Accounting

Our accounting service templates are designed to integrate sophisticated accounting principles with user-friendly interfaces seamlessly. It means you get not just a generic accounting model but a tool finely tuned to the nuances of your sector. Dive into our range of accounting service templates and discover how they can transform your financial analysis and planning approach. Prepare for a future where better financial decisions lead to more tremendous success.

Architecture Firm Management Dashboard Excel Template (6 Month)

Our Excel dashboard and template streamline small and medium architecture…

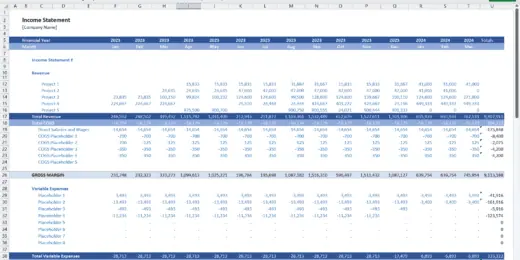

Startup Company Financial Model – Dynamic 3 Statement Financial Projections up to 8-Years

Highly Dynamic and Easy-to-Navigate Excel Financial Projections Model that allows…

Advanced Financial Model – Dynamic 3 Statement 10-Year Financial Model with DCF Valuation

Advanced, Dynamic and Easy-to-Use Excel Financial Projections Model that allows…

Sales and Revenue Dashboard Excel Template

Empowers your business with real-time revenue and profit insights to…

Online Store Sales Dashboard Excel Template

Equips businesses with actionable insights for optimizing sales strategies tailored…

CEO Dashboard KPI Excel Template

Our CEO Dashboard Excel Template provides a comprehensive overview of…

Accounts Receivable Dashboard Excel Template

Accounts Receivable Dashboard: Tracking Key Metrics and Payments Effectiveness.

Biomethane Producer Financial Model (Renewable Natural Gas)

Create a detailed pro forma with this biogas financial model.…

Bookkeeping Agency Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking Bookkeeping services…

Start Up Company Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking start-up company…

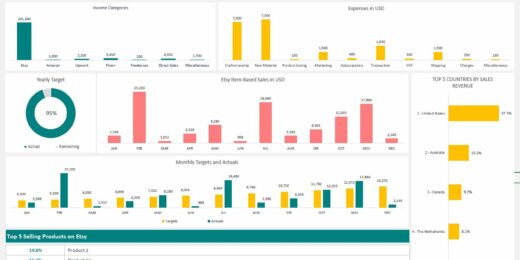

Etsy Seller Excel Template

Excel Bookkeeping Template for Etsy Shop Owners: Efficiently Monitor and…

CRM Software Development Company Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking CRM software…

3 Statement Van Hire Company Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking van hire…

Car Dealership Financial Model and Valuation – Financial Projections

Welcome to the Car Dealership Company Financial Model and Valuation,…

Hospitality (Hotel) Financial Model and Valuation – 10-year Projections

Welcome to the Hospitality (Hotel) Company Financial Model and Valuation,…

Expense Analysis Excel Dashboard

This spreadsheet is a comprehensive tool for monthly spend analysis,…

B2C eCommerce Financial Model & Valuation Model

Tailored ecommerce financial model Model for startups. Forecast revenue, integrate…

Logistics Company Finance Model

A comprehensive editable, MS Excel spreadsheet for tracking logistic company…

Income and Expenses Excel Dashboard

The Monthly Income and Expenses spreadsheet provides a comprehensive insight…

Subscription-Based B2C SaaS Financial Model Template

Optimize your Subscription-based B2C SaaS startup's financial planning with our…

Healthcare – Hospital – Financial Model and Valuation (10-year Forecast)

Welcome to the Healthcare (Hospital) Company Financial Model and Valuation,…

Construction Tender and Proposal Example and Model Answer

A successful, high-quality and detailed tender and proposal document that…

Coffee Shop Financial Plan and Budget Control

This Excel model is a highly adaptable and user-friendly tool…

Daycare Service Facility Financial Simulation – Up to 10 Year

Dynamic assumptions to create pro forma financial statements for a…

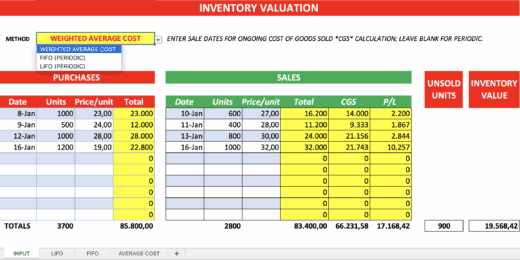

Inventory Valuation Calculator (LIFO, FIFO, AVERAGE COST)

