Investing Cash Flows

Multifamily Rehab Model (Includes Investor Returns Waterfall)

Introducing the Multifamily Rehab Flip Model with Investor Returns Waterfall…

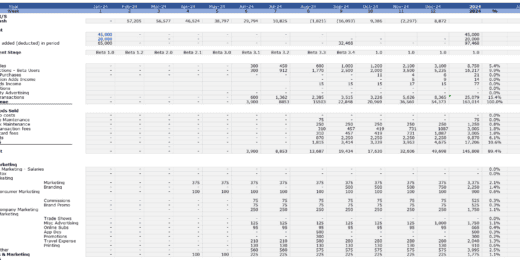

Project Finance Excel Model – 10 Year Projection

The template creates a financial model for your individual project…

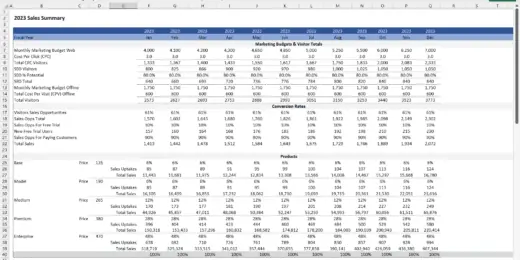

Startup Company Financial Model – Dynamic 3 Statement Financial Projections up to 8-Years

Highly Dynamic and Easy-to-Navigate Excel Financial Projections Model that allows…

Advanced Financial Model – Dynamic 3 Statement 10-Year Financial Model with DCF Valuation

Advanced, Dynamic and Easy-to-Use Excel Financial Projections Model that allows…

Biomethane Producer Financial Model (Renewable Natural Gas)

Create a detailed pro forma with this biogas financial model.…

Beginner Commercial Property Modelling Tool

"Beginners Commercial Property Modelling Tool," a resource for developers embarking…

Fintech Mobile App Financial Model

A comprehensive editable, MS Excel spreadsheet for tracking Fintech Mobile…

Manufacturing Start up Feasibility Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for forecasting and tracking…

Physiotherapy Clinic Finance Model 5 Year 3 Statement

A comprehensive editable, MS Excel spreadsheet for tracking Physiotherapy Clinic…

Fast Food Restaurant Financial Model Template

Maximize fast food financials with our user-friendly financial model template.…

Budget vs Actual Forecasts 5 Years Excel Template

MS Excel spreadsheet for tracking budget finances. Can be used…

3 Statement 5 Year SAAS HR Software Development Company Finance Model Excel Template

A comprehensive editable, MS Excel spreadsheet for tracking SAAS HR…

Car Dealership Financial Model and Valuation – Financial Projections

Welcome to the Car Dealership Company Financial Model and Valuation,…

Hospitality (Hotel) Financial Model and Valuation – 10-year Projections

Welcome to the Hospitality (Hotel) Company Financial Model and Valuation,…

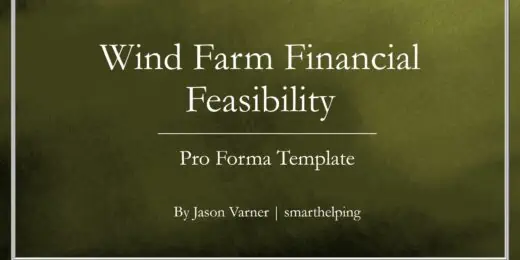

Renewable Energy Financial Model

Comprehensive financial model designed for analyzing renewable energy projects, such…

Carbon Capture and Sequestration Project Analysis

The Carbon Capture and Sequestration (CCS) Project Analysis Template is…

Gym Financial Model and Budget Control

This Excel model is a highly adaptable and user-friendly tool…

Surfboard Rental Business Financial Model

Surfing is not just a sport—it's a lifestyle booming globally.…

EPC Model for Builders and JV Partners

The EPC Financial Model Template for Builders and JV Partners…

Single Airbnb Rental Unit Financial Model

If you're considering renting your property on Airbnb, downloading a…

Real Estate Portfolio Template – Excel Spreadsheet

The Real Estate Portfolio Template forecasts the financial performance when…

Business Plan for Ethanol Manufacturing Plant

A well-planned and implemented business strategy is necessary for setting…

Financial Model for Mobile App | Mobile App Business Plan

The Mobile App Financial Plan Template in Excel allows you…

The Power of Investing Cash Flows

In the early 2000s, Amazon began to leverage the power of investing cash flows by expanding its core e-commerce business, improving customer experience through faster shipping times, and widening its inventory. This strategic allocation of cash flows into areas with high return potential has been a critical driver of Amazon's market valuation and its ability to continue investing in new technologies and markets.

Amazon's story underscores the transformative cash flow from investing activities example. This strategic approach to investing cash flows has been instrumental in Amazon's success. By continuously channeling resources into high-potential areas, Amazon has sustained its growth and positioned itself at the forefront of multiple industries. Let us explore the power of investing cash flows as they transform visionary ideas into towering realities, fueling the growth and innovation that drive the world's most successful companies forward.

What is the Cash Flow from Investing Activities?

Cash flow from investing activities is part of a company's financial operations involving cash transactions related to its long-term investments. The emphasis is on long-term cash uses, indicating that these are not day-to-day operational transactions but strategic investments and divestments aimed at shaping the company's asset base and investment portfolio over time. Cash flow from investing activities is a distinct section within a company's cash flow statement. It specifically records changes in the company's cash position resulting from transactions involving its assets, investments, or equipment. It highlights that this part of the cash flow statement will document any financial activity associated with acquiring or disposing long-term assets or changes in investment holdings that affect the company's cash reserves. Cash flow from investing activities allows stakeholders to see how investments and divestitures impact the company's liquidity.

What is the Difference Between Financing and Investing Cash Flows?

Financing cash flow pertains to transactions involving external sources of funding. It includes activities that alter the equity and debt of the company. Financing activities are essential for understanding how a company raises capital and repays its investors. Positive financing cash flows indicate that a company is raising more money than it is paying back to investors, which can be seen in activities such as issuing stock or obtaining a loan. Negative financing cash flows suggest that a company is paying back more to investors than it is raising, such as through dividend payments or debt repayments.

Investing cash flows relates to purchasing and selling long-term assets and investments unrelated to the company's primary business operations. Positive investing cash flows indicate a company is selling more of its assets than it is buying, which might not always be a positive sign, significantly, if it is not investing in its future growth. Conversely, negative investing cash flows suggest that a company is investing in its future growth by acquiring assets.

Financing cash flows focus on financing activities related to the company's equity and debt structure. In contrast, investing cash flows are concerned with investments in long-term assets and other investments. While both impact the cash flow statement, investing activities directly affect the balance sheet's assets, and financing activities influence the balance sheet's liabilities and equity sides.

What is the Difference Between Operating and Investing Cash Flows?

Operating cash flows pertain to cash transactions related to the core business activities of a company. It includes cash received from customers, cash paid to suppliers and employees, interest, and tax payments. This metric is a crucial indicator of the company’s ability to generate sufficient cash to maintain or expand operations without resorting to external funding sources.

As mentioned, investing cash flows involves transactions related to the company’s investments in long-term assets and investment securities. This category reflects how a company allocates its resources to build future growth. These flows indicate the company’s growth strategy and capability to generate future earnings. A negative investing cash flow might not be a bad sign if the company invests in its growth.

Operating cash flows directly indicate the company’s operational health and efficiency in generating cash from its core operations. On the other hand, investing cash flows provides insight into the company’s growth prospects and how effectively it invests its resources for future growth. Regular positive operating cash flows are crucial for financial stability, enabling a company to invest, pay debts, and return money to shareholders. Investing cash flows can be negative, indicating investment in assets expected to generate returns in the future, or positive, which might suggest divestment from specific assets.

Cash Flow From Investing Activities Examples

Cash flow from investing activities is crucial to a company's financial health, revealing how much money is spent or generated from various investment-related transactions. The most common items listed under cash flow from investing activities examples can be divided into cash inflow and cash outflow.

Cash Inflow from Investing Activities

Cash inflow from investing activities is a section of a company's cash flow statement that reports the cash generated or spent from various investment-related activities within a specific period. These activities mainly involve purchasing and selling long-term assets and investments unrelated to the company's day-to-day operations.

- Sale of Property, Plant, and Equipment (PPE): When a company sells its long-term assets, such as buildings, land, or machinery, the cash received from these sales is considered a cash inflow from investing activities. It can occur when a company downsizes, upgrades its assets, or optimizes its asset portfolio.

