Investment

Here's a selection of financial model templates under the real estate industry, designed specifically for Investment purposes.

Beginner Commercial Property Modelling Tool

"Beginners Commercial Property Modelling Tool," a resource for developers embarking…

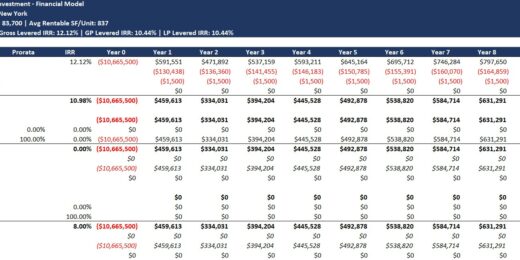

Real Estate Industrial Acquisition Model Single Tenant

This Excel-based tool is tailored for the nuanced analysis of…

Real Estate Joint Venture Financial Model

The Real Estate JV Model analyses an equity joint venture…

Real Estate – Multi Family Acquisition Pro-forma

This Excel template is an intuitive and comprehensive solution tailored…

Real Estate Proforma – Value-Add Apartment Acquisition Model

This multifamily apartment value-added real estate model is a sophisticated…

Rental Property (Airbnb – Real Estate) Financial Model

Powerful Real Estate Rental Property Financial Model for Informed Decision-Making,…

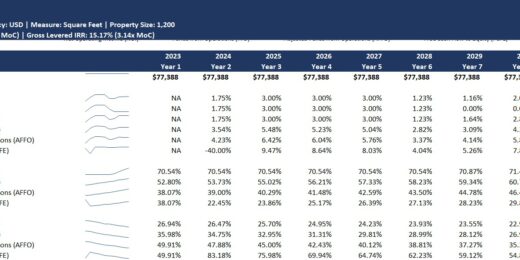

Multifamily Real Estate Financial Model

The Multifamily Real Estate Financial Model allows users to evaluate…

Rental Portfolio Financial Model

Introducing our Rental Portfolio Model – a comprehensive and user-friendly…

Senior Living Development – 10 Year Financial Model

Financial model presenting a development scenario for a Senior Living…

Student Accommodation / Village Development Model – 20 years

This Student Accommodation 20-year Development Model (hold and lease) will…

Real Estate – Fix and Flip Pro-forma

This meticulously crafted Financial Model for Analyzing Fix and Flip…

Self-Storage Park Development Model

This Self-Storage Park development model will produce 20 years of…

iBuyer Real Estate Porfolio Financial Model

Overview: The iBuyer model is transforming real estate transactions. As…

Financial Model for a Smart City Project

This is a financial model to identify various components of…

Rental Property Financial Model

The Rental Property financial model template, forecasts a rental property's…

Recreation & Community Center – Dynamic 10 Year Financial Model

Financial Model presenting a development and operating scenario of a…

House Flipping – Rehab Financial Model

The house flipping financial model is a comprehensive tool designed…

Yacht Marina Acquisition Financial Model

Financial model presenting an acquisition scenario of a Yacht Marina.

Real Estate PE Multiple Hurdles Waterfall Analysis Model

We proudly present our cutting-edge Real Estate Waterfall Analysis Model…

Public-Private Partnership (PPP) Financial Model

Financial Model presenting development and operating scenarios of various projects…

PADEL Court and Club Dynamic Financial Model 10 years

Introducing the Padel Court and Club Financial Forecasting Model, a…

Real Estate Acquisition Financial Model (Commercial, Industrial, Residential)

Simple Real Estate Acquisition Financial Model suitable for Commercial, Industrial…

Real Estate – Multiphase Land Development

Raw land development projects: The model is specifically designed for…

PICKLEBALL Court and Club Development – Dynamic Financial Model (10 years)

Introducing our Pickleball and Club Financial Forecasting Model – your…

Quick Coherent HOTEL / GUESTHOUSE Valuation and Financial Model 20 years

This quick and coherent Valuation and Financial model (20 years)…

Real Estate Development Financial Model

A professional model for real estate construction (build – hold…

Real Estate Acquisition Financial Model

A professional model for real estate acquisition (buy – hold…

Discounted Big Bundle Real Estate Valuation and Financial Models

One Excel file for this bundle of Valuation and Financial…

Shopping Center Valuation and Financial Model 20 years – Acquisition

This Shopping Center Valuation and Three Statement (20 years) Model…

Self Storage Park – Valuation and Financial Model 20 years (Acquisitions)

