Debt Schedule

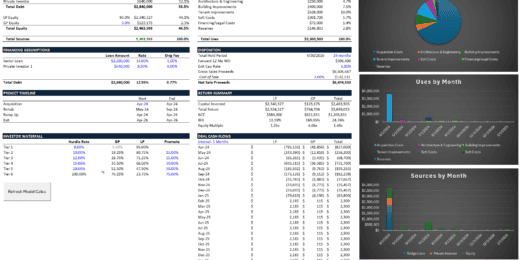

Multifamily Rehab Model (Includes Investor Returns Waterfall)

Introducing the Multifamily Rehab Flip Model with Investor Returns Waterfall…

Project Finance Excel Model – 10 Year Projection

The template creates a financial model for your individual project…

Startup Company Financial Model – Dynamic 3 Statement Financial Projections up to 8-Years

Highly Dynamic and Easy-to-Navigate Excel Financial Projections Model that allows…

Advanced Financial Model – Dynamic 3 Statement 10-Year Financial Model with DCF Valuation

Advanced, Dynamic and Easy-to-Use Excel Financial Projections Model that allows…

B2B SaaS FInancial Model & Valuation Template

Unlock your B2B SaaS venture's full potential with our B2B…

Biomethane Producer Financial Model (Renewable Natural Gas)

Create a detailed pro forma with this biogas financial model.…

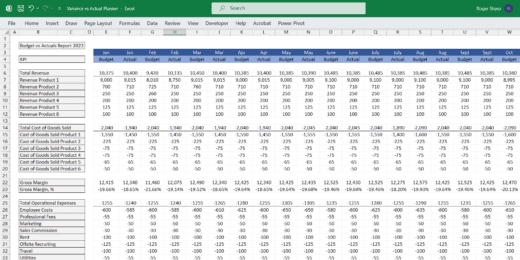

Budget vs Actual Forecasts 5 Years Excel Template

MS Excel spreadsheet for tracking budget finances. Can be used…

Real Estate Industrial Acquisition Model Single Tenant

This Excel-based tool is tailored for the nuanced analysis of…

CBD Personal Care Financial Model and Valuation Template

CBD Personal Care Financial Model and Valuation Template, a comprehensive…

EdTech Financial Model and Valuation Template

Empower your EdTech startup with our comprehensive Financial Model, including,…

Hospitality (Hotel) Financial Model and Valuation – 10-year Projections

Welcome to the Hospitality (Hotel) Company Financial Model and Valuation,…

Subscription-Based B2C SaaS Financial Model Template

Optimize your Subscription-based B2C SaaS startup's financial planning with our…

Brewery Financial Model and Budget Control

This Excel model is an advanced, user-friendly financial planning tool…

Gym Financial Model and Budget Control

This Excel model is a highly adaptable and user-friendly tool…

Surfboard Rental Business Financial Model

Surfing is not just a sport—it's a lifestyle booming globally.…

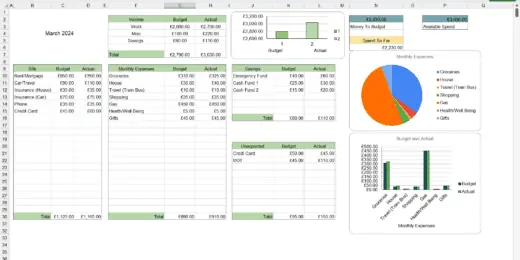

Ultimate Budget Spreadsheet, Budget Dashboard, Google Sheets, Excel

Ultimate Budget Spreadsheet, Budget Dashboard, in both Google Sheets and…

Healthcare – Hospital – Financial Model and Valuation (10-year Forecast)

Welcome to the Healthcare (Hospital) Company Financial Model and Valuation,…

Real Estate – Multi Family Acquisition Pro-forma

This Excel template is an intuitive and comprehensive solution tailored…

Real Estate – Single Family Rental Pro-Forma Template

This real estate financial model is a dynamic tool designed…

Motorboat Rental Business Financial Model

Dive into the heart of financial planning with our Motorboat…

AgroTech Services Financial Model (10+ Yrs. DCF and Valuation)

The AgroTech Services Financial Model with DCF (Discounted Cash Flow)…

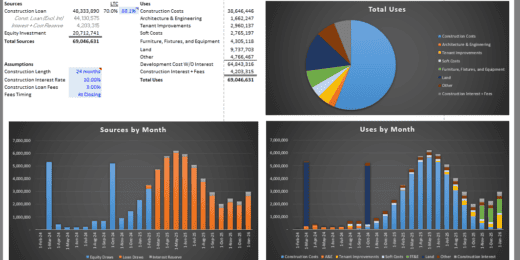

Construction Draw Schedule & Gantt (New Development Cost/Sources & Uses Model)

