WACC Calculator | Discount Rate Estimation

Unlock the power of informed financial decision-making with our WACC Calculator! Dive into accurate discount rate estimations and empower your business strategies with confidence. Simplify complex calculations and gain the competitive edge you need for success.

| Financial Model, General Excel Financial Models |

| DCF Model, Discount Rate, Excel, Free Financial Model Templates, NPV (Net Present Value), Valuation, WACC (Weighted Average Cost of Capital) |

Understanding the Weighted Average Cost of Capital (WACC)

The Weighted Average Cost of Capital (WACC) is a financial metric used to determine the average rate of return a company is expected to pay its investors and creditors. It shows the typical cost of using debt and equity to fund a business’s operations.

WACC considers the cost of debt and equity, weighted by their relative proportions in the company’s capital structure. It is a crucial measure used in evaluating investment opportunities and making decisions about capital budgeting, as it represents the minimum return a company should generate to satisfy its investors and creditors. It’s calculated by considering the proportion of each funding source (debt, equity, preferred stock, etc.) and their respective costs.

Are WACC and Discount Rate the Same?

WACC and discount rates are related, but they are different. WACC refers to the average rate of return a company is expected to pay to all its security holders to finance its assets. The discount rate is the rate used to adjust future cash flows to their value today.

The discount rate could be calculated using various methods. These include the following:

- Cost of Equity Capital Formula

- Cost of Debt After-Tax Formula

- Weighted Average Cost of Capital Formula Excel

- Other Specific Measures of Investment or Valuation

WACC is one potential source for the discount rate, especially when evaluating an entire company or a project with a capital structure that mirrors the overall firm. But in essence, the discount rate may not always be the same as the WACC.

Is A High WACC Good or Bad?

Generally, a high WACC can indicate that a company faces higher costs in raising funds for its operations or investments. It can make potential investments or projects less attractive if the cost of capital is high, potentially reducing the overall value of the company. Although a higher WACC can be a good thing in the sense that it indicates a more conservative valuation.

A good WACC for a company is typically lower than the potential return on investments or projects the company is considering. In simple terms, if the company can generate returns on its investments higher than the WACC, these investments are worthwhile. When the cost of capital is low, the company can take on projects that offer higher returns than the cost of capital, potentially leading to increased profitability.

It’s important to note that WACC is a blended cost of capital, considering both debt and equity. Companies often strive to optimize their capital structure to achieve a WACC that minimizes their overall cost of capital while maintaining an appropriate level of financial risk. Comparing a company’s WACC to others in the same industry can provide some context. Still, it’s essential to understand the specific circumstances and risk profiles of each company before drawing direct comparisons.

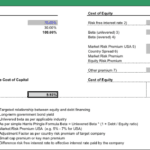

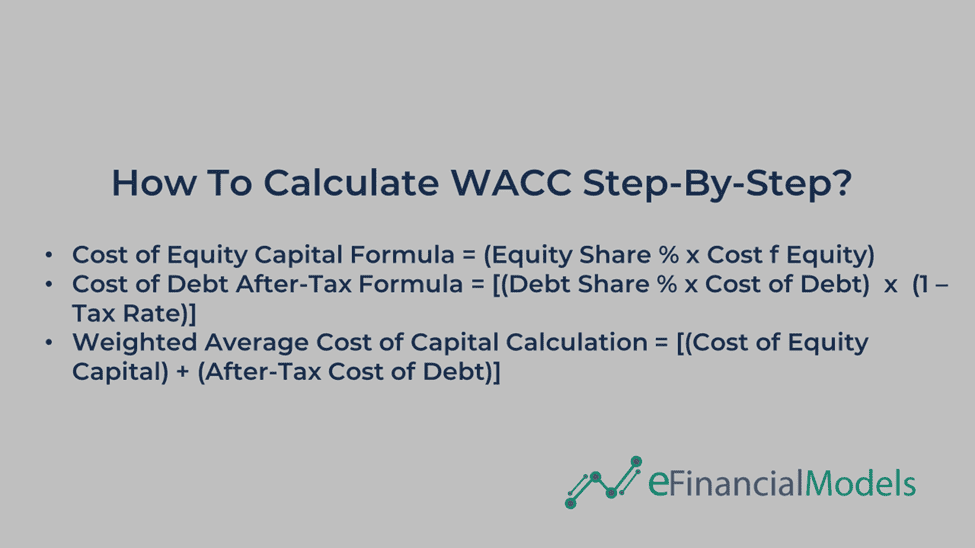

How To Calculate WACC Step-By-Step?

The Weighted Average Cost of Capital calculation involves determining the different sources of financing a company uses, weighted by their proportion in the company’s capital structure. Here’s a step-by-step to the Weighted Average Cost of Capital calculation:

- Determine the proportion of each capital component. Calculate the percentage of equity and debt in the company’s capital structure.

