Achieving Mastery in Estimated Cash Flow Statement: The Definitive Guide

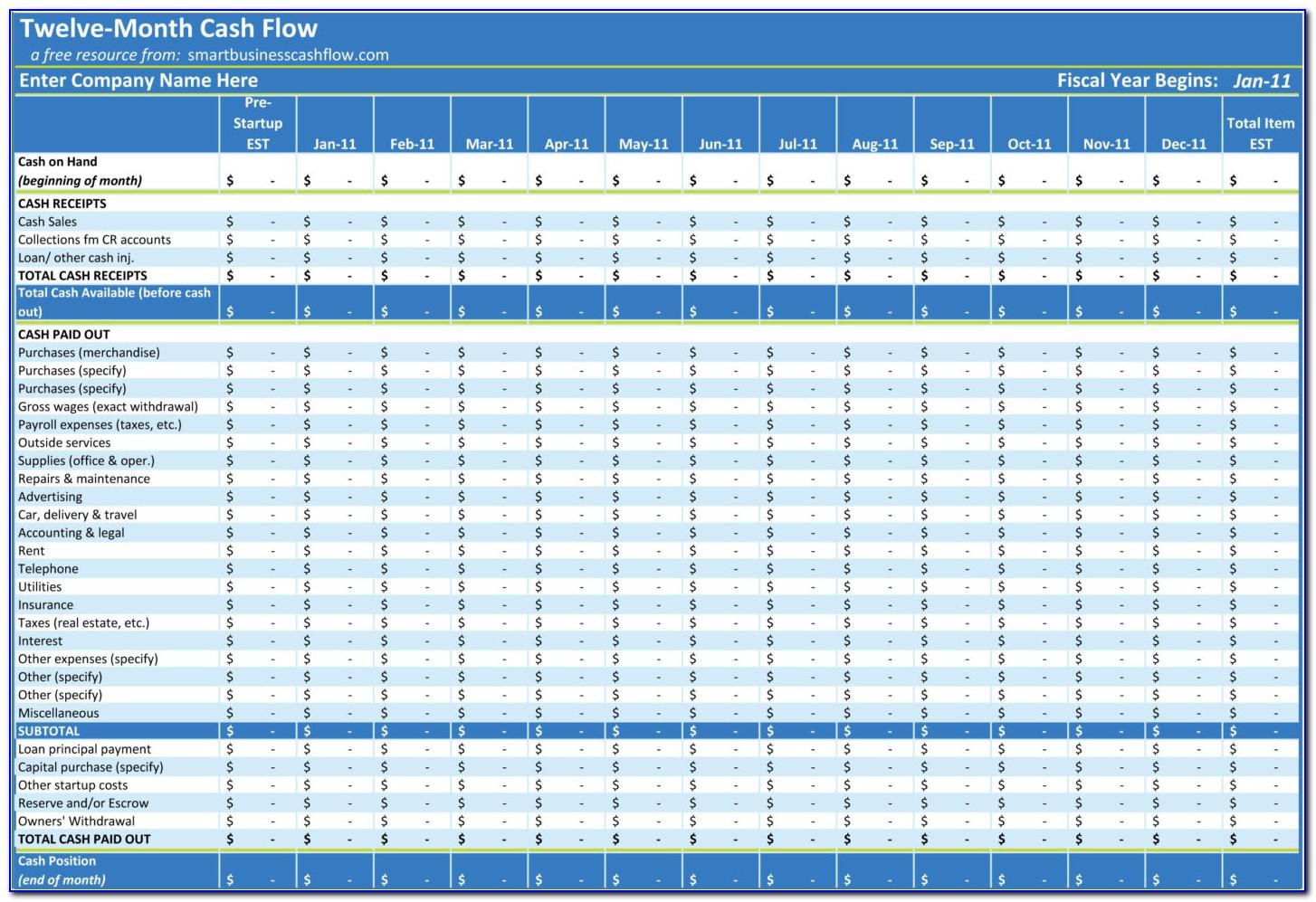

The estimated cash flow statement is crucial for mastering financial forecasting, offering a detailed guide to managing company finances effectively.