Calculate the value of your inventory (physical items or financial…

CPG Company Financial Model and Valuation

Discover the CPG Company Financial Model and Valuation, an essential…

SaaS Company Financial Model and Valuation

Discover the SaaS Company Financial Model and Valuation, an essential…

Zero Down Seller Financing Strategy for Real Estate Investment

A tool to estimate expected risk and cash flow of…

Comprehensive Oil & Gas Financial Model

Comprehensive financial model for an oil & gas company. Flexible…

Multifamily Real Estate Financial Model

The Multifamily Real Estate Financial Model allows users to evaluate…

Start-up Manufacturing Financial Projection and Budget Control – Excel & Google Sheets

The financial model is an essential tool that enables owners…

Financial Modeling Mastery Bundle: Diverse Insights for Informed Decision-Making

Unlock financial expertise with our 'Diverse Insights Bundle.' Seven meticulously…

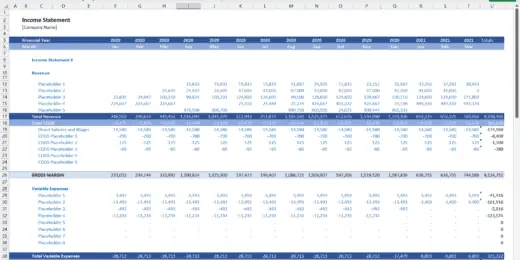

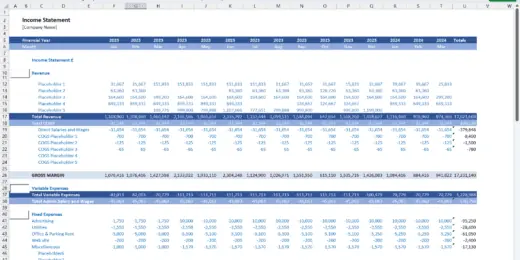

Full 3 Financial Statements Projections Model

Comprehensive three financial statements model (Income Statement, Balance Sheet, and…

Data-as-a-Service Financial Feasibility Study

This model is built for data-as-a-service startups. If you have…

Staffing Planner: Up to 900 Headcount Slots

Payroll can often be the largest expense of any business,…

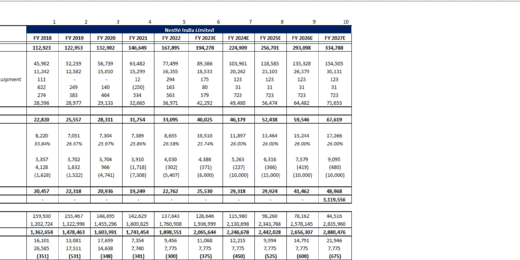

3 – Statement Financial Model – Compacted – For All Industry

Introducing the Ultimate Financial Modeling Tool for Thriving Businesses with…

IFRS 16 Lease Accounting For Lessors Excel Calculation Model

Excel calculation model to calculate accounting movements and balances for…

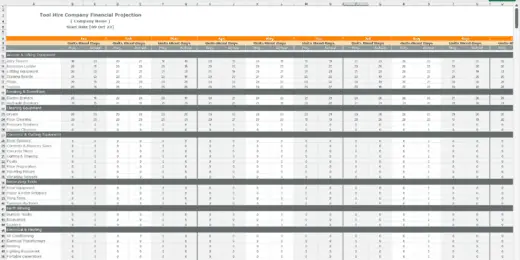

Tool Hire Company Finance Model

A very comprehensive editable Excel spreadsheet for tracking your tool…

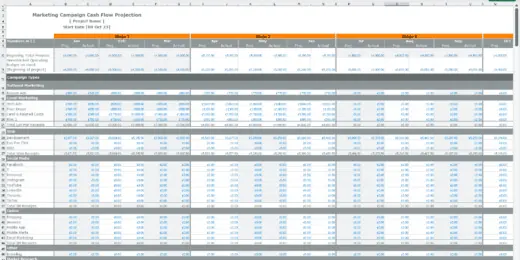

Marketing Campaign Financial Projection Model

Comprehensive editable, Excel spreadsheet for tracking marketing campaign financials in…

