Valuation Methods for Stocks: Intrinsic Value vs Market Value

Most stock market trader, investor, and money manager seek to outperform the market. Handpicking winning stocks and selecting the next Amazon or Google Company is not an easy task. A company’s stock price does not always reflect its true value. The stock price reflected in the markets may be trading lower and higher than its true value. Compared to their fundamental value, the company’s stock price can either be viewed as over-valued or under-valued.

Knowing and understanding the basic methods to determine a stock’s value is an essential skill to learn and master in order to enhance the decision-making process when investing in the stock market.

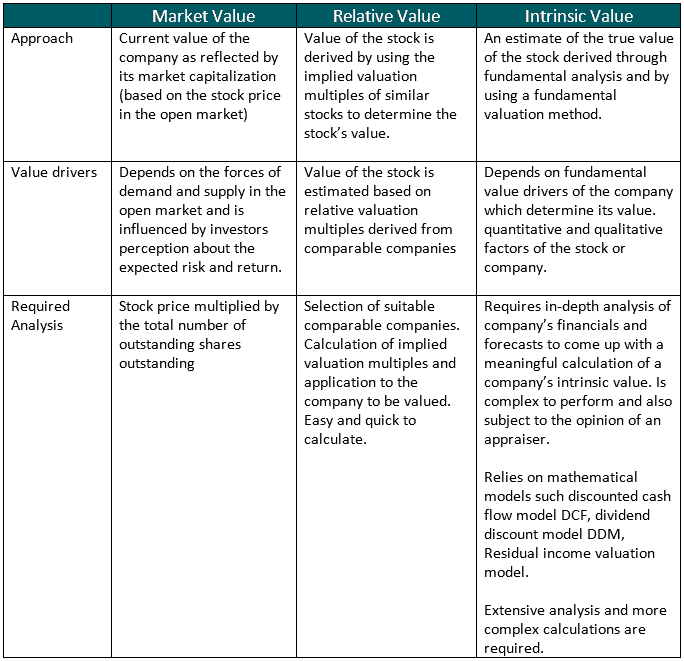

Intrinsic Value, Relative Value, vs Market value

Value, as defined in Meriam Webster, in its basic context means the monetary worth of something.

When valuing stocks, and essential to the understanding of valuation methods for stocks, three concepts of value must be understood:

- Market value: The market value of a company’s equity capital is basically its market capitalization (number of outstanding shares multiplied by the stock price.

- Relative value: The valuation bases on the comparison of market prices of similar stocks.

- Intrinsic value: By using fundamental analysis and determining the company’s intrinsic value, this is one of the most solid valuation methods for stocks

While market value is a relatively simple concept based on observable market prices paid for a stock, relative and intrinsic valuation methods come in a variety of forms.

Relative Valuation Methods for Stocks

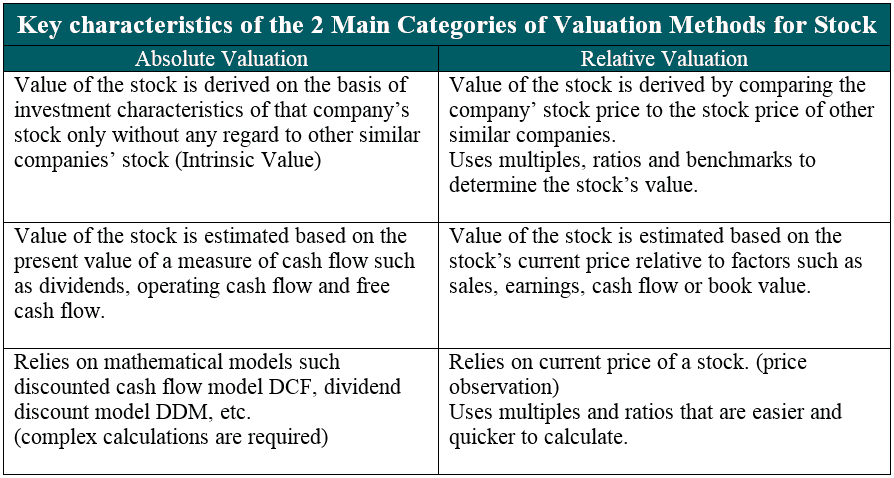

Relative Valuation methods for stocks offer a pretty simple approach in determining a stock’s value and are easier to perform than fundamental valuation methods which require a lot of analysis.

Unlike the intrinsic valuation methods for stocks where many calculations analysis need to be performed, relative valuation methods rely on how the open market is currently valuing similar stocks. Think of it as similar buying a house. The home buyer compares different houses in the neighborhood or locality to check what houses are worth in the area in terms of square meters or square feet. As such, they rely on the use of valuation multiples derived from comparable companies.

There are numerous valuation multiples which can be used. Below we present 4 simple multiples to be used in relative valuations.

Price to Earnings (PE) ratio.