The estimated cash flow statement is crucial for mastering financial forecasting, offering a detailed guide to managing company finances effectively.

Transform your approach to financial forecasting with our cash projection model guide. It introduces advanced techniques for creating accurate financial plans, helping you to anticipate future cash flows and make strategic decisions based on solid financial data.

Planning an event involves intricate financial planning, and our cash flow statement for event planning tutorial is here to help. It provides a thorough walkthrough of creating and managing your event’s budget, ensuring financial success and efficiency.

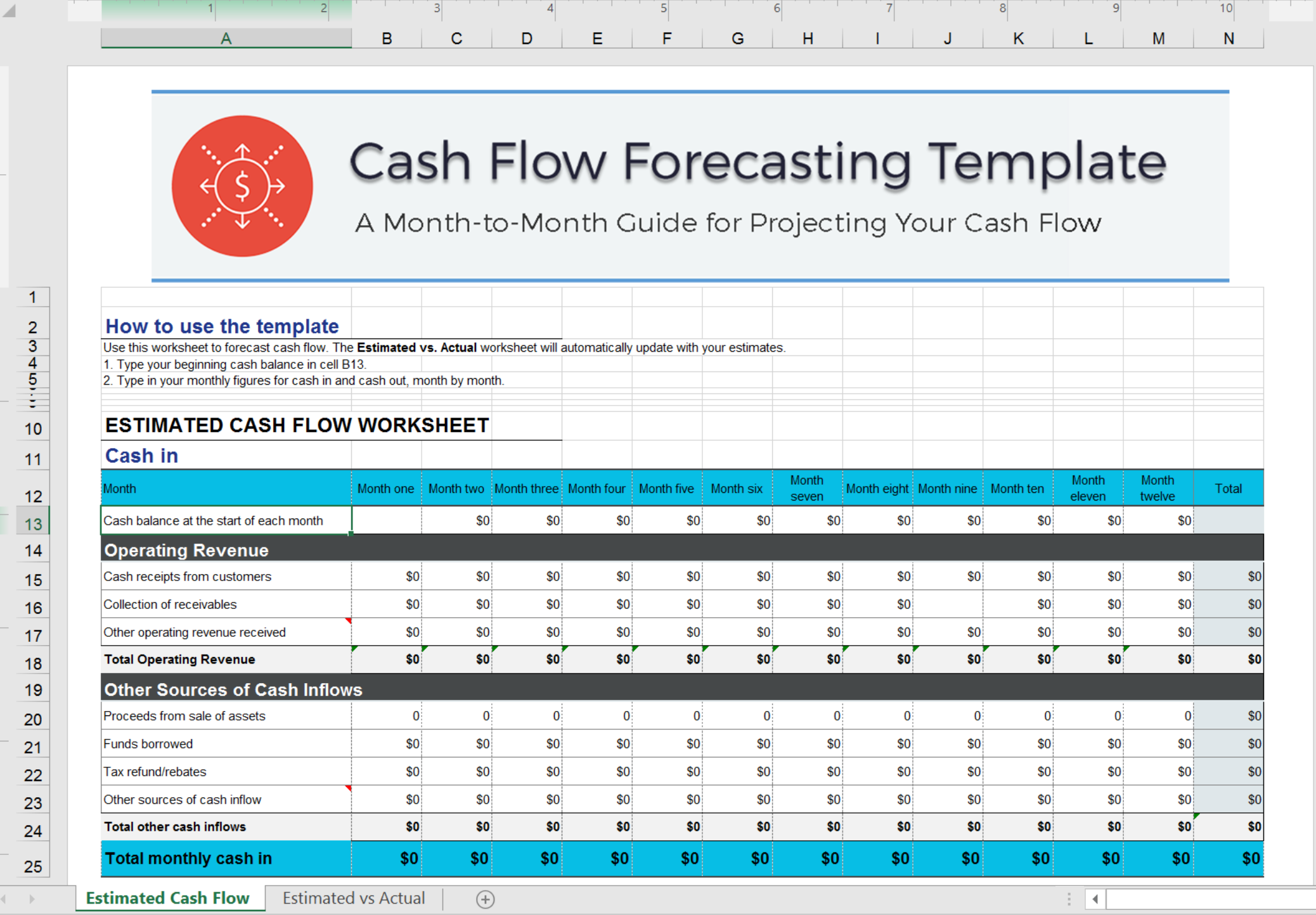

Navigating through financial statements can be challenging, but with our cash flow statement download guide, you’ll gain valuable tips and tricks that will make the process smoother and more intuitive, enhancing your Excel skills in financial management.

