Residual Land Value Calculation

The Residual Land Value Calculation model allows you to determine the value of a piece of land from a developer’s point of view by analyzing how much a real estate developer should be willing to pay for the land so that he can still make a decent return and profit.

| Development, Financial Model, Real Estate |

| Excel, IRR (Internal Rate of Return), NPV (Net Present Value), Uses and Sources of Funds, Valuation |

The Residual Land Valuation model allows you to determine the value of a piece of buildable land from a developer’s point of view by analyzing how much a real estate developer should be willing to pay for the land so that he can still make a decent return. Understanding the developer’s profit and return calculation is the key to maximize the value of land with construction rights during price negotiations.

Below video explains how the model works:

The financial model template allows you to put yourself in the shoes of the developer:

- What price he/she can sell the developed land/real estate project?

- How much his/her development costs are expected to be?

- How much bank financing can he/she obtain?

- How long will it take him/her to develop the land?

- What profit/return does a developer require in order to do such a project?

- How much a developer can afford to pay for the land so that he can still make a decent return?

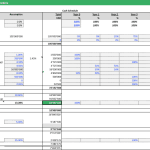

The residual land value calculation starts from the revenues and costs a developer will incur when developing the land, his required profits and results with the residual value a developer should be willing to pay for the land (see screenshots for more details on the valuation approach used).

This financial model template in Excel puts you in the shoes of a real estate developer by first calculating the residual land value but then also to obtain more details on the likely development plan and time required for the development. The model includes a detailed phasing plan over the course of 5 years where expected cash flows (revenues, costs, etc.) can be allocated easily to the appropriate years. This allows to calculate the Unlevered and Levered Free Cash Flows and obtain more insights into the expected Internal Rate of Return (IRR) a real estate developer can expect to obtain when pursuing this project. Keep in mind, a real estate developer will only pay the residual land value if he is convinced that he can generate a decent return on his investment

The model comes in two versions:

- Version with Yearly Cash Flows over 5 years => this is the model which for normal purposes will be fine to use

- Version with Monthly Cash Flows over 5 years => this version is more intended for real estate appraisers wishing to obtain more precision in their calculations. When you purchase this option you will also get the yearly version.

Both models come either as Free PDF Demo version or paid Excel version with all cells editable. Feel free do download the Free PDF Demo versions to check the model out.

File Types:

- Excel file – .xlsx

- PDF file – .pdf

Similar Products

Other customers were also interested in...

Real Estate Financial Model Templates Package

This is a collection of ready-made Excel financial model templates for real estate businesses and it... Read more

Hotel Development Financial Model (Construction, O...

Financial model presenting a development scenario for a Hotel including construction, operation, and... Read more

Residential Building Development Model (Sale, Rent...

Financial model presenting a development scenario for a Residential Building with units available fo... Read more

Shopping Mall Financial Model

Shopping Mall Financial Model presents the case of an investment into a shopping mall and its operat... Read more

Real Estate Financial Model Bundle

This is a collection of financial model templates that provides the financial projections and valuat... Read more

Real Estate Multi-Family Development Excel Model

Real Estate Financial Model to evaluate a development project, with Equity Waterfall and Advanced Sc... Read more

Construction / Development Financial Model

Development & Construction Model presents the case where a property with multiple residential un... Read more

Commercial Real Estate – Lease or Sell Quart...

Commercial Real Estate - Lease or Sell Quarterly Excel Model with 3 Statements, Valuation, and Devel... Read more

Mixed-Use Real Estate Model: Leverage / JV Options

A general real estate model to plan all assumptions for up to 7 'uses' for a given property. Include... Read more

Apartments Development REFM Financial Model Excel ...

Impress bankers and investors with a proven, solid Apartments Development REFM Financial Projection ... Read more

You must log in to submit a review.