Bakery Financial Model Excel Template

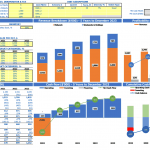

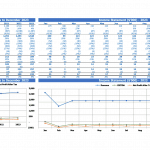

Shop Bakery Budget Template. Solid package of print-ready reports, including P&L and cash flow statements, and a complete set of financial ratios. Five-year bakery five year financial projection template for startups and entrepreneurs to impress investors and get funded. Key financial charts, summaries, metrics, and funding forecasts built-in. Created with the mind of the bakery business. Bakery Financial Projection Template Excel helps to estimate required startup costs. Unlocked – edit all – last updated in Sep 2020. Solid package of print-ready reports, including a bakery pro forma p&l statement, cash flow statement by month, a break-even analysis, and a complete set of financial ratios.

NOTE: Single-User pertains to a limited Single User License where the template can only be used by one single user; while Multi-User is a license for users sharing the template with up to 20 members. Please refer to Terms of Use and License and Permitted Use for clarification.

BAKERY STARTUP FINANCIAL MODEL KEY FEATURES

Video tutorial:

Convince investors and lenders

Enhance your pitches and impress potential financiers with a 3 Way Forecast Model delivering the right information and expected financial and operational metrics. Facilitate your negotiations with investors for successful funding. Raise money more quickly and refocus on your core business.

We do the math

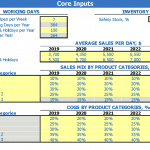

Financial Projection Model Excel has all the required features ready with no formula writing, no formatting, no programming, no charting, and no expensive external consultants! Concentrate on the task of planning rather than programming.

Track your spending and staying within budget

Have you written a vague idea of cash inflows and cash outflows on the back of a napkin? All is well and good. Looking at the statement of profit and loss proforma will give you a snapshot of the past business performance, but it won’t show the future in terms of the Pro Forma Cash Flow Projection. With a cash flow statement, you can plan future cash inflows and cash outflows and compare it to the budget, which can be invaluable information.

Easy to follow

Clear and transparent Bakery Cash Flow Proforma Template structure (15+ separate tabs, each focusing on a specific planning category, colour coded => input, calculation and report sheets).

Investors ready

Print ready (including a profit and loss statement, a Projected Cash Flow Statement, a balance sheet, and a complete set of financial ratios).

All necessary reports

When creating a Bakery Financial Projection Model, you will not need to independently prepare financial reports and study the requirements for them. Our Excel template contains all the necessary reports and calculations that correspond with the lenders demand.

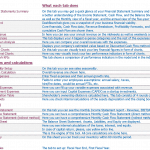

REPORTS and INPUTS

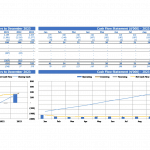

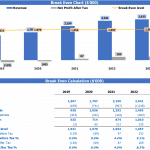

Burn and Runway

This Bakery Financial Projection Template automatically calculates the cash burn rate based on the inputs from other spreadsheets, in particular, from the cash flow statement.

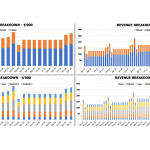

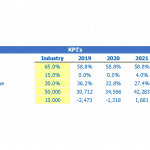

Benchmarks

The financial benchmarking study tab in this Cash Flow Proforma will help the companies assess their key performance indicators and compare them with other companies’ KPIs.

The term ‘benchmarking’ means the process of comparing the business, financial or other metrics of your company to that of other firms within the same industry. It is essential to use other businesses’ best practices in the same industry as a ‘benchmark’ to improve your own company’s standards.

As a result of the benchmarking study, companies can learn how to operate in a certain industry more efficiently. This benefit makes the financial benchmarking study an essential planning tool for start-ups.

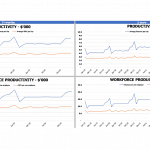

Performance KPIs

Return on capital. The return on capital reflects the correspondence of the Balance Sheet and Income Statement. Return on capital measures the accomplishment of earnings to the capital employed.

Companies with good financial management have good returns.

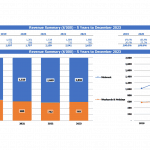

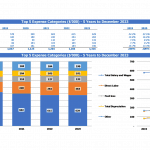

Top Expenses

It is very important for a start-up and existing company to monitor, plan, and manage its costs and expenses to maintain a good profitability level.

For this purpose, it is necessary to analyze the highest costs and always work on their optimization. In our Startup Financial Model we have created a Top expense report helps users with this task. It summarizes the four biggest expense categories and the rest of the expenses as the ‘other’, so the users can easily monitor these expenses and track the tendencies related to their increase or decrease from year to year.

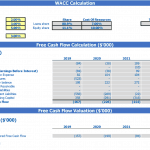

Cash Flow KPIs

Cash conversion cycle (CCC). The cash conversion cycle (CCC) is a financial metric that expresses the time it takes for a company to convert its resources in the form of inventory and other resources into cash flows. The cash conversion cycle is also called the Net Operating Cycle.

CCC measures how long each dollar that the company inputted is tied up in the production and sales process before it gets converted into cash.

The cash conversion cycl metric accounts for various factors, such as how much time it takes to sell inventory, how much time it takes to collect accounts receivable, and how much time it takes to pay obligations.

Loan opt-in

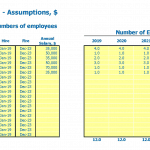

The loan amortization schedule template in this Bakery Startup Financial Model reflects the schedule of repayment of the loan. It shows detailed information about the company’s periodic payments or installments that comprise of principal amount and an interest component.

These elements are shown in the loan amortization schedule template for the period till the end of the loan term or up to which the full amount of the loan is paid off.

Financial Statements

With our Cash Flow Proforma Template, you can easily create an profit and loss statement proforma, a Balance Sheet, and a projected cash flow statement for your company. You can choose these statements’ format and make any financial statement with a monthly or annual breakdown, or for five years.

File types:

Excel – Single-User: .xlsx

Excel – Multi-User: .xlsx

Free Demo – .xlsx

Similar Products

Other customers were also interested in...

Grocery Store Financial Model Excel Template

Try Grocery Store Financial Projection. Creates 5-year Pro-forma financial statements, and financial... Read more

Pizzeria Financial Model Excel Template

Get Your Pizzeria Budget Template. Excel template - robust and powerful. This is your solid foundati... Read more

Candy Store Financial Model Excel Template

Order Candy Store Financial Model Template. Sources & Uses, Profit & Loss, Cash Flow stateme... Read more

Clothing Store Financial Model Excel Template

Get Your Clothing Store Budget Template. Creates 5-year Pro-forma financial statements, and financia... Read more

Food Truck Financial Model Excel Template

Purchase Food Truck Financial Projection Template. Excel Template for your pitch deck to convince In... Read more

Confectionery Shop Financial Model Excel Template

Confectionery Shop Financial Plan Allows investors and business owners to make a complete financial ... Read more

BAKERY – 3 Statement Financial Model with 5 ...

This Bakery Business Plan Model is a perfect tool for a financial feasibility study on launching a B... Read more

Gift Shop Financial Model Excel Template

Try Gift Shop Financial Projection. Investor-ready. Includes a P&L and cash flow statement, bala... Read more

Flower Shop Financial Model Excel Template

Discover Flower Shop Financial Model Template. Allows investors and business owners to make a comple... Read more

Coffee Shop Financial Model Excel Template

Download Coffee Shop Financial Model Template. Allows you to start planning with no fuss and maximum... Read more

Reviews

After working on the model I found it very powerful, comprehensive, and integrated.

584 of 1191 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

You must log in to submit a review.