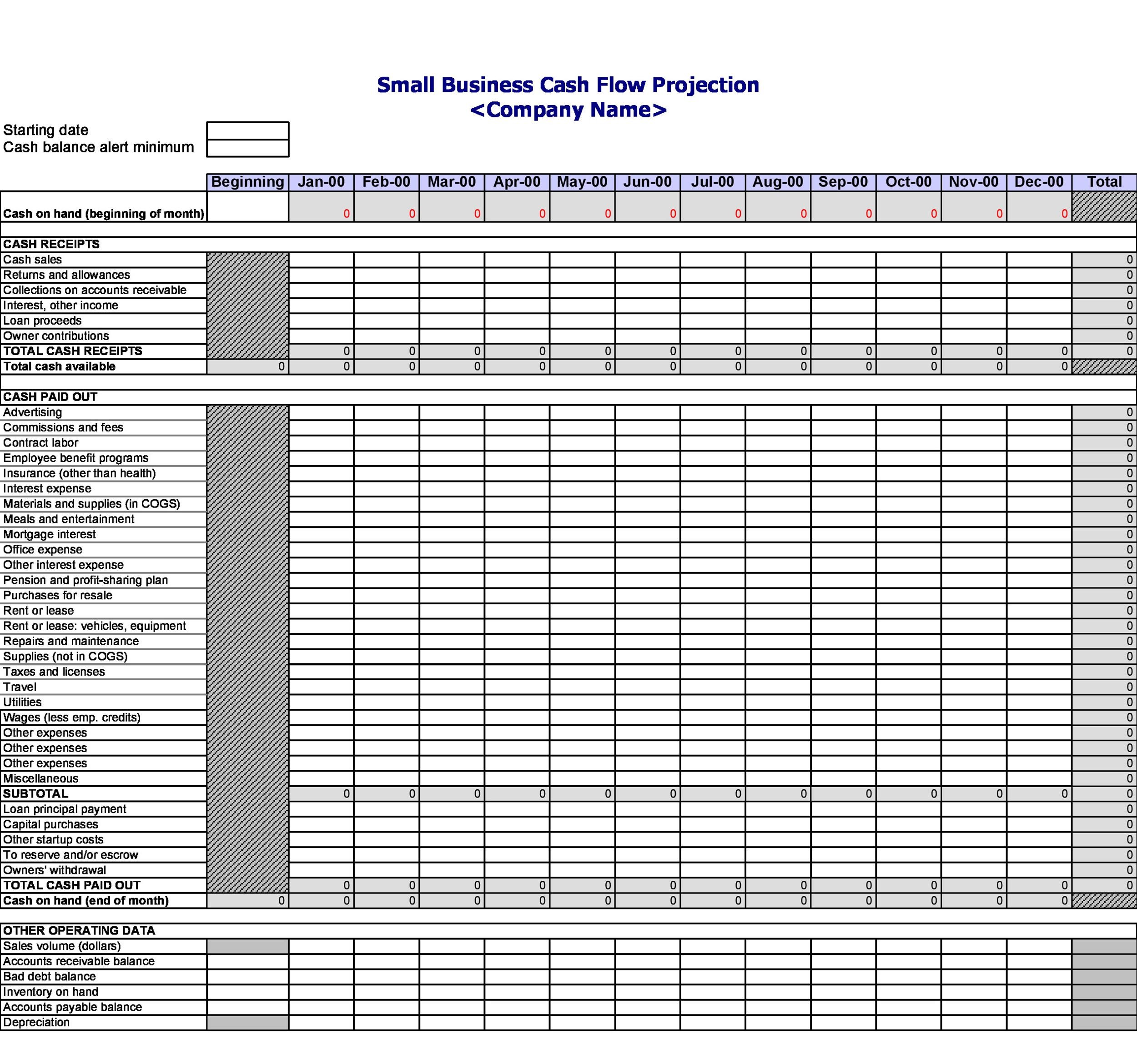

The cash flow sample template is an essential tool for anyone looking to get a grip on their financial planning. This guide offers an in-depth look at how to use the template effectively, ensuring you have the knowledge needed to manage your cash flow efficiently.

Discover the ultimate guide to the cash flow forecast template for restaurants. This article provides detailed instructions on how to use the template to manage your restaurant’s finances, plan for future expenses, and ensure operational success.

Master the cash flow estimate template with this step-by-step guide, designed for financial analysts and business owners. Learn how to accurately estimate future cash flows, essential for strategic planning and financial stability.

Unlock the secrets for success with our guide to the cash flow document template. Learn how to efficiently create and manage financial documents, streamlining the process and ensuring accuracy in your financial reporting.

Transform your approach to financial planning with our guide on advanced cash flow chart template techniques. Discover how to utilize templates to their fullest potential, optimizing your financial analysis and strategic planning.

Explore the world of cash flow assumptions format with insights and strategies that will change how you approach financial analysis. This guide offers advanced techniques for formatting and interpreting cash flow assumptions, enhancing accuracy in forecasts.

Achieving mastery in cash flow assumptions is key to accurate financial forecasting. This guide provides a thorough understanding of how to develop realistic assumptions, critical for planning and decision-making in any business environment.

The business plan cash flow projection example is a vital tool for any entrepreneur. In this article, we delve into how to accurately forecast your cash flow, helping you to plan ahead and ensure financial stability for your business.

A business cash flow worksheet is an invaluable tool for managing your company’s finances. This blog post introduces advanced techniques to transform your approach to cash flow management, helping you maintain a healthy balance between your inflows and outflows.

