Financial Projections

Multifamily Rehab Model (Includes Investor Returns Waterfall)

Introducing the Multifamily Rehab Flip Model with Investor Returns Waterfall…

EV Charging Station Finance Model

Provides a comprehensive analysis of the financial viability and potential…

Project Finance Excel Model – 10 Year Projection

The template creates a financial model for your individual project…

Startup Company Financial Model – Dynamic 3 Statement Financial Projections up to 8-Years

Highly Dynamic and Easy-to-Navigate Excel Financial Projections Model that allows…

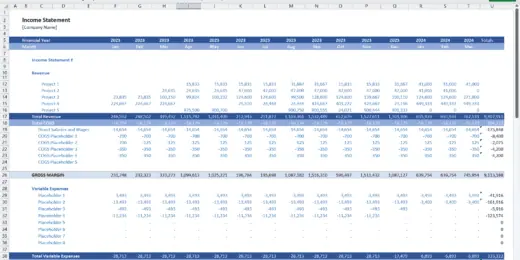

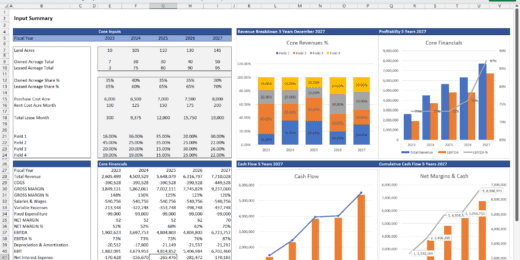

Advanced Financial Model – Dynamic 3 Statement 10-Year Financial Model with DCF Valuation

Advanced, Dynamic and Easy-to-Use Excel Financial Projections Model that allows…

Veterinary Imaging Center Financial Model

The Veterinary Imaging Center financial model is designed to analyze…

Parcel Locker Network Business Financial Model (10+ Yrs. DCF and Valuation)

The Parcel Locker Network Business Financial Model is a comprehensive…

Dental Imaging Center Financial Model

The Dental Imaging Center financial model is a comprehensive tool…

Diagnostic and Analysis Center Financial Model

It is excel financial model for financial forecasting of a…

Diagnostic Collection Center Financial Model

It is financial model for diagnostic collection center whose phlebotomists…

Mobile Imaging Center Financial Model

This Excel model facilitates mobile imaging services by providing equipment…

Private Aircraft Rental Business Financial Model

"The Private Aircraft Rental business financial model is a versatile…

Radiology Center Financial Model

The Radiology Center financial model is a comprehensive and versatile…

B2B SaaS FInancial Model & Valuation Template

Unlock your B2B SaaS venture's full potential with our B2B…

Venture Capital Fund Financial Projection Model with Distribution Waterfall

Highly versatile venture capital fund financial projection model with equity,…

Biomethane Producer Financial Model (Renewable Natural Gas)

Create a detailed pro forma with this biogas financial model.…

VC Startup Portfolio Financial Forecasting Model

Elevate your venture capital strategy with the VC Startup Portfolio…

Beginner Commercial Property Modelling Tool

"Beginners Commercial Property Modelling Tool," a resource for developers embarking…