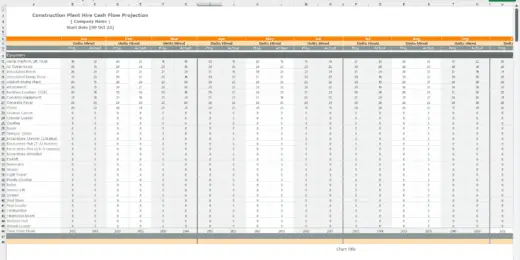

Plant Hire Business Financial Model

A comprehensive editable MS Excel spreadsheet for tracking your plant…

Educational Courses: Financial Feasibility and Capacity Model

Model up to 3 course types that have scaling logic…

Blue Ammonia using Natural Gas – 3 Statements, Cash Waterfall & NPV/IRR Analysis

An integrated and comprehensive Blue Ammonia Production Plant Model that…

Google [Alphabet, Inc.] Financial Model

Looking for a basic financial model with hardcoded numbers of…

Discounted Cash Flow (DCF) Financial Model

Discounted Cash Flow (DCF) Financial Model with 5-year projections and…

Side Hustle Success: 12-Month P&L Tracker for Passion Projects

Introducing the comprehensive 'Side Hustle Success' P&L Tracker, designed for…

Comprehensive Merger Financial Model

Our sophisticated merger financial model is a versatile and powerful…

How Accounting Helps in Business

A small business may need help keeping track of finances, and a large corporation may need to know how much money it is making or losing. That is why accounting services are a crucial component of any successful business. It helps track income and expenses, manage cash flow, and make informed decisions. By keeping track of her financials, an entrepreneur will better understand the business's overall financial health. Thanks to accounting service, a company can grow and succeed. Accounting is not just about numbers; it's about understanding your business and making intelligent decisions for its future.

What is the Definition of Accounting?

Accounting plays a vital role in a business's financial health and decision-making processes. It offers specialized expertise to ensure financial accuracy and compliance, which is crucial for companies to thrive and grow. Accounting is a comprehensive and systematic process of recording, classifying, and summarizing financial transactions. It is the practice of tracking a business's income, expenses, assets, and liabilities. It involves analyzing, verifying, and reporting the results to oversight agencies, regulators, and tax collection entities. The three main financial statements produced by accounting are crucial for informed decision-making by investors, managers, and other stakeholders. The balance sheets, income statements, and cash flow statements clearly show a company's financial health. This information aids in making informed decisions regarding investment, management, and operational strategies.

What is an Accounting Service?

An accounting service is a professional service provided by an accountant or an accounting firm. These services include bookkeeping, preparation of financial statements, tax planning and compliance, auditing, management consulting, and financial analysis. Such services are essential for businesses to ensure compliance with financial regulations, optimize tax strategies, and provide strategic financial planning and analysis.

Are Accounting and Bookkeeping the Same?

Accounting and bookkeeping are related but distinct disciplines. Bookkeeping is a subset of accounting and involves recording financial transactions, which is the foundational work for the accounting process. Conversely, accounting involves more analytical, strategic, and complex tasks such as interpreting, classifying, analyzing, reporting, and summarizing financial data.

Are Accounting and Finance the Same?

Accounting and finance are closely related fields, but they are not the same. Accounting focuses on the day-to-day management of financial records and reports. It's more about accurately recording past financial transactions. Finance, however, deals more with managing assets and liabilities and planning for future growth and stability. It encompasses areas like financial planning, investment decisions, and risk management. While accounting provides the necessary financial information, finance uses this information for decision-making and strategic planning.

Benefits of Accounting in Business

Accounting is essential to the stability and expansion of businesses; it's not simply about crunching numbers. Entrepreneurs' approaches to their financial strategy can be revolutionized by an understanding of the benefits accounting offers a business. Here's a thorough examination of the essential functions accounting performs:

Improved Financial Analysis and Management

- Understanding Cash Flow: A core benefit of accounting is its ability to track and analyze cash flow, ensuring that businesses have a clear understanding of their financial standing at any given time. This insight is crucial for managing day-to-day operations and for planning future investments or expansions.

- Budgeting and Forecasting: Accounting enables businesses to create accurate budgets and forecasts. By analyzing past financial data, companies can set realistic targets, allocate resources efficiently, and anticipate future financial needs or challenges.

Compliance and Legal Benefits

- Regulatory Adherence: A significant advantage of rigorous accounting practices is compliance with legal and regulatory requirements. Proper accounting ensures that businesses adhere to tax laws and financial reporting standards, minimizing legal risks.

- Audit Readiness: Regular and detailed accounting prepares businesses for audits by ensuring all financial records are accurate and in order. This readiness can significantly reduce the stress and potential financial implications of undergoing an audit.