The Self Storage Park Financial Model is a dynamic three-statement…

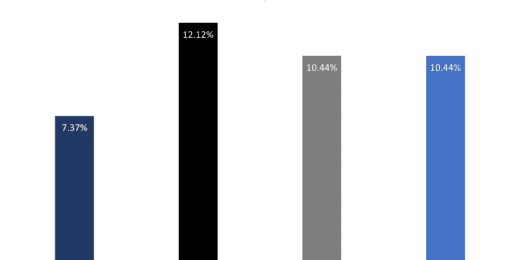

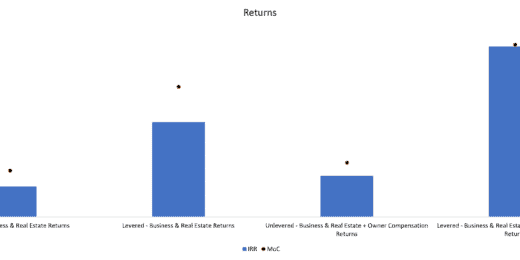

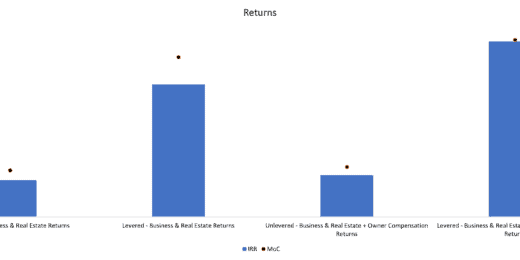

Multi (20) AIRBNB Acquisition and/or Portfolio Model

This AIRBNB 20 model will assist you in evaluating up…

Real Estate Acquisition-Rent-Sell Comprehensive Analysis Model

An integrated, dynamic and ready-to-use Real Estate Acquisition-Rent-Sell Comprehensive Analysis…

Core Single-Family (SFR) Build to Rent (B2R) Real Estate Investment Model with Waterfall

Pro Forma Models created this financial model to calculate and…

Short-term Rental (Airbnb) Financial Model

A professional model for residential property acquisition, renovation and short-term…

Multi Sports Complex Financial Model – Dynamic 10 Year Forecast

Financial Model presenting a development and operating scenario of an…

Commercial Real Estate Multi Valuations Compare Model with NPV, IRR and MIRR

This Commercial Real Estate (Multi) Valuation Model will help your…

Student Hostel Development – Dynamic 10 Year Financial Model

Financial model presenting a development scenario for a Student Hostel…

Principal Residence Real Estate Investment Model

This Pro Forma Model is designed to analyze Principal Residence…

Real Estate Brokerage Business Plan with Return Calculation

Pro Forma Models created this model to analyze the financial return…

Property Manager Plan with Return Calculations & M&A Model

Pro Forma Models created this model to analyze the financial return…

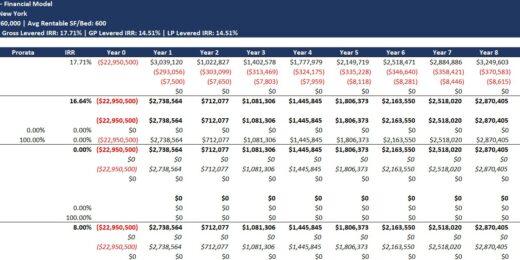

Student Housing Real Estate Investment Model with Returns & Waterfall

Pro Forma Models created this financial model to calculate and…

Single Tenant Net Lease (NNN) – Investment & Valuation Model

Financial model presenting an investment scenario for a Single Tenant…

Triple Net Lease (NNN) Real Estate Investment with Returns & Waterfall

This Pro Forma Model is used to analyze the financial…

Storage Facility Development Model

The Storage Facility Development model projects annual future cash flows…

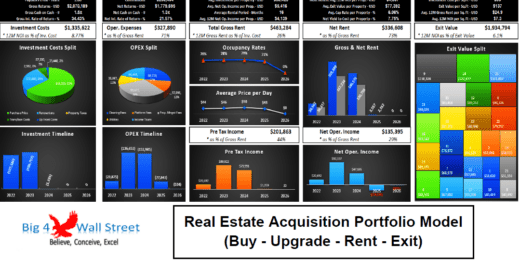

Real Estate Acquisition Portfolio Model (Buy – Upgrade – Rent – Exit)

Real Estate Acquisition Portfolio Model consists of a financial model…

Hostel Real Estate Investment Model with Waterfall

Pro Forma Models created this financial model to calculate and…

Value-Add Multi-Family (Apartment) Investment Model with Waterfall

Pro Forma Models created this financial model to calculate and…

Investment Fund Preferred Return Tracker: Up to 30 Members

Track preferred returns for investors in a fund with this…

Hotel Real Estate Investment Model Template

Pro Forma Models created this financial model to calculate and…

Core Multi-Family (Apartment) Real Estate Investment Model with Waterfall

Pro Forma Models created this financial model to calculate and…

Residential “Build & Sell” Financial Model

A professional model for residential property construction (build & sell)

