Amortization

Multifamily Rehab Model (Includes Investor Returns Waterfall)

Introducing the Multifamily Rehab Flip Model with Investor Returns Waterfall…

EV Charging Station Finance Model

Provides a comprehensive analysis of the financial viability and potential…

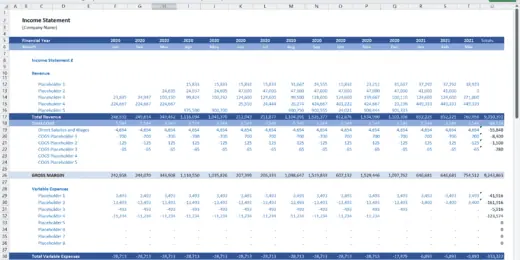

Startup Company Financial Model – Dynamic 3 Statement Financial Projections up to 8-Years

Highly Dynamic and Easy-to-Navigate Excel Financial Projections Model that allows…

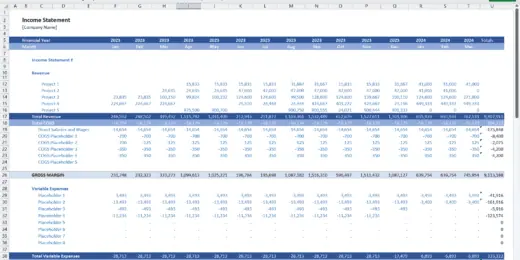

Advanced Financial Model – Dynamic 3 Statement 10-Year Financial Model with DCF Valuation

Advanced, Dynamic and Easy-to-Use Excel Financial Projections Model that allows…

Parcel Locker Network Business Financial Model (10+ Yrs. DCF and Valuation)

The Parcel Locker Network Business Financial Model is a comprehensive…

B2B SaaS FInancial Model & Valuation Template

Unlock your B2B SaaS venture's full potential with our B2B…

Beginner Commercial Property Modelling Tool

"Beginners Commercial Property Modelling Tool," a resource for developers embarking…

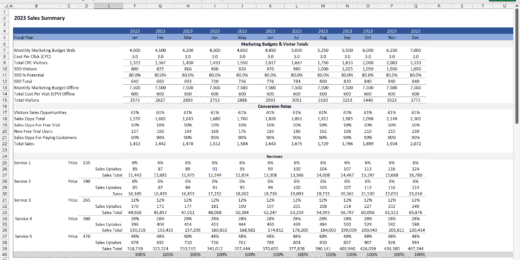

Start Up Company Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking start-up company…

B2B Services Company Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking B2B Services…

Medical Spa (MediSpa) Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Medical Spa…

3 Statement Car Hire Company Financial Model

A comprehensive editable, MS Excel spreadsheet for tracking car hire…

3 Statement Van Hire Company Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking van hire…

Car Dealership Financial Model and Valuation – Financial Projections

Welcome to the Car Dealership Company Financial Model and Valuation,…

Hospitality (Hotel) Financial Model and Valuation – 10-year Projections

Welcome to the Hospitality (Hotel) Company Financial Model and Valuation,…

Logistics Company Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking logistic company…

AgroTech Services Financial Model (10+ Yrs. DCF and Valuation)

The AgroTech Services Financial Model with DCF (Discounted Cash Flow)…

Coffee Shop Financial Plan and Budget Control

This Excel model is a highly adaptable and user-friendly tool…

Telehealth Services Company Financial Model (10+ Yrs. DCF and Valuation)

The Telehealth Services Company Financial Model with a 10+ Years…

Pro Financial Forecast – Dynamic and Advanced Financial Projections

Unleash the power of precise, customizable forecasting with Pro Financial…

Oil & Gas Financial Model – DCF and NAV Valuation (5+ Yrs.)

The Oil and Gas financial model with DCF (Discounted Cash…

eCommerce | Online Retail Financial Model and Valuation

Discover the eCommerce - Online Retail Company Financial Model and…

SaaS Company Financial Model and Valuation

Discover the SaaS Company Financial Model and Valuation, an essential…

Zero Down Seller Financing Strategy for Real Estate Investment

A tool to estimate expected risk and cash flow of…

Real Estate Proforma – Value-Add Apartment Acquisition Model

This multifamily apartment value-added real estate model is a sophisticated…

Rental Property (Airbnb – Real Estate) Financial Model

Powerful Real Estate Rental Property Financial Model for Informed Decision-Making,…

Hotel Complex – Financial Model (5 Yrs. DCF and Valuation)

The Hotel Complex financial model is a comprehensive tool designed…

Comprehensive Oil & Gas Financial Model

Comprehensive financial model for an oil & gas company. Flexible…

Start-up Manufacturing Financial Projection and Budget Control – Excel & Google Sheets