Elevate your construction project planning with our Construction Draw Schedule…

Urban Micro-Mobility Services Financial Model (10+ Yrs. DCF and Valuation)

The Urban Micro-Mobility Services Financial Model with DCF (Discounted Cash…

Trucking Company – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

Pet Grooming Business Dynamic Financial Model 2024

Tailored for pet grooming businesses, this dynamic financial model streamlines…

Telehealth Services Company Financial Model (10+ Yrs. DCF and Valuation)

The Telehealth Services Company Financial Model with a 10+ Years…

Online Tutoring Services Financial Model (10+ Yrs DCF and Valuation)

The Online Tutoring Services Financial Model is a comprehensive tool…

Daycare Service Facility Financial Simulation – Up to 10 Year

Dynamic assumptions to create pro forma financial statements for a…

Pro Financial Forecast – Dynamic and Advanced Financial Projections

Unleash the power of precise, customizable forecasting with Pro Financial…

Oil & Gas Financial Model – DCF and NAV Valuation (5+ Yrs.)

The Oil and Gas financial model with DCF (Discounted Cash…

CPG Company Financial Model and Valuation

Discover the CPG Company Financial Model and Valuation, an essential…

eCommerce | Online Retail Financial Model and Valuation

Discover the eCommerce - Online Retail Company Financial Model and…

Private Aircraft Rental Company Financial Model

Embark on a journey to financial mastery with our Private…

Webinar Organizer Business Plan Template

Discover the key to financial success in your webinar ventures…

SaaS Company Financial Model and Valuation

Discover the SaaS Company Financial Model and Valuation, an essential…

Party Planning Business Financial Model

Introducing the Party Planning Business Financial Model – Your Ultimate…

Dog Grooming Services Financial Model (10+ Yrs DCF and Valuation)

The Dog Grooming Services financial model is a comprehensive tool…

Zero Down Seller Financing Strategy for Real Estate Investment

A tool to estimate expected risk and cash flow of…

Catering and Ballroom Rental Financial Model

This Excel model is a highly adaptable and user-friendly tool…

Buy Now Pay Later DCF Model & Valuation (10 Year DCF Model)

The Buy Now Pay Later (BNPL) Company financial model is…

Real Estate Proforma – Value-Add Apartment Acquisition Model

This multifamily apartment value-added real estate model is a sophisticated…

Event Organizer Business Model Template

Elevate your event planning business to new heights with our…

Sailboat Rental Business Financial Model

This comprehensive 10-year monthly Excel template offers an ideal basis…

Rental Property (Airbnb – Real Estate) Financial Model

Powerful Real Estate Rental Property Financial Model for Informed Decision-Making,…

Hotel Complex – Financial Model (5 Yrs. DCF and Valuation)

The Hotel Complex financial model is a comprehensive tool designed…

Comprehensive Oil & Gas Financial Model

Comprehensive financial model for an oil & gas company. Flexible…

Start-up Manufacturing Financial Projection and Budget Control – Excel & Google Sheets

The financial model is an essential tool that enables owners…

Full 3 Financial Statements Projections Model

Comprehensive three financial statements model (Income Statement, Balance Sheet, and…

Senior Living Development – 10 Year Financial Model

Financial model presenting a development scenario for a Senior Living…

EV Battery Recycling Plant Financial Model (10+ Yrs DCF and Valuation)

The EV Battery Recycling Plant financial model is a comprehensive…

Microfinance Platform – 5 Year Financial Model

Financial Model presenting an advanced 5-year financial plan for a…

Film Production 10-Year 3 Statement Financial Projection Model

10 year rolling financial projection Excel model for a new…

What is Debt Schedule?

It's critical to have a firm grasp on the specifics of your payment schedules and interest rates. A business debt schedule makes it simple to gather and review your company's debts so that repayments can be planned accurately and efficiently. They can even assist you in determining whether your company is eligible for a second small business loan. This is now where Debt Schedule comes into play.

A debt schedule template is a tool that lays out all of the debt a business has which helps to review, assess, and visualize the debts. By building a debt schedule, a business will be able to make strategic decisions on whether to pay off debt, acquire new debt, or create long-term projections for investors and creditors. A debt naturally requires periodic payment, otherwise, the interest will keep on increasing. A business debt schedule is basically a list of all the debts your business currently owes, such as:

- Loans– could be money, property, or other material goods that is given to another entity in exchange for future repayment of the loan value amount included with interest or other finance charges. Both parties (lender-borrower) must abide by mutual agreement before anything is given.