Condominium Development – Dynamic 10 Year Financial Model

Financial model presenting a development scenario for a Condominium Units…

Real Estate – Self Storage Acquisition Model

This template is an Institutional-Quality excel-based analysis tool for a…

Real Estate – Industrial Acquisition Model

An Excel-based analysis tool for the acquisition, operation, and ultimate…

Real Estate – Simple Acquisition Model for Office, Retail Properties

This is a fully functional, institutional quality, and dynamic real…

Is Real Estate a Good Investment? Here's What You Need to Know

If you're reading this, you're likely intrigued by the world of real estate investment. According to Statista, the global real estate market is valued at $613.6 trillion as of April 2023. And guess what? It is expected to soar to over $729.4 trillion by 2028.

That's not just a number; it's a testament to the incredible opportunities to get rich in real estate investing. We're talking about high returns, a steady income, tax breaks, and the ability to leverage your investment. Doesn't it sound interesting?

Let's add a dash of motivation right now. According to a study by Thomas J. Stanley, author of the book "The Millionaire Next Door," 80% of U.S. millionaires are first-generation rich, and 90% made their fortune through real estate. Thus, be encouraged if you're beginning from zero or even with a limited budget. Real estate investing isn't just for the wealthy; it's a pathway to becoming wealthy.

As we step into 2023, the real estate landscape is anything but static. From the rise of the rental market to tech-driven innovations and the allure of alternative investments, the industry is buzzing with activity and opportunities.

In this comprehensive guide, we'll explore everything from getting started in real estate and choosing the right market to investment methods, financial models, and even tips on managing properties and networking.

Our aim is to equip you— whether you're an aspiring business owner, a future investor, or anyone in between — with the knowledge and tools you need for successful real estate investing. And for those of you who are keen on financial modeling, we at eFinancialModels have got you covered with industry-specific templates and services that can help you make smarter financial decisions.

So, are you ready to start this fun adventure in an arena where you can genuinely get rich? Let's get started.

Direct vs. Indirect Investing

Real estate investing is a popular way to build wealth, but many different ways exist. Two main categories of real estate investing are direct and indirect investing.

Direct real estate investments involve directly buying, owning, and managing real estate properties. This can be done through residential real estate, commercial real estate, raw land, and house flipping. On the other hand, Indirect real estate investments involve investing in real estate through other means, such as real estate investment trusts (REITs), real estate crowdfunding, and real estate investment groups (REIGs).

In this article, we will focus on direct real estate investing. We will discuss the different types of properties to invest in. Each type of property has its own unique set of risks and rewards.

Single-family homes

Single-family homes are typically the most common type of real estate investment. They are generally considered to be lower-risk investments than other types of properties, such as commercial properties or multi-family homes.

This is because single-family homes are in high demand from both renters and buyers and tend to hold their value well over time. However, single-family homes can also be more time-consuming to manage and may require more maintenance.

Multi-family homes

Multi-family homes, such as duplexes, triplexes, and fourplexes, can generate more income than single-family homes, but they also come with more risk. Multi-family homes can be more challenging to manage and may require more maintenance.

Additionally, there is a greater risk of vacancies in multi-family homes. However, multi-family homes can be a good investment for those looking to generate a higher income and willing to take on more risk.

Commercial properties

Commercial properties, such as office buildings, retail centers, and industrial properties, can generate even more income than multi-family homes, but they also come with even more risk. Commercial properties are typically more expensive to purchase and maintain than residential properties.

Additionally, commercial properties are more sensitive to economic downturns. However, commercial properties can be a good investment for investors looking to generate a high income and willing to take on more risk.

Investment Horizon

The investment horizon is how long an investor intends to keep an investment. It is important to consider your investment horizon when choosing a property type to invest in.

Long-term holding is typically defined as holding a property for five years or more. Long-term holding is a good strategy for investors looking to build wealth over time and willing to ride out short-term market fluctuations.

Short-term holding is typically defined as holding a property for less than five years. Short-term holding can be a good investment strategy for investors looking to generate quick profits or flip properties.

In this article, we are primarily focusing on long-term holding. Long-term holding is the best way to build wealth through real estate investing.

Why real estate is a good investment?

Real estate is a robust investment avenue that offers multiple benefits: stability, income generation, and inflation protection. As a tangible asset, it provides a resilient investment choice, particularly in volatile economic conditions.

Main Challenges in Real Estate Investing

Investing in real estate can be a good way to make money, but it's important to know the main challenges.

