Real Estate Portfolio Template – Excel Spreadsheet

The Real Estate Portfolio Template forecasts the financial performance when building a real estate portfolio. The model allows simulating various scenarios ranging from acquisition, development, and renovations of the properties and their inclusion into an investment portfolio.

The Real Estate Portfolio Spreadsheet Template in Excel allows for preparing a sophisticated 10-year financial forecast of a real estate portfolio of up to 100 properties and analyzing the expected financial performance and its breakdown in detail. The model results in a forecast of the financial statements (Income Statement, Balance Sheet, and Cash Flow Statement) and forecasted Financial Ratios, Debt Schedule, and Free Cash Flow Forecast for the envisaged Real Estate Portfolio under management. The model forecasts the size of the portfolio and the relevant financial metrics, such as the gross and net yield of the real estate portfolio overall, while providing breakdowns to better analyze each property’s profit contributions.

The real estate portfolio Excel template allows the preparation of a Financial Forecast of a Real Estate Portfolio of up to 100 Properties of Commercial or Residential Real Estate. The forecast is created dynamically, depending on when each property will be included in the forecast of the real estate portfolio. This allows simulations of scenarios depending on when each property is acquired over time during a quarterly forecasting period. The real estate portfolio financial model then prepares a detailed financial analysis of the envisaged portfolio, including Internal Rate of Return (IRR), yields, cash flows, and much more. A reinvestment option also foresees to reinvest excess cash into new acquisitions to simulate the effect on yields through reinvesting.

An overview of this financial model template is provided in the video below.

Highlights of Real Estate Portfolio Template

The Highlights of this real estate portfolio spreadsheet template in Excel are the following:

Assumption Sheet

- General Assumptions currency, area units (e.g., sq ft or sqm),

- Labels as per deal types, market segments, etc.

- Income at the Portfolio level

- Definition of management costs / overhead costs at the Portfolio level

- Financial Debt to be obtained at the Portfolio Level

- Default Interest Rate Assumptions

- Tax Assumptions for Income Tax and Capital Gain Taxes

- Uses and Sources of Funds

- Exit assumptions (year and net cap rates)

- Auto-reinvestment option to invest excess cash into new acquisitions to grow the portfolio further

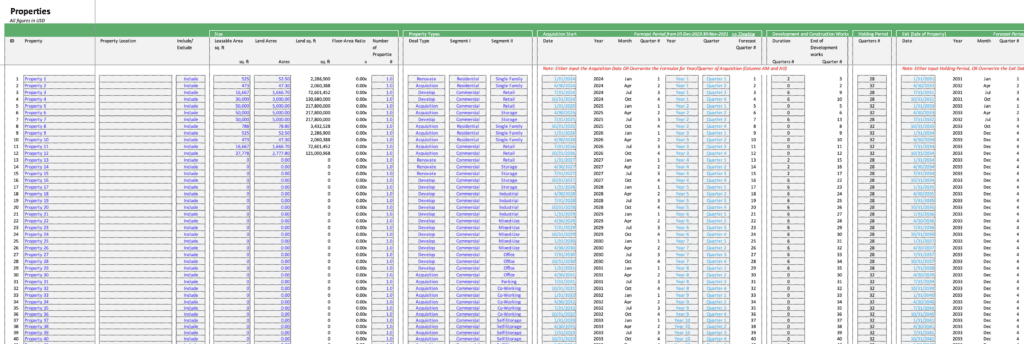

List of Properties

- A worksheet that contains more detailed assumptions per Property

- Whether to include/exclude each property into the financial forecast

- Leasable Area per Property

- Deal Type and Market Segment per Property

- CAPEX and Acquisition Costs per Property

- Loan to Value (LTV) Ratio per Property and calculation of expected Financial Debt per Property

- Rental Income, OPEX, and Net Operating Income (NOI) per Property

- Cash Surplus Analysis by Property based on NOI and Debt Service

- Timeline of Entry, Duration of Development, and Exit per Property NEW: Date Input

- Net Cap Rate Assumption for Valuation Purposes

- Calculation of the Funding Required

Quarterly Forecast

- Comprehensive Quarterly Financial Forecast over a period of 10 Years

- Detailed forecasts for Leasable Area, Rental Income, OPEX, Financial Debt, etc.

- Quarterly Financial Statement Forecast in the form of a Three Statement Model (Income Statement, Balance Sheet, Cash Flow Statement)

- Calculation of the required funding

- Calculation of Lifetime Profit per Property

- And more..

Annual Forecast

- Aggregates the quarterly forecast into an Annual Forecast

- Yearly Financial Statement Forecast in the form of a Three Statement Model (Income Statement, Balance Sheet, Cash Flow Statement)

- Calculation of Lifetime Profit per Property

- Calculation of all relevant financial metrics

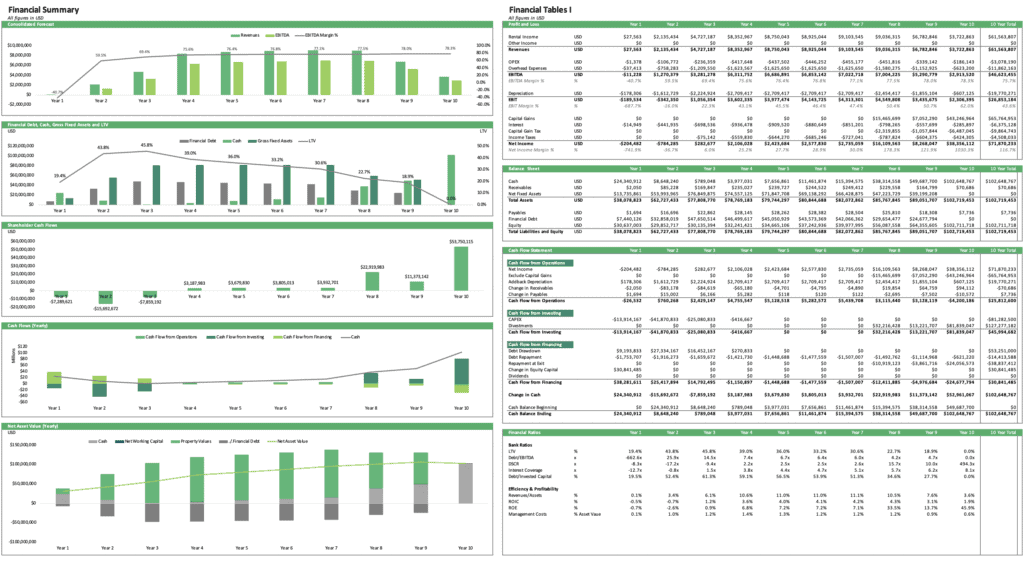

Summary

- Executive Summary Dashboard that summarizes the relevant expected financial performance metrics of your property portfolio

- Tons of charts, tables, and breakdowns to better analyze the contribution of property value, rental income, yields and CAPEX by deal types and market segments.

- Summary of the expected cash balances, financial statement forecast (Income Statement, Balance Sheet, Cash Flow Statement, Financial Ratio)

- Summary of the expected value of the property portfolio

Assumptions and Instructions Sheets

- An assumption and instruction sheet explains the terms used in this template and how to work with the Real Estate Portfolio Template.

When to use the Real Estate Portfolio Template?

To explain how to use this Excel spreadsheet best, we list below a few use cases of this financial model template:

Use Case 1 – Better understand your Acquisition Strategy and the Real Estate Portfolio you are going to build

- What size will your portfolio have?

- How much rental income can you expect?

- How much overhead expenses/management costs will your real estate portfolio be able to absorb?

- How much Equity Financing will you need to reach a target portfolio size?

Use Case 2 – Analyzing the Effect of your Deal Pipeline on your Real Estate Portfolio

- What type of properties have you identified in your deal pipeline?

- Is the type of deal mix reflecting your strategy?

- Which ones should you include/exclude from your portfolio?

- What will be the effect of including each property in your portfolio?

- When will be the best time to include them?

Use Case 3 – Building a Financial Statement Forecast for Your Real Estate Portfolio

- How will the consolidated Financial Statements of your intended Real Estate Portfolio look like?

- How much Debt Financing can this Portfolio carry?

- How will the financial ratios on a portfolio level look like from the point of view of a bank?

- How will acquisitions, development projects, or divestitures affect cash flows and the financial statements?

- What will be the expected cash balances?

Use Case 4 – Understanding the Future Value of your Property Portfolio

As you can set the net cap rates by Property, you will be able to better understand the expected future value of your real estate portfolio over time and its breakdown:

- What will be the expected value of your properties in your portfolio?

- Which deal type will contribute to how much of this expected property value?

- How will the value of your property portfolio be diversified by industry or market segment?

- How will acquisitions or divestitures affect the overall value of your real estate portfolio?

These are just some of the use cases which are addressed in this financial model template. The Real Estate Portfolio Template includes many more charts, allowing you to quickly analyze the effect of new acquisitions or divestments on your portfolio. Planning your real estate portfolio lets you stay one step ahead and anticipate the financial effects.

The Excel Model comes either as a fully editable Excel File or as a PDF-Demo Version (real estate portfolio template pdf). Please refer to the PDF Demo Version for a detailed overview of the structure of this real estate portfolio template.

The latest model version is 2.4, and the File Types are .xlsx (MS Excel) and .pdf (Adobe Acrobat Reader)

Similar Products

Other customers were also interested in...

Real Estate Financial Model Templates Package

This is a collection of ready-made Excel financial model templates for real estate businesses and it... Read more

Real Estate Private Equity (REPE) Financial Model

New Version Updates:• The model supports now up to 50 properties• Updated Acquisition, Financing... Read more

Real Estate Financial Model Bundle

This is a collection of financial model templates that provides the financial projections and valuat... Read more

Mixed-Use Real Estate Model: Leverage / JV Options

A general real estate model to plan all assumptions for up to 7 'uses' for a given property. Include... Read more

Real Estate Acquisition-Rent-Sell Comprehensive An...

An integrated, dynamic and ready-to-use Real Estate Acquisition-Rent-Sell Comprehensive Analysis Mod... Read more

Acquisition Model for Commercial Property

This is the Quintessential Commercial Property Acquisition Model that allows you to compare up to 20... Read more

Real Estate Acquisition Financial Model (Commercia...

Simple Real Estate Acquisition Financial Model suitable for Commercial, Industrial and Residential P... Read more

Condominium Development – Dynamic 10 Year Fi...

A condominium (or condo for short) is a building structure divided into several units that are each ... Read more

Single Family Residential Property Investment Mode...

Financial model presenting an investment scenario (buy, hold, sell) for a Single Family Residential ... Read more

Real Estate Multi-Family Development Excel Model

Real Estate Financial Model to evaluate a development project, with Equity Waterfall and Advanced Sc... Read more

You must log in to submit a review.