Construction Contractor Business – Cash Flow Forecast

This financial model lets the user plan out cash requirements and expected returns of running a construction business. 10 Year monthly/annual and three statement model integrated.

Video Overview:

The model is really good at two things. Planning out the economics of a large-scale contractor business and getting the cash flows correctly. Dynamic assumptions make it easy to configure up to three general job types your construction business does and see the resulting unit economics and pro forma. You will be able to test various pricing strategies / costs and see what kind of profitability and feasibility exist.

For each job type, the user can define the following:

– Number of jobs started per month

– Average contract value

– Monthly timeline to define the percentage of the job that gets done per month on average (drives earned revenue and labor wages)

– Monthly timeline to define the percentage of the total contract value that is collected per month (resulting in receivables or unrecognized revenue line item on the balance sheet if different from job completion percentage

– Schedule for average material costs and expected equipment rental costs of the job

– Monthly timeline to define the percentage of material costs / equipment that are paid (likely based on % completion, but you can adjust independently)

– Worker configuration (up to 10 worker type slots defined by overtime vs regular hours module, average hours worked per a given job, and payroll taxes/benefits) These assumptions apply to a single job. Hence, as the jobs scale, so does the workforce. This could be sub-contracts, laborer employees, or a combination.

The Excel template also includes assumptions for capital asset purchases if you are going to buy equipment rather than rent, other one-time startup costs, fixed expenses defined by the total monthly cost in each of the 10 years and the start month, and an option to fund some of the initial costs through a traditional bank loan, owner and/or investor equity.

Output Reports:

– Monthly and Annual Financial Statements (Income Statement, Balance Sheet, Cash Flow Statement)

– DCF Analysis with IRR and NPV on a project level and per investor pool (owner vs. outside investors)

– Cap Table

– Monthly and Annual Pro Forma detail (shows how all the assumptions come together and drive cash flow per period)

– Lots of Visualizations

There is a sanity check on the total labor hours an average worker slot is working per day over each month, and that runs off the job completion / hour count above.

An exit month and option for the inclusion of an exit value were built in for a more accurate DCF Analysis, and it is driven by a trailing 12-month EBITDA multiple.

Included in the industry-specific variety bundle and the all-models bundle.

Similar Products

Other customers were also interested in...

Carpentry Business – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for a startup or operating Carpentry Bus... Read more

Plumbing Business Financial Model – 5 Year Forec...

Financial Model presenting an advanced 5-year financial plan for a startup or operating Plumbing Bus... Read more

Artisan Contractor Business – 5 Year Financial M...

Financial Model providing an advanced 5-year financial plan for an Artisan Contractor Business scena... Read more

Electrician Business Financial Model – 5 Year Fo...

Financial Model presenting an advanced 5-year financial plan for a startup or operating Electrician ... Read more

Construction/Engineering Project Business Financia...

3 statement 5 year rolling financial projection Excel model for a startup /existing business engaged... Read more