- Sale of Investments: Companies often invest in stocks, bonds, or other financial instruments. The sale of these investments results in a cash inflow. It includes sales of investments in other companies (equity securities), government and corporate bonds (debt securities), and any other investment vehicles outside the company's primary operations.

- Proceeds from the Sale of Intangible Assets: Similar to physical assets, selling intangible assets such as patents, copyrights, and trademarks can generate cash inflow. These sales are often part of strategic decisions to monetize assets no longer central to the company's business model or to capitalize on the assets' value.

- Collection of Principal on Loans to Other Entities: If a company lends money to other parties, the collection of the principal amount (the initial amount lent) is recorded as a cash inflow from investing activities. Interest received is typically classified as an operating activity, but the return of the loaned amount itself is considered an investing activity.

- Maturities or Redemption of Bonds and Other Fixed-Income Investments: When bonds or other fixed-income securities that a company holds reach their maturity date, the issuer repays the principal amount to the bondholders, which includes the investing company. This repayment is considered a cash inflow from investing activities.

- Proceeds from Insurance Settlements Related to Investment Assets: If a company receives an insurance payout due to damage or loss of investment-related assets, this payment is recorded as a cash inflow under investing activities. It is less common but can be significant when it occurs.

These examples highlight how cash inflow from investing activities can provide insights into how a company manages its long-term assets and investments. They reflect decisions made by management about reallocating resources, optimizing asset portfolios, and capitalizing on investment opportunities to support the company's growth and financial health.

Cash Outflow from Investing Activities

Cash outflow from investing activities refers to the money spent by a company on investments in the pursuit of future growth and returns. These outflows are crucial for a company's expansion and long-term success but can also impact its short-term liquidity.

- Purchase of Property, Plant, and Equipment (PPE): This includes cash spent on acquiring physical assets such as buildings, machinery, vehicles, and equipment. These purchases are essential for expanding operational capacity, entering new markets, or maintaining current production levels. The investment in PPE is considered a long-term investment in the company's operational infrastructure.

- Purchase of Investment Securities: Outlays for buying stocks, bonds, or other financial instruments for investment purposes. Companies invest in securities to manage excess cash efficiently and generate returns over time, although this is not part of their primary business operations.

- Loans to Other Entities: When a company provides loans to other businesses or individuals, the cash disbursed as loans represents an investing activity outflow. It could include financing provided to suppliers, customers, or subsidiary companies, aiming for a financial return through interest or equity participation.

- Investment in Intangible Assets: Outflows for purchasing intangible assets like patents, trademarks, licenses, and software development. These assets do not have a physical form but provide significant value to the company in terms of proprietary technology, brand recognition, and competitive advantages.

- Capital Expenditure on Improvements: Spending on enhancing or upgrading existing assets to increase efficiency, capacity, or lifespan. It could involve renovating facilities, retrofitting machinery, or updating technology infrastructure. Although these expenditures do not increase the asset base, they are essential for maintaining competitiveness and operational efficiency.

- Acquisition of Businesses: Cash spent buying other companies or significant stakes. These strategic acquisitions aim to expand the company's market presence, acquire new technologies or products, and achieve synergies that can enhance profitability and growth prospects.

These examples illustrate how cash outflows from investing activities are directed toward acquiring or improving assets expected to generate future economic benefits. While these outflows can reduce the company's cash reserves in the short term, they are crucial for ensuring long-term growth and sustainability.

The Investing Cash Flow Formula

Although there isn't a single, universally accepted investing cash flow formula, its calculation focuses on understanding how much money a company spends (cash outflows) versus how much it receives (cash inflows) from its investment-related activities. This calculation is crucial for investors and analysts as it provides insight into a company's investment strategy and ability to generate value from those investments.

The simplest investing cash flow formula is:

Let's break down what typically constitutes cash inflows and outflows in investing activities:

- Cash Inflows: This can include CapEx/purchase of non-current assets, marketable securities, business acquisitions, and other cash inflow from investing activities.

- Cash Outflows: These are the so-called divestitures, expenditures made by the company to acquire assets, investments in other companies, and other cash outflows from investing activities.

Sample Calculation

For a practical example, let's consider a hypothetical company, "ABC Corp," with the following cash flow from investing activities examples for the fiscal year 2023:

- Capital Expenditures: $10,000

- Purchases of Non-current Assets: $5,000

- Investments in Marketable Securities: $3,000

- Business Acquisitions: $2,000

- Divestitures (Sale of a Division): $4,000

Using the formula, we can calculate ABC Corp's cash flow from investing activities:

The spreadsheet above shows that ABC Corp's cash flow from investing activities for the fiscal year 2023 is negative ($16,000). This result indicates a net outflow of cash, meaning that the company spent more on its investment activities (such as acquiring assets and businesses) than recouped from divestitures (such as selling a division) during the period.

What Does a Positive and Negative Investing Cash Flow Mean?

A positive investing cash flow indicates a company is divesting assets, which could mean selling off long-term investments, property, plant and equipment (PPE), or other businesses. It isn't inherently harmful; it suggests the company is reallocating or optimizing its asset base to focus on its core business, reduce debt, or return value to shareholders through dividends or share repurchases. Positive investing cash flow can signal a strategic shift or an effort to capitalize on assets no longer essential to the company's strategic goals. However, consistently high positive investing cash flows also imply the company is shrinking or struggling to find profitable reinvestment opportunities within the business.

Conversely, a negative investing cash flow signifies a company is acquiring assets, investing in its future growth through capital expenditures, purchasing long-term investments, or acquiring businesses. It is generally a positive indicator of the company's long-term prospects, suggesting confidence in future growth and expansion. However, balancing such investments against the company's overall financial health and cash flow from operations is important. Excessive spending on investments relative to cash inflows can lead to liquidity issues. Therefore, while negative investing cash flow reflects growth ambitions, careful management must ensure these investments generate adequate returns and do not strain the company's financial stability.

Whether it's good for a company to spend more on its investment activities than it recoups from divestitures depends on several factors, including the company's financial health, the nature of the investments, and its strategic objectives.

- A company with a strong balance sheet and ample cash reserves can afford to make significant investments without jeopardizing its financial stability. However, high investment spending could be risky and unsustainable if a company is heavily indebted or has limited cash flows.

- The outcomes also hinge on the quality of the investments. If the investments are in high-potential areas with expected strong returns, then spending more could be justified. However, poor investment decisions can lead to significant losses and financial strain.

- Furthermore, if a company is in a growth phase, high spending on capital expenditures, acquisitions, and other investments might be a positive indicator. It suggests the company invests in future growth, expands operations, or enters new markets. These investments can yield significant returns over the long term.

In summary, while spending more on investment activities can indicate a proactive approach to growth and may lead to higher future earnings, it's crucial to consider the context. The decision should be based on a careful assessment of the potential returns, the company's capacity to absorb the costs, and the overall strategic fit of the investments.

Maximize Wealth with Strategic Investments

Investing cash flows represent the money moving in and out of a company due to investments it makes or receives. These flows are a crucial part of a company's cash flow statement, one of the three primary financial statements used to evaluate a company's financial health. Cash inflow from investing activities can arise from selling long-term assets (like property, plant, and equipment), selling investment securities (other than those classified as cash equivalents), or receiving repayments on loans made to others. On the other hand, cash outflow from investing activities occurs when a company buys long-term assets, makes investments in securities, or loans money to others. These movements are essential for understanding how a company allocates capital and manages its long-term investment strategy.

Whether an investing cash flow is considered good or bad, positive or negative, depends on the context and the company's stage of development. For growing companies, a negative investing cash flow might not be a bad sign; it can indicate that a company is investing heavily in its future growth by acquiring assets or making strategic investments. It is often seen in startups and expanding businesses focusing on scaling operations and capturing market share. Conversely, a positive investing cash flow might suggest that a company is selling off assets, which could indicate either strategic divestiture or a need to generate cash, possibly due to financial distress. For mature companies, positive investing cash flows can also reflect a steady state of reaping the benefits from past investments.

Financial modeling plays a pivotal role in analyzing investing cash flows by providing a framework to forecast and evaluate the potential impacts of different investment decisions on a company's financial health. Financial models can use detailed assumptions and scenarios to help managers and investors understand the cash flow implications of purchasing new assets, divesting existing ones, or making strategic investments. These models allow for the simulation of future states based on different investment strategies, helping stakeholders make informed decisions. By incorporating variables such as the cost of capital, expected returns on investment, and potential risks, financial modeling helps assess the viability and timing of investments, thereby optimizing capital allocation for growth and shareholder value creation.