Picking a property

One of the biggest challenges in real estate investing is picking the right property. Investors need to consider a number of factors, such as:

- Location: One of the most important factors is the property's location. Investors should look for properties in desirable locations with strong job growth and low crime rates.

- Condition: It is also important to consider the condition of the property. Investors should look for properties that are in good condition or need only minor repairs.

- Potential for appreciation: Investors should look for properties with the potential for appreciation over time. This is important because it will help increase the value of their investment.

In addition to these factors, investors should consider their investment goals and risk tolerance. For example, investors looking for a short-term investment may want to focus on flipping houses. Investors looking for a long-term investment may want to focus on buying and holding rental properties.

Negotiating price

Once an investor has found a property, they must negotiate the price with the seller. This can be challenging, as both parties are trying to get the best deal possible. Investors should do their research to determine the fair market value of the property and should be prepared to walk away from the deal if they cannot agree on a price.

Obtaining bank financing

Most investors need to obtain bank financing to purchase a property. This can be a challenge, as banks have strict lending requirements. Investors should have a good credit score and a down payment in order to qualify for a mortgage.

Managing improvements, leasing of space

Once an investor has purchased a property, they may need to make improvements to the property before leasing it to tenants. This can be a time-consuming and challenging process. Investors need to obtain the necessary permits and hire qualified contractors to make the improvements.

Once the improvements have been made, investors must find tenants to lease the property. This can also be a challenge, as investors need to find creditworthy tenants who will take care of the property.

Exit

Investors eventually need to exit their investment by selling or refinancing the property. This can be a challenge, as the market conditions may need to be more favorable at the time. Investors should carefully consider the market conditions before exiting their investment.

Real Estate Rewards: Get Rewarded for Buying or Selling Your Home

Real estate is a popular investment choice for many reasons. It is a tangible asset that is in high demand, generating stable cash flows, protection against inflation, and potential rewards for investors.

Stable Cash Flows

When you invest in real estate, you can generate income from rent payments. Most rent payments are made once a month, which gives investors a rewarding stream of income. This can be especially beneficial for investors looking to generate passive income or close to retirement.

The amount of rental income you generate will depend on several factors, including the type of property you own, its location, and the current rental market. However, if you choose your investment properties wisely, you can expect to generate a rewarding return on your investment.

Inflation Protection

Real estate is a tangible asset, which means that its value is not as closely tied to the stock market or other investments. As a result, real estate can be a good way to protect your wealth from inflation.

Over time, the value of real estate tends to increase. This is because real estate is a limited resource, and demand always increases. As inflation rises, so will the value of your real estate investment. This can help keep your overall wealth from going down because of inflation.

Safer Than Other Alternatives (Stocks, Bonds):

The stock market can be volatile, and bond prices can fluctuate. Real estate, on the other hand, is generally considered to be a safer investment. This is because real estate is a physical asset that has intrinsic value.

Additionally, real estate is typically less liquid than other investments, making it less likely to be affected by market swings. This is because real estate takes time to sell, and it is not as easy to convert into cash as stocks or bonds.

However, this lack of liquidity can also be seen as a disadvantage. If you need to access your cash quickly, selling your real estate investment may be challenging.

How to Choose the Best Properties to Invest in for the Long Term

The property selection process is pivotal, dictating not only your initial investment but also the long-term viability and profitability of your investment strategy. The best type of property to invest in for the long term depends on a number of factors, including your investment goals, risk tolerance, and budget. However, some general tips include:

- Choose a property type that you are familiar with. This will help you to understand the market better and make informed decisions.

- Consider the long-term potential of the area where the property is located. Look for growing and developing areas with good infrastructure and amenities.

- Choose a property type that is in high demand. This will make it easier to find tenants and sell the property in the future.

- Consider your investment goals. If you are looking for a high return on investment, you may want to consider investing in a commercial property. If you are looking for a more stable investment, you may want to consider investing in a residential property.

Property Type

Residential: Residential properties are typically the most affordable type of property to invest in. However, residential properties can be more time-consuming to manage than other types of properties.

Logistics: Logistics properties are in high demand due to the growth of e-commerce. They can be a good investment for investors looking for a long-term investment with the potential for high returns. However, logistics properties can be expensive to purchase and maintain.

Commercial: Commercial properties include office buildings, retail centers, and industrial properties. They can be a good investment for investors looking for a steady stream of income and the potential for capital appreciation. Purchasing and maintaining commercial properties can be more expensive than residential properties.

Land: Land can be a good investment for investors looking for a long-term investment with the potential for high returns. However, land can be expensive to purchase and may only generate income after a period of time.

When selecting a property type to invest in, choosing a type you are familiar with is important. This will help you better understand the market, risks, and potential returns. If you are unfamiliar with a particular property type, it is important to research and talk to experienced investors before making an investment.

Market Analysis

Market analysis is an important part of any real estate investment. Understanding current market conditions and trends allows investors to make more informed decisions regarding when and where to purchase and sell properties.

- Talk with brokers: Real estate brokers are a valuable resource for market analysis. They understand the local market deeply and can provide insights on trends, pricing, and demand.

- Compare prices of similar properties: Comparing a property to recently sold comparable properties is one way to estimate its market value. This information can be found online on real estate websites or through a real estate agent.

- Understand future demand and supply – how will the market change in the future? Another important factor to consider is the future demand and supply of real estate in the area where you are considering investing. A number of factors, such as population growth, job growth, and economic development, can influence this.

Property Analysis

Property analysis is the process of evaluating a property to determine its value and investment potential. It involves a number of factors, including the property's condition, location, and market trends.

- Technical analysis: Technical analysis is the inspection of the physical condition of the property. This is typically done by a qualified home inspector, who will assess the condition of the foundation, roof, electrical system, plumbing system, and other components of the property.

- CAPEX requirements: CAPEX, or capital expenditures, are the costs associated with maintaining and improving a property. CAPEX requirements can vary depending on the type of property and its condition. For example, a commercial property may require more CAPEX than a residential property.

- Legal: Legal analysis is the process of reviewing the property's legal title and documentation. This includes checking for liens, mortgages, and other encumbrances on the property. Ensuring that the property is zoned for the intended use is also important.

Asking Price and Seller Financing

The asking price is the amount the seller is willing to accept for a property. It is important to note that the asking price is just a starting point for negotiations. Buyers may be able to negotiate a lower price, especially if the property has been on the market for a long time or if there are other factors that make the property less desirable.

When a seller agrees to finance the buyer's property purchase, this is known as seller financing. This can be a good option for buyers who do not have the full purchase price of the property upfront or who have difficulty qualifying for a traditional mortgage. However, it is important to understand the risks involved in seller financing, such as the possibility of the seller defaulting on the loan.

Seller Circumstances

Understanding the seller's circumstances can give you insights into their selling motivations and negotiating position. For example, if the seller wants to sell quickly, they might be more willing to negotiate on price.

When negotiating the asking price and seller financing, it is important to be prepared and clearly understand your budget and goals. Here are some tips:

- Do your research. Compare the asking price to the prices of similar properties in the area. This will give you a good idea of the property's market value.

- Be prepared to walk away. If the seller won't negotiate price or financing, you should be ready to back out of the deal. This will show the seller that you are serious about your offer.

- Be flexible. Be willing to compromise on some things in order to get a deal. For example, you may be willing to agree to a higher purchase price if the seller is willing to provide seller financing.

To understand the seller's circumstances, you can ask them questions about their selling reasons and timeline. You can also learn more about the seller's financial situation. This information can help you better understand the seller's negotiating position and develop a negotiation strategy.

Negotiating the asking price and seller financing can be a complex process. However, following the tips above can increase your chances of getting a good deal.

What will the business plan be for this property?

To develop a business plan for a real estate investment property, you need to answer the following questions:

1) What are you going to do with this property?

Do you want to rent out the property, sell it for a profit, or use it for personal use? Once you know what you want to do with the property, you can develop a business plan to help you achieve your goals.

2) How do you find good tenants?

If you plan to rent out the property, you must develop a plan for finding good tenants. This may involve advertising the property, screening tenants, and signing a lease agreement. You may also want to consider hiring a property manager to help you with this process.

3) Maintenance – how much capex is required to keep the property in good shape?

All properties require some level of maintenance. When developing your business plan, you need to estimate the amount of CAPEX required to keep the property in good condition. This may include things like repairs, replacements, and upgrades.

4) When will you exit from this property (investment horizon)? Who could be interested in buying this property?

It is important to have a plan for when you want to exit your investment. This may be after a few years after the property has been appreciated or after you have paid off the mortgage. Once you know your investment horizon, you can start to target potential buyers.

5) What is the plan?

Now that you have answered the preceding questions, you can begin developing a business plan for your investment property in real estate. Your business plan should include the following:

- Executive summary: This is a brief summary of your business plan, which includes your investment objectives, strategy, and financial forecasts.

- Company description: This section describes your company's target market, products or services, and competitive advantage.

- Marketing plan: This section explains how you intend to market your property to prospective tenants or buyers.

- Operations plan: This section describes how you will maintain and repair the property.