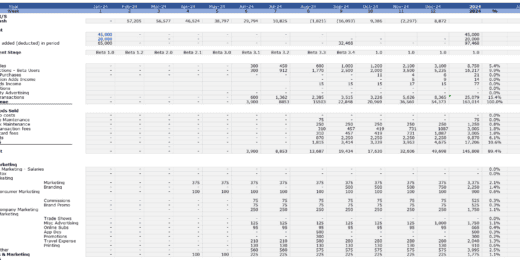

Fintech Mobile App Financial Model

A comprehensive editable, MS Excel spreadsheet for tracking Fintech Mobile…

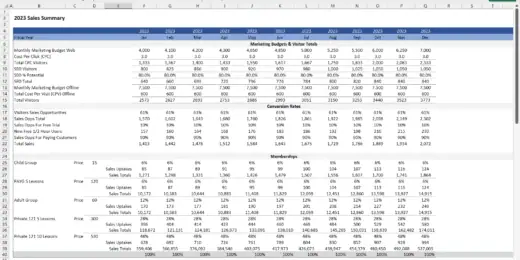

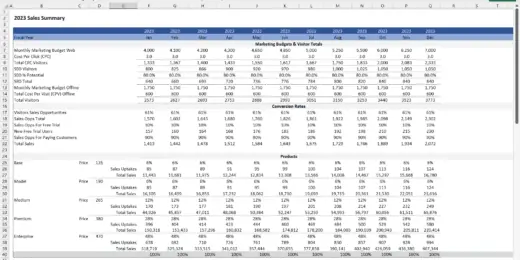

Indoor Golf Centre Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking Indoor Golf…

Cannabis Grow and Dispensary Pro-Forma Model

The Cannabis Grow and Dispensary Pro-Forma Model is a comprehensive…

Animal Feed Mill – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

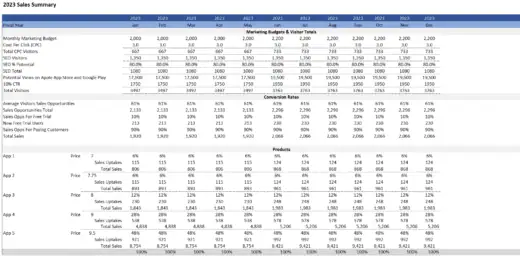

Mobile App Development Financial Model

A comprehensive editable, MS Excel spreadsheet for tracking Mobile App…

Food Truck Monthly Financial Model Template

The Food Truck Financial Model Template is a comprehensive solution…

Bookkeeping Agency Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Bookkeeping services…

Manufacturing Start up Feasibility Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for forecasting and tracking…

Start Up Company Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking start-up company…

Broilers Poultry Farm – 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

B2B Services Company Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking B2B Services…

Medical Spa (MediSpa) Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Medical Spa…

Medical Clinic Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking private Medical…

Physiotherapy Clinic Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Physiotherapy Clinic…

Fast Food Restaurant Financial Model Template

Maximize fast food financials with our user-friendly financial model template.…

Food Bar Financial Model 5 year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Food Bar…

Restaurant Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Restaurant finances,…

Virtual Reality Software Company Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Virtual Reality…

Budget vs Actual Forecasts 5 Years Excel Template

MS Excel spreadsheet for tracking budget finances. Can be used…

Social Media Marketing Agency Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Social Media…

Affiliate Marketing Agency Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Affiliate Marketing…

Web Hosting Company Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking web hosting…

5 Year 3 Statement Recycling Centre Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Recycling Centre…

5 Year 3 Statement Construction Company Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking construction company…

5 Year 3 Statement Solar Energy Solutions Company Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking Solar Energy…

Digital Advertising Agency Finance Model Excel Template

A comprehensive editable 5 Year 3 Statement, MS Excel spreadsheet…

5 Year 3 Statement Virtualization Software Company Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Virtualization Software…

5 Year 3 Statement Cyber Security Software Company Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Cyber Security…

Graphic Design Company Finance Model Excel Spreadsheet

A comprehensive editable, MS Excel spreadsheet for tracking Graphic Design…

Private Equity Fund Financial Projection Model with Distribution Waterfall

Highly versatile private equity fund financial projection model with calculations…

5 Year 3 Statement Private Mental Health Care Centre Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking private Mental…

5 Year 3 Statement Alpaca Farming Finance Model Excel Template

A comprehensive 3 Statement 5 Year editable, MS Excel spreadsheet…

5 Year 3 Statement Architect Company Finance Model Excel Template

A comprehensive 5 Year 3 Statement editable, MS Excel spreadsheet…

Swimming School Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Swimming School…

CBD Personal Care Financial Model and Valuation Template

CBD Personal Care Financial Model and Valuation Template, a comprehensive…

EdTech Financial Model and Valuation Template

Empower your EdTech startup with our comprehensive Financial Model, including,…

3 Statement 5 Year SAAS HR Software Development Company Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking SAAS HR…

CRM Software Development Company Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking CRM software…

Making the Right Decisions Through Financial Projections

Imagine two companies embarking on similar paths in the tech industry. Company A leverages detailed financial projections to anticipate market trends, adjust its budget for R&D accordingly and identify the perfect timing for expansion. This foresight enabled them to allocate resources efficiently, optimize operations, and significantly reduce financial risks. On the other hand, Company B, flying blind without the insight provided by financial projections, reacted to market changes rather than anticipating them, leading to missed opportunities and wasted resources.

