What is a Residual Income Model?

Residual Income Model is an equity valuation method used to estimate the true or intrinsic value of a stock based on the present value of all future residual income the company generates.

A company has two sources of capital, equity, and debt. The cost of debt, represented by interest expense, is deducted from operating income to calculate net income. However, the cost of equity represented by dividends and other equity distributions are not accounted for (Dividends on common stock are not reported in the Income Statement as these are not considered as expenses). Because of this, a company’s net income does not necessarily reflect its economic profit. A company may be earning profits but after paying dividends, the company is economically unprofitable after all.

To reflect the effect of the cost of equity, it must be considered as a “charge” against the company’s net income. The “equity charge” is the company’s total equity capital multiplied by the cost of equity. The mathematical formula for the equity charge is:

Equity Charge = Equity Capital x Cost of Equity

To calculate for the residual income, simply deduct the equity charge from net income. The term “residual” represents the excess income after accounting for the company’s true cost of capital. The residual income formula is:

Residual Income (RI) = Net Income – Equity Charge

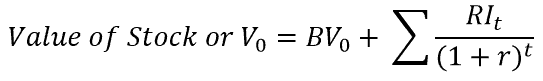

The Residual Income Model Formula has three (3) components:

- Residual Income

- Book Value of the company’s equity. Also known as Shareholder’s equity.

- Cost of equity (%) or required rate of return for equity investors. Capital Asset Pricing Model (CAPM) is often used to determine the rate.

The intrinsic value of the stock is determined by adding the company’s current book value of equity capital and the present value of the company’s future residual income discounted at the cost of equity. The Residual Income Model Formula is:

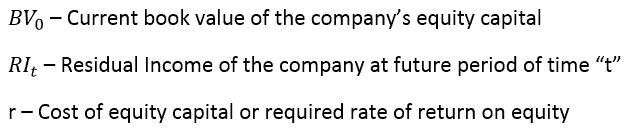

Where:

If the value calculated is higher than the current trading price, the stock is undervalued and may qualify as a signal to buy. On the other hand, if it is lower the stock is overvalued and may not be a sound investment.

The residual income model is appropriate for companies in the following scenarios:

- A company is not paying dividends or exhibits an unpredictable dividend pattern (no established dividend policy). This model is a good alternative to the Dividend Discount Model (DDM). You can read more about the DDM here: What is a Dividend Discount Model as well as download for free the DDM Excel Calculator here: Multi-Stage Dividend Discount Model and Gordon Growth Model Calculator.

- A company generates negative free cash flow for a certain number of years but is expected to generate positive cash flow at some point in the future.

Here is a list of industry-specific financial model templates that you can use as a base or reference as you create your own financial model that calculates the residual income: