Computer Hardware Industry Average Financial Ratios Demystified: A Beginner’S Handbook

Get started with understanding computer hardware industry average financial ratios with our beginner-friendly handbook.

Financial ratios allows entrepreneurs to evaluate their company’s performance and compare it other similar businesses in their industry. Ratios measure the relationship between two or more components of financial statements. They often effectively when results over several periods are compared. It is ideal to follow business’s performance over time and uncover any signs of trouble.

Get started with understanding computer hardware industry average financial ratios with our beginner-friendly handbook.

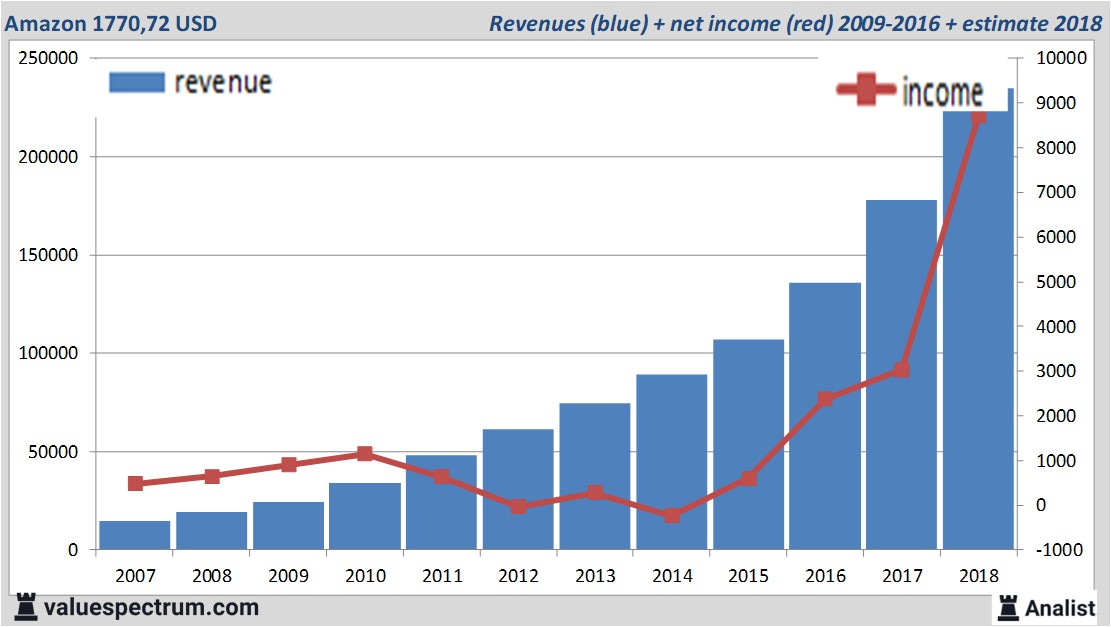

The financial landscape of Amazon in 2018 is dissected through a detailed analysis of its financial ratios. This guide aims to provide investors with a step-by-step understanding of Amazon’s financial health, highlighting key metrics that influence investment decisions and providing insights into how these ratios reflect the company’s operational efficiency.

In “Manage Your Money: Financial Ratios Categories Basics,” we delve into the core of personal finance management by exploring the fundamental financial ratios that can transform the way you handle your money. This guide is designed to demystify complex financial concepts, making them accessible to everyone, regardless of their financial background. Through a clear, concise breakdown, you’ll learn about liquidity ratios, debt ratios, profitability ratios, and efficiency ratios, and how each of these categories plays a pivotal role in assessing your financial health. By understanding and applying these ratios, you’ll be equipped to make more informed decisions, ensuring your financial stability and paving the way for a secure financial future.

