The Essential Guide to Calculating the Cap Rate for Real Estate Valuations

Aspiring real estate investors often come across the term “cap rate.” Yet understanding its significance can be quite perplexing. Cap rate, short for capitalization rate, is a crucial metric used in real estate investment. It helps investors assess the real estate value of a property and its profitability.

This guide will uncover the cap rate real estate definition and capitalization rate real estate formula. We will also provide sample calculations. By the end of this article, you will have a clear understanding of cap rates and be equipped with valuable knowledge to make informed decisions when evaluating real estate opportunities.

What is Cap Rate for Real Estate?

Cap rate, short for capitalization rate, is fundamental in real estate investing. It is one of the key financial metrics used to evaluate the real estate value of property and its profitability. Investors commonly use it as part of a property valuation and return on invested capital calculation.

Two types of cap rates are commonly used in property valuation.

- Gross Capitalization Rate (Gross Cap Rate) is calculated by dividing the property’s annual gross operating income (income before any expenses).

- Net Capitalization Rate (Net Cap Rate) considers the property’s net operating income (income after deducting operating expenses) instead of the gross operating income.

In this article, we focus more on the net cap rate as a more accurate and reliable metric for property valuation.

The cap rate real estate definition is a percentage that represents the relationship between a property’s net operating income (NOI) and its current market value or purchase price. Understanding the cap rate is crucial for seasoned investors and real estate market newcomers. It gives investors a return on invested capital calculation they can expect to generate relative to the purchase price.

Different cap rates between similar properties or different time periods on a property indicate different risk levels. The calculation reveals that properties with lower valuations and better net operating income will have lower cap rates and vice versa.

The Importance of Calculating Cap Rate

Well, it serves as a valuable tool to compare different investment opportunities and determine the financial viability of a property.

- Risk Assessment: Cap Rate helps investors gauge the level of risk associated with an investment property. A higher capitalization rate indicates a higher potential return but may also suggest higher risk. On the other hand, a lower capitalization rate implies a more stable investment but may yield lower returns. Investors can assess a real estate investment’s risk and potential reward by analyzing the cap rate.

- Property Performance Comparison: The capitalization rate allows investors to compare the performance of different investment properties, regardless of their size, location, or purchase price. By focusing on the cap rate, investors can quickly assess which properties have the potential for higher returns relative to their costs.

- Market Conditions: Cap Rate can provide insights into prevailing market conditions. If the capitalization rates in a particular area are declining, it might indicate increased demand for properties, possibly leading to rising property prices. Conversely, rising capitalization rates suggest a softer market or potential investment opportunities.

- Investment Decision-Making: The capitalization rate plays a crucial role in investment decision-making. It assists investors in identifying properties that align with their risk tolerance, return expectations, and investment strategy. Investors have different objectives, and the cap rate helps find properties that suit individual preferences.

- Financing & Lenders: Lenders often use cap rate as a factor to evaluate a loan application’s viability. A higher capitalization rate may increase the likelihood of securing favorable financing terms as it shows the property’s ability to generate sufficient income to cover the mortgage payments.

- Exit Strategy: When investors plan to sell a property in the future, the capitalization rate can influence the property’s resale value. Higher cap rates attract more investors, potentially resulting in a higher selling price.

While capitalization rate is a valuable tool for initial property assessment, it is essential to consider other factors like local market trends, maintenance costs, property appreciation, and rental growth to make a well-rounded investment decision. It should be used hand-in-hand with financial due diligence and financial ratios analysis before investing in real estate.

Understanding the Capitalization Rate Real Estate Formula

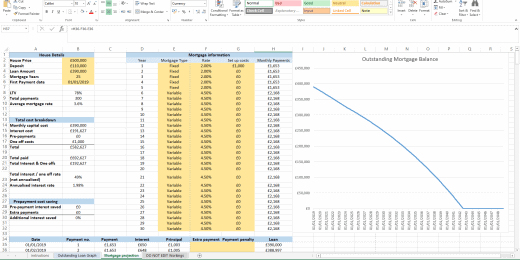

There are two capitalization rate real estate formulas. These are based on the current market value and the purchase price. The capitalization rate real estate formula based on a property’s current market value or real estate value is Cap Rate = Annual Net Operating Income (NOI) / Property’s Market Value. At the same time, the capitalization rate real estate formula based on the purchase price is Cap Rate = Annual Net Operating Income (NOI) / Purchase Price.

However, the first formula (based on the current market value) is more popular among investors. First, the second formula produces erroneous results for old properties acquired at bargain prices several years or decades ago. Second, it cannot divide inherited properties because their purchase price is zero. Additionally, the first formula utilizing the current market price is a more accurate representation than the second one using the fixed value original purchase price because real estate prices vary greatly.

Net Operating Income (NOI)

Net Operating Income (NOI) represents a property’s income from its operations after deducting all direct operating expenses but before deducting any financing costs like mortgage payments, income taxes, and other non-operating items.

The factors included under net operating income for real estate are:

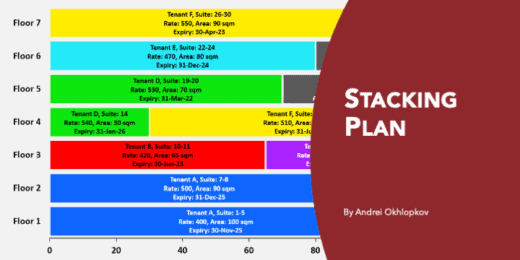

- Rental Income: This includes the revenue generated from leasing t out the property to tenants. It encompasses both residential and commercial rents.

- Ancillary Income: Besides rental income, ancillary income sources may also contribute to the NOI. These sources can include additional fees, such as parking fees, laundry income, vending machines, pet fees, storage fees, etc.

- Miscellaneous Income: This includes any other income streams related to the property, such as income from billboards, cell tower leases, or any other non-rental income.

The formula to calculate the net operating income for real estate is NOI = (Total Rental Income + Total Ancillary Income + Total Miscellaneous Income) – Total Operating Expenses. Direct operating expenses typically include maintenance and repairs, property insurance, property management fees, property taxes, utilities, and other day-to-day expenses related to running the property.

Property’s Market Value

Market Value is the current or estimated fair market value of the property. The property’s market value refers to the current estimated worth or price in the open market, assuming a willing buyer and a willing seller. It represents the total value of the real estate property.

To identify the market value, you have several options:

- Appraisal: Professional real estate appraisers use various methods to determine the property’s market value, such as the sales comparison approach, income approach, and cost approach.

- Comparable Sales: These are known as “comps” or comparable sales. Look for properties with similar characteristics (e.g., size, location, condition) to understand the property’s market value.

- Online Valuation Tools: Numerous online real estate valuation tools and websites estimate a property’s value. While these can give you a rough idea, they may only sometimes be as accurate as a professional appraisal or thorough research of comparable sales.

- Real Estate Agents: Local real estate agents are familiar with the area and have expertise in valuing properties. They can provide insight into market trends and help estimate the property’s market value.

Keep in mind that determining the market value is an essential step in the investment process, as it directly influences the cap rate calculation and, consequently, the decision to invest in a particular property.

Purchase Price

The purchase price is the total amount paid to acquire the property, including any closing costs and fees. Generally, a higher property’s purchase price will lead to a lower cap rate. A lower capitalization rate implies the property’s potential return on investment is relatively lower than its cost. Conversely, if the purchase price is lower, it will result in a higher cap rate. A higher capitalization rate suggests that the property has the potential for a higher return on investment relative to its cost.

Interpreting Cap Rate in Real Estate Valuation

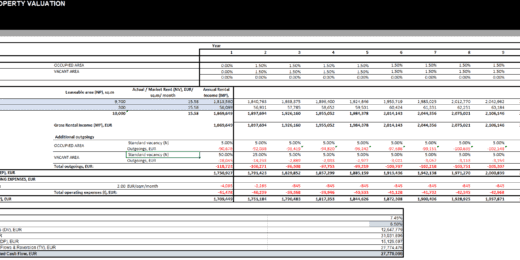

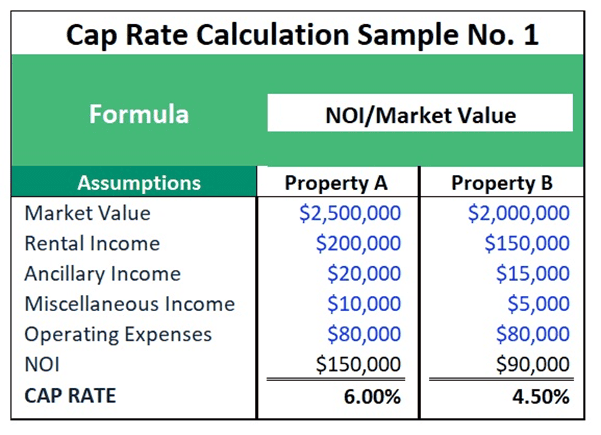

Let us try some calculations to learn how to interpret the capitalization rate real estate formula using the following assumptions for two real estate properties in the same location.

| Property A: Market Value = $2,500,000 Rental Income = $200,000 Ancillary Income = $20,000 Miscellaneous Income = $10,000 Operating Expenses = $80,000 | Property B: Market Value = $2,000,000 Rental Income = $150,000 Ancillary Income = $15,000 Miscellaneous Income = $5,000 Operating Expenses = $80,000 |

Sample No. 1

First, we must calculate the net operating income (NOI) using the formula: NOI = (Total Rental Income + Total Ancillary Income + Total Miscellaneous Income) – Total Operating Expenses. The final results show that Property A has a cap rate of 6.00%, and Property B has a cap rate of 4.50%.

Property A has a higher cap rate than Property B. It indicates That it is a potentially more attractive investment opportunity because it suggests that the property’s net income is relatively high relative to its market value. Still, they might also involve higher risk, such as properties in less desirable locations or requiring significant maintenance and repairs.

Sample No. 2

Now, let us assume a higher market value for Property A at $3,500,000 with the other assumptions the same as above.

The final results show that the cap rate of Property A decreases to 4.29%, making Property B a potentially more attractive investment opportunity. Furthermore, it indicates that capitalization rate and market value have an inverse relationship. The cap rate decreases as the market value increases, and vice versa.

A higher cap rate implies a lower property value, and a lower cap rate suggests a higher property value. This relationship holds because the cap rate represents the expected return on investment, and investors typically demand a higher return for riskier or less desirable properties, leading to a higher cap rate and a lower market value.

Sample No. 3

Now, let’s assume Property A and Property B have the same market value of $2,000,000 and different cap rates.

Now, let’s assume Property A and Property B have the same market value of $2,000,000 and different cap rates.

In this example, Property A has a higher cap rate (6%) than Property B (4.5%). At the same market value, Property A yields a higher net operating income of $120,000, and Property B yields a lower net operating income of $90,000.

As you can see, when two properties have the same market value, a higher cap rate implies a higher net operating income for real estate, and a lower cap rate implies a lower net operating income for real estate. It is because the cap rate reflects the expected return on the investment, and if the cap rate is higher, it means the property’s income (NOI) relative to its value is higher. Conversely, if the cap rate is lower, the property’s income relative to its value is lower.

What is A Good Cap Rate for Real Estate Investment?

A good cap rate for real estate investment can vary depending on the investor’s objectives, risk tolerance, and specific market conditions. There is no one-size-fits-all answer, and investors must assess individual circumstances before deciding.

Here are some key points to consider:

- Risk and Returns: A higher cap rate generally indicates a riskier investment but may also offer potentially higher returns. On the other hand, a lower cap rate typically implies a more stable and less risky investment, though with potentially lower returns.

- Market Norms: Cap rates can differ significantly between different types of real estate and various locations. In some markets, a cap rate of 5% to 10% might be considered attractive, while in other high-demand areas, cap rates could be lower due to higher property values.

- Investment Strategy: Investors pursuing value-add opportunities or properties in emerging markets might look for higher cap rates to achieve more substantial returns. Meanwhile, those seeking stable, income-generating properties might accept lower cap rates for reduced risk.

- Exit Strategy: Investors should also think about their exit strategy. If the plan is to hold the property long-term, a lower cap rate might be acceptable for its stability and potential appreciation.

In conclusion, a “good” cap rate is subjective and dependent on various factors.

Summary

The capitalization rate is a critical metric for assessing the potential return on investment in real estate properties. It is calculated by dividing a property’s annual net operating income by its current market value or purchase price. While a higher cap rate generally suggests greater potential returns, assessing additional factors, such as market trends, property type, and location, is crucial before making an informed investment decision.

Financial model spreadsheet templates available at eFinancialModels can be useful for entrepreneurs, small business owners, and investors to analyze real estate investments and determine valuations, Cap Rates, and other critical financial factors.

Tags: business valuation