In the rapidly evolving business landscape, the power of financial projections cannot be overstated. A strategic edge through business plan financial projections propelled companies' innovation and market share. They play a critical role in navigating the complexities of today's business environment, making it an indispensable tool for any company aiming for success and sustainability.

What are Business Plan Financial Projections?

Business Plan Financial Projections refer to the quantitative section of a business plan, providing a forecast of the future financial performance of the business. These projections are essential for demonstrating the company's potential for profitability, financial health, and the ability to generate cash flows over a specified period, typically covering three to five years. Usually, a financial projection for 5 years business plan financial projections are essential for both internal planning and external communication, especially when seeking funding or investment.

Financial Forecast vs. Projection

Financial forecast vs. projections are essential tools used in financial planning and analysis, but they serve different purposes and are based on various assumptions. A financial forecast is typically a more conservative approach that uses historical data to predict short-term or immediate financial performance. It is often considered a likely or expected financial outcome based on current trends and known variables, making it a tool for operational planning and budgeting.

On the other hand, financial projections are more speculative and are used to explore various financial scenarios over a longer term. They are based on hypothetical situations or assumptions about future events, such as entering a new market or launching a new product line. Financial projections are used for strategic planning and investment decisions and to assess the potential financial impact of various strategic initiatives.

In general, financial forecast vs. projections focus on different goals. While forecasts focus on the expected outcomes based on current paths, projections allow organizations to explore "what-if" scenarios and prepare for future possibilities.

Two Types of Financial Projections

Business plan financial projections can be divided into two types: short-term and long-term financial projections. Both are essential to a business's financial planning and analysis, serving different purposes and focusing on various time horizons.

- Short-term Financial Projections: Short-term financial projections typically cover one year or less. These projections focus on the immediate future of the business and are used for more detailed operational planning. Given the shorter time frame, they are usually more detailed and specific, often including detailed monthly or quarterly sales forecasts, cash flow statements, and working capital requirements. Short-term financial projections aim to manage day-to-day operations, address short-term financial needs, and achieve immediate business goals. They are more susceptible to adjustments and updates as they respond to immediate market conditions and operational realities.

- Long-term Financial Projections: Long-term financial projections extend beyond one year, typically covering a financial projection for 3 years, a financial projection for 5 years, or even longer in some cases. These projections focus on the strategic direction of the business. They help assess the viability of long-term projects, secure financing or investment, and set long-term goals. Long-term financial projections are less detailed than short-term ones, with a broader view focusing on annual or semi-annual figures. They are more about identifying trends, growth rates, and strategic milestones to guide strategic planning, investment decisions, and long-term growth initiatives. While they are subject to revisions, changes are usually driven by significant shifts in business strategy or external factors rather than short-term operational adjustments.

Common Elements of an Excel Financial Projection Template

An Excel financial projection template is a versatile tool designed to forecast a business's financial performance over a future period, incorporating variables like revenue, costs, and cash flow. It enables users to input assumptions and see their potential impact on the business's financial health, aiding in decision-making and strategic planning.

An Excel financial projection template typically includes several key components, each crucial in providing a comprehensive view of the company's financial future.