Decision Making

- Data-Driven Strategies: Accounting provides the quantitative data necessary for making informed business decisions. Whether it's expanding into new markets, adjusting pricing strategies, or cutting costs, accounting data offers the insights needed to make strategic choices.

- Risk Management: By identifying financial trends and irregularities, accounting helps businesses anticipate and mitigate risks. This foresight can be crucial in avoiding costly mistakes or financial downturns.

Cost Management

- Identifying Cost Savings: Through meticulous record-keeping and financial analysis, accounting helps businesses identify areas where they can cut costs without sacrificing quality or performance. This process is vital for improving profit margins and financial efficiency.

- Expense Tracking: Effective accounting ensures that all expenses are tracked and categorized correctly, providing clear insights into where a business's money is going. This transparency is key to managing operational costs and optimizing spending.

Financial Health Monitoring

- Real-Time Financial Health Assessment: Accounting offers a real-time view of a business's financial health, allowing for prompt adjustments in strategy or operations as needed. This ongoing monitoring is essential for maintaining stability and pursuing growth.

- Long-Term Financial Planning: By providing a clear picture of a business's financial trajectory, accounting aids in long-term financial planning. Businesses can use this information to plan for investments, debt management, and savings, securing their financial future.

The benefits of accounting in business extend far beyond mere compliance and record-keeping. Accounting is a vital tool for financial management, strategic planning, and overall business growth. By leveraging these benefits, businesses can achieve greater efficiency, profitability, and sustainability.

Why Is Accounting a Service Industry?

The service industry is a sector of the economy that provides intangible products, such as experiences, expertise, or activities, rather than physical goods. Accounting is considered a service industry because it primarily involves providing expert services to individuals, businesses, and organizations rather than producing tangible goods. As a professional service business, accounting plays a crucial role in entities' financial health and compliance across various sectors. Furthermore, it is a professional service business that provides specialized, tailored, and intangible services essential for clients' financial management and compliance.

Here are some key characterize why is accounting a service industry:

- Professional Expertise: Accounting services are provided by professionals with specialized training and qualifications, such as Certified Public Accountants (CPAs). These professionals possess a deep understanding of financial laws, regulations, and standards, which they apply to offer informed advice and solutions.

- Intangible Output: Unlike industries that manufacture products, the output of accounting services is intangible. It includes financial reports, tax filings, and strategic advice. The value of these services is in the expertise and knowledge applied to produce them, a valid reason why is accounting a service industry.

- Customized Solutions: Service customization is a hallmark of the service industry, where solutions are not one-size-fits-all but are adapted to individual client requirements. Accounting services, for example, are tailored to clients' needs, from basic bookkeeping to complex financial analysis and consulting.

Accounting Services Offered

The right accounting services can empower businesses to not only manage their finances effectively but also to strategize for growth and stability. Here's a closer look at the key services offered in the realm of accounting:

Bookkeeping

- Accurate Financial Records: Bookkeeping is the foundation of all accounting services, involving the systematic recording of financial transactions. This service ensures that all financial data is accurate, up-to-date, and organized, enabling businesses to track their financial activities meticulously.

- Financial Reporting: Regular bookkeeping allows for the preparation of financial statements, including income statements, balance sheets, and cash flow statements. These reports are crucial for understanding the financial status of the business at any given time.

Tax Preparation and Planning

- Compliance Assurance: Tax preparation services ensure that businesses file their taxes accurately and on time, adhering to the latest tax laws and regulations. This service minimizes the risk of penalties or audits from tax authorities.

- Strategic Tax Planning: Beyond compliance, tax planning services help businesses strategize to minimize their tax liabilities. This involves advising on tax-efficient structures, deductions, credits, and investments, which can significantly reduce the overall tax burden.

Financial Analysis and Advisory

- Insightful Financial Analysis: This service involves a deep dive into the company's financial statements to identify trends, strengths, weaknesses, and opportunities. Financial analysis provides actionable insights that can inform strategic decision-making.

- Bespoke Advisory Services: Tailored financial advice can help businesses navigate complex financial landscapes, make informed investment decisions, and plan for future growth. This personalized approach ensures that strategies are aligned with the business's unique goals and challenges.

Auditing Services

- Independent Verification: Auditing services offer an objective examination of financial statements to ensure their accuracy and compliance with accounting standards. This process enhances the credibility of the financial information presented to stakeholders.

- Risk Assessment: Auditors also assess the effectiveness of a company's internal controls, identifying potential risks and areas for improvement. This evaluation can lead to enhanced operational efficiencies and reduced financial inaccuracies.