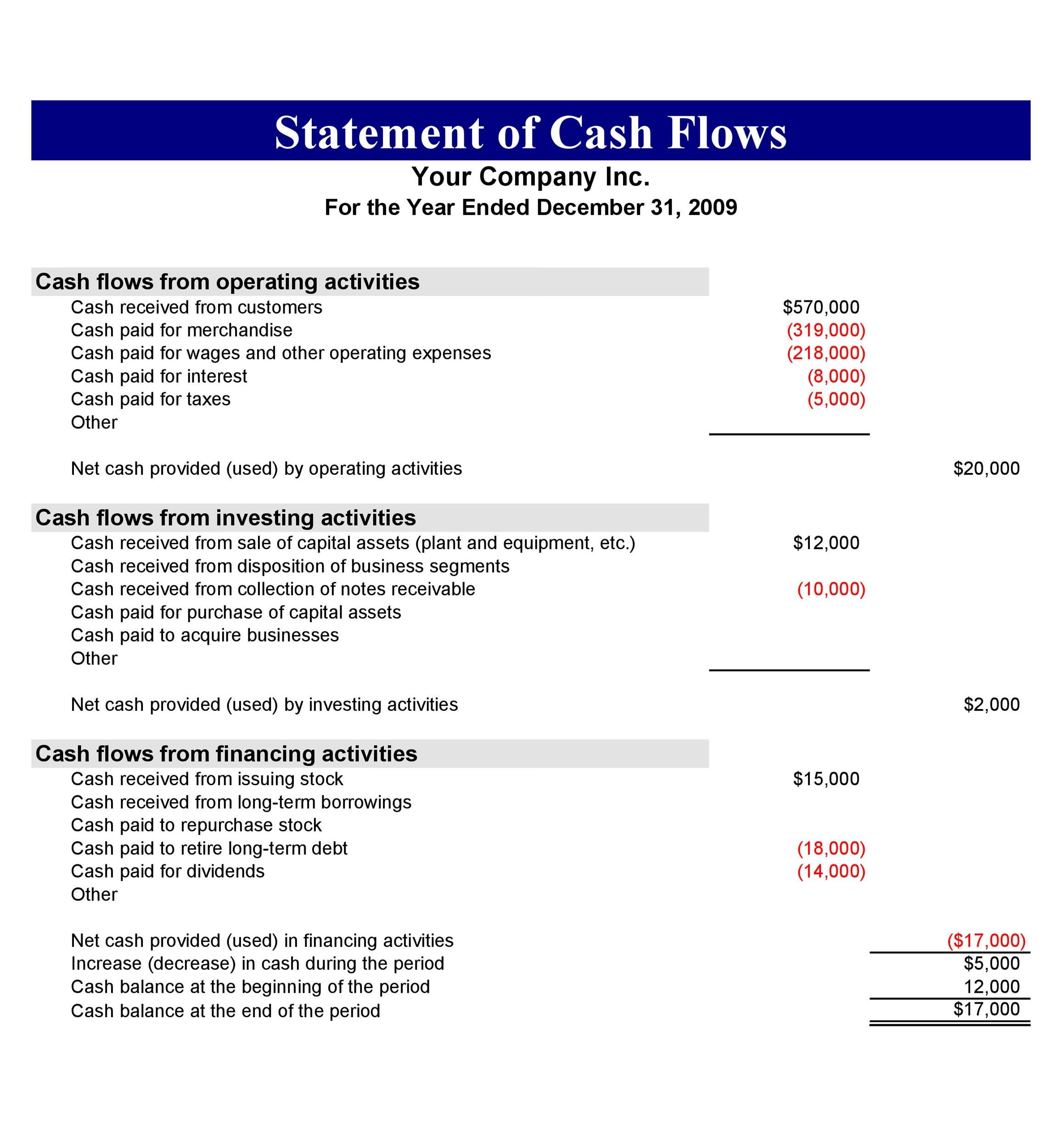

The accounting cash flow statement template is an indispensable tool for businesses. This guide provides the ultimate insights into maximizing its utility for transparent and effective financial reporting.

