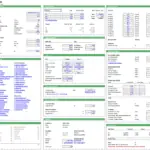

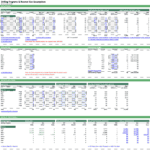

The template projects the expected production output of 50 or 100 oil & gas wells which will be drilled during the execution of 5 to 8 drilling programs (depending on the model version). The resulting production forecast, combined with assumptions for prices, costs, required investment, and funding, allows the development of a comprehensive three-statement forecast – Income Statement, Balance Sheet, and Cash Flow Statement – combined with forecasting free cash flows and the calculation of the relevant financial ratios and metrics at the project and the investor level. The Pro Version also includes break-even and sensitivity analysis to study the risks of such drilling projects in more detail. The model has been updated from its previous version, and years of practical experience modeling oil & gas projects have been included in the analysis.

For a hands-on guide, please watch the detailed video walkthrough provided below.

The Main Challenges in the Financial Analysis of Oil & Gas Drilling Projects

The upstream oil & gas sector isn’t for the faint-hearted: attractive returns come with great risks. Drilled wells can be dry or a hit, and obtaining financing for oil & gas projects is not easy. Therefore, analyzing Oil & Gas projects offers unique challenges:

- Profits Determinant? With a vast 50-year horizon, predicting profits and cash flows requires an in-depth understanding of the determinants of profits. We must understand the composition of production volumes, prices, revenues, and costs. Therefore, we need to identify our project’s assumptions and drivers of value.

- Resource Variation: Oil and gas wells can produce diverse oil, gas, and NGL output from your drilled oil wells.

- Model Dependencies: Oil and gas prices typically in tandem long-term. The start of your drilling programs and the expected rates of decline from peak production define by when the first revenues can be obtained. Furthermore, we need to understand the effect of each drilling program on the financial success of our project. Therefore, several dependencies must be analyzed and defined when modeling an oil & gas project.

- Break-Even Analysis: We will want to know at which prices production will still be profitable and when it makes more sense to shut down production. This requires some understanding of what is our break-even price.

- Financing Oil & Gas Projects: Drilling projects are expensive in nature. The less funding required means a project becomes less risky and can offer better returns for investors. How to minimize the initial cash outlay and partially use first revenues to finance the drilling of additional oil & gas wells?

- Investor Perspective: Oil & Gas drilling projects are mostly financed by equity. This requires a deeper look into the shareholder structure as depending on the shareholder type (General Partner or Limited Partner), their share of profits can be different.

For a deeper dive into these complexities and others, please refer to our informative PDF Demo Version.

Upstream Oil & Gas Financial Model Template – Perfect for Drilling Oils Wells

Unlock the potential of your upcoming oil & gas drilling project with our intuitive Excel spreadsheet template. The Excel model tailored analysis, specifically prepared for upstream oil & gas industry modeling projects. The main highlights of this spreadsheet model template are the following:

- Assumptions: The main assumptions are stated on separate assumption sheets, making defining the project’s business case easy.

- Dynamic Calculations: The model reacts dynamically to any update in assumptions and immediately calculates a new scenario upon update. This allows us to understand how the financial result changes upon a change of assumptions and run nearly unlimited scenarios.

- Timing: The model allows different timeframes for the rollout of the drilling programs defined by when the oil & gas wells come into the production stage and when their output declines from peak production.

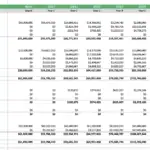

- Comprehensive Forecasts: The model builds a comprehensive three-statement forecast of the Income Statement, Balance Sheet, and Cash Flow Statement, derives Free Cash Flow Forecasts, and calculates the relevant financial ratios and breakdowns. This allows for in-depth insights into your forecast and project.

- Calculation of all Key Metrics: The model calculates the relevant financial metrics such as the Payback Period, Internal Rate of Return, and cash-on-cash yield. Separate metrics are calculated at the Project and the Investor participation level.

- Valuation of Reserves and Tracking of Resource Depletion: The model allows for a quick initial valuation of the expected resource reserve and tracks the depletion of such reserves as the production progresses.

- Investor-Metrics: Get a complete suite of financial metrics and analyses crucial for wooing investors.

The template shows an example of how the economics of upstream oil & gas project work. With this template, you will have a clearer view of your project’s financial landscape and be better equipped to prepare the financing of your oil & gas projects when pitching your next drilling venture to potential investors.

Who are the intended Users of this Template

- Promoters interested in drilling oil wells or studying fracking oi fields

- Project Promoters interested in drilling gas wells

- Entrepreneurs and Advisors preparing for the financing of oil & gas projects

- Investors in need of a solid analysis of oil & gas drilling projects

- Anybody interested in understanding the oil and gas industry

Key Features of the Upstream Oil & Gas Financial Model Template

This financial model template allows you to dive into the financial implications of starting oil & gas drilling in detail and understand its consequences from all sorts of angles. The template offers the following key features:

Basic Version:

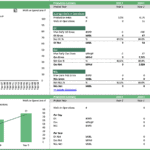

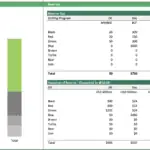

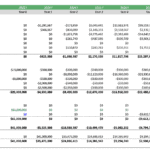

- Dynamic Assumptions: Incorporate production volumes (peak volumes and production decline assumptions), reserve size, pricing, capital outlay, operating costs for drilled wells and overhead, valuation, timing, project lifetime, funding, and investor profit sharing.

