12 BUSINESS VALUATION METHODS

A business valuation is a process of determining the estimated economic value of an owner’s interest in a business, using objective measures, and evaluating all aspects of the business. Valuation of a company is conducted whenever:

- There are changes in the shareholder’s structure,

- Owners need debt or equity to expand,

- Owners are looking to sell all or a part of their business, or merge with another company, and

- There is a need for thorough tax analysis.

Business owners will often turn to professional business evaluators for an objective estimate on the transaction value they would need to agree on. There are sophisticated approaches and valuation methods that would analyze the company’s economic value, capital structure, future earnings prospects, or the market value of its assets (Source: Investopedia). Being familiar with the value of the business is important in making a smart decision about the company.

To achieve reliable estimates and results, it is best to use or mix up multiple valuation methods wherein valuators can maximize these data points to diligently and systematically make an analysis that would triangulate where a reasonable business should lie.

THE VALUATION OF A COMPANY

In the valuation of a company, there are three widely recognized business valuation approaches, which are discussed in order for a reason. The Income-based approach is mentioned first, the market-based approach second, and lastly, the cost-based approach. The reason behind the order is that this is usually the systematic way of determining the value of an asset or business:

- From valuing a business based on calculations of their past, present, and future income; to

- Comparison to relevant comparable businesses to check if the resulting value is a fair value and not over or under the acceptable range of prices based on the prices of comparable businesses; and to

- Further check the estimated value of the business, the last approach is to check the total value of existing assets minus the liabilities.

In deciding on the valuation method to choose, the following are taken into considerations:

- The type of business that needs to be valued,

- The purpose of the valuation (quick or in-depth),

- The audience or recipients of the valuation report,

- The availability of data.

The following listed below are the three valuation approaches and their main characteristics:

- Income-based Approach – The value of a business can be derived from the expected future income or cash flows to this business. This approach allows the use of analysis specific for each business by considering the circumstances that define the future income results of this business.

The common characteristics of the valuation methods under the income valuation approach are the following:

- Requires a budget or 5-year financial plan

- Based on forward-looking estimates

- Forecast in most cases will be subjective

- Result depends on the quality and accuracy of the assumptions used

- Will require the use of a risk factor such as a Discount Rate

- Historic results might not be a good measure of future results

- Market-based Approach – The Market Approach derives the value of a business based on comparable valuation multiples observed from similar businesses. Choosing which business valuation methods under the market approach to apply will depend on the data source being used. The main advantage of these market-based methods is that they are quick to do and easy to perform.

The main characteristics of market-based valuation methods are the following:

- Requires a reliable data set such as stock market data, transaction data, and asking prices of businesses for sale

- The data set might include asking prices while real transacted prices might not be available (e.g. only the listing prices are available while the actual sale prices normally are not disclosed)

- Requires an analysis which companies are similar in nature (peer companies)

- Uses several multiples such as EV/Sales, EV/EBITDA, EV/EBIT, P/E, P/Book, Price per sqm, Price per sq ft, etc.

- The definition of multiples can vary by industry and allows flexible use of whatever multiple makes the most sense in that industry.

- The analysis is only as good as how well other similar companies fit

Market-based valuation methods can be subject to manipulation when including peer companies that have a different business model and therefore should not be used as a comparable. The main criticism of using this approach is that the definition of what is a similar company in many cases can easily be challenged.

- Cost/Asset-based Approach – Cost-(or asset-) based valuation approaches determine the value of a business based on the cost of their assets (or the cost to reproduce those assets). This method aims to sum up the costs or value of all assets that would generate the same economic benefits for the business.

The following are the common requirements and characteristics of cost-based valuation approaches:

- Requires a definition of which assets need to be included in the analysis. (e.g. the assets of a balance sheet of a business or a list of costs to re-build an asset).

- Mostly requires a definition of a scenario (e.g. continuing a business, liquidating a business, or rebuilding a business)

- Only consider costs or the value of assets, which does not specifically include the future income potential of these assets

- Normally require a lot of corrections. (e.g. performing a Net Asset Valuation starting with a balance sheet requires to also add the value of intangible assets such as Brands, Customer Base, Patents, and contingent tax liabilities. This opens a certain room for manipulation as well)

Among the three valuation approaches, the Income Approach should have more weight as compared to the Cost Approach since the income is the real benefit to the Company. Market approaches are the quickest to do, but as they are based on comparable companies – and not all companies are the same – they may neglect certain particularities of a business and exclude such in the valuation consideration. Cost approaches neglect revenues and cannot make any statement if the capital is well invested or not.

