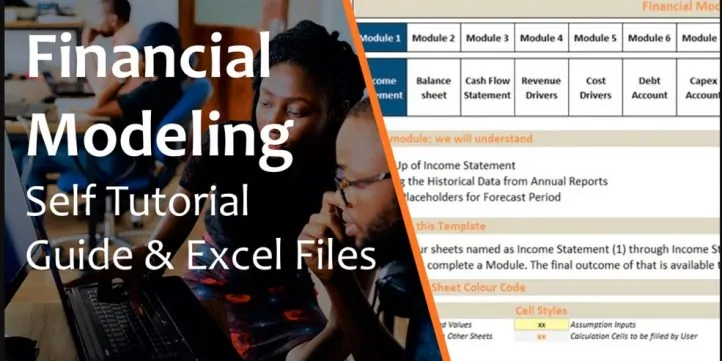

3 Statement Financial Modeling with DCF & Relative Valuation – Self Learning Kit

Financial Modeling Tutorial guides user via step by step approach on how to build financial models with DCF valuation

Financial Modeling Tutorial is a comprehensive step-by-step guide on how to build financial models for discounted cash flow (DCF) valuation and relative valuation.

This Tutorial is divided into the following 16 modules:

1. Building Historical Income statement

2. Building Historical Balance Sheet

3. Building Historical Cash Flow Statement

4. Setting up Revenue Drivers

5. Building Cost Drives

6. Setting up Debt Account

7. Accounting for Capital Expenditure and Depreciation

8. Working Capital Calculations

9. Calculating Interest Income and Interest Expense

10. Setting up Equity Capital and Reserve Account

11. Calculating Income Tax and Deferred Tax

12. Financial Statement Integration

13. DCF Valuation

14. Financial Ratios

15. Relative Valuation/ Comparable Company Analysis

15. Dashboarding

In addition to the above files, there are two PDFs on:

1. Discounted Cash Flow valuation: which talks about the concept of DCF valuation along with its components, How to calculate FCFF and FCFE, Discount Rate, Advantages and Disadvantages of DCF.

2. Enterprise Value: which talks about the concept of EV along with its components, how to derive Equity value from Enterprise Value, Valuation Multiples EV Based, and Price based.

This pack also includes a Final Model for the user’s preference. Therefore, this package is a set of self-study templates that will help a user walkthrough on how to conduct a valuation.

This valuation model is built for Tesla Motors and the user can download their annual reports from their investor relation website to understand the historical data.

Similar Products

Other customers were also interested in...

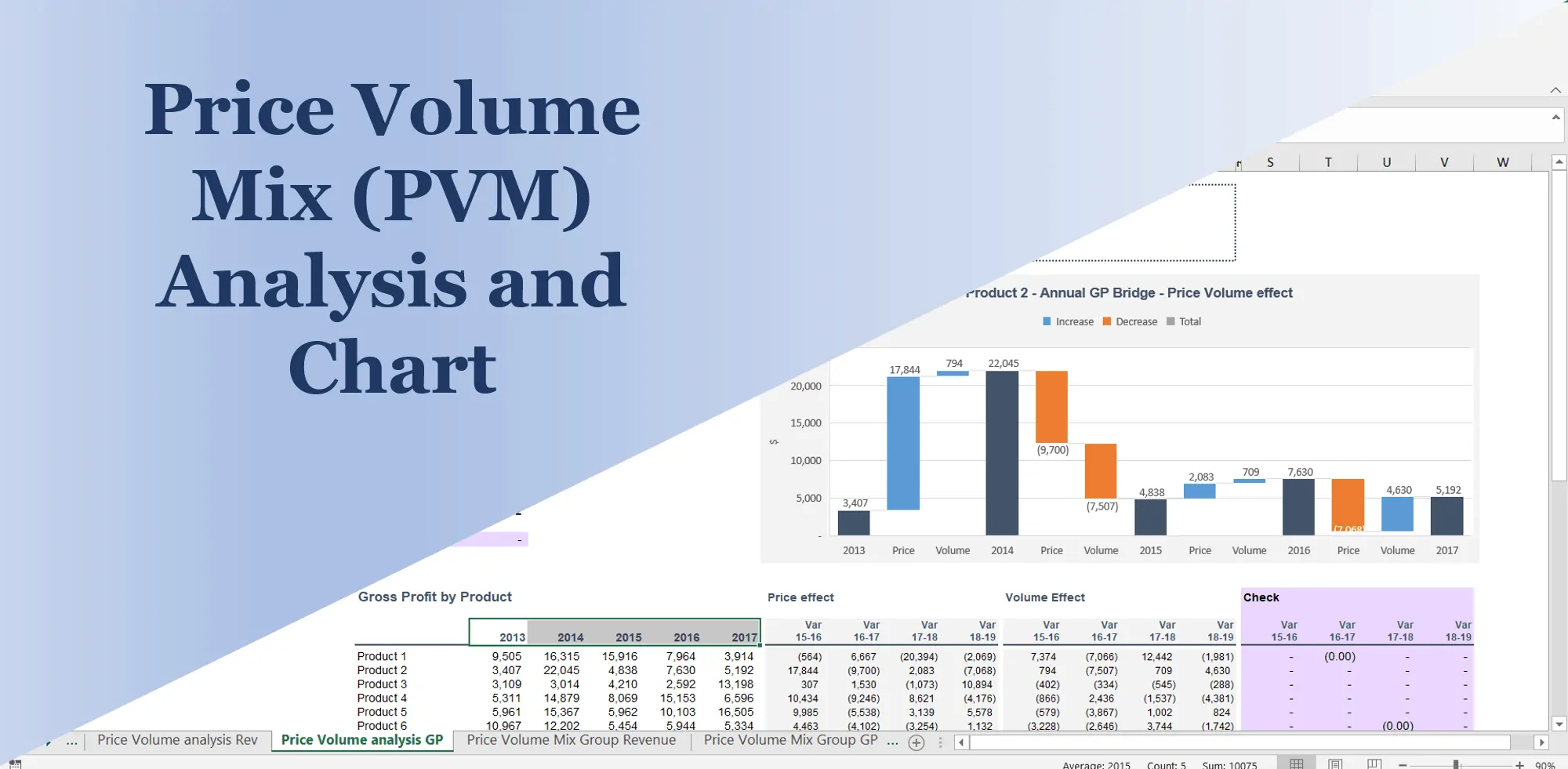

Price Volume Mix Charts and Analysis – On re...

Best practice model for a complete Price Volume Mix (PVM) analysis on revenue and on gross profit by... Read more

Financial Analysis Template

Financial analysis is used to evaluate economic trends, set financial policy, build long-term plans ... Read more

Private Equity Fund Model (Investor Cashflows)

Private Equity Financial Model to analyze fund cashflows and returns available to Limited Partners (... Read more

All My Financial Models, Spreadsheets, Templates, ...

Lifetime access to all future templates as well! Here is a set of spreadsheets that have some of the... Read more

Startup Company Financial Model – 5 Year Fin...

Highly-sophisticated and user-friendly financial model for Startup Companies providing a 5-Year adva... Read more

Leveraged Buyout (LBO) Model

Leveraged Buy Out (LBO) Model presents the business case of the purchase of a company by using a hig... Read more

Franchisor Licensing: Financial Model with Cap Tab...

Build up to a 10 year financial forecast with assumptions directly related to the startup and operat... Read more

Joint Venture and Fund Cash Flow Waterfall Templat...

Here are all the spreadsheets I've built that involve cash flow distributions between GP/LP. Include... Read more

Small Business Playbook (Financial / Tracking Temp...

About the Template Bundle: https://youtu.be/FPj9x-Ahajs These templates were built with the ... Read more

Advanced Financial Model with DCF & Valuation

General Overview Advanced Financial Model suitable for any type of business/industry and fully cu... Read more

You must log in to submit a review.