This is one of the most widely used relative valuation methods by investors as it compares the company’s market capitalization to its net income. P/E valuation multiples derived from similar companies are then used and applied to the company to be valued. The P/E ratio represents the dollar amount an investor pays for a stock to earn one dollar of the company’s earnings.

The downside to this multiple is that the multiple itself is influenced by the leverage (by how much debt is used) and the multiple is subject to manipulation (e.g. depreciation, financing structure) whose effects sometimes are difficult to separate.

EV/EBITDA Ratio

Opposite to the P/E ratio, the EV/EBITDA multiple compares profits to the Enterprise Value (EV) not the equity value. The multiple represents the company’s valuation when not considering the effect of how the company is financed (through debt and equity).

The EV/EBITDA Multiple uses similar logic as the P/E Ratio but with the main difference that the company’s depreciation policy and financing structure do not influence the valuation multiple. While the P/E ratio is mostly used by less sophisticated investors, professional investors will focus more on the valuation using the EV/EBITDA multiple in order to avoid being confused and mixing the effect of leverage and the company’s true operating performance.

The advantage of using the EV/EBITDA multiple is that compared to the EV/Sales multiple, the multiple takes into account the company’s profitability. A higher EBITDA margin leads to a higher valuation. Compared to the EV/EBIT multiple, the effect – and source of potential manipulation – of depreciation is excluded. Regardless of what financing structure a company uses, the EV/EBITDA multiple should not be affected.

Price to Book Ratio

Easy to calculate by dividing the market capitalization by the book value of comparable companies. Same as the P/E ratio, the multiple is affected by the company’s financing structure since we are focusing on the Equity value, not the enterprise value. In order to understand P/B, the P/B ratio needs to be interpreted in light of the company’s ROE (a higher ROE should result in a higher Price to Book ratio)

Dividend Yield

The dividend yield compares the dividends paid of similar companies to their market capitalizations. The approach only works for stocks which pay dividends. It does not work to value high-growth companies where no dividends are paid. The multiple is not widely used but it can be useful to analyze if the focus of the investment strategy lies on generating steady dividend income.

In general, relative valuation methods can be very useful to quickly obtain an estimate about most likely valuation ranges for stocks compared to their peers. However, there are some limitations as well for the relative valuation methods:

- Does not result in an exact specific value (unlike discounted cash flow, dividend discount models, etc.) as this approach is based on the comparison.

- Assumes the market has valued the companies correctly.

- Difficulty in searching for similar or comparable companies (peer selection). Ratios will vary significantly from one industry group or sector to another, careful consideration must be observed when searching for comparable or similar companies.

- Neglects fundamental analysis of a company and its value drivers. In reality, no company is the same as another one. There are always differences and therefore a valuation based on relative valuation methods for stocks is just an approximation.

- Multiples represent a snapshot of the stock or company’s performance at a specific point of time and fail to capture the growth of the nature of the business as well as the industry (based on past performance, not forward-looking).

- Also to be noted, sometimes the required data to perform a relative valuation outside established stock markets such as the US, Canada, United Kingdom, Germany, France, Japan makes it impossible to use certain methods. E.g. valuing a company in South Africa requires the availability of similar quoted companies in South Africa. If e.g. comparable companies can only be used located in Australia or New Zealand, this already limits the explanatory power of such an approach since it is based on peer data outside the target country.

Intrinsic Value: Fundamental Valuation Methods for Stocks

Intrinsic value, also called the fundamental value or true value because the valuation is derived through fundamental analysis of a company’s value. It represents the rational value investors would place on the stock price if they had all information available about it and the market behave fully rationale.

Furthermore, it also represents characteristics or factors inherent or innate to the stock or company and is not compared to similar stocks (comparables or “comps”) in the market. Value investors seek to invest in stocks that have a higher intrinsic value than its current stock price (market value) as they anticipate that over time the stock price will increase to its true value, therefore, turning the stock into a good investment.

Determining a stock’s Intrinsic Value is important because:

- Helps investors make informed decisions about buying and selling a company’s stock.

- Helps identify stocks that are mispriced in the open market.

- Leads to a better understanding of a company’s profitability of the business and value creation process

- Determines the future stock prices for the investors to time their buys or sells (market-timing purposes).

The Efficient Market Hypothesis

Among investors, one of the most debated questions is “Do the stock prices of public companies listed on the stock market reflect all relevant information?” In other words, “Is the stock market efficient?”

Efficient is commonly defined as achieving maximum productivity with minimum effort, cost or expense. However, in finance, a market is efficient when market prices reflect all available and relevant information. This idea is based on, what is considered as the cornerstone of modern financial theory, the efficient market hypothesis or EMH developed in 1970 by American economist Eugene Fama.

The efficient market hypothesis is an investment theory that proposes:

- All information is already incorporated into stock prices.

- Stocks always trade at their market values.

- An investor cannot “beat” or outperform the market.

