Financial Due Diligence

Multifamily Rehab Model (Includes Investor Returns Waterfall)

Introducing the Multifamily Rehab Flip Model with Investor Returns Waterfall…

Startup Company Financial Model – Dynamic 3 Statement Financial Projections up to 8-Years

Highly Dynamic and Easy-to-Navigate Excel Financial Projections Model that allows…

Advanced Financial Model – Dynamic 3 Statement 10-Year Financial Model with DCF Valuation

Advanced, Dynamic and Easy-to-Use Excel Financial Projections Model that allows…

B2B SaaS FInancial Model & Valuation Template

Unlock your B2B SaaS venture's full potential with our B2B…

Biomethane Producer Financial Model (Renewable Natural Gas)

Create a detailed pro forma with this biogas financial model.…

VC Startup Portfolio Financial Forecasting Model

Elevate your venture capital strategy with the VC Startup Portfolio…

Cannabis Grow and Dispensary Pro-Forma Model

The Cannabis Grow and Dispensary Pro-Forma Model is a comprehensive…

Food Truck Monthly Financial Model Template

The Food Truck Financial Model Template is a comprehensive solution…

Start Up Company Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking start-up company…

Fast Food Restaurant Financial Model Template

Maximize fast food financials with our user-friendly financial model template.…

CBD Personal Care Financial Model and Valuation Template

CBD Personal Care Financial Model and Valuation Template, a comprehensive…

EdTech Financial Model and Valuation Template

Empower your EdTech startup with our comprehensive Financial Model, including,…

Car Dealership Financial Model and Valuation – Financial Projections

Welcome to the Car Dealership Company Financial Model and Valuation,…

Hospitality (Hotel) Financial Model and Valuation – 10-year Projections

Welcome to the Hospitality (Hotel) Company Financial Model and Valuation,…

B2C eCommerce Financial Model & Valuation Model

Tailored ecommerce financial model Model for startups. Forecast revenue, integrate…

Gym Financial Model and Budget Control

This Excel model is a highly adaptable and user-friendly tool…

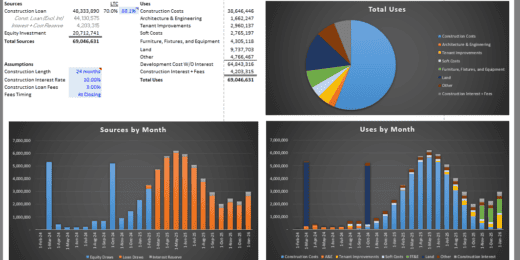

Construction Draw Schedule & Gantt (New Development Cost/Sources & Uses Model)

Elevate your construction project planning with our Construction Draw Schedule…

Coffee Shop Financial Plan and Budget Control

This Excel model is a highly adaptable and user-friendly tool…

Catering and Ballroom Rental Financial Model

This Excel model is a highly adaptable and user-friendly tool…

Cohort Modeling Framework for SaaS – Historical Data Analysis

A simple framework for any recurring revenue business (SaaS or…

Blue Ammonia using Natural Gas – 3 Statements, Cash Waterfall & NPV/IRR Analysis

An integrated and comprehensive Blue Ammonia Production Plant Model that…

Tenant Management: Real Estate Dashboard

Structured database with the right columns to keep track of…

Cost Segregation Study: Estimated Benefit Summary and Supporting Data

This calculator has inputs for many different asset categories and…

SDE, EBITDA, DCF Business Valuation Matrix Template

Includes all helper calculations and a sensitivity table for up…

Oil & Gas Marketing and Distribution DCF Valuation Model with 5 Yrs Actual,1 Yr Budget & 5 Years Forecast

A detailed and user friend financial model that captures 5…

Apartment Building / Self-Storage / Multi-Family Acquisition Model: 15 Year

This real estate model works great for acquisitions of apartment…

Pricing Excel Model – Van Westendorp Price Sensitivity Meter

The Van Westendorp Price Sensitivity Meter (PSM) is a market…

Principal Residence Real Estate Investment Model

This Pro Forma Model is designed to analyze Principal Residence…

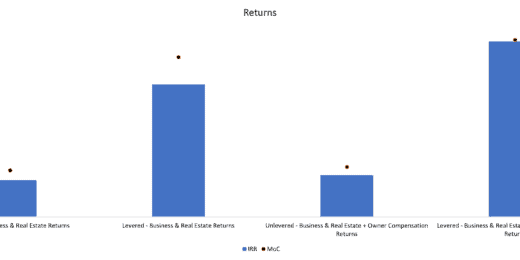

Property Manager Plan with Return Calculations & M&A Model

Pro Forma Models created this model to analyze the financial return…

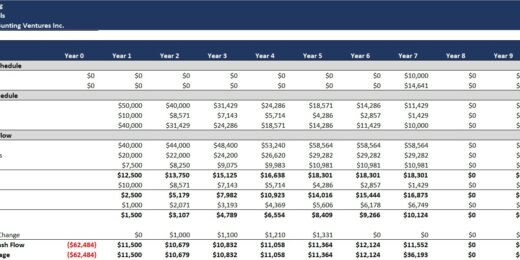

Capital Budgeting Model with NPV, IRR, & RoC Calculation

This model was developed to complete capital budgeting and analysis…

Dynamic Franchise Business Plan – 3 Statement Model with DCF & Returns

Pro Forma Models created this model to analyze the financial…

Private Equity Profit Distribution Waterfall Model

The model allows for the distribution of funds between the…

Single Family Rental Property ROI Analysis

Analyze rental property investments with this tool. Simple assumption tab…

Dupont Analysis Template – Full Analysis & Customizable – Example Amazon

This model provides a complete financial analysis via Dupont methodology…

Air Taxi – Build and Operate Business Plan Model with 3 Statements and Valuation

Air Taxi – Build and Operate Business Plan Model with…

Hydrogen Gas Equipment Manufacturing and Sales Model – DCF Valuation Model

Hydrogen Gas Equipment Manufacturing and Sales Model – Discounted Cash…

Biomass to Hydrogen Gas PPP Project Model Template

Biomass to Hydrogen Gas PPP Project Model with 3 Statements,…

Hydrogen Gas Sales & Tolling Business Plan and Valuation Model

Hydrogen Gas Sales & Tolling Business Plan and Valuation Model…

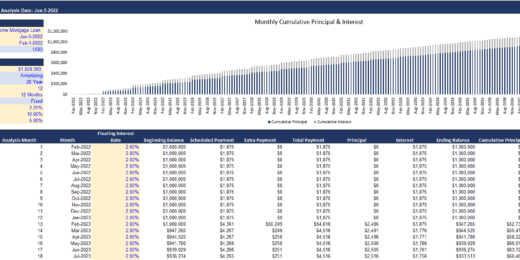

Debt Schedule – Up to 30 Year Model with Prepay, Fixed/Floating, and Interest Only

This debt schedule model is dynamic, easy to use, and…

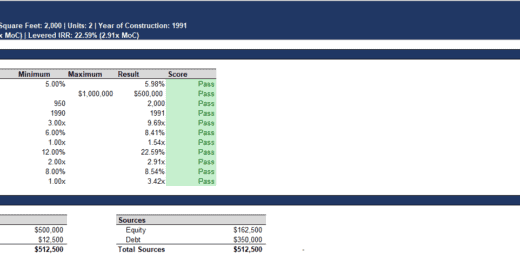

Real Estate Investment Screening Model – Levered IRR, Unlevered IRR, Cap Rate, DSCR, and More

This model can be used to quickly (5 minutes if…

Business Scoring and Valuation Matrix

This scoring and valuation model will help investors or entrepreneurs…

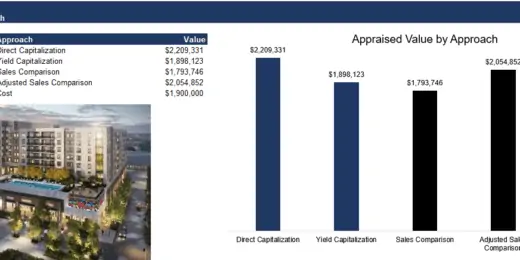

Complete Real Estate Appraisal Toolkit

This model serves as a complete real estate appraisal toolkit…

Alternative Investment Company Valuation Template

Alternative Investment Company Valuation: All-In-One Model for Private Equity, Asset…

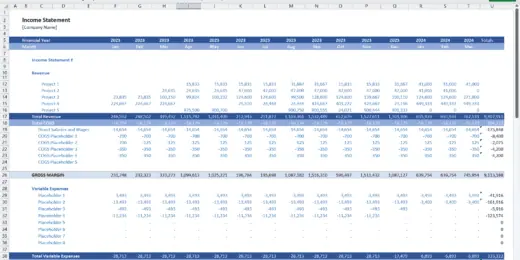

Due Diligence P&L – Exhaustive Revenue and Costs Analysis Template

Model for in depth understanding of high level profit and…

Financial Due Diligence

Due diligence is the cornerstone of informed decision-making in business transactions. It's a comprehensive appraisal of a business or individual prior to signing a contract, or an act of verifying important details before engaging in a financial agreement. The essence of due diligence lies in its ability to minimize risk, validate assumptions, and establish trust between parties. This guide explores the multifaceted nature of due diligence, highlighting its importance as an indispensable tool for entrepreneurs, investors, and financial professionals.

Exploring Types of Due Diligence

Understanding the various types of due diligence is crucial for conducting a comprehensive assessment of a business or investment opportunity. Each type focuses on a different aspect of the business, providing a detailed and multi-dimensional analysis. Here are the key types:

What Is Financial Due Diligence?

Financial due diligence is a critical process typically undertaken by potential investors or acquirers to assess the financial consequences when considering investing in or acquiring a business. It is an in-depth analysis conducted to confirm the accuracy of a company's financial information and to understand the underlying performance drivers.

This process is integral in making informed investment decisions and mitigating risks. The essence of financial due diligence is to uncover the financial implications of a transaction, thoroughly scrutinizing the inherent risks and potential opportunities.

A key component of this process is a deep understanding of the target company's business plan, essential for forming an informed opinion about the company's future. This involves assessing whether the business plan is realistic, evaluating potential outcomes in both worst-case and best-case scenarios, and linking these to scenario analysis to explore various conditions.

Financial due diligence goes beyond mere financial assessment; it integrates and quantifies the results from all types of due diligence, including operational and legal. This holistic approach enables investors and acquirers to make well-informed decisions, effectively balancing the risks and rewards of their potential investment or acquisition.

Financial due diligence is a critical analysis of the financials of a company from either the perspective of a potential buyer (buy-side) or seller (sell-side). Buy-side due diligence aims to ensure that the buyer is making a sound investment, while sell-side due diligence prepares the seller for potential scrutiny and maximizes the transaction value. This involves a deep dive into financial statements, assets, liabilities, and future projections.

When to Do Financial Due Diligence

Financial due diligence is a critical process in various business transactions, particularly when purchasing a company, an asset of a business, or property. Understanding when to conduct financial due diligence in these scenarios is crucial for ensuring a successful and informed transaction.

When Purchasing a Company

When acquiring a company, financial due diligence is indispensable. It should be initiated as soon as a potential acquisition target is identified. This process helps in verifying the financial information presented by the target company, assessing its financial performance, and understanding any underlying risks. It also aids in determining the valuation of the company and ensuring that the investment is sound.

Acquiring an Asset of a Business

In the case of buying specific assets from a business, such as equipment, intellectual property, or a division of the company, financial due diligence is key to understanding the value and liabilities associated with the asset. This process involves assessing the asset's historical performance, its contribution to the revenue of the business, and any potential risks or liabilities that might transfer with the asset.

Purchasing Property

When it comes to real estate or property acquisition, financial due diligence is equally important. This includes analyzing the property's value, understanding its revenue-generating potential (in case of commercial properties), examining existing leases, and assessing any liabilities, such as mortgages or liens on the property. Additionally, for commercial properties, it is important to evaluate the financial health of tenants and the stability of rental income.

In each of these scenarios, financial due diligence serves as a protective measure for the buyer or investor. It provides a clear picture of what is being purchased, the risks involved, and the potential for future returns.

Conducting thorough financial due diligence helps in negotiating better terms, avoiding unforeseen liabilities, and making a well-informed decision that aligns with the investor's or buyer's strategic and financial objectives. The timing of due diligence is critical – it should be initiated early in the transaction process but after a preliminary agreement or expression of interest, allowing the due diligence findings to inform the final decision-making and transaction terms.

Who Does Financial Due Diligence

Financial due diligence is typically conducted by financial analysts, accountants, or specialized due diligence firms. These professionals possess the expertise to thoroughly assess financial records and interpret complex financial information. The key players involved are:

- External Accounting or Consulting Firms: Often, companies engage external firms specializing in due diligence services. These firms have dedicated teams with expertise in various aspects of financial analysis and are adept at uncovering hidden risks and opportunities in financial statements.

- In-House Financial Teams: Larger companies might have in-house teams equipped to perform financial due diligence. These teams usually consist of financial analysts, accountants, and other finance professionals who understand the specific nuances of their industry and business.

- Investment Bankers: In merger and acquisition scenarios, investment bankers often play a role in conducting financial due diligence. They analyze financial data to advise their clients on the valuation and structuring of the deal.

- Legal Advisors: While primarily concerned with legal due diligence, legal advisors also collaborate with financial teams to understand any legal implications that might have financial consequences.

- Specialized Due Diligence Firms: Some firms focus exclusively on due diligence, offering comprehensive services that encompass financial, legal, and operational due diligence.

How Much Does Financial Due Diligence Cost

The cost of financial due diligence is subject to variation, largely influenced by the size and intricacy of the business under examination, but it typically does not surpass 1% of the overall value of the transaction . It's an investment in securing a more accurate understanding of the potential risks and rewards associated with a business transaction.

The cost of financial due diligence varies widely depending on several factors:

- Size and Complexity of the Target Company: Larger companies with more complex operations and international presence typically require more extensive due diligence, leading to higher costs.

- Depth of Analysis Required: The scope of due diligence (whether it's a high-level overview or a deep dive) can impact the cost. More detailed analyses involving multiple business units or geographies increase costs.

- Professional Fees: External firms charge based on their expertise, reputation, and the complexity of the task. Fees can be structured as hourly rates, fixed fees, or a percentage of the transaction value.

- Duration of the Due Diligence Process: Longer due diligence processes incur higher costs due to the extended engagement of professionals.

How long does the financial due diligence process take?

The duration of financial due diligence can range from a few weeks to several months, depending on the scope of the analysis and the responsiveness of the parties involved. The duration of the financial due diligence process can vary, but it typically takes between a few weeks to several months. The timeline depends on:

- Availability of Information: Quick access to complete and organized financial records can expedite the process.

- Complexity of the Business: More complex businesses, such as those with multiple product lines or international operations, require a longer due diligence period.

- Scope of the Due Diligence: A more comprehensive due diligence covering various aspects of the business will take longer than a focused financial review.

- Responsiveness of the Parties Involved: The efficiency of communication and cooperation between the buyer, seller, and due diligence providers affects the timeline.

What Is the Difference Between Audit and Financial Due Diligence?

While both audits and financial due diligence involve financial analysis, they serve different purposes. An audit is designed to verify the accuracy of financial statements, while financial due diligence provides a more comprehensive understanding of the business's financial health, including profitability, sustainability, and risks.

Here's a comparative table outlining these differences:

What Are the Principles of Financial Due Diligence?

The principles of financial due diligence serve as the foundational guidelines to ensure a thorough, effective, and insightful analysis of a company's financial health and prospects. These principles are critical for investors and acquirers to make informed decisions. Here are the key principles:

- Thoroughness: Financial due diligence should be comprehensive, covering all financial aspects of the target entity. This includes in-depth analysis of financial statements, tax compliance, debts, assets, liabilities, cash flow, and other financial obligations.

- Accuracy: The process should aim for the highest degree of accuracy in data collection and analysis. Verification of financial information against source documents and independent data sources is crucial to ensure the reliability of the findings.

- Risk Assessment: Identifying and assessing potential financial risks is a core principle. This includes understanding market risks, credit risks, operational risks, and any other risks that could impact the financial stability and future performance of the entity.

- Future Outlook: Financial due diligence should not only focus on the current financial position but also on the future sustainability and growth potential of the business. This involves analyzing business plans, forecasts, and market conditions.

- Contextual Analysis: The financial data should be analyzed in the context of the industry, market trends, and economic conditions. This contextual understanding is essential to gauge the entity's performance and potential realistically.

- Legal Compliance: Ensuring that the financial operations of the entity comply with relevant legal and regulatory standards is vital. This includes examining tax filings, adherence to financial regulations, and other compliance matters.

- Transparency: The due diligence process should be transparent, with clear communication between all parties involved. This transparency builds trust and ensures that all stakeholders have a common understanding of the financial health and prospects of the entity.

- Confidentiality: Maintaining the confidentiality of sensitive financial information is imperative throughout the due diligence process to protect the interests of all parties involved.

- Objectivity: The analysis should be objective, free from biases or preconceived notions. This objectivity is essential for providing a fair and unbiased assessment of the financial status of the entity.

- Integration Capability: Understanding how the target entity's financial aspects will integrate with the acquiring company's operations is important, especially in merger and acquisition scenarios. This includes evaluating synergies, integration costs, and potential financial impact.

These principles guide the due diligence process to ensure that it provides a detailed, accurate, and holistic view of the financial health and prospects of the entity under consideration, thereby aiding in making informed investment or acquisition decisions.

What Does Financial Due Diligence Involve

Financial due diligence involves a detailed examination of financial statements, understanding the quality of earnings, examining the sustainability of cash flows, and identifying any financial risks or anomalies.

Financial due diligence is a comprehensive process that involves a meticulous examination of various financial aspects of a company. While a detailed financial due diligence list is often employed to guide this process, the main elements of financial due diligence typically revolve around the following key areas:

Historic Financial Statement Analysis (Last 3 Years)

This is a fundamental aspect of financial due diligence. It involves a thorough review of the company's financial statements over the past three years, including the balance sheet, income statement, and cash flow statement. The objective here is to assess the historical financial performance of the business, identify trends in revenue, profitability, and cash flow, and understand the financial stability and operational efficiency of the company. It also includes an examination of the accounting policies and practices to ensure they adhere to the standard accounting principles and assessing the sustainability of the earnings reported.

Budget Analysis

This part of the due diligence process involves evaluating the company's budgeting and financial planning practices. It includes a review of past budgets versus actual performance to assess the accuracy and reliability of the company's budgeting process. This analysis helps in understanding how well the company manages and anticipates expenses and revenues, and how effectively it can plan for and adapt to changing business conditions. It also provides insights into the company's financial discipline and forecasting capabilities.

Business Plan Analysis

Analyzing the company's business plan is crucial for understanding the strategic direction and growth prospects of the business. This involves evaluating the company's short-term and long-term business plans, including market analysis, competitive positioning, growth strategies, revenue streams, and projected financial performance. This analysis is particularly important for assessing the feasibility and viability of the company's future plans and strategies. It also helps in identifying potential risks and opportunities that could impact the company's financial performance in the future.

While these are the main elements, financial due diligence is a multi-faceted process that may also include additional analyses such as tax compliance review, debt and financing assessment, operational financial review, and future financial prospects evaluation. The comprehensive checklist attached provides a more detailed structure for conducting this due diligence, ensuring that all significant financial aspects of the company are thoroughly examined and assessed.

What Should You Focus on When Doing Financial Due Diligence?

When conducting financial due diligence, focusing on several key areas is crucial to obtain a comprehensive understanding of the target company's financial health and prospects. Here are the primary topics to concentrate on:

- Financial Statements Analysis: Review and analyze the target company's balance sheets, income statements, and cash flow statements for the past several years. This includes assessing the quality of earnings, revenue recognition practices, and any irregularities or inconsistencies.

- Asset Evaluation: Scrutinize the company's tangible and intangible assets. Evaluate the condition, valuation, and implications of significant assets, including real estate, equipment, patents, and trademarks.

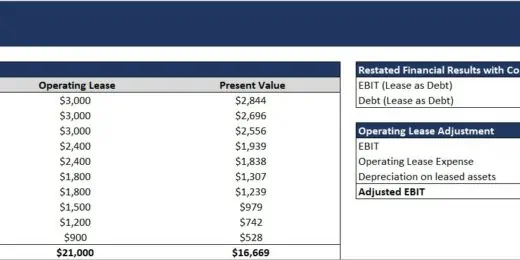

- Liabilities and Debt Review: Examine all liabilities, including bank debts, leases, contingent liabilities, and any off-balance sheet liabilities. Understanding the terms, covenants, and maturity profiles of outstanding debts is essential.

- Working Capital Analysis: Analyze the management of working capital. Look into accounts receivable, accounts payable, inventory levels, and the cash conversion cycle.

- Revenue and Profit Margins: Assess the company’s revenue streams and profitability. Look for trends, profitability by product line or business segment, and compare them with industry benchmarks.

- Cash Flow Analysis: Evaluate the quality and sustainability of cash flow. Analyze historical cash flow patterns, sources of cash, and the company's ability to generate cash in the future.

- Tax Compliance and Liabilities: Review the company’s tax compliance history, including income taxes, sales taxes, payroll taxes, and other relevant taxes. Also, assess any potential tax liabilities.

- Capital Expenditure (CapEx): Review past capital expenditures and future CapEx plans. Understand how these investments align with the company’s strategy and their impact on financial performance.

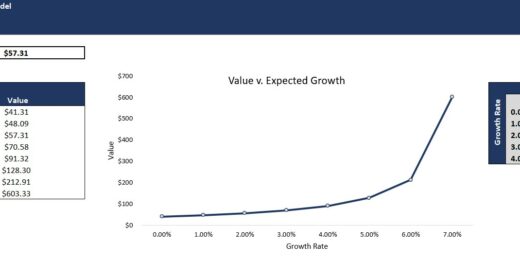

- Financial Projections and Budgets: Analyze the target company's financial projections and budgets. Assess the realism and achievability of these forecasts based on historical performance and market conditions.

- Legal and Regulatory Compliance: Ensure that the company is in compliance with all financial regulatory requirements and understand any potential legal risks that might have financial implications.

- Related Party Transactions: Investigate any transactions between the company and its related parties. These transactions should be scrutinized for fairness and market conformity.

- Employee and Management Obligations: Review employee contracts, compensation, benefits, and any pending labor issues. Also, assess the strength and stability of the management team.

- Market and Industry Analysis: Understand the market dynamics and industry trends that could impact the company’s financial performance.

By thoroughly focusing on these areas during financial due diligence, you can gain a deep understanding of the target company's financial health, identify potential risks and opportunities, and make a well-informed investment decision. A financial due diligence list should be a great help when it comes to keeping things in order, so make sure to download your free copy.

Curating Your Custom Due Diligence List

Creating a custom due diligence list is essential for ensuring a thorough examination. This list should include financial records, legal documents, operational details, and more. Tailoring the checklist to the specific business or asset is crucial for a comprehensive analysis.

Your Path to Due Diligence Mastery

Mastering due diligence is a journey. Avail resources like templates, guidelines, and expert consultation to navigate this complex landscape. Engage with confidence and competence by leveraging these tools.

Due diligence checklists provided is crucial as it offers a structured and comprehensive framework for evaluating a potential investment or acquisition from multiple critical perspectives.

Each category in the checklist addresses specific areas of concern:

- Financial Due Diligence ensures the financial stability and viability of the business.

- Legal Due Diligence safeguards against legal and regulatory pitfalls.

- Technical Due Diligence assesses the operational capabilities and infrastructure.

- Market and Commercial Due Diligences evaluate the market positioning, competitive landscape, and business model effectiveness.

- Tax Due Diligence ensures compliance and identifies potential tax liabilities.

- Environmental Due Diligence assesses compliance with environmental standards and potential liabilities.

Using this checklist helps in identifying risks, uncovering hidden value, and ensuring informed decision-making. When utilizing this checklist, it's essential to tailor the focus according to the specific nature of the transaction and the industry involved, emphasizing those areas that are most relevant to the business under consideration. This approach not only mitigates risks but also contributes significantly to the strategic assessment of the investment or acquisition.

How Important Is Financial Due Diligence?

Financial due diligence is vital for mitigating risks, validating financial information, and ensuring a transparent and successful transaction. It provides the foundation for sound investment decisions and strategic planning.

Financial due diligence is of paramount importance in the business world, especially in the context of mergers, acquisitions, investments, and other financial transactions. Here's why:

- Risk Identification and Mitigation: Financial due diligence helps in identifying potential financial risks associated with a transaction. These risks could stem from overvalued assets, hidden liabilities, or optimistic revenue projections. By uncovering these risks, investors and acquirers can either negotiate better terms or decide against a potentially harmful transaction.

- Verifying Financial Information: It ensures that the financial data presented by the target company is accurate and reliable. This verification is crucial to prevent cases of financial misrepresentation or fraud.

- Understanding Business Viability: Through financial due diligence, investors gain insights into the target company’s business model, revenue streams, cost structures, and profit margins. This understanding is essential to evaluate the long-term sustainability and growth potential of the business.

- Valuation Accuracy: It plays a key role in ensuring that the valuation of the business is fair and justified. This is particularly important in mergers and acquisitions, where the purchase price needs to reflect the true worth of the business.

- Strategic Decision Making: Financial due diligence provides a solid foundation for strategic decision-making. Investors and acquirers can use the insights gained to formulate strategies for integration, scaling, or even turnaround initiatives post-acquisition.

- Compliance and Legal Protection: It helps in ensuring that the target company is compliant with financial regulations and reporting standards. This compliance is crucial to avoid legal repercussions and financial penalties post-transaction.

