Equipment Rental Cash Flow Model

Highly dynamic financial model that is specific to renting equipment out. High attention paid to the cash flows and timeliness of them so the user has optimal planning and insight capability. (3-statement model recently integrated)

Video Tutorial:

Latest Update on 10-Year Comprehensive Model: Added formal monthly and annual financial statements (Income Statement, Balance Sheet, Cash Flow Statement), a formal cap table, distribution summary, startup cost schedule, exit assumptions if applicable, and general formatting convention updates.

Added logic to account for the frequency that a given piece of equipment gets rented out and returned as well as tied a cost to each occurrence.

**Note, both the original and modified version have been upgraded to show a DCF analysis and executive summary. The modified version has additional inputs for investor funding, startup costs, and one-time future expenditures that may fall outside of regular operating expenses. Also, the modified version only goes out for a period of 5 years and it allows for utilization to be adjusted on a quarterly basis rather than an annual basis.

The financial forecast is for a 10 year period.

If you are looking to get into the equipment rental business, you will want to plan out what kind of equipment you want to buy, when you want to buy it, and how much you want to rent it out for. You may also want to factor in the equipment being used up and discontinued/salvaged (with a salvage value you want to account for).

You will also need to know how much financing the business can support, how much cash you may need to put into the business (how long the rental cash flows will take to pay you back), and how much debt to cash you have over time.

All of those factors have been taken into account and applied to this super intuitive model. You can even pick by year how many days on average each piece of equipment will project to be used per month.

The total equipment pieces supported is 100, but that can easily be changed to 1,000 or more with little effort.

Video Overview of Version 2:

VERSION 2: This is a completely different model with new revenue assumptions and more advanced logic. It also includes depreciation calculations that are automatically based on purchase schedule and defined useful life. It drives down to EBT and Net Income after Taxes as well. This model was recently upgraded to include a fully integrated monthly and annual 3-statement model (Income Statement, Balance Sheet, and Cash Flow Statement) and cap table.

Similar Products

Other customers were also interested in...

Crane Truck Rental Company Financial Model

Step into the world of crane rental business success with our Crane Truck Rental Company Financial M... Read more

Equipment Leasing Company Financial Model – Dyna...

Financial model presenting a business scenario of an Equipment Leasing Company, which offers Monthly... Read more

Startup Business Plan – Rental Heavy Machine...

If you dream to start a heavy machinery rental business, the template is the first step in making yo... Read more

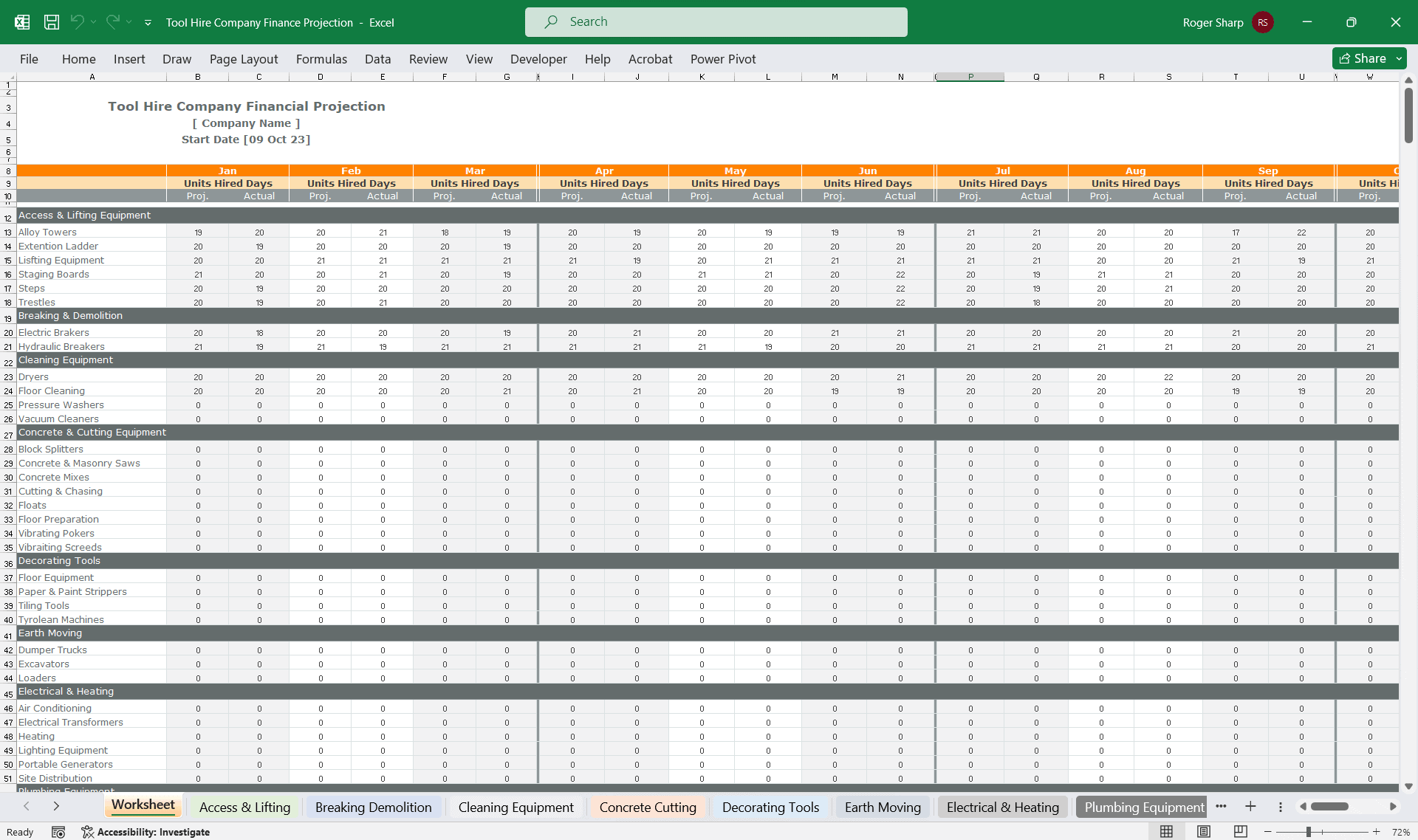

Tool Hire Company Finance Model

A very comprehensive editable Excel spreadsheet for tracking your tool hire financials throughout th... Read more

Bundle – Business Financial Forecasting Mode...

The purpose of this Bundle of Business Forecasting and Financial Models is to assist Business Owners... Read more

Equipment Rental Business Financial Model – ...

The equipment rental financial model is a comprehensive tool designed to assist business owners and ... Read more

Construction Contractor Business – Cash Flow...

This financial model lets the user plan out cash requirements and expected returns of running a cons... Read more

Top 16 Google Sheet Templates

This is a bundle of all the most useful and efficient google sheet templates I have built over the y... Read more

Construction Machinery Rental Company Financial Mo...

Discover the key to financial planning in the construction machinery rental sector with our sophisti... Read more

Industrial Building Development Financial Model (C...

Financial model presenting a development scenario for an Industrial Building including construction,... Read more

You must log in to submit a review.