- There are no under- or overvalued stocks available in the market.

Economist Eugene Fama won the Nobel Prize for Economics for his contribution to the Efficient Market Hypothesis (EMH). Although the EMH is considered as the cornerstone of modern financial theory it is both controversial and often disputed. Warren Buffet, considered as one of the most successful and influential investors, has consistently outperformed the market over a long period of time. His holding company, Berkshire Hathaway, continues to outperform S&P 500 for decades.

Two notable investors who have also done a similar feat:

- John Templeton, mutual fund manager and founder of the Templeton Growth Fund. In 1999, Money magazine called him “arguably the greatest global stock picker of the century.”

- Peter Lynch, mutual fund manager, managed Magellan Fund at Fidelity Investments, earned 29.2% average annual return (1977 -1990).

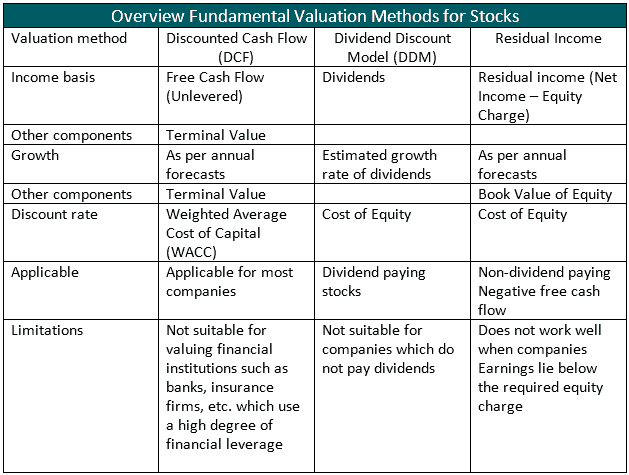

DCF, DDM, and Residual Income Valuation Methods for Stocks

Three of the most common fundamental valuation methods for stocks are the following:

Discounted Cash Flow Model (DCF)

The DCF valuation method derives the value of a stock by calculating the present value of the future cash flows the company will generate. It is the intrinsic value of the company’s stock today based on the forecasted free cash flows available to the company it will generate in the future.

The cash flow is represented by the unlevered free cash flow, also known as the free cash flow to the firm. Please refer to this article on How to calculate the DCF value of a company. To mention also the importance of the discount rate Weighted Average Cost of Capital (WACC), which requires solid analysis

Most stock market research analyst will use the DCF method when valuing stocks as this allows them to obtain a solid understanding of the fundamental value of a company. Most research reports then compare the DCF value to the current stock price and conclude if the stock is over- or undervalued.

Dividend Discount Model (DDM)

Same as the DCF method, the Dividend Discount Model is based on the concept of the time value of money.

The estimated value of the stock is determined by calculating the present value of the future cash flows the stock will generate in the form of dividends. Simply put, it is the value of the company’s stock today based on the forecasted dividends it will generate in the future.

As the cash flows are represented by the company’s dividends which belongs to equity shareholders, now the cost of equity needs to be used to discount the dividends. As dividends grow over time, a Gordon Growth Model is used, which means the discount rate is adjusted by deducting the expected future annual growth rate in dividend income.

The Dividend Discount Model valuation method for stocks is mostly applicable to mature companies or businesses that are paying dividends. This valuation method cannot be used to value companies that pay no dividends.

Feel free to download this simple Multi-Stage Dividend Discount Model which includes the Gordon Growth Model here: Dividend Discount Model | Gordon Growth Model.

Discounted Residual Income Model

The residual income valuation method is related to the DCF method but it looks at value from an Equity investor point of view and focuses on the excess income (Residual Income) generated by the company. The method focuses on accounting metrics (Net Income) rather than cash flow metrics. The future expected Residual Incomes are then discounted by using the company’s cost of equity and added to the book value of the Equity.

- Residual Income = Net Income – Equity Charge

- Equity Charge = Equity Capital * Cost of Equity %

- Equity Value = Book Value of Equity + sum of all future discounted residual incomes

The Residual Income Model valuation method for stocks is a more complicated method to use and to explain than other methods. It’s similar to economic profit or EVA valuation methods. For stock valuation purposes, the Residual Income Valuation Method for Stocks can be used to value companies that are not dividend-paying and which generate negative (-) free cash flows.

Common to all fundamental valuation methods is that they required extensive analysis and are also subjective estimations influenced by the view of the appraiser. Fundamental valuation methods for stocks all come with their limitations as complex calculations are involved and each method is intended to be used for specific use cases.

Valuing Stocks: Selection of appropriate Valuation Methods is Key

Despite the numerous valuation methods at an investor’s disposal, there is no single method that is the best and can be used in every situation. Every company’s stock is different and every industry or sector it belongs to have distinct characteristics. The art of valuation is to select and combine the appropriate valuation methods for stocks.

Below a summary is provided for the three main valuation approaches when valuing stocks.