The financial model is an essential tool that enables owners…

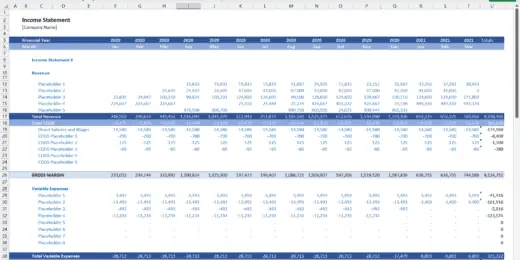

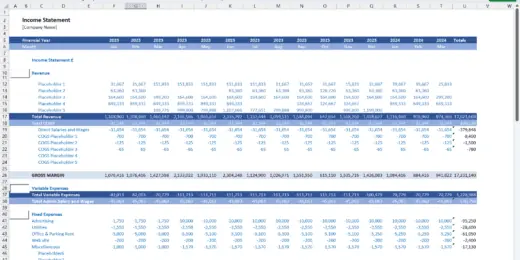

Full 3 Financial Statements Projections Model

Comprehensive three financial statements model (Income Statement, Balance Sheet, and…

Dental Clinic Financial Model and Budget Control Template

This financial model serves as a tool for owners and…

Squash Court and Club Dynamic Financial Model 10 years

Introducing our Squash Courts and Club Financial Forecasting Model –…

Gas / EV Charging Station 10-year Financial Forecasting Model

This model is adaptable and useful for a Gas Station,…

Gym and Fitness Club 10 year Financial Forecasting Model

Introducing our indispensable 10-Year Excel Financial Forecasting Model, a vital…

Blue Hydrogen using Natural Gas – 3 Statements, Cash Waterfall & NPV/IRR Analysis

An integrated and comprehensive Blue Hydrogen Production Plant Model which…

Discounted Cash Flow (DCF) Financial Model

Discounted Cash Flow (DCF) Financial Model with 5-year projections and…

Comprehensive Merger Financial Model

Our sophisticated merger financial model is a versatile and powerful…

Vending Machine Business 5-Year 3 Statement Financial Projection Model

5 year rolling financial projection Excel model for a vending…

Amortization Schedules Template (Loans, Mortgages, LC, Bonds, Leases)

User friendly template including Amortization Schedules for Loans, Mortgages, Operating…

Comprehensive Logistics Company Financial Model and Valuation

Discover the Comprehensive Logistics Company Financial Model and Valuation, an…

Comprehensive Financial Model and Valuation – Restaurant Business

Discover the Comprehensive Restaurant Company Financial Model and Valuation, an…

Rental Property Financial Model

The Rental Property financial model template, forecasts a rental property's…

Car Repair Shop Financial Model (10+ Yrs DCF and Valuation)

The Car Repair Shop Fin. Model (DCF and Valuation) is…

Real Estate Private Equity GP Catchup Waterfall Analysis Model

Ultimate Real Estate Private Equity Financial Model Template: Preferred IRR…

Olive Orchard Business – DCF 10-Year Financial Model

The Olive Orchard Financial Model is a comprehensive tool tailored…

Beverage Trailer (Self-Pour or Manual) 10-year Financial Model

This beverage trailer financial model will provide you with 10…

Green Ammonia from Renewable Energy Financial Model

This comprehensive 40-year tool aid investors in evaluating potential risks…

Paintball Park Business – 10+ Years DCF Model & Valuation

The paintball park business financial model is a comprehensive tool…

Real Estate PE Multiple Hurdles Waterfall Analysis Model

We proudly present our cutting-edge Real Estate Waterfall Analysis Model…

PADEL Court and Club Dynamic Financial Model 10 years

Introducing the Padel Court and Club Financial Forecasting Model, a…

Electric Vehicle (EV) Charging Station Financial Model

With this comprehensive 5- or 10-year monthly tool, investors can…

Trucking / Transportation Business: Scaling Financial Model

Build assumptions around scaling deliveries. Smart logic built for truck…

PICKLEBALL Court and Club Development – Dynamic Financial Model (10 years)

Introducing our Pickleball and Club Financial Forecasting Model – your…

Amortization: What You Need to Know

Business owners need to understand amortization. This financial concept can help them make better decisions about investments and loans. Amortization is vital for anyone involved in business, investing, or financial planning. It spreads out a loan into a series of fixed payments over time. This systematic approach breaks down the repayment into manageable chunks and provides clarity and predictability in financial planning.

Understanding amortization is crucial for entrepreneurs, investors, and finance professionals, as it directly impacts how loans are structured and how repayment affects a business's or investment's financial health. Whether evaluating a new project's feasibility, preparing for fundraising, or analyzing investment opportunities, a thorough grasp of amortization can empower you to make more informed and strategic financial decisions.