Custom Accounting Solutions

- Tailored to Your Business Needs: Recognizing that each business has unique needs, custom accounting solutions are designed to address specific challenges and objectives. Whether it's integrating new accounting software, setting up internal accounting processes, or providing specialized financial analysis, these services offer flexibility and expertise tailored to the business's requirements.

- Scalability and Support: Custom solutions can grow with your business, providing the right level of support as your financial and operational complexities evolve. This scalability ensures that your accounting systems and processes remain robust and efficient, regardless of the size or stage of your business.

A comprehensive suite of accounting services offers businesses the tools they need to manage their finances effectively, comply with regulatory requirements, make informed decisions, and plan strategically for the future. By leveraging these services, businesses can achieve greater financial clarity, efficiency, and success.

What Are the Different Types of Accounting?

Accounting is an essential field for any business. It encompasses various types that cater to different needs and objectives. The main types of accounting are financial and managerial accounting, each of which includes several subcategories.

Financial Accounting

Financial accounting is the process of recording, summarizing, and reporting transactions resulting from business operations over time to produce accurate financial statements reflecting a company's financial position and performance. It gives external stakeholders a clear view of a company's financial status. Its most common subcategories are:

- Accrual Accounting: This method records revenues and expenses when they are incurred, regardless of when cash transactions occur. It provides a more accurate picture of a company's financial position by recognizing economic events regardless of when cash transactions happen.

- Cash Accounting: Unlike the accrual method, this approach records revenue when cash is received and expenses when paid. This method is more straightforward and often used by smaller businesses because it clearly shows how much money they have at any given time.

- Auditing: Auditing involves the examination of financial statements and records by an independent third party. Its accounting service aims to ensure that the financial statements are free from material misstatement and presented fairly in conformity with generally accepted accounting principles (GAAP).

Managerial Accounting

Managerial accounting analyzes, interprets, and presents financial and non-financial information to internal management. It offers internal stakeholders the data necessary for making informed business decisions. Its most common subcategories are:

- Cost Accounting: This type focuses on calculating and assessing operational costs involved in producing goods or services. It is a vital tool for internal management, as it allows for budgeting, setting up cost control, and pricing strategies.

- Tax Accounting: Tax accounting prepares, analyzes, and presents tax payments and returns. It requires a thorough understanding of tax laws and regulations and involves strategies for minimizing tax liabilities.

- Valuation Accounting: This type of accounting concerns estimating the value of a business, its assets, or its liabilities. It's crucial in business acquisitions, sales, mergers, or capital raising. Valuation requires a deep understanding of financial statements, market trends, and various valuation techniques.

What is the Basics of Accounting?

Accounting, often called the "language of business," is a vital field that forms the backbone of financial transparency and decision-making in the business world. The accounting basics encompass a range of principles and practices, including the fundamental accounting cycle, generally accepted accounting principles, and effective accounting practices.

The Accounting Cycle

The accounting cycle is a series of steps an accounting team follows to keep track of financial transactions and prepare financial statements. The accounting cycle usually encompasses the following stages:

- Identification of Transactions: Recognizing financial transactions that need to be recorded.

- Recording Transactions in a Journal: Documenting these transactions chronologically in a journal.

- Posting to the General Ledger: Transferring the journal entries to the general ledger accounts.

- Trial Balance Preparation: Creating a trial balance to balance debits and credits.

- Adjusting Entries: Making adjustments for accrued and deferred items.

- Adjusted Trial Balance: Preparing a new trial balance after adjusting entries.

- Financial Statements Preparation: Creating statements like the balance sheet, income statement, and cash flow statement.

- Closing Entries: Clearing out temporary accounts and transferring their balances to permanent accounts.

- Post-Closing Trial Balance: Ensuring all temporary accounts are closed and the ledger is ready for the next accounting period.

The accounting cycle is repeated each accounting period, whether monthly, quarterly, or annually, ensuring that a company's financial records are accurate and up-to-date.

Generally Accepted Accounting Principles (GAAP)

Generally Accepted Accounting Principles (GAAP) refers to a set of rules and standards for financial reporting that are widely accepted in the U.S. These principles are designed to ensure consistency, clarity, and comparability of financial statements. The key Generally Accepted Accounting Principles (GAAP) include:

- Principle of Regularity: Adherence to GAAP rules and regulations as a standard.

- Principle of Consistency: Applying the same accounting methods across periods.

