IPO Valuation Model

This financial model can be used to value any Initial Public Offering (IPO) using Option Value, DCF and Relative Valuation.

An IPO valuation is the process by which an analyst determines the fair value of a company’s shares.

This IPO Valuation Model template is a ready-made template that you can use as a base to start with or as a reference to help you build a working IPO Valuation Model.

The following are included in the template:

1. Assumptions page for easy inputs

2. 5-Year projections

3. Debt schedule to assess Financial Feasibility

4. Detailed depreciation, capital expenditure, and amortization schedule

5. Detailed options value calculations

6. Discounted Cash Flow

7. Relative Valuations page (This page gives you an idea about the method. You need to shortlist relevant similar/peer companies)

8. Index page for Easy maneuverability

9. Printable

Similar Products

Other customers were also interested in...

Auditor Financial Model Excel Template

Discover Auditor Pro-forma Template. Allows you to start planning with no fuss and maximum of help C... Read more

Financial Advisors Agency Financial Model Excel Te...

Shop Financial Advisors Agency Pro-forma Template. Creates 5-year financial projection and financial... Read more

Crowdlending (P2P) Platform – 5 Year Financi...

Financial Model providing an advanced 5-year financial plan for a startup Crowdlending (Peer-to-Peer... Read more

Lending Company Financial Model – 5 Year Forecas...

This Financial model template presents a business scenario of a corporation engaged in granting loan... Read more

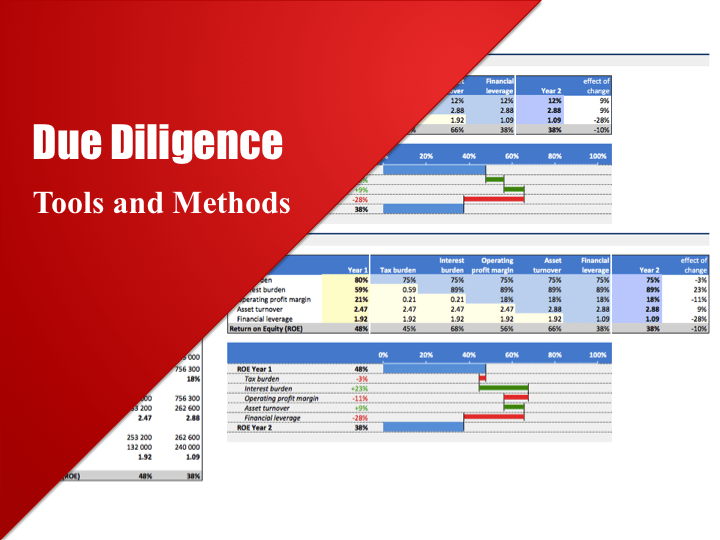

Due Diligence Tools and Methods

A suite of best practices to perform financial and commercial due diligence. Use it if you are consi... Read more

Consulting Firm Financial Model – Dynamic 10 Yea...

Financial Model providing a dynamic up to 10-year financial forecast for a startup or existing Consu... Read more

Accounting Firm Financial Model – Dynamic 10...

Financial Model providing a dynamic up to 10-year financial forecast for a startup or existing Accou... Read more

Bookkeeping Agency Financial Model Excel Template

Try Bookkeeping Agency Financial Plan. Allows you to start planning with no fuss and maximum of help... Read more

Startup Business Plan – Consulting Firm

If you dream to start a Consulting Firm Business, the template is the first step in making your drea... Read more

Multi-Member Investment Fund Portfolio and Distrib...

A fund management tool to track many positions over time as well as distributions to up to 20 member... Read more

You must log in to submit a review.