- Revenue Streams: Oil, Gas, and Natural Gas Liquefied (NGL) revenues.

- Drilling Programs: Map out up to 5 drilling initiatives, spanning up to 50 oil & gas wells with different times of start of production,

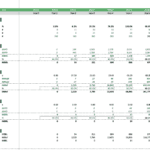

- Robust Forecasting: Create detailed 50-year production timelines grounded on projected decline rates for varied drilling ventures. Enjoy both annual (up to 50 years)

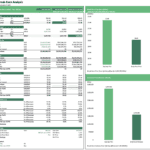

- Solid Financial Analysis Framework: An all-inclusive three-statement model covering the Income Statement, Balance Sheet, and Cash Flow Statement, combined with the calculation of essential Financial Ratios and detailed Free Cash Flow Forecast, lay the basis for the project’s analysis. Forecasts also include schedules for fixed assets and debt.

- In-depth Financial Calculations: The model calculates the relevant financial metrics of the project, such as the IRR for the unlevered and levered free cash flows, lifetime profits, payback period, cash yield, NPV, and more.

- Resource Management: Assumptions for expected oil & gas reserves allow us to quickly estimate the value of the project’s resources and track such depletion.

- Snapshot & Analysis: The analysis of oil & gas is summarized with a variety of charts and tables. A one-page Executive Summary and a more detailed summary with in-depth breakdowns of the different aspects of your upstream oil & gas drilling project are provided.

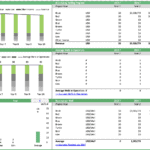

- Investor-Metrics: The model includes assumptions for shareholder’s equity stakes and funding contributions, as well as profit sharing for a standard General and Limited Partners structure which returns in investor-specific metrics for returns and profit for up to 5 investors.

- Scenario Mastery: Convenient switches to toggle between including and excluding drilling programs for comprehensive scenario studies and for analyzing the contribution of each drilling program to the project’s success.

Pro Version:

- All Basic Features: Everything from the Basic version and…

- Extended Drilling Scope: Model up to 8 oil & gas drilling programs, encompassing 100 wells.

- Financial Analysis: A break-even analysis to identify the crucial oil price for the project’s success and sensitivity analysis to gauge IRR’s potential responses to assumption changes.

NEW: As of model version 8.3, we have added an option so that each of the 5 (Basic Version) or 8 (Pro Version) drilling programs can have their own lifespans, allowing additional forecasting accuracy.

Financing Projects and Understanding the oil and gas industry

In conclusion, the template allows for preparing a sophisticated financial plan typically required for financing oil & gas projects. The template scopes out the timing of your drilling plan and can simulate various scenarios, aiding in understanding the different aspects of the upstream oil & gas industry.

The Basic and Pro versions offer fully editable Excel spreadsheet templates for immediate download. Additionally, a free PDF demo version is provided for a sneak peek into the capabilities of each model version. Current Model Version 8.3.

File Types: .xlsx and .pdf

Similar Products

Other customers were also interested in...

Private Equity Oil and Gas Financial Model

The Private Equity Oil and Gas Financial Model evaluates the financial feasibility and investor retu... Read more

Oil & Gas Financial Model – Dynamic 10 Y...

Financial Model providing forecast and valuation analysis of an upstream Oil & Gas Project. T... Read more

Oil & Gas Financial Model – DCF and NAV Valu...

The Oil and Gas financial model with DCF (Discounted Cash Flow) and NAV (Net Asset Value) Valuation ... Read more

Economic Model for Oil and Gas Extraction Feasibil...

This model runs for 20 years and makes it easy to create a financial plan and feasibility study for ... Read more

Oil & Gas Marketing and Distribution DCF Valu...

A detailed and user friend financial model that captures 5 years of Historical + 1 Year of Budget + ... Read more

Oil and Gas Project Finance Model

Oil and Gas Project Finance Modeling Template. This is a project finance model for an oil and gas up... Read more

Break Even Analysis in Petroleum Project Models

The main purpose of the model is to enable users to get a robust understanding of the business sen... Read more

Upstream Petroleum Operations Development Model

The main purpose of the model is to enable users to get a robust understanding of the upstream pet... Read more

Expert Sensitivity Analysis for Upstream Petroleum...

The main purpose of the model is to enable users to get a robust understanding of the business sensi... Read more

Hydrogen Gas Sales & Tolling Business Plan an...

Hydrogen Gas Sales & Tolling Fee business plan and valuation model is an excellent tool to asses... Read more

Reviews

Simply the best Upstream Oil & Gas Template I have used. The layout of the assumptions is intuitive. The flow and logic of the model is excellent. Finally, the Summary Tab information is well organized. The modeler was very responsive to my questions and feedback and has a sound understanding of the workings of Upstream Oil and Gas. I am very pleased with the workings of the model and the creator’s thoughtful and timely responsiveness!

29 of 49 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

A complete and comprehensive oil and gas project financial model.

94 of 196 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

Incredible value for the price. Becomes intuitive after playing around with it. Versatile and full of useful information. Can tweak so many different scenarios. Professional looking. Would’ve paid more for it. The creator is knowledgeable about financial modeling and drilling and producing oil and gas.

578 of 1169 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

Thank you!

628 of 1283 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

You must log in to submit a review.