In most cases, the choice of the business valuation method to apply simply depends on whether the recipient can understand a complex valuation method, such as Discounted Free Cash Flow (DCF) Method. Theoretically, this method is correct. However, this may not be feasible if the recipient is unable to provide a reliable business plan as a basis for the valuation. Therefore, to achieve better results, it might be more appropriate to use a much easier to grasp and simpler method such as Market Multiples, where the valuation is based on similar industry multiplies.

INCOME-BASED COMPANY VALUATION APPROACHES

Income-based valuation approaches involve looking at an organization’s financial history and then constitutes an estimation of the business value by calculating the present value of all the future benefit flows which the company is expected to generate, incorporating the risks and opportunity costs inherent in any future project into the discount rate. The resulting value is highly sensitive due to different estimates of growth rate and required rate of return. The appraiser needs to provide inputs that are realistic and fair.

Because this valuation approach bases value on the business’s ability to generate future economic benefits, it’s generally best suited for established, profitable businesses with stable, predictable, and positive cash flows. Moreover, this valuation approach is relevant if the goal is to arrive at a fair and defensible enterprise value.

The income-based approach requires an extensive amount of detail and analysis. Calculated value relies on many assumptions of different scenarios about the forecast period, the cost of capital, and the terminal growth rate derived. Any minor changes in those key assumptions can materially impact the assigned value. Therefore, the income valuation method has the highest model risk.

The emphasis on future cash flows makes it a unique attribute of this approach that distinguishes it from the other valuation approaches. This approach considers three key characteristics of a business: the level of cash flows, the timing of cash flows, and the risk associated with those cash flows.

There are five business valuation methods under the income-based approach:

I. DISCOUNTED CASH FLOW VALUATION

Discounted Cash Flow Valuation is the most used and theoretically sound valuation method for determining the expected value based on its projected free cash flows. It is widely used for business valuations, real estate properties, and assets such as brands, patents, or trademarks. This method requires building a DCF model in a spreadsheet, usually in Excel.

A DCF valuation model illustrates and builds solid financial projections of the company’s Free Cash Flows (to the Firm), which are a reliable measure of a firm’s health that eliminates window dressing and subjective accounting policies. These free cash flows are discounted to their present value using the DCF discount rate, resulting to the Enterprise Value, also known as the Net Present Value. Having a DCF valuation model ready is very useful to explain the economics of a business and discuss its impact on the valuation.

There are seven elements to value a business using a DCF Valuation:

- Historic Financials – Build and analyze at least three years of a company’s historic financials.

- Financial Forecast – 5-year financial projection/forecast of the company’s projected Income Statement, Balance Sheet, and Cash Flow Statement (using the Three Statement Model approach).

- Future Free Cash Flows – From the forecasted data, calculate Free Cash Flows to firm using the formula shown to the right.

- Discount Rate – Each business operates with different risks and within selected industries, which therefore requires the calculations of WACC.

- Terminal Value – The Terminal Value represents the value generated from all the expected cash flows beyond the forecasted period which normally is 5 years. There are three different ways to estimate terminal value: Perpetual/Gordon Growth Model, Value Driver Models based on Economic Profit and Exit Multiple Method.

- Discounting Free Cash Flows – Projected free cash flows and the terminal value are discounted to their present values called the Net Present Value (NPV) of future cash flows, by using the discount factor.

- Calculating EnterpriseValue and Equity Value – Enterprise Value is the total value of the assets of a business (excluding cash) and is simply the Net Present Value or the summation of discounted free cash flows. The Equity is the value that remains for the shareholders after any debts have been paid off and is computed by adding back the beginning balance of cash to the enterprise value, and then deducting the beginning balance of the financial debt

To further understand the process of calculating DCF in an Excel spreadsheet, you may refer to: How to Calculate a DCF Model.