- Leases– mostly used for real-estate agreements, leases are legal and binding contracts that outline the terms under which the owner of the property, the lessor, agrees to rent their property to the lessee or the tenant. It requires regular payments from the lessee for a specified number of months or even years. Both parties are subjected to consequences if they failed to uphold the legal contract.

- Contracts– could be verbal or written agreement by both parties. There are many types of contracts, especially when running a business. Most of it is written contracts to ensure legality and also to bind a contractual commitment between the parties.

- Notes Payable – represents a loan from a financing source such as banks which requires a formal loan agreement. It also stands for all the promissory notes issued/drafted to owed parties. In business terms, it is a note promising to repay the money owed in the future.

- Miscellaneous other Periodic Payables– other payables which guarantee both parties benefits and an agreement is made.

The short-term accounts payable and accrued liabilities are normally not included as they are considered as regular expenses, not to mention the payroll, real-estate taxes, and other types of taxes, which are also expenses that are accrued and recorded in the balance sheet. Each debt listed in the business debt schedule should include all the needed details such as the following:

- Creditor / Lender

- Original amount of debt

- Current balance

- Interest rate

- Monthly payment

- Due date

- Maturity date

- Collateral

By laying down all the details on the debt schedule, as the business owner, you will be able to quickly assess an overview of all your business’ current debt, especially in cases where you make a decision such as either to take out more debt, which debt to repay first, or to renegotiate with the creditor/lender.

Components of a Debt Schedule Template

When making a debt schedule model, there are several components that are critical and need to be included, such as:

- Projected Debt Balance – opening / current debt balance subtracted by repayments

- Debt Repayment Schedule – schedule determining which debt to repay first

- Debt Drawdowns – gradually issuing funds instead of taking out the full debt amount

- Interest Expense – expected interest expenses that will be accrued over time

- Closing Balance – ending balance at the end of the period

Every component is strictly tracked until maturity and comprised the full debt schedule model. But of course, there are important factors to consider as you build a debt schedule model, such as:

- Debt Maturity

A very important factor that every borrower needs to consider. When taking out a loan, one must first look at the debt maturity date for this will determine how much interest you will have to give in, aside from the original amount owed. Since most debts are amortized and paid monthly, the longer the maturity of the debt, the lower the amount you will have to pay monthly, but this also means that the total sum of debt owed will be bigger due to the accrued interest added. - Interest Rate

Another important factor that makes a debt, a liability. It helps remind a borrower that nothing is free especially when it involves money. Every debt will always be tagged with an interest rate which will be accrued every month or depending on the agreement between the lender and borrower. It is said that the lower the interest rate, the better, but that is not always the case. A lender could extend the debt maturity date which basically means, the interest accrued will still be greater compared to a short-term date with a higher interest rate. So, the importance of calculating the interest rate is the biggest determining factor before signing the agreement. - Floating or Fixed Interest

When acquiring debt, one must determine whether the debt has a floating interest rate or a fixed interest rate. These are two important factors that could be considered troublesome, such as when the debt has a floating interest rate since it greatly affects the overall amount of debt annually. So, if there’s a fluctuation with the figures, the debt schedule model made will have to be updated again. On the other hand, if the debt has a fixed interest rate, it will provide a reliable calculation and a much more accurate projection. But this doesn’t mean that a floating interest rate is not a good choice, it is still a better choice for a low or declining interest rate environment. - Repayment Capability

Before even taking out debt, one must ensure that as a borrower, you will have a steady stream of income to repay the debt off. This is actually the topmost priority to consider before even talking about debt. Any failure to comply according to the agreement will result in dire consequences such as forced liquidation and a loss of trust. Reputation is everything for a business, thus, it is important that the debt must be repaid before or until it reached its maturity date.

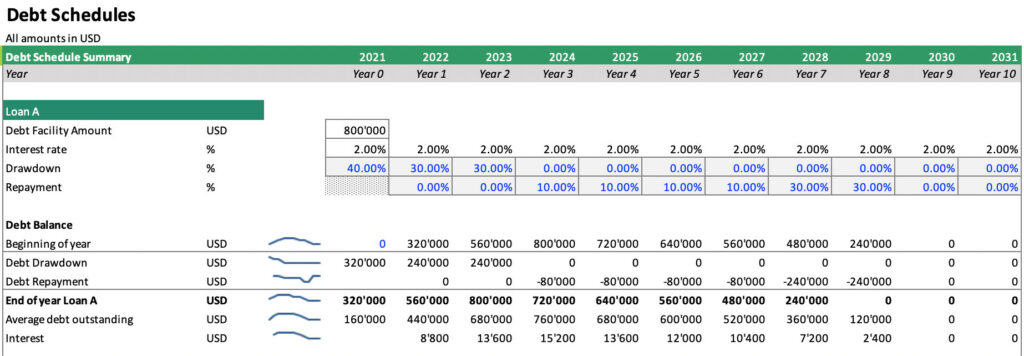

Debt Schedule Example

Below is an example of a Debt Schedule. It shows the important components we needed to analyze our debt refinance and repayments such as the interest rate, drawdown percentage, repayment percentages and the beginning balances of the debt to be repaid.