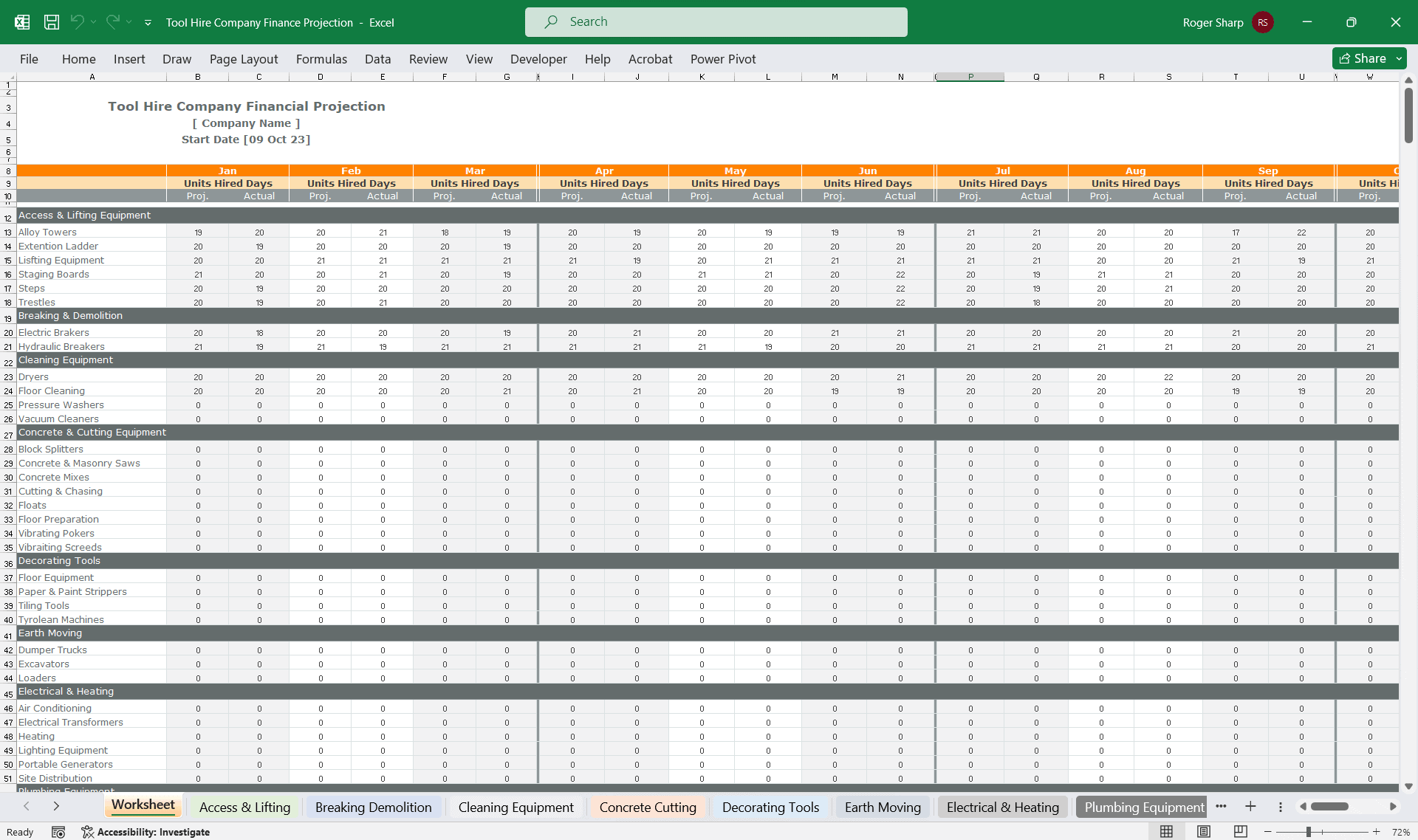

Tool Hire Company Finance Model

A very comprehensive editable Excel spreadsheet for tracking your tool hire financials throughout th... Read more

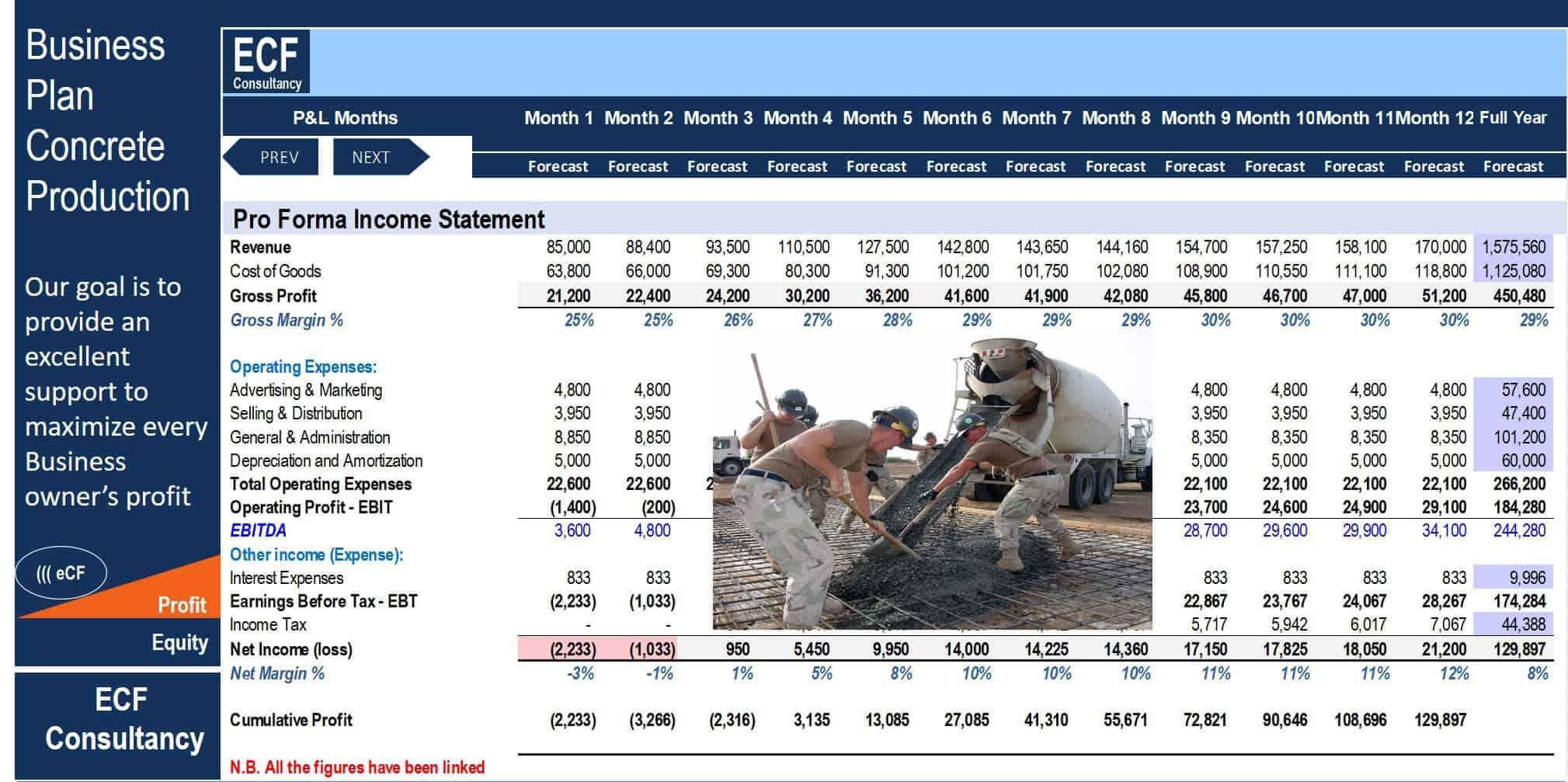

Startup Business Plan – Concrete Production ...

If you're dreaming of starting a Concrete Contractor business, try this Startup Business Plan - Conc... Read more

Financial Feasibility Study – Excavation Con...

The report is containing full set of financial feasibility study project for Excavation Contractor, ... Read more

Electrical Contractor Financial Model Excel Templa...

Electrical Contractor Financial Model Enhance your pitches and impress potential investors with the ... Read more

Equipment Rental Cash Flow Model

Highly dynamic financial model that is specific to renting equipment out. High attention paid to the... Read more

Reviews

Excellent tool for startups and even small construction contractors with fewer projects. There could be a learning curve even if someone is Excel savvy. Fantastic work.

134 of 267 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

You must log in to submit a review.