Below is a detailed example that shows you how to determine the valuation of a business using a DCF Valuation Model:

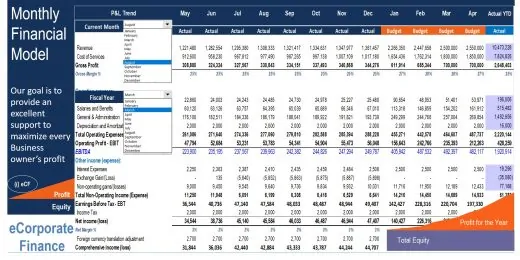

An easy way to start a discounted cash flow valuation is to use one of the DCF model templates, which were prepared by skilled expert financial modelers. These include industry-specific valuation frameworks and make it easy to prepare a valuation of a business. The DCF valuation method is widely used worldwide, by users of nearly all countries such as the USA, UK, Canada, Mexico, Australia, Brazil, Colombia, Germany, France, Spain, Italy, Switzerland, Australia, New Zealand, Austria, Japan, India, Saudi Arabia, UAE, and many more.

II. CAPITALIZED EARNINGS VALUATION

Capitalization of Earnings Valuation method determines the business value of a company by calculating the normalized earnings and dividing them by an appropriate capitalization rate. This business valuation method is widely used in valuing real estate companies that can benefit from stable income streams.

TWO ELEMENTS UNDER THIS VALUATION METHOD

Normalized Earnings refer to the normalization of actual EBIT to reveal the normalized income potential available to interested buyers. It is important to normalize EBIT to better understand a company’s ongoing net operating income and to help see the underlying trends in a business more clearly.

Normalizing adjustments and “add-backs” include cleaning out the impact of non-recurring items – expense items that are currently being recorded through the Income Statement but will not continue to be realized or recorded as expenses after the transaction is closed. Determining the amount(s) of these adjustments is particularly important because it goes directly to what a buyer will likely pay for the business

The 10 most encountered normalizations include (Source: Divestopedia):

- Non-arms-length revenue or expenses;

- Revenue or expenses generated by redundant assets;

- Owner salaries and bonuses that are not at fair market value;

- Rent of facilities at prices above or below fair market value;

- Start-up costs;

- Lawsuits, arbitrations, insurance claim recoveries and one-time disputes;

- One-time professional fees;

- Capital expenses recorded as repairs and maintenance;

- Inventories previously expensed that remain in the business; and

- Other income and expenses that remain uncategorized and are non-recurring.

Capitalization Rate represents the risk associated with receiving the future profits and shows the opportunity cost by the investors of investing in an asset with similar risk. The capitalization rate is the same as used in a DCF Valuation and can be determined via a WACC calculator – Weighted Average Cost of Capital. Determining a capitalization rate for a business involves significant research and knowledge about the business, its competitors, and the industry. A higher capitalization rate indicates higher risk.

HOW DOES CAPITALIZATION EARNINGS VALUATION METHOD WORK?

The following steps in the valuation of a company using this method are:

- Build and analyze a 3-year historic Income Statement

- Compute for the EBIT in the Income Statement

- Identify and remove extraordinary effects/items. These are on/off items which are non-recurring and would in “normalized year” normally not happen.

- Identify the normalizing adjustments and add them back to the EBIT to determine the Normalized EBIT

- Deduct the income taxes to arrive at the NOPLAT (Net operating profit less adjusted taxes which is the same as EBIT less pro forma taxes)

- Calculate the Normalized Earnings by finding the average of the 3-year historic NOPLAT

- Enterprise or Business Value is computed by using the formula:

- We use the Weighted Average Cost of Capital (WACC) as the capitalization rate.

- Like the DCF Valuation method, Equity Value is computed by adding back the beginning balance of cash to the enterprise value, and then deducting the beginning balance of the financial debt.

Based on the steps stated above, Capitalized Earnings model below illustrates how to calculate valuation of a business:

THE PROS AND CONS OF THE CAPITALIZED EARNINGS METHOD

The capitalized earnings methodology is generally considered a short form of a discounted cash flow method, where a single representative earnings figure is capitalized, rather than a stream of individual cash flows being discounted. The main advantage is that this valuation method is quick to use and easy to understand compared to a standard DCF valuation method.

One downside of the capitalized earnings valuation method is that it only can be applied to a stable company or asset producing steady profits. As soon as a company grows heavily, this method is not very suitable to capture the effects of huge growth and will quickly reach a limit where the results are not any more meaningful. Moreover, this method is also subject to a lot of manipulation, hence it is not usually accepted.