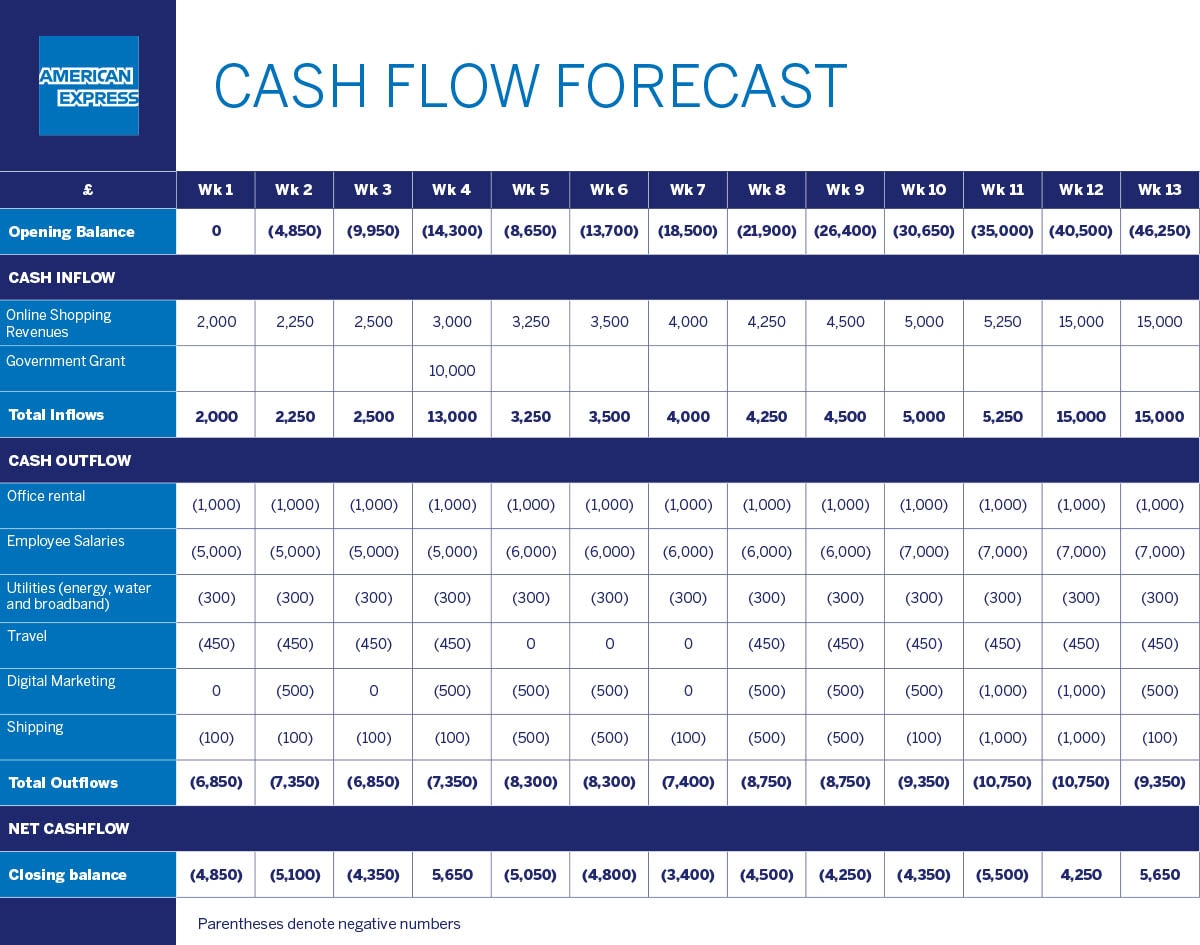

Financial forecasting is critical for business planning. Our 6 month cash flow projection template is the ultimate guide to understanding your future financial position, allowing you to make informed decisions and prepare for upcoming financial challenges and opportunities.

Take control of your business’s financial future with our free projected cash flow statement template. This resource is invaluable for understanding your cash inflows and outflows, helping you plan with precision.

Cost analysis is key to a profitable Airbnb business. This guide provides a comprehensive look at how to evaluate and manage costs, from operational expenses to pricing strategies, enabling you to make informed decisions and maximize your earnings.

Our Weekly cash flow template is designed to help businesses monitor their cash movements accurately. This template simplifies financial tracking, providing insights into cash inflows and outflows, aiding in better financial planning and decision-making for sustained growth.

Maximizing potential with terminal cash flow is essential for long-term investment strategies, offering insights into the final value of investments over time. This article delves into techniques to accurately project and maximize terminal cash flow, ensuring robust financial planning.

A solid template for cash flow statement is indispensable for businesses aiming to maintain financial stability. This strategy guide emphasizes the importance of accurately projecting cash inflows and outflows, ensuring you can make informed decisions to sustain and grow your business.

This beginner’s guide demystifies the monthly cash flow projection template Excel, making it accessible for novices to effectively forecast their finances.

Facing challenges with your monthly cash flow plan? Our insights offer strategic guidance to navigate through financial uncertainties, ensuring stability and growth.

Navigating the complexities of a monthly profit and loss template in Excel can be a transformative experience for any business professional. Our step-by-step guide simplifies this journey, turning a daunting task into an empowering tool for financial analysis. With clear instructions and practical tips, you’ll seamlessly integrate this free template into your financial repertoire, enabling you to meticulously track revenues, expenses, and profitability with precision. This guide is not just about inputting numbers; it’s about understanding the story they tell about your business, aiding in strategic decision-making and fostering a deeper comprehension of your financial landscape. As you master this template, you’ll unlock valuable insights, paving the way for informed, confident decisions that drive business success.

Optimizing the goodwill cash flow statement can be a strategic move that not only ensures compliance with accounting standards but also unlocks a significant competitive advantage. By meticulously assessing and managing the components of goodwill, businesses can enhance their financial transparency and attract investors and lenders with greater confidence. A well-optimized goodwill cash flow statement reflects a commitment to prudent financial management, fostering trust among stakeholders. Moreover, it provides a comprehensive view of intangible assets and their contribution to overall value, aiding in strategic decision-making. This proactive approach positions businesses to navigate challenges effectively and seize growth opportunities, ultimately solidifying their competitive edge in the market.

In the dynamic landscape of financial analysis, the future of the daily cash flow sheet template is set to become even more integral to decision-making and strategic planning. As we look ahead, emerging trends and predictions indicate a significant evolution, with advanced analytics, real-time data integration, and AI-driven forecasts becoming standard features. These enhancements will not only provide deeper insights into financial health but also offer predictive scenarios that empower entrepreneurs, investors, and finance professionals to navigate market volatilities with greater confidence. The daily cash flow sheet of tomorrow will be a powerful tool, offering a clearer lens through which to view the immediate financial implications of every business decision, ensuring that users are always one step ahead in their financial strategy.

Mastering the cash flow statement using the indirect method is a pivotal skill for driving enhanced business performance. This approach delves deep into the intricacies of how operational activities impact a company’s liquidity. By adjusting net income for non-cash transactions, changes in working capital, and other operational activities, businesses gain a clearer, more comprehensive understanding of their financial health. This knowledge is crucial for entrepreneurs, investors, and finance professionals, enabling them to make more informed decisions, identify potential cash shortfalls before they become critical, and strategically plan for sustainable growth. Mastering this technique not only enhances the accuracy of financial forecasting but also bolsters the confidence of stakeholders in the company’s financial stewardship.

Mastering cash flow statement templates is a pivotal step for any business aiming to enhance its performance. These templates serve as crucial tools for entrepreneurs, startup founders, and finance professionals, enabling them to accurately track and manage the lifeblood of their business: cash flow. By leveraging well-structured templates, businesses can gain deeper insights into their operational, investing, and financing activities, revealing the true liquidity and financial health of the enterprise. This mastery not only aids in making informed decisions but also strengthens the foundation for robust financial planning and analysis, ultimately steering the business towards sustainable growth and profitability. With the right cash flow statement template, you’re not just organizing numbers; you’re unlocking the potential to drive your business forward with clarity and confidence.

In today’s dynamic market landscape, projecting cash flow has become a pivotal tool for businesses aiming to navigate the unpredictable economic tides. It equips entrepreneurs, investors, and finance professionals with a powerful lens to peer into the future financial health of their ventures. By meticulously forecasting cash inflows and outflows, companies can anticipate potential liquidity challenges, strategically allocate resources, and make well-informed decisions that are crucial for sustaining growth and competitive advantage. The profound impact of cash flow projection lies in its ability to transform uncertainty into a clear roadmap, enabling businesses to adapt swiftly to market changes, capitalize on emerging opportunities, and secure a robust financial footing in an ever-evolving economic environment.

Cash flow projections are an indispensable tool in financial management, serving as a crystal ball that offers a glimpse into the future financial health of a business. At their core, these projections are meticulously crafted forecasts that detail the amount of money expected to flow in and out of a business over a specific period. They encompass the intricate dance of revenues, expenses, investments, and financing activities, painting a vivid picture of a company’s liquidity. By mapping out these monetary movements, cash flow projections enable entrepreneurs, investors, and finance professionals to make informed decisions, anticipate potential shortfalls, and strategize for growth. In essence, they are the heartbeat of financial planning, pulsating with insights that guide businesses towards stability and success.

“Understanding Projected Cash Flow: A Comprehensive Guide” is your essential roadmap to mastering the art of financial forecasting. In this comprehensive guide, we delve deep into the intricacies of projecting cash flow, equipping entrepreneurs, investors, and finance professionals with the knowledge needed to make informed decisions. Explore the foundations of cash flow analysis, learn to dissect historical data, and uncover the secrets of building robust financial models that pave the way for sound financial planning. Whether you’re a startup founder seeking to secure funding or a seasoned investor evaluating opportunities, this guide will empower you to navigate the world of cash flow projection with confidence and precision. Elevate your financial acumen and embark on a journey towards smarter, more profitable decision-making with this indispensable resource.