This illustration basically shows that from 2021 to 2023, a loan totaled 800,000 was made. Then starting 2024 to 2029, the debt is repaid with regards to the interest, drawdown, and repayment rates set beforehand on the illustration to see how much more loan to get and when to start repaying using specific rates.

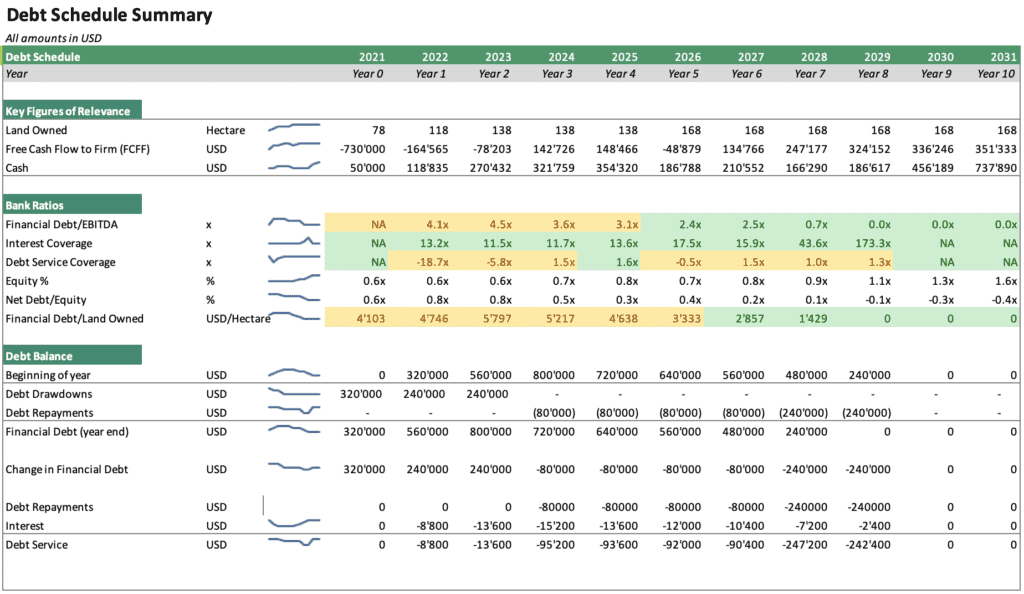

Debt Schedule Summary

The below example shows a much comprehensive Debt Schedule Summary showing additional important details regarding your debt refinance and repayments. We can now see Relevant Figures such as bank ratios and percentage details that may affect securing and repaying debts, and finally, the Debt Balance yearly schedule depending on the refinancing and repaying activities made.

Uses and Significance of a Debt Schedule

Aside from keeping all your finances organized, there are several uses for a debt repayment schedule.

- Raise Financing from banks – This is simply the key reason as to why you should build or use a debt schedule for your business. Why? The debt schedule can tell us when is the most suitable time to acquire additional finances from banks and when to pay it and at what interest percentage.

- Accurate bookkeeping and forecasting– with a detailed report of all the needed data of each debt, it will be easier to create a projection of how much you’ll have to stake out from your business as you set goals in the future too.

- Monitoring financial health– you’ll be able to monitor how your business is doing and also help direct your repayments to which debt must be repaid first.

- Determine if you can get a new debt– using the debt schedule will help you calculate if your business can handle another debt.

- Tracking repayment– since every debt will incur interest as time goes by, the debt schedule will help you not miss a payment and keep the interest added on a down low.

- Estimate total amount– the ability to estimate how much a business will have to pay once the debt matures.

- Tool for negotiation– the debt schedule can be used as an instrument to convince lenders to give you a new line of credit, negotiate better interest rates, attract potential investors, etc.

- Don't Miss a Payment - Having all of your payments in one place is one of the most important functions of a debt schedule, and it should give you peace of mind.

- Create a Payment Strategy - By aligning your payments, you'll be able to make payments with more confidence, knowing that you've planned ahead.

In summary, the ability to estimate the total amount owed once a debt matures is the primary reason for creating a debt schedule as well as using this tool allows the company to track the debt's maturity and make decisions based on it, such as refinancing the debt with a different institution/source when the interest rate falls.