III. RISK ADJUSTED DISCOUNTED CASH FLOW

Risk-Adjusted Discounted Cash Flow method is a special type of DCF valuation that adjusts the cash flow forecast by the specific development risks. This valuation method is used in Biotechnology companies.

Biotechnology companies have several products – such as drugs, vaccines, substances, medicines, or similar products – in their pipeline at various stages of development. Each product is subject to different development risks validation through clinical studies, and approval by the appropriate authorities is required. Using the Risk-Adjusted DCF valuation model, the risk will be captured in the success probability factor for each product. The product forecasts are probability adjusted to consider the success probabilities at different stages during the product development stages and simulate the effect on the company’s valuation.

A drug that is in the discovery or preclinical stage is a risky proposition. In valuation, biotech companies should only include those drugs that are already in one of the three clinical trial stages. With this, users need to start by making assumptions about the drug’s market potential and look at the information provided by the company and market research reports to determine the size of the patient group that will use the drug. Analysts typically focus on market potential in industrialized countries, where people will pay the market price for drugs.

The Enterprise Value of a biotechnology company is calculated by discounting the risk-adjusted future free cash flows to today’s value via the risk-adjusted Discounted Cash Flow Valuation Method.

To further learn more on the use of risk-adjusted DCF valuation model for Biotech companies, you may refer to the Pharma Biotech Valuation model template:

IV. ECONOMIC PROFIT CALCULATION

Economic Profit, also known as Economic Value Added (EVA), is a method based on the Residual Income technique. This valuation method attempts to capture the truest economic profitability and the measure of the financial performance of the company, based on the residual wealth. Residual wealth is the excess profit above the cost of capital, generated by the business, adjusted for taxes, and presented on a cash basis. It also represents the difference between the Rate of Return and Cost of Capital and measures the value generated by invested capital.

Its underlying premise consists of the idea that real profitability occurs when additional wealth is created for shareholders and that projects should create returns above their cost of capital. A negative EVA means that the business is generating no value from the funds invested into the business. Conversely, a positive EVA implies that the project of a company is producing value or profits above the required minimum rate from the funds invested in it.

The Firm’s value is calculated by adding the invested capital today and the discounted economic value added.

The following steps in the valuation of a company using this method are:

- Build and analyze Balance Sheet and Income Statement for today’s year and a 5-year forecast.

- Based on the data in the Balance Sheet, calculate Invested Capital = Equity + Financial Debt – Cash:

- Calculate Required Return and NOPLAT.

Required Return = Average Invested Capital * WACC

NOPLAT = EBIT (1-Tx Rate)

- Similar to the DCF model, terminal value for the 5th year is computed as EVA will not stop in year 6 and onwards. Using the Gordon Growth model, terminal value is computed by:

- Compute for Economic Value Added by deducting Required Return from NOPLAT. For year 5, terminal value is added.

- Discount the EVA using a discount factor.

- Enterprise value is calculated by adding the invested capital today and the discounted economic value added.

Below is a detailed example that shows you how to determine the valuation of a business using the Economic Profit Calculation Valuation model:

When conducting a company valuation, in most cases it is easier to do a DCF Valuation than an Economic Profit Calculation. The concept of “Economic Profit” or “Economic Value Add” is much more useful when measuring past performance. An EVA calculation shows how and where a company created wealth, through the inclusion of balance sheet items. This forces managers to be aware of assets and expenses when making managerial decisions. However, the EVA calculation relies heavily on the amount of invested capital and is best used for asset-rich companies that are stable or mature. Companies with intangible assets, such as technology businesses, may not be good candidates for an EVA evaluation.

V. VENTURE CAPITAL METHOD

The Venture Capital (VC) Method, as the name implies, is a famous quick valuation approach used by many venture capitalists all over the world mostly for valuing early-stage startup companies. Most investment scenarios involve investment in an early-stage company that is showing great promise but typically does not have a long track record and its earnings prospects are perhaps volatile and highly uncertain.

The main idea of the VC Method is that it is much easier to estimate a business’ value in the future than today. When an estimated value of how much a business should be worth 5 or 7 years down to the road is available, the value is simply discounted back to its present value by using the required Internal Rate of Return (mostly between 20% to 25%).

The following steps on how to calculate valuation of a business using the Venture Capital method are explained and illustrated below:

- Build a spreadsheet forecasting a 7-year Balance Sheet and Income Statement

- To determine the Exit Enterprise Value, apply an exit multiple only in year 7 because no money is received from years 1-6. Moreover, Exit value is the value a company is expected to be sold for.