An Overview of Amortization

Amortization is a fundamental concept in finance and accounting, essential for understanding the financial management of loans and intangible assets. An amortization expense journal entry represents spreading out a loan or an intangible asset's cost over its useful life. This cost allocation method provides a realistic financial picture for businesses and individuals.

Amortization of Loan

In finance, amortization refers to gradually paying off a debt over time through regular payments. An amortization expense journal entry is commonly applied to loans and mortgages. Each payment typically consists of two parts: one part reduces the principal amount borrowed, and the other pays the interest on the debt. In the early stages of a loan, a more significant portion of each payment is allocated to interest, while in the later stages, more of the amount is applied to the principal. The interest is calculated on the remaining principal, which decreases with each payment.

Amortization schedules, often presented in a table format, provide a detailed breakdown of each payment, showing how much is applied to the principal versus the interest. It helps borrowers understand how their debt is reduced over time and plan their finances accordingly.

Amortization of an Asset

Amortization in accounting refers to the gradual recognition of the cost of an intangible asset over its useful life. Unlike tangible assets, intangible assets such as patents, trademarks, and software development costs do not have a physical presence but still hold value for a business. An amortization expense journal entry helps systematically allocate the cost of these assets over the period expected to benefit the company. It involves determining the asset's useful life and spreading its cost evenly over that period. This practice ensures that the expense recognition aligns with the revenue generated from the investment, adhering to the matching principle in accounting.

Amortization vs. Depreciation

Both amortization vs. depreciation are methods of allocating the cost of an asset over its useful life, but they apply to different types of assets. Depreciation is used for tangible assets like machinery, vehicles, and buildings. This method acknowledges their physical wear and tear and expected decrease in value over time. Amortization, on the other hand, is exclusively for intangible assets. Since these assets do not physically deteriorate, amortization is more about the asset's consumption or the expiry of its legal life (such as a patent or copyright). In essence, amortization vs. depreciation differs with the kind of asset they apply - amortization to intangible assets and depreciation to tangible ones.

Can Amortization Be Negative?

In typical scenarios, amortization cannot be negative. It is because it represents the process of steadily reducing a debt, which is inherently a positive or zero value (in case the debt is fully paid off). A negative amortization could theoretically imply that the debt is increasing over time. It can happen in specific loan structures like negative amortization loans, where the payments made are less than the interest expense, causing the unpaid interest to be added to the principal balance. However, in general accounting and finance, an amortization expense journal entry is not negative; the loan balance might increase. When amortizing intangible assets, the amortization expense is a positive amount representing the allocation of the asset's cost over its useful life. The amortization expense journal entry must be positive since you cannot un-incur a cost already paid or allocated.

Why Amortization is Important?

Amortization is a crucial concept for both individuals and businesses. Here are the top reasons why amortization is important:

- Budgeting: Amortization schedules enable businesses and individuals to anticipate their future financial obligations accurately. By understanding each payment's exact amount and allocation toward interest and principal, entities can better plan and manage their budgets or cash flows.

- Decision Making: Amortization details help assess the feasibility of loans and investments. Entities can decide whether a loan or investment terms are favorable and sustainable in the long term.

- Loan Management: Amortization explains how loan payments are gradually divided between principal and interest. Initially, a larger portion of each amount is typically allocated to interest, with the balance shifting progressively toward the principal. This knowledge helps in understanding the actual cost of borrowing.

- Refinancing Decisions: Amortization can indicate the best time to refinance a loan. Refinancing is beneficial if the interest component is still high when interest rates have dropped. Utilize amortization schedules to analyze different refinancing scenarios, including changes in interest rates, loan terms, and payment options.

- Tax Deductions: Amortization can result in tax benefits. For instance, the interest portion of a loan payment may be tax-deductible in certain cases, and amortization schedules help calculate these deductions accurately. Amortization is crucial for accurate tax reporting for intangible assets (like patents, trademarks, and goodwill). It helps reflect the true value of these assets over time.

- Valuation: Understanding the amortization of investments, like bonds, is essential for assessing their performance and true value at any point in time.

How Is an Amortization Schedule Calculated?

An amortization schedule is a table detailing each periodic payment on a loan (typically a mortgage) over time. How is an amortization schedule calculated involves determining the amount of each payment that goes towards the principal and the amount that goes towards interest.

