How to Use the Dividend Discount Model?

The dividend discount model (DDM) is an equity valuation method used to estimate the true or intrinsic value of the stock based on the present value of all future dividend payments. The concept of DDM lies in the financial theory that a stock is fundamentally worth no more than what it will compensate investors in current and future dividends.

To make money, a business manufactures products or provides services. The profits generated by such business operations are determined by the cash flow generated, which is expressed in the company’s stock prices. Companies often pay dividends to stockholders, which are typically extracted from company earnings. The DDM model is based on the idea that a company’s value is equal to the current value of all of its potential dividend payments.

Understanding the Dividend Discount Model (DDM)

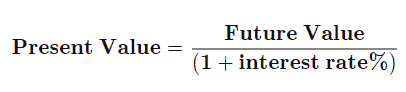

The dividend discount model works on the theory of calculating the net present value (NPV) of a company’s future cash flows using the time value of money concept (TVM). Basically, the DDM is based on estimating the present value of all potential dividends expected to be paid by the firm using a net interest rate factor or also called discount rate.

Estimating a company’s potential dividends can be a challenging job. To predict future dividends, analysts and investors may make certain assumptions or attempt to identify trends based on past dividend payment history. One can conclude that the company’s dividend growth rate will remain constant in perpetuity, which refers to an endless stream of similar cash flows with no end date.

Another thing is that shareholders who put their money into stocks run the risk of losing money because their investments can lose value. They anticipate a return/compensation in exchange for this risk. The market and investors expect reimbursement from a company’s cost of equity capital in return for owning the asset and bearing the burden of ownership. The Capital Asset Pricing Model (CAPM) or the Dividend Growth Model can be used to estimate this rate of return, which is expressed by (r). This rate of return, on the other hand, can only be realized when an investor sells his stock. Due to investor discretion, the appropriate rate of return can vary.

The DDM Formula

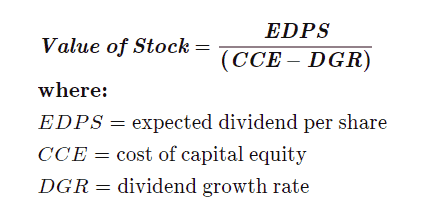

The Dividend Discount Formula requires the following components:

- Annual Dividend Per Share – The amount each investor receives as compensation for investing in the company.

- Dividend Growth Rate – Represents the rate at which the dividend is increased from year to year. The dividend growth rate can undergo a stable or constant growth, and it can also undergo a combination of different stages:

- A high, aggressive, and unsustainable growth rate for a finite period of time.

- A slower and declining growth rate for a finite period of time.

- A stable growth rate for an indefinite period of time (perpetuity).

- Required Rate of Return – Also called “cost of equity”, is the minimum rate of return an investor requires to compensate him for the risk undertaken in investing in the stock. The Capital Asset Pricing Model (CAPM) is often used to determine the rate. The rate calculated should be higher than the dividend growth rate otherwise, the stock will have a negative intrinsic value.

The DDM comes in a variety of forms, each with its own level of complexity. The simplest version of the dividend discount model assumes zero dividend growth, in which the stock’s value is the dividend separated by the projected rate of return, which is not true for most businesses.

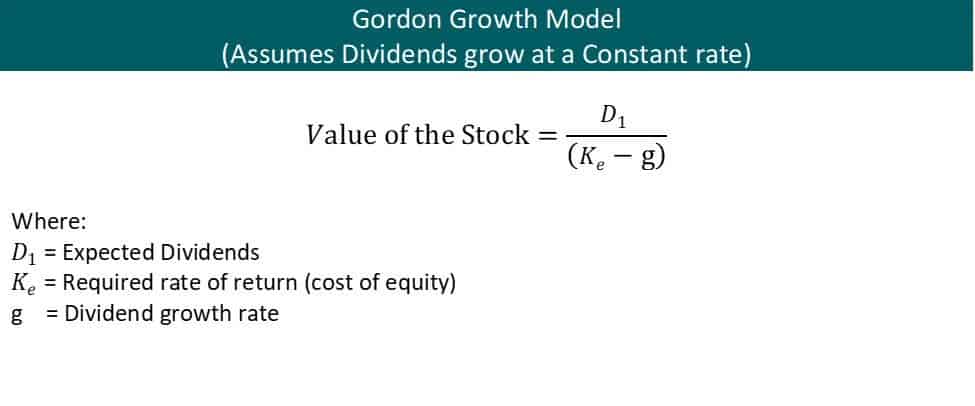

The simplest form of the Dividend Discount Model is the Gordon Growth Model, named after the American economist Professor Myron J. Gordon. GGM assumes the company’s business will last indefinitely, and the dividend payments increase at a constant rate year to year. If the value calculated is higher than the current trading price, the stock is undervalued and may qualify as a signal to buy. On the other hand, if it is lower, the stock is overvalued and may not be a sound investment.

The GGM is built on the premise that the stream of potential dividends will continue to rise at a constant pace indefinitely. The model is useful for determining the valuation of stable firms with consistent dividend growth and good cash flow. It is usually presumed that the company being analyzed has a clear and reliable business model and that the company’s growth is steady over time.

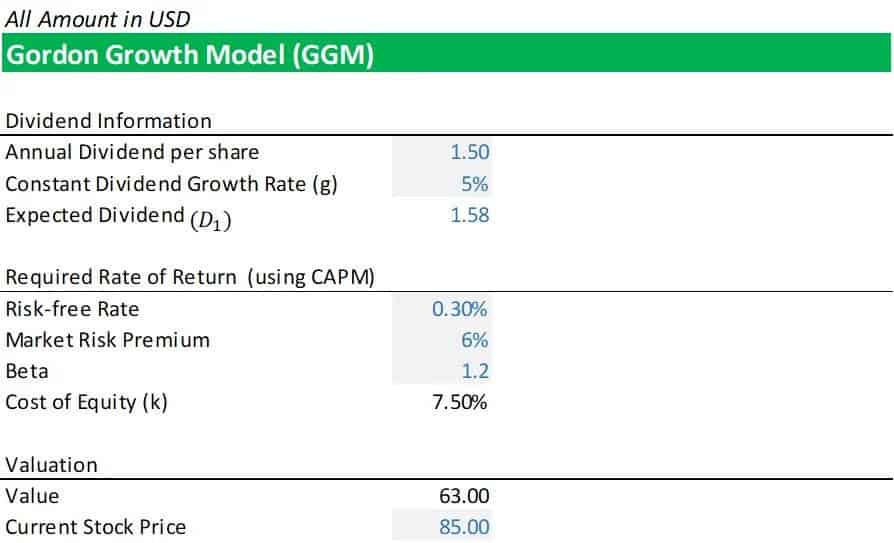

If Company A pays a dividend of $1.50 and expects dividends to grow indefinitely at 5% annually with a required rate of return of 7.5%. What is the intrinsic value of Company A? Incorporating the dividend discount model formula in excel, the intrinsic value of Company A’s stock is $63. If the current trading price of the stock is $85, we can conclude that Company A’s stock is overvalued.

The dividend discount model is not a suitable valuation model for all companies. Regular dividend payments imply that the company has matured in its business and industry. Using DDM to value companies that do not pay dividends, such as growth stocks and companies that have inconsistent dividend payout (no established dividend payout policy), is not appropriate. In addition, DDM is not applicable to value new companies that are just starting to pay dividends to their shareholders.

Feel free to download the Dividend Discount Model Template, which includes the calculation using the Gordon Growth Model here: Dividend Discount Model Calculator.