- Calculate the Exit Equity Value by deducting Financial Debt and adding back Cash from year 7 Balance Sheet

- Discount the Exit Equity Value using the require Internal Rate of Return (IRR) to today’s date, to determine the Equity Value of a business

The Venture Capital Method is by no means a comprehensive model for valuing early-stage companies. Nevertheless, because of its simplicity and straightforwardness, it is widely used as a rule of thumb and a starting point for more in-depth models.

VI. ROYALTY RATE VALUATION

The royalty rate valuation method, also known as the royalty relief method, is one of the methods that can be used to value a wide range of intellectual property assets or intangible assets such as trademarks, trade names, brands, patents, technology, and know-how.

This valuation method determines the value of an intangible asset by calculating how much a company would save in hypothetical royalty payments if it were to own the asset rather than licensing it from a third party. In other words, the value of the intangible asset is based on the costs that the company would avoid by not having to pay a license fee or royalty to use the asset.

The royalty relief method is a combination of the market and income valuation approaches. It reflects the market approach in its use of similar licensing deals to calculate an appropriate royalty rate and it mirrors the income approach by using estimates of revenue, growth rates, tax rates, and discount rates as a basis for value.

To illustrate the computation of business value using the Royalty Rate Valuation method, below are the following steps:

- Build an Income Statement that would forecast 10 years income of an Intangible asset such as Patent

- Apply a suitable estimated Royalty Rate to the revenue to determine the Royalty Income

- Calculate the After-Tax Royalty income by deducting the taxes using the income tax rate

- Discount the values using a discounting factor

- Enterprise Value is calculated by getting the total of the 10-year discounted values

MARKET-BASED COMPANY VALUATION APPROACHES

The Market-based Valuation Approach determines company value by comparing one or more aspects of the subject company to similar aspects of reasonably comparable companies which have an established market value and are in a similar region with equal size or operating in a similar sector. This method relies on pricing multiples to determine if there’s relevance between the economic value and potential selling price of a business.

Since this method only involves simple calculations, it is easy to understand and more honest as it uses figures or data which is real and public. Therefore, there is no need for guessing or making any estimations which makes the market approach not dependent on subjective projections. However, as compared to other approaches, it is less flexible that may lead to the loss of opportunities of earning or saving more because it eliminates the chance to check the future value of a business. It may also raise problems such as not having enough data available when needed or raised doubts as to whether the data is good enough to use. One would need an experienced expert with expansive know-how in the industry to try and resolve those issues.

There are three valuation methods that make use of the market-based valuation approach:

I. MARKET COMPARABLE ANALYSIS

Market Comparable Analysis is a relative valuation methodology that values a company by comparing comparable companies’ multiples to see how the public market values the company. Users such as research analysts, investors (private equity), and investment bankers prefer to use this method because it is easy to perform, and the data required is usually relatively widely available (provided that the comparable companies are publicly traded). Also, this method assumes that the market is pricing the securities of other businesses efficiently.

The following listed below are the steps to determine the valuation of a company using the market comparable analysis:

- Analyze the target company and set comparable criteria

- Select the right comparable companies by creating a peer group

- Collect necessary financial data

- Identify multiples of comparable company by either calculating or if already available, gather information from relevant websites. These ratios will be used to estimate the targeted company’s value. The ratios that the analyst may gather or calculate any of the following:

- P/E (price-earnings ratio)

- P/B (price-book ratio)

- P/NAV (price-net asset value ratio)

- EV/ Gross Profit (enterprise value-gross profit ratio)

- EV/Revenue (enterprise value-revenue ratio)

- EV/EBITDA (enterprise value-earnings before interest, tax, depreciation, amortization)

The following data below are consolidated from Yahoo Finance:

- Determine the average or the median of the selected multiples. For the analyst to come up with a meaningful average, they will remove the outliers and massage the numbers till they look realistic or relevant.

- Apply the average multiple either EBITDA, gross profit, net income, or revenue, whichever is applicable, to determine the Enterprise Value.

Below is an example of a Market Comparable Valuation model:

Keep in mind that the main idea of this method is that it gives investors an estimate close to the real value.