Straight Line Amortization Method

The straight-line amortization method is one of the simplest ways to how is an amortization schedule calculated. It's commonly used for loans, patents, and trademarks. The same principal amount is paid in each period, with the remaining balance of the payment going towards interest. The formula to calculate each periodic amortization amount under the straight-line amortization method is:

Amortization Expense Per Period = Principal/Total Loan Amount/Number of Periods

Where:

- The Principal Amount = the amortized asset's value or the total amount borrowed

- The Number of Periods = the asset's useful life or loan term. It is the time the asset will be used or the loan will be repaid.

Using the straight-line amortization method of how an amortization schedule is calculated, loan interest may be calculated separately and added to the amortization expense to get the total periodic payment.

Sample Calculation

For instance, a loan worth $100,000 needs to be amortized over ten years (120 months). We can now calculate the monthly amortization expense using the straight-line amortization method formula. It would be:

Monthly Amortization Expense = Principal/Total Loan Amount/Number of Periods

Monthly Amortization Expense = $100,000 / 120 = $833.33

In the case of a loan, if there's interest, it would be calculated based on the remaining principal balance each period and added to this figure to get the total payment.

Declining Balance Method

Another way of how is an amortization schedule calculated is by using the declining balance method, which involves a distinct approach compared to the traditional straight-line amortization method. This method is particularly relevant for assets that lose value quickly in the initial years or for loans where you want to pay more interest upfront. How is an amortization schedule calculated using the declining balance method uses the general formula:

Amortization Expense Per Period = Book Value at the Beginning of Period × Depreciation Rate

Where:

- Book Value at the Beginning of Period = the asset's value at the start of the accounting period. For the first period, this is usually the asset's initial cost. In subsequent periods, it is the initial cost minus the accumulated depreciation.

- Depreciation Rate = a fixed percentage representing how quickly the asset loses its value. This rate is higher than the straight-line method, reflecting accelerated depreciation.

When applied to loan repayment, the declining balance method involves paying off interest first, then the principal amount. The formula changes slightly:

Repayment Amount = (Principal × Interest Rate)/1 − (1+Interest Rate) ^ -Number of Periods

Where:

- Principal = the total amount of the loan.

- Interest Rate = the periodic interest rate (if the loan payments are monthly, this should be the monthly interest rate).

- Number of Periods = the total number of payment periods in the life of the loan (e.g., if the loan term is five years and payments are monthly, this would be 60 periods).

In each period, interest is calculated on the remaining loan balance, which decreases as repayments are made. The repayment includes both interest and principal, but as the outstanding loan balance falls, the portion of the payment allocated to the principal increases while the interest portion decreases.

Sample Calculation for Asset Amortization

For instance, an asset with an initial cost of $10,000 has an estimated useful life of 10 years. The annual depreciation rate would be 10% (100% / 10 years). We can now calculate the yearly amortization expense using the declining balance method. It would be:

Year 1

Book Value at the Beginning of Year 1: $10,000 (initial cost)

Depreciation Rate: 10%

Amortization Expense Per Period = Book Value at the Beginning of Period × Depreciation Rate

Amortization Expense for Year 1 = $10,000 × 10% = $1,000

Year 2

Book Value at the Beginning of Year 2: $10,000 - $1,000 = $9,000

Depreciation Rate: 10%

Amortization Expense Per Period = Book Value at the Beginning of Period × Depreciation Rate

Amortization Expense for Year 2 = $9,000 × 10% = $900

For each subsequent year, the book value at the beginning of the year would decrease by the amortization expense of the previous year.

Sample Calculation for Loan Repayment

Suppose a loan of $100,000 at an annual interest rate of 5% is payable monthly over 20 years (240 months). Let's calculate the monthly repayment amount.

- Principal = $100,000

- Annual Interest Rate = 5% (0.05 as a decimal)

- Monthly Interest Rate = Annual Interest Rate / 12 = 0.05 / 12

- Number of Periods (months) = 20 years x 12 months/year = 240

We'll plug these values into the formula to find the monthly repayment amount.

Repayment Amount = (Principal × Interest Rate)/ 1− (1+Interest Rate) ^-Number of Periods

Repayment Amount = ($100,000 x 0.05)/1 − (1+0.05) ^ -240

Repayment Amount = $659.96

Streamline Amortization with Our Tailored Financial Model Templates

In conclusion, our tailored financial model templates are designed to simplify and streamline the amortization process for your business. By integrating sophisticated, user-friendly tools, we ensure that entrepreneurs, startup founders, business owners, investors, and finance professionals can efficiently manage and understand their amortization schedules. Our templates are more than a solution; they are a pathway to making informed, strategic financial decisions. With our products, you are empowered to navigate the complexities of amortization with confidence and precision, enabling you to focus on the broader aspects of your business growth and financial health. Let us be your partner in financial success, providing the clarity and control you need in your financial planning and analysis.