- Principle of Sincerity: Reflecting an accurate and fair view of the organization's financial condition.

- Principle of Permanence of Methods: Consistent application of accounting techniques across periods.

- Principle of Non-Compensation: Full disclosure of positive and negative values without expectation of debt compensation.

- Principle of Prudence: Reporting fact-based financial data, not speculation.

- Principle of Continuity: Assuming the business will continue to operate.

- Principle of Periodicity: Reporting financial data in regular, consistent intervals.

- Principle of Materiality / Good Faith: Ensuring all relevant financial information is reported.

Compliance with the Generally Accepted Accounting Principles (GAAP) is essential for credibility and trust in financial reporting, particularly for public companies and entities seeking investment.

Effective Accounting Practices

Effective accounting practices are vital for accurate financial reporting and decision-making. These include:

- Budgeting and Forecasting: Preparing detailed budgets and forecasts to guide business planning and strategy.

- Compliance and Ethical Standards: Ensuring compliance with legal standards and maintaining high ethical values.

- Continual Learning and Adaptation: Keeping abreast of accounting standards, technology, and business practices changes.

- Effective Use of Technology: Utilizing accounting software and tools for efficiency and accuracy.

- Internal Controls: Implementing robust internal controls to prevent errors and fraud.

- Maintaining Accurate Records: Diligently recording all financial transactions.

- Regular Financial Analysis: Periodically reviewing financial statements to assess health and performance.

Understanding and implementing these accounting fundamentals is critical for businesses, especially those in the early stages or those looking to scale. They help maintain financial health, make informed strategic decisions, and ensure regulatory compliance. Mastering these principles and practices is a cornerstone of effective financial management and decision-making for entrepreneurs, startup founders, and finance professionals.

How Accounting System Helps the Business

An accounting system is essential for businesses, providing critical support in several key areas. Let's explore how an accounting system aids in these aspects:

- Budgeting: Accounting systems enable businesses to forecast future revenues and expenses, creating an adequate budget. By tracking income and expenditures, an accounting system helps maintain a healthy cash flow, ensuring that a business has sufficient funds for its operations and investments. Identifying areas of high expenditure and analyzing cost patterns can lead to more effective cost management and control.

- Decision-Making: Accounting systems provide real-time financial data, offering insights into the company's financial health. This information is crucial for making informed business decisions. By analyzing financial trends and ratios, businesses can identify potential risks and make decisions to mitigate them.

- Financial Performance: Accounting systems track revenue streams and profitability, providing a clear picture of financial performance. Comparing actual financial results with budgeted figures helps evaluate business performance and make strategic decisions.

- Fundraising: Accurate and detailed financial reports are crucial for fundraising. An accounting system ensures the reliability of these reports. Transparency in financial reporting builds investor trust, a critical factor in successful fundraising efforts.

- Legal Compliance: Regulatory reporting in the accounting system ensures compliance with financial reporting standards and tax regulations, reducing legal risks. Maintaining a record of all financial transactions is essential for audits and legal scrutiny—furthermore, accurate record-keeping aids in efficient tax planning and compliance.

- Strategic Planning: The accounting system helps align financial goals with the business's objectives. Financial data can be analyzed to identify market trends and competitive landscapes, informing strategic decisions. It guides decision-making on where to allocate resources for optimal growth and profitability.

Use Accounting and Financial Modeling to Your Advantage

In conclusion, the intersection of accounting and sophisticated financial modeling marks a pivotal advancement in how businesses approach their financial strategy and operational management. Accounting, with its rigorous attention to detail in tracking income, expenditures, and ensuring compliance with legal standards, forms the backbone of a company's financial health. It not only provides a transparent and accurate view of financial standings but also equips investors, management, and stakeholders with the crucial data needed for informed decision-making.

The integration of advanced financial models, similar to those developed by platforms like eFinancialModels.com, further amplifies the benefits of traditional accounting. These models bring a new level of efficiency, precision, and foresight to financial planning and analysis. With capabilities for detailed forecasting, scenario analysis, and strategic planning, they empower businesses to navigate future financial landscapes, evaluate project viability, and carve out informed strategies with greater confidence.

By combining the foundational strengths of accounting with the forward-looking insights provided by advanced financial modeling, businesses are positioned to gain a holistic understanding of their financial ecosystem. This synergy not only enhances decision-making processes but also lays down a robust framework for sustainable growth and success. In essence, the melding of accounting principles with state-of-the-art financial modeling tools represents a strategic imperative for businesses aiming to thrive in today's dynamic economic environment.