- Investor Confidence: For investors and stakeholders, thorough financial due diligence conveys a message of prudence and diligence. It builds confidence in the investment decision and in the management’s commitment to safeguarding the investment.

- Predicting Future Performance: By analyzing historical financial data and projections, financial due diligence can provide a reasonable prediction of the company’s future performance, helping in assessing the potential return on investment.

- Negotiation Leverage: The findings from financial due diligence can provide significant leverage in negotiations. Discoveries of financial weaknesses or risks can be used to renegotiate the terms of the deal more favorably.

- Integration Planning: In mergers and acquisitions, financial due diligence aids in planning the integration process by highlighting the financial synergies and challenges that might arise.

In essence, financial due diligence is not just a step in the transaction process; it's a crucial exercise that ensures a well-informed, risk-mitigated, and strategically sound financial decision. Its importance in safeguarding investments and facilitating successful business transactions cannot be overstated.

Why Do Due Diligence?

Performing due diligence, particularly financial due diligence, is an indispensable practice for companies considering investments, mergers, acquisitions, or other significant business transactions. The reasons for its necessity are multifaceted:

- Risk Assessment: Due diligence enables a company to thoroughly assess the financial risks associated with a potential transaction. This includes identifying liabilities, debts, or any financial inconsistencies that could impact the investment’s viability.

- Confirming Asset Valuation: It's crucial for verifying the true value of the assets involved. This verification helps ensure that a company doesn’t overpay for an asset or a business and gets a fair deal.

- Understanding Cash Flows: Analyzing the target’s cash flow during due diligence helps in understanding its operational efficiency, revenue generation capacity, and the predictability of future cash flows.

- Compliance Check: Due diligence ensures that the target company is in compliance with accounting standards, tax laws, and other regulatory requirements. Non-compliance can lead to significant financial penalties and reputational damage.

- Operational Synergies: In mergers and acquisitions, it’s vital to understand how the merging entities' operations can synergize. Financial due diligence aids in evaluating the compatibility and potential benefits of the integration.

- Strategic Fit: It helps in assessing whether the investment aligns with the company’s strategic goals and long-term vision. This strategic alignment is key to ensuring a successful outcome of the transaction.

- Market Position and Competitiveness: Understanding the target company’s market position and competitiveness is crucial. Due diligence provides insights into market trends, customer base, and competitive landscape, which are essential for strategic planning.

- Forecasting Future Performance: By examining historical financial data and projections, due diligence helps in forecasting the target company's future performance, crucial for evaluating the investment’s potential return.

- Negotiation Leverage: The findings from due diligence can provide a strong basis for negotiation. Knowledge of the target company’s weaknesses or potential risks can be leveraged to renegotiate terms.

- Investor Confidence: Conducting thorough due diligence demonstrates a commitment to making informed and responsible investment decisions, which can significantly boost investor and stakeholder confidence.

- Avoiding Bad Investments: Perhaps most critically, due diligence serves as a safeguard against poor investment decisions. By uncovering hidden issues and providing a clear picture of the financial health of the target, it helps companies avoid costly mistakes.

In summary, due diligence, especially financial due diligence, is a vital exercise that equips companies with essential information and insights needed to make informed, strategic, and financially sound decisions in their business dealings. It's a fundamental step in mitigating risks and enhancing the success potential of any significant business transaction.

Mastering Due Diligence for Empowered Decision-Making

Financial due diligence stands as a cornerstone in the realm of smart and secure business transactions. Whether you are navigating the complexities of a merger, an acquisition, or any significant investment, the need for a thorough and insightful analysis of your potential business venture cannot be overstated. Financial due diligence is not just about safeguarding your investments; it's about empowering your business decisions with clarity, confidence, and strategic foresight.

We understand that the process can be daunting, which is why we have meticulously crafted two essential resources for you – the Financial Due Diligence Checklist and the Comprehensive Due Diligence Checklist. These checklists are designed to guide you through each step of the due diligence process, ensuring no stone is left unturned. From assessing financial risks to uncovering hidden opportunities, these tools are invaluable for anyone looking to make informed, data-driven decisions.

Due diligence is not just a process but a pathway to empowered decision-making. It offers a shield against unforeseen risks and a lens for identifying opportunities. Integrating our financial model templates can streamline and enhance the due diligence process, providing precise, customizable tools for analyzing and interpreting financial data. With these resources at your disposal, you're equipped to make decisions with clarity and confidence, paving the way for successful business outcomes.