II. PRECEDENT TRANSACTION ANALYSIS

Precedent Transaction Analysis is another valuation method following the market approach where the company’s value is derived from a comparison of the historical transaction prices paid for similar comparable businesses. As a market-based approach, it heavily relies on publicly available information to arrive at a reasonable estimate of pricing multiples or premiums that other similar buyers or sellers have paid for in a publicly-traded business. This method is commonly used by analysts when analyzing mergers and acquisitions where a controlling stake of a company is being sold.

The most important component of precedent transaction analysis is identifying the transactions that are the most relevant. The following steps below can be used as a guideline for a successful valuation:

- Companies should be chosen based on having similar financial characteristics and for being in the same industry.

- The size of the transactions should be similar in size to the transaction that is being considered for the target company.

- The type of transaction and the characteristics of the buyer should be similar. Transactions that occurred more recently are considered more valuable in terms of usefulness for analysis.

How to determine the valuation of a business using this method is similar to the Market Comparable analysis. The difference is that, instead of using present data, past performance data are used to calculate multiples. Moreover, since this valuation method is often used for merging and acquiring purposes, more than 2 acquisition transactions of different companies are gathered and used as relevant data.

A conclusion will be needed whether to use one of the identified valuation multiples as the best estimate or an average of a select data set. In most cases, an EV/EBITDA or EV/Sales multiple will be available depending on how much information is disclosed. The average valuation multiples are then applied to the target company’s income statement line item to arrive at the Enterprise Value for our company.

An example is shown below:

Precedent transaction analysis is an excellent tool to be used when valuing a business. The limitations of this method are that the results are only as good as the peer set used, the availability of publicly disclosed data such as the valuation multiples, and the assumption that the market conditions would need to remain unchanged.

III. INDUSTRY MULTIPLES ANALYSIS

Industry multiples are simply an industry-specific ‘ratio’ or a ‘factor’ that determines the current value and worth of a company. Business owners talk to industry experts to attain reliable sources of multiples. A reliable industry multiple is derived by considering the selling price and annual revenues of comparable public companies in the industry.

To evaluate the estimate of the value of the business one can use financial ratios such as:

- Enterprise value (EV) to gross revenues or net sales

- EV to net income

- EV to EBIT and EBITDA (earnings before interest, taxes, depreciation, and amortization)

- EV to seller’s discretionary cash flow

- EV to total business assets

- EV to owners’ equity.

These ratios vary for different industries and different-sized companies. The size of the subject company, its profitability, its growth prospects, and the industry within which it operates will have an impact on its industry multiple. The wider the batch of reference companies, the better the credibility.

To calculate an estimation of the firm’s value, one can use different combinations of financial performances. For instance, EV/revenue multiple is used to evaluate the value of various new industries, while EV/EBITDAR multiple is used when there are significant rental and lease expenses incurred by business operations.

These industry multiples are used as baselines or guidelines wherein they provide a general idea about how a startup will fare in a particular industry. Since early-stage startups do not have a robust cash flow and stable earnings, financial analysts and investors use these multiples as a blanket metric to gauge the startup’s profitability.

COST / ASSET-BASED APPROACH

The Cost or Asset-based approach focuses on determining the fair market value (FMV) of the total assets, then subtracts the total existing liabilities resulting in the net asset value or equity, the would-be cost to re-create the business.

Since the data needed to calculate is available by just referring to the balance sheet, finding the total value is easier and simpler compared to the other approaches. However, it only focuses on finding the value of cost to be expended rather than determining the total value of a business’s future earnings to determine the value of a business. The book value of assets is also seldom the same as the real or fair market value.

The cost-based valuation approach will typically yield the lowest among the 3 valuation approaches for a profitable company, but it may result in an appropriate value when used in valuing holding companies, asset-intensive companies, and distressed entities that aren’t worth more than their net tangible value.

There are three methods under the cost-based valuation approach:

I. REPLACEMENT VALUE ANALYSIS

Replacement Value Analysis is a business valuation method used when a company assumes that they will continue to operate as against shutting down of business. This method looks at the operating assets of a business and assigns a value based on what it would cost to replace them, and then evaluates the cost of replacing the assets to achieve a commensurate output given the current state of technology in the industry. Moreover, replacement value analysis considers the value of each asset independently of the operations or productive capacity of the whole business. The replacement values of the individual assets of the firm are added together to arrive at the enterprise value.