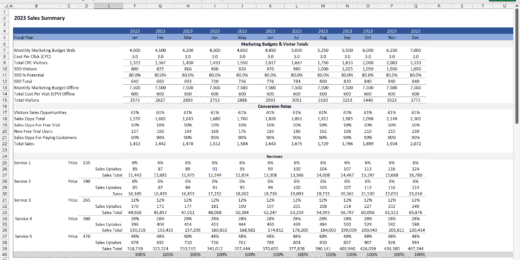

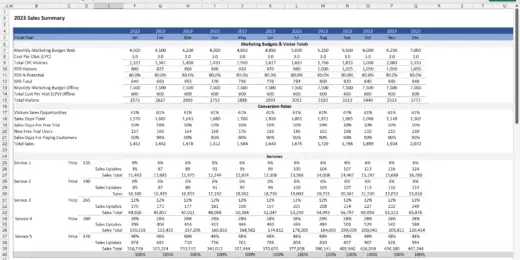

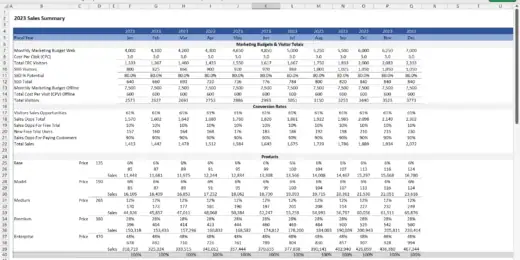

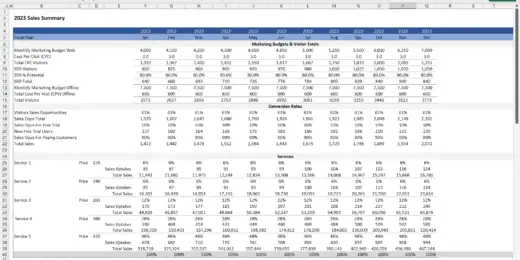

- Sales Projections: This section is dedicated to forecasting the revenue the business expects to generate from its sales activities. It involves estimating the sales volume for each product or service and multiplying those quantities by their respective selling prices. Market research, historical sales data, industry trends, and marketing strategies influence sales projections. This part is critical as it sets the foundation for the business's financial health, influencing decisions on budgeting, staffing, and investments.

- Expense Projections: The business estimates its future expenses, categorized into fixed and variable costs. Fixed costs remain constant regardless of the business activity level (e.g., rent, salaries), while variable costs fluctuate with sales volume (e.g., cost of goods sold, shipping). Expense projections help plan and control costs, ensuring the business can maintain profitability. This section requires a detailed analysis of past spending patterns, supplier agreements, and planned operational changes to predict future outflows accurately.

- Balance Sheet: The balance sheet component of the template provides a snapshot of the company's financial position at a specific time. It lists the company's assets, liabilities, and shareholders' equity. Assets include anything of value owned by the business, liabilities represent its debts, and equity shows the owners' stake in the company. This financial statement is crucial for assessing the company's liquidity, solvency, and overall financial health, which is vital for investors, lenders, and management.

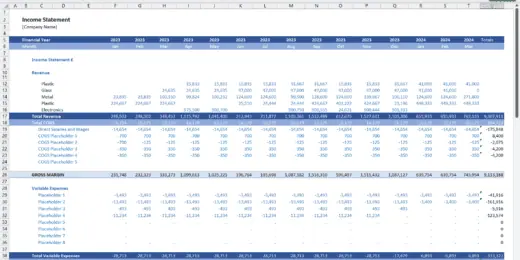

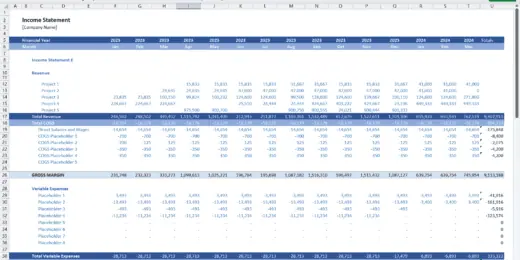

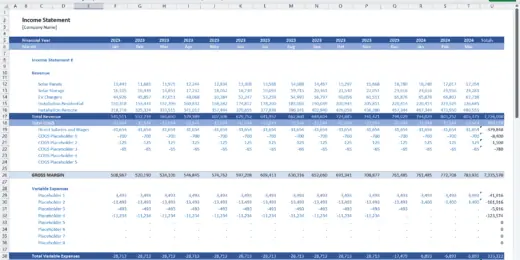

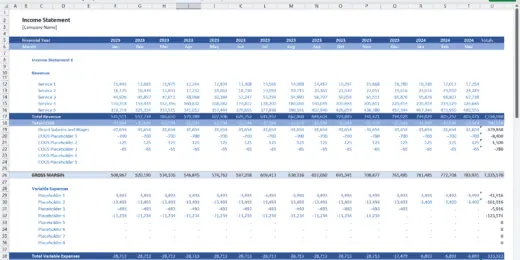

- Income Statement: Also known as the profit and loss statement, this section summarizes the company's revenues, costs, and expenses over a period to calculate the net income. It starts with sales revenue, subtracts the costs of goods sold to find the gross profit, and then deducts operating expenses to arrive at the operating profit. Finally, after accounting for interest, taxes, and other non-operating items, it provides the net profit or loss. The income statement is vital for understanding the company's operational efficiency and profitability.

- Cash Flow Statement: This part of the template focuses on the inflows and outflows of cash within the business, categorized into operating, investing, and financing activities. It's essential for assessing the company's liquidity and long-term viability by showing how well it manages its cash to fund operations, pay debts, and make investments. The cash flow statement helps identify cash shortages and surpluses, enabling effective cash management strategies.

Each component of an Excel financial projection template interrelates and provides different perspectives on the company's financial performance and position. Together, they offer a comprehensive overview, helping businesses make informed decisions, plan for the future, and communicate their financial health to stakeholders.

Steps to Create a Startup Business Financial Projections Template

Creating a startup business financial projections template can be the roadmap to your venture's future success, offering a clear vision of financial expectations and milestones. This essential tool helps strategize for growth and attract potential investors by showcasing your business's likely profitability.

Step 1 – Forecast Monthly/Annual Income

The initial step in creating a startup business financial projections template for your startup involves forecasting your monthly or annual income. It requires a detailed analysis of your business model, market research, and historical data (if available) to predict future sales. The forecast should account for various factors such as seasonality, market trends, and growth rate. You must be realistic and possibly conservative in your estimates to avoid overestimating your potential income. This projection will serve as the foundation for your financial plan, helping you understand the possible revenue streams and their contribution to the overall financial health of your startup.

Step 2 – Estimate Revenue & Expenses

After forecasting your income, the next step is to estimate your startup's revenue and expenses. Revenue estimation involves identifying all possible income sources, including product sales, services, subscriptions, or other revenue streams. On the other hand, estimating expenses requires listing all expected costs associated with running your business. It includes fixed costs (such as rent, salaries, and utility bills) and variable costs (such as materials and marketing expenses). You can determine your startup's gross margin and net profit by subtracting the estimated costs from the projected revenue. This step is crucial for understanding the financial viability of your business model.

Step 3 – Determine Financial Requirements

Determining your startup's financial requirements is about identifying the total capital expenditure needed to launch and sustain the business until it becomes profitable. It involves summing up the initial setup costs, operational expenses, and any buffer amount for unforeseen expenses. It is essential to consider the runway needed before the business starts generating enough revenue to cover its costs. This step helps in planning for funding strategies through bootstrapping, seeking investors, or applying for loans. Understanding your financial requirements is critical for effective financial planning and avoiding cash flow problems.

Step 4 – Assess Forecasts for Planning

Assessing your forecasts involves thoroughly reviewing and analyzing the financial projections to ensure they are accurate and feasible. This step includes comparing your forecasts against industry benchmarks, competitor data, and economic conditions to validate your assumptions. It's also an opportunity to perform sensitivity analysis by adjusting various factors to see how market or business operations changes could impact your financial projections. This assessment helps refine your financial plan, set realistic goals, and develop strategies to achieve them. It also prepares you for discussions with potential investors by providing a solid foundation for your financial projections.

Step 5 – Anticipate Contingencies

The final step in creating a startup business financial projections template is to anticipate contingencies by identifying potential risks and preparing for unexpected changes in the business environment. It includes creating "what-if" scenarios, such as changes in market demand, cost increases, or delays in product development, and planning how to address these challenges. Having contingency plans ensures that your startup can remain agile and adapt to changes, minimizing the impact on your financial health. This proactive approach helps in risk management and instills confidence in investors and stakeholders about your startup's resilience and preparedness for the future.

Forecasting Futures: Navigating Financial Success

Financial projections are critical for forecasting the future financial performance of a business, allowing you to make informed decisions about investments, budget allocations, and strategic planning. By analyzing these projections, companies can identify potential financial challenges and opportunities, enabling them to adjust their strategies proactively to optimize their financial health and growth potential.

- Attracting Investors: Financial projections play a pivotal role in attracting investors, serving as a testament to a business's potential success and profitability. By presenting detailed forecasts of revenue, expenses, and profit, entrepreneurs can demonstrate their venture's financial viability and growth prospects. These projections provide investors with a clear picture of expected returns and showcase the business's strategic planning capabilities. Convincing financial forecasts can make the difference in securing funding, as they signal potential backers that the company has a solid plan for achieving financial success and managing risks effectively.

- Budgeting: Budgeting is another critical use of financial projections, allowing businesses to allocate resources efficiently and control financial operations proactively. Through budgeting, companies can set financial targets and establish spending limits, which helps minimize unnecessary expenses and optimize cash flow. Financial projections aid in the creation of a detailed budget by forecasting future sales, costs, and fees based on historical data and market analysis. It enables businesses to plan their financial activities more precisely, ensuring they can fund strategic initiatives while maintaining healthy liquidity.

- Financial Analysis: Financial projections are integral to the financial analysis process, providing insights into the company's performance under various scenarios. By comparing projected figures with actual results, businesses can evaluate the accuracy of their forecasts and understand the reasons behind any variances. This analysis helps identify trends, assess the impact of different strategies, and make adjustments to improve future performance. Financial projections also facilitate benchmarking against industry standards, allowing businesses to gauge their competitiveness and identify areas for improvement.

- Financial Planning: Financial planning relies heavily on financial projections to map out the future trajectory of a business. This process involves setting long-term financial goals and developing strategies to achieve them. Financial projections enable companies to anticipate future cash flows, profitability, and capital requirements, guiding strategic decisions such as expansions, acquisitions, or new product launches. Effective financial planning ensures businesses have a roadmap to grow sustainably, manage debt wisely, and maximize shareholder value over time.

- Informed Decision-Making: Finally, financial projections are crucial for informed decision-making. They provide a foundation for making strategic business decisions by forecasting the financial outcomes of various actions. Financial projections offer a quantitative basis for these decisions, whether deciding on a new investment, entering a new market, or adjusting pricing strategies. By understanding the potential financial implications of different choices, businesses can make decisions that align with their financial goals and risk tolerance, ultimately steering the company toward success and stability.

Decisions Defined: Financial Projection Templates Propel Success

Making informed decisions is crucial in any business or financial endeavor. Financial projections play a vital role in this process, serving as a compass that guides entrepreneurs, business owners, and financial managers through the complexities of planning and strategy. These projections are not mere guesses about the future but are carefully crafted forecasts based on historical data, market analysis, and educated assumptions. They enable decision-makers to visualize the potential outcomes of various strategies, understand the financial implications of different choices, and allocate resources more effectively. By providing a clear picture of expected income, expenses, and cash flow, financial projections help assess the viability of projects, identify potential financial shortfalls, and secure funding from investors or lenders. Thus, making the right decisions through financial projections is about blending analytical rigor with strategic foresight, ensuring businesses can confidently and precisely navigate uncertainty.

The use of financial projection templates significantly bolsters decisions in the realm of business and finance. These templates are not just tools for forecasting; they are catalysts for success. By standardizing the process of creating financial projections, templates make it accessible for businesses of all sizes to engage in sophisticated financial planning without needing expert-level financial analysis skills. They encourage consistency, reduce the margin for error, and save time, allowing businesses to focus more on strategy and less on the mechanics of calculation. Moreover, financial projection templates often include industry benchmarks and standards, helping companies to set realistic goals and measure their performance against competitors. As a result, these templates do more than propel businesses toward success; they redefine the decision-making landscape by democratizing access to high-level financial planning and analysis. Through the strategic use of financial projection templates, companies can ensure that their decisions are informed by data and aligned with broader industry trends and opportunities, setting the stage for sustainable growth and competitive advantage.