- Solve for the Cost of Equity Capital formula. It is by multiplying the percentage of equity shares with the cost of equity. Use the appropriate method, such as the Capital Asset Pricing Model (CAPM), Dividend Discount Model (DDM), or the Bond Yield Plus Risk Premium method, to determine the cost of equity.

- Solve for the Cost of Debt After-Tax formula. Determine the cost of debt from the interest rate on the company’s existing debt or through other debt valuation methods.

- We can now proceed with the Weighted Average Cost of Capital calculation using the formula: WACC = (Cost of Equity Capital) + (After-Tax Cost of Debt)

It’s important to note that WACC calculations might vary based on the specifics of a company’s financial structure and the methods used to determine the cost of equity and debt. These steps offer a generalized guideline for calculating WACC. Always ensure the use of accurate and relevant data for a precise estimation of WACC.

Why Use a WACC Excel Template?

A WACC Excel template is an instrumental tool, providing a quantitative foundation for many strategic financial analyses and decision-making processes. A well-constructed WACC Excel template can streamline and enhance the efficacy of several core financial exercises:

- DCF Valuation Analysis: The Discounted Cash Flow (DCF) valuation is a cornerstone of investment banking and corporate finance. It relies on the WACC to discount future cash flows to their present value, which is critical in determining the intrinsic value of a company, asset, or project. A WACC Excel template is designed to encapsulate complex calculations into a user-friendly interface, enabling users to input forecasted cash flows and instantly compute present values using the WACC. It not only expedites the analysis process but also minimizes the potential for manual error, thus increasing the reliability of the valuation output.

- Economic Profit Calculation: Economic profit, or Economic Value Added (EVA), measures the value a company generates from its capital. It is the surplus after deducting the cost of capital (WACC) from the company’s net operating profit after taxes (NOPAT). A Google WACC calculator helps in swiftly ascertaining the cost of the capital component of this calculation.

Investment Analysis: Investment decisions are fundamentally based on comparing the expected returns with the costs associated with the investment, where WACC serves as a benchmark cost of capital. A WACC Excel template allows investors and analysts to input different financing scenarios to see how changes in capital structure might affect the cost of capital and, hence, the potential for an investment to meet or exceed that cost.

For an organization like eFinancialModels, providing clients with a sophisticated Google WACC calculator empowers them with a tool that encapsulates financial theory into a practical application, enabling them to execute complex financial analyses with precision and confidence. It can significantly enhance their capacity to make informed financial decisions, evaluate strategic opportunities, and fulfill the overarching objective of maximizing shareholder value.

In conclusion, a WACC Excel template is more than just a calculator; it’s a strategic asset in the financial toolkit of businesses and financial professionals. Its integration into your suite of financial model templates and services would not only exemplify your commitment to delivering professional, top-tier financial tools but also solidify your clientele’s trust in your ability to equip them for success in their financial endeavors.

Similar Products

Other customers were also interested in...

Waterfall Profit Distribution Model (up to 4 Tiers...

We are introducing our 4-Tier Waterfall Profit Distribution Model. The waterfall profit distribution... Read more

Budget Template in Excel – Analysis in 4 Ste...

The Purpose of the 4 Step Budget Analysis Spreadsheet Template is to offer a user-friendly solution ... Read more

Private Equity Fund Model (Investor Cashflows)

Private Equity Financial Model to analyze fund cashflows and returns available to Limited Partners (... Read more

All My Financial Models, Spreadsheets, Templates, ...

Lifetime access to all future templates as well! Here is a set of spreadsheets that have some of the... Read more

Advanced Financial Model with DCF & Valuation

General Overview Advanced Financial Model suitable for any type of business/industry and fully cu... Read more

Startup Company Financial Model – 5 Year Fin...

Highly-sophisticated and user-friendly financial model for Startup Companies providing a 5-Year adva... Read more

Investment Financial Models – All-in-One Bundle ...

A collection of templates suitable for investment decisions in various types of businesses/industrie... Read more

3 Statement Financial Modeling with DCF & Rel...

Financial Modeling Tutorial guides user via step by step approach on how to build financial models w... Read more

Detailed Leveraged Buyout (LBO) Financial Model Te...

This is a detailed and easy-to-use Leveraged Buyout (LBO) financial model. This is a modular financi... Read more

Dynamic Arrays Financial Model

Dynamic Arrays Financial Model generates the three financial statements (profit & loss, balance ... Read more

Reviews

Great spreadsheet, easy to use and nice layout. .I always use your spreadsheets and never been disappointed

89 of 173 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

very nice WACC tool with graphs ! usefull! Thanks for the free spreadsheet.

110 of 192 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

Great spreadsheet, easy to use and nice layout. Thanks for the free spreadsheet.

138 of 287 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

You must log in to submit a review.