In the dynamic world of finance, mastering the art of interpreting financial ratios can transform the way you perceive a company’s health and potential. These mathematical indicators, such as the Price-to-Earnings (P/E) Ratio, which compares a company’s stock price to its earnings per share, or the Debt-to-Equity (D/E) Ratio, which assesses a company’s financial leverage by dividing its total liabilities by shareholder equity, serve as the compass by which savvy investors navigate the tumultuous seas of the stock market. For instance, a company with a P/E Ratio significantly lower than its industry average might be undervalued, presenting a golden opportunity for investors. Meanwhile, a high D/E Ratio could signal excessive reliance on borrowing, hinting at potential financial instability. Through these examples, financial ratios not only demystify complex financial statements but also empower investors with the insight to make informed decisions, making numbers truly work for you.

In “Navigate Your Finances: Financial Ratios Benchmarks Tips,” readers are equipped with the essential tools to decode the complexities of financial health. This comprehensive guide demystifies the intricate world of financial ratios, providing clear, actionable advice on how to assess and improve your financial standing using benchmark comparisons. Whether you’re a budding entrepreneur keen on steering your startup to success, an individual striving for personal financial mastery, or a seasoned investor looking to refine your portfolio strategy, this insightful excerpt offers a treasure trove of wisdom. It illuminates the path towards financial acumen, empowering you to make informed decisions that align with your financial goals and aspirations.

In the ever-evolving landscape of financial literacy, mastering the art of smart money moves is essential for anyone looking to secure their financial future. Through the lens of financial ratios, a tool often reserved for the analytical minds in the corridors of corporate finance, individuals can unlock a new level of financial insight and decision-making prowess. By examining examples such as the debt-to-income ratio, savings-to-expense ratio, and investment returns ratio, individuals can assess their financial health, pinpoint areas for improvement, and strategize for success. These ratios serve as a compass, guiding users through the complexities of personal finance and empowering them to make informed decisions that pave the way for financial stability and growth.

Designed for entrepreneurs and finance professionals, this essential tool streamlines your business processes, ensuring you have the immediate insight needed to make informed decisions. Dive deep into the mechanics of liquidity ratios, understand their significance, and learn how to apply them effectively to maintain a healthy cash flow. Whether you’re assessing short-term obligations or planning for long-term growth, our comprehensive approach empowers you to navigate the financial landscape with confidence and precision.

Leveraging financial ratios for business excellence is a critical strategy for industry leaders like Walmart, offering a profound insight into operational efficiency, profitability, and market position. By meticulously analyzing key ratios such as the inventory turnover, return on equity, and current ratio, Walmart hones its competitive edge, ensuring a robust financial health that supports strategic decisions and growth initiatives. This focus on financial ratios not only drives Walmart’s operational excellence but also provides a blueprint for businesses aiming to optimize performance, enhance investor confidence, and achieve sustained success in the dynamic retail landscape. This analytical approach embodies a commitment to transparency and strategic foresight, positioning Walmart as a paragon of financial acumen and business excellence.

Leveraging financial ratios is a crucial strategy for achieving business excellence. This comprehensive guide provides a deep dive into how you can use these powerful tools to gauge the financial health of your company, benchmark performance against competitors, and make informed decisions that drive growth and efficiency. From understanding liquidity and profitability to dissecting leverage and efficiency metrics, this PDF equips entrepreneurs, investors, and finance professionals with the knowledge to turn financial data into a strategic asset. Embrace the insights offered by financial ratios and propel your business toward a future marked by informed decisions and sustainable success.

In “The Comprehensive Guide to Financial Ratios for Nonprofits,” you’ll embark on an enlightening journey through the critical numbers and benchmarks that drive the world of charitable organizations. This essential resource demystifies complex financial concepts, transforming them into powerful tools for evaluating operational efficiency, financial health, and the overall impact of your nonprofit. Whether you’re a seasoned financial professional or a passionate leader looking to sharpen your fiscal acumen, this guide provides the insights and methodologies needed to navigate the unique financial landscape of the nonprofit sector, ensuring that every dollar contributes to your noble mission. Discover how to use financial ratios not just as mere numbers, but as beacons guiding your organization towards greater accountability, sustainability, and success.

The future of financial ratios and accounting is poised at an exciting juncture, characterized by innovation and transformative trends. As we navigate forward, predictive analytics, artificial intelligence, and machine learning are set to revolutionize the way financial health is measured and interpreted. These technologies promise not only greater accuracy and efficiency but also the ability to uncover deeper insights and forward-looking indicators, empowering entrepreneurs, investors, and finance professionals to make more informed and strategic decisions. With the integration of real-time data and the rise of more sophisticated analytical tools, the landscape of financial ratios accounting is evolving into a more dynamic, predictive, and invaluable asset in financial decision-making, setting the stage for a new era of financial intelligence and strategic foresight.

Our expert insights guide you through advanced techniques to enhance project returns, refine investment decisions, and drive business growth. Unveil the potential of savvy IRR optimization and transform your financial planning with precision.

“The Essential Guide to Financial Ratios in Accounting: Tips and Techniques” is a comprehensive resource designed to empower entrepreneurs, business owners, investors, and finance professionals with the knowledge they need to harness the power of financial ratios. In this expertly crafted guide, you’ll delve into the intricacies of key financial metrics, gaining a deep understanding of how to interpret and leverage ratios for informed decision-making. From liquidity and profitability ratios to solvency and efficiency indicators, this guide equips you with the tools to assess a company’s financial health and performance. Whether you’re preparing a business plan, evaluating investment opportunities, or analyzing financial statements, this guide is your compass for navigating the complex world of accounting ratios with confidence and precision. Unlock the secrets to making sound financial decisions and drive your success to new heights with this indispensable resource.

Understanding key financial ratios is essential for entrepreneurs, startup founders, business owners, investors, lenders, consultants, and finance professionals alike. These ratios serve as the compass guiding financial decision-making. They offer invaluable insights into a company’s financial health, performance, and potential risks. From profitability metrics like the return on equity (ROE) and net profit margin to liquidity indicators such as the current ratio and quick ratio, these ratios empower individuals to assess the strength of a business. Moreover, leverage ratios like the debt-to-equity ratio shed light on a company’s capital structure and risk profile. Mastery of these ratios is not merely a skill but a cornerstone of effective financial analysis, allowing stakeholders to make informed, strategic choices in the dynamic landscape of business and investment.

In the world of finance and business analysis, comprehending financial ratios and their relevance to industry averages is paramount. Financial ratios serve as the compass guiding entrepreneurs, investors, and finance professionals in their decision-making processes. By comparing a company’s ratios to industry averages, one gains valuable insights into its financial health and performance relative to peers. This data-driven approach empowers individuals to make informed choices, whether it’s assessing investment opportunities, evaluating a business’s viability, or fine-tuning financial strategies. Dive into this crucial aspect of financial modeling to harness the power of industry averages and pave the way for more successful financial decisions.

When it comes to maximizing investment returns, understanding Internal Rate of Return (IRR) calculations is pivotal. IRR unveils the true potential of investments, allowing you to make informed decisions for maximum gains. Dive into our comprehensive guide, uncovering the secrets behind IRR, and learn how to supercharge your investment strategies. It’s time to take your financial prowess to new heights!

Discover the key to financial success with ‘Mastering the Art of IRR Calculation.’ This comprehensive guide empowers investors with the skills and knowledge needed to navigate the complex world of investment returns. Whether you’re a seasoned pro or just starting out, this book is your roadmap to financial mastery.

Financial ratios analysis is a beacon for investors, analysts, and business owners, offering a clear window into companies’ financial health and performance. By breaking down complex financial statements into understandable ratios, this analysis illuminates the paths of profitability, efficiency, liquidity, and solvency, guiding stakeholders in making informed decisions.

Financial analysis uses the interpretation of important Key Financial Ratios to understand a company’s financial situation. We can group those ratios in several categories: Liquidity ratios – help to understand whether the company can honor…