- Financial plan: This section includes your financial projections for the property, such as income, expenses, and cash flow.

For an in-depth financial analysis, consider leveraging eFinancialModels' Real Estate Investment Financial Model. This tool offers a comprehensive framework for financial planning, empowering you to make savvy investment decisions for long-term success.

By diligently following these steps, you'll be well-positioned to make an optimized property selection, thereby maximizing your investment returns over the long term.

Factors Affecting Property Value: Everything You Need to Know

The following are some of the key factors that affect property value in real estate investment:

Location: Location is one of the most important factors influencing a property's value. Properties in desirable locations, such as major cities or near amenities, tend to be more valuable than properties in less desirable locations.

Market demand: The demand for leasing or buying properties in a particular area also affects their value. If there is a high demand for properties in an area, the value of properties in that area will be higher.

Property condition: The condition of a property also affects its value. Properties that are in good condition and well-maintained are worth more than properties that are in poor condition or need repairs.

Property type: Certain properties, such as single-family homes and apartments, are more valuable than others, such as vacant land or commercial properties.

Economic conditions: The overall state of the economy also affects property values. When the economy is doing well, property values tend to rise. When the economy is doing poorly, property values tend to fall.

In addition to the above factors, there are a number of other factors that can affect property value, such as the following:

- Zoning: The zoning of a property can affect its value. Properties zoned for commercial use are typically worth more than properties zoned for residential use.

- Taxes: The property taxes on a property can also affect its value. Properties with high property taxes are typically worth less than properties with low property taxes.

- Crime rates: The crime rates in an area can also affect property value. Properties in areas with high crime rates are typically worth less than properties in areas with low crime rates.

When investing in real estate, it is important to consider all of the factors that can affect property value.

Exit Strategies for Real Estate Investors

There are a number of ways to exit a real estate investment. Some of the most common options include:

- Selling the property: This is the most common way to exit a real estate. You can sell the property to another investor, a homeowner, or a developer.

- Refinancing and keeping the property: If you have equity, you can refinance the mortgage and take out some of the cash. This can be a good option if you want to keep the property but need some cash for other investments or expenses.

- Not exiting (buy and hold): This option is for investors who want to hold onto the property for the long term. This can be a good option if you believe that the property will appreciate in value over time.

The best way to exit a real estate investment depends on your individual circumstances and investment goals.

Who could buy this property? And why?

The type of buyer interested in your property will be determined by a number of factors, including the type of property, location, and condition. Some potential buyers include:

- Investors: Investors may be interested in purchasing your property as a rental property or flipping and selling for a profit.

- Homeowners: Homeowners may be interested in purchasing your property as their primary residence or as a vacation home.

- Developers: Developers may be interested in purchasing your property to build new homes or commercial properties.

When can this property earliest be sold again?

The earliest you can sell your property again depends on several factors, including the type of property, market conditions, and financial situation. For example, if you are selling a recently inherited property, you may need to wait a certain amount of time before you can sell it without paying capital gains taxes.

It is important to speak with a real estate agent or financial advisor to discuss your specific situation and get advice on when to sell your property.

Here are some additional tips for selling and exiting a real estate rental investment:

- Prepare your property for sale. This may involve making repairs, staging the property, and taking professional photos.

- Price your property competitively. It is important to price your property competitively so that it sells quickly and for a good price.

- Market your property effectively. Market your property to potential buyers through online and offline channels.

- Work with a qualified real estate agent. A qualified real estate agent can help you prepare your property for sale, price it competitively, market it effectively, and negotiate the sale.

Following these tips can increase your chances of success when selling and exiting a real estate investment.

Real Estate Project Analysis Will Help You to Invest Wisely

To understand the attractiveness of a real estate investment opportunity, we need to analyze the expected rental income and all costs to understand the investment return.

Rent Roll

The rent roll is a financial document that lists all the rentable spaces in a property, the tenants who occupy those spaces, and the amount of rent that each tenant pays. The rent roll is important for real estate project analysis because it provides insights into the property's expected rental income.

To analyze a real estate investment project using the rent roll, you need to consider the following factors:

- Which are the rentable spaces? Not all properties have the same types of rentable spaces. For example, a single-family home may have only one rentable space, while a multi-family property may have multiple rentable spaces, such as apartments or townhouses.

- At what prices can the property be rented? The rent you can charge for a property is determined by a number of factors, including the type of property, location, condition, and amenities. You can research comparable properties in the area to get an idea of what rents are being charged.

- What is the projected rental income? Once you know how many rentable spaces you have and what rents you can charge, you can project the property's expected rental income. This will give you an idea of how much cash flow you can expect from the property.

OPEX

OPEX, or operating expenses, are the ongoing costs of owning and operating a property. OPEX can be divided into two categories: fixed costs and variable costs.

- Fixed costs are costs that remain the same regardless of how much the property is used. Property taxes, insurance, and mortgage payments are examples of fixed costs.

- Variable costs are costs that fluctuate depending on how much the property is used. Examples of variable costs include utilities, maintenance and repairs, and landscaping.

Which costs will be borne by the tenants and which by the landlord?

The costs borne by the tenants and the landlord will vary depending on the lease agreement. However, some common costs the tenants bear include utilities, trash, and snow removal. Some common costs that the landlord bears include property taxes, insurance, and maintenance and repairs.

Net Operating Income (NOI)

NOI, or net operating income, is the amount of income that a property generates after all operating expenses have been deducted. NOI is calculated by subtracting OPEX from rental income.

CAPEX

CAPEX, or capital expenditures, are the costs associated with maintaining and improving a property. CAPEX can include things like repairs, replacements, and upgrades.

- What is the required investment? The required investment for a real estate investment project depends on several factors, including the property's purchase price, the cost of any renovations, and the financing costs.

- How much additional capex will need to be spent? The amount of additional capex that will need to be spent will depend on the property's condition and your investment goals. For example, if you are planning to flip the property, you may need to spend a significant amount of money on renovations upfront. If you are planning to hold the property for the long term, you may be able to spread out the cost of repairs and replacements over time.

Financing

The amount of the required investment that can be financed from the bank (LTV%; Loan-to-Value ratio) will depend on a number of factors, including the type of property, the location of the property, and the borrower's creditworthiness.

Generally, banks are willing to finance a higher percentage of the purchase price for investment properties than for primary residences. This is because investment properties are typically more expensive than primary residences, and investors are more likely to have the financial resources to make a down payment and repay the loan.

The drawdown period, grace period, interest rate, and repayment terms of bank financing will also vary depending on the lender and the borrower's qualifications.

Taxes

The expected property taxes for a particular property can be estimated by contacting the local tax assessor's office.

The taxable income from a real estate investment property is the property's net operating income (NOI) minus depreciation. Depreciation is a non-cash expense that allows investors to deduct property costs over time.

The capital gain tax on a real estate investment property is the tax the investor pays on the profit they make when they sell the property. The capital gain tax rate depends on the investor's income tax bracket.

Funding for Real Estate: How to Finance Your Investment Property

There are a number of different ways to finance a real estate investment property. The best option for you depends on your circumstances and investment goals.

Financing Options

Stage

There are two main stages of financing for real estate investment properties: initial financing and refinancing.

- Initial financing is the financing that you use to purchase the property. This can be done through a bank, a private lender, or a combination.

- Refinancing refers to exchanging your current mortgage for a new one. This can be done to get a lower interest rate, to extend the term of the loan, or to cash out some of the equity in the property.

Lenders

There are two main types of lenders for real estate investment properties: banks and private lenders.

- Banks are the most common type of lender for real estate investment properties. Banks provide various mortgage products, such as conventional mortgages, FHA loans, and VA loans.

- Private lenders are individuals or businesses that provide real estate investors with loans. Private lenders usually have more flexible terms than banks, but they may have higher interest rates.

How to Choose the Best Financing Option for You

When it comes to financing a property, it is important to consider the following factors:

- Your credit score: Your credit score will determine your loan interest rate and loan amount.

- The down payment: The size of your down payment will determine how much you must borrow.

- The property type: The type of property you are purchasing will affect the financing options available to you.

- Your investment goals: Your investment objectives will assist you in determining the best financing option for your needs.

Before choosing a loan, compare offers from multiple lenders. This will help you to get the best possible financing terms.

Tips for Getting a Loan for a Real Estate Investment Property

- Prepare a realistic proposed term sheet. This document describes the loan's conditions, including the interest rate, loan term, and repayment terms. Preparing a realistic term sheet will show the lender that you are serious about the loan and understand the financing process well.

- Develop financial projections. This includes creating a pro forma income statement and balance sheet. The financial projections should show the lender that the property is a good investment and that you will be able to repay the loan.

- Offer collateral (the property or, eventually, additional guarantees). If you fail to make payments on your loan, the lender may seize your collateral. You can make the loan more appealing to the lender by providing collateral. In addition to the tips listed above, there are a few additional things you can do to increase your chances of obtaining a loan for an investment property in real estate:

- Get pre-approved for a mortgage. This will give you an idea of how much money you can borrow and will make you more competitive when you make an offer on a property.

- Work with a mortgage broker. A mortgage broker can assist you in locating the best financing options and obtaining pre-approval for a loan.

- Prepare to answer questions about your investment strategy and real estate investing experience. The lender will want to know that you are an experienced and knowledgeable investor who is likely to succeed.

What else can you do?

- Improve your credit score. A high credit score makes you more appealing to lenders and qualifies you for lower interest rates.

- Reduce your debt-to-income ratio. The debt-to-income ratio refers to the proportion of an individual's debt in relation to their income. An individual with a lower debt-to-income ratio is more likely to receive approval for a loan.

- Save for a down payment. A larger down payment will reduce the money you need to borrow and make you more attractive to lenders.

Following these tips can increase your chances of getting a real estate investment property loan.

In the dynamic world of real estate investment, making well-informed decisions is pivotal for achieving favorable returns. Understanding the return potential and evaluating various scenarios are indispensable steps in this process.

How Financial Models Can Help You Succeed in Real Estate Investment

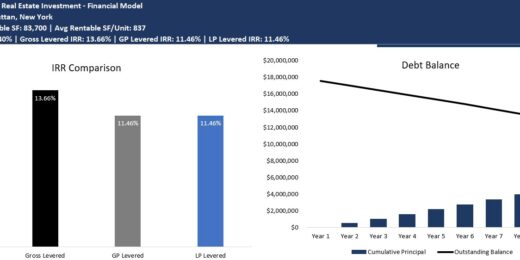

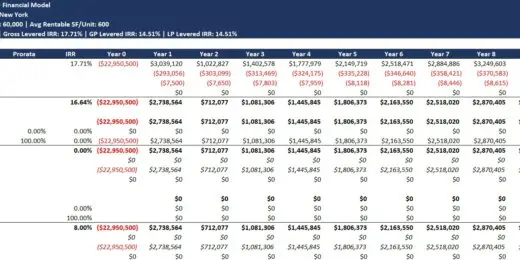

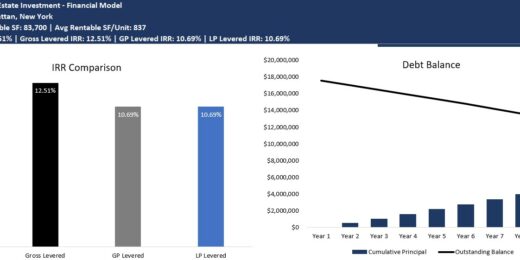

A comprehensive real estate investment financial model serves as a robust tool for projecting free cash flows—both levered and unlevered—and calculating essential return metrics such as the Internal Rate of Return (IRR) and Cash Yield. IRR provides a quantitative measure of profitability, helping you decide the optimal time to buy and sell a property.

On the other hand, understanding the Cash Yield is crucial if your strategy leans towards long-term investment, allowing you to gauge the annual returns and evaluate if the asset is worth holding indefinitely.

Excel is the go-to platform for modeling these financial metrics, owing to its unparalleled flexibility and user-friendliness. Excel cannot only handle complex calculations and scenario analyses but also facilitate seamless communication with stakeholders. A well-crafted Excel model can be easily shared with banks or investors, accelerating decision-making and enhancing investment strategy.

So, if you're an investor aiming to minimize risk and maximize profit in real estate, consider utilizing our specialized Financial Model for Real Estate. It's designed to provide accurate forecasts and actionable insights, equipping you to make better financial decisions in this competitive market.

Conclusion: Thorough Financial Analysis Pays Off in Real Estate Investment

Real estate has long been considered a good investment, serving as a cornerstone for many diversified portfolios. The allure of growing property values and the potential for steady rental income make it an attractive option for many. Yet, as with any venture, it's vital to conduct a comprehensive property analysis before diving in, considering factors affecting property value, such as location and the specific type of property you're considering.

When we look at the comparison between real estate and the stock market, it's clear that the real estate investing business offers unique benefits, especially for those who value tangible assets and have more control over their investments. But it's crucial to remember that real estate isn't a guaranteed win; effective funding for real estate requires a well-articulated real estate investment business plan, incisive strategy, and a thorough understanding of the market landscape.

From a financial standpoint, real estate is far from a casual endeavor. There are upfront costs, ongoing maintenance, and, of course, taxes to consider. Here is where a robust financial model for real estate comes into play. With meticulous planning, guided by a well-crafted business plan for real estate business, the potential for lucrative returns can become a reality. The advent of tech startups in the real estate sector indicates that the industry is rapidly evolving, providing an even greater array of tools for those serious about financing property.

In wrapping up, real estate stands out as a solid investment choice for those willing to put in the effort. With the right approach, it can offer both financial growth and the satisfaction of owning a tangible asset.