Replacement cost or value refers to the amount of money a business must currently spend to replace an essential asset like a real estate property, investment security, lien, or another item, with one of the same or higher value. The cost excludes those assets which are not being used by the company for its daily operations. A replacement cost may also fluctuate, depending on factors such as the market value of components used to reconstruct or repurchase the asset and the expenses involved in preparing assets for use.

Using depreciation to determine replacement cost, computation of the enterprise value is illustrated below:

Because the replacement cost method assumes that it is possible to reconstruct the value of the entire investment simply by replacing its physical assets, this method is often considered a deficient method of valuing a business.

II. NET ASSET VALUATION

Used for going-concern businesses that are asset-rich, the Net Asset Valuation method is used to determine the enterprise value of a business by simply calculating the difference between estimated restated fair market or current value of the existing assets and all associated liabilities.

The assets are valued as if they will continue to be used collectively, which will almost certainly be higher than if they were individually sold, resulting in a net gain. Tax provision, a liability, is calculated by applying a tax rate based on the net gain of the assets. The liabilities will also be restated but will not result in any net gain or loss.

Calculation of net asset value is illustrated below:

This simple business valuation method is commonly used for a controlling interest and in valuing securities of businesses involved in the development and sale of real estate, investment holding companies, and certain natural resource companies.

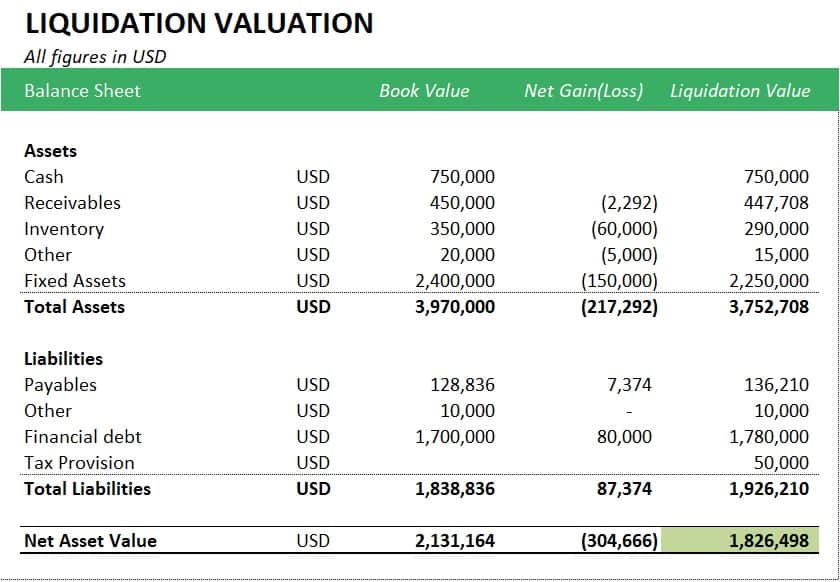

III. LIQUIDATION VALUE

The Liquidation Valuation method is applicable only to businesses with little prospect of continued operations, or that are out or about to go out of business (e.g. bankruptcies, workouts, insolvency, etc.). If a business qualifies in either of the two, the liquidation value or the net cash of a business is then determined by taking the total worth of the business’s physical assets to be received if it were sold and its liabilities paid.

Like the Net Present Valuation method, the value of the assets and liabilities are re-assessed, but at their break-up values or liquidation value. The liquidation value of assets is lower than their book value while the liquidation of the liabilities will be greater than their face value. Since there is no net gain for the assets, tax provision under the liability is estimated.

Net asset value using the liquidation valuation method is calculated below:

THE BEST METHOD IN VALUATION OF A COMPANY

To recap, there are twelve business valuation methods under categorized three widely recognized valuation approaches – Income, Market, and Cost/Asset-based approaches. Each method provides a framework of the valuation techniques to better understand the total value of our subject company, no matter the industry. It is clear to see that the valuation methods are somewhat connected and have their own edges that differentiate them from each other.

There is no “right” approach or method for all circumstances, which raises a relevant point on valuation.

Achieving the best reliable estimates and results of valuation is the target of every business. To attain such a goal, it is best to use or mix up multiple valuation methods wherein valuators can maximize these data points to diligently and systematically make an analysis that would triangulate where a reasonable business should lie.

Please feel free to check out our list of Valuation Model Templates here: