Interest Rate Swap Valuation and Payment Schedule

Compare fixed and variable legs of an interest rate swap.

Video Tutorial:

An interest rate swap acts just like it sounds. One entity pays a fixed interest rate to another. They then receive a variable interest rate from that entity. Based on how the variable rate changes, it will determine the difference in cash flows over time and who is paid what and when.

You also have the valuation aspect. It is possible for one side to have to pay more to the other, but the side receiving more cash flow over time actually ends up with a lower net present value because the increase in cash flows to them happens further out in time. This would be driven by the discount rate assumption as well as the amount you expect Libor to change and when you expect that change to happen. All are editable variables within this model.

There are charts to show the accumulated net present value of both variable / fixed legs as well as the non-discounted cash value and the payment schedule of both fixed/variable legs over time (i.e. who pays what to who and when) based on assumptions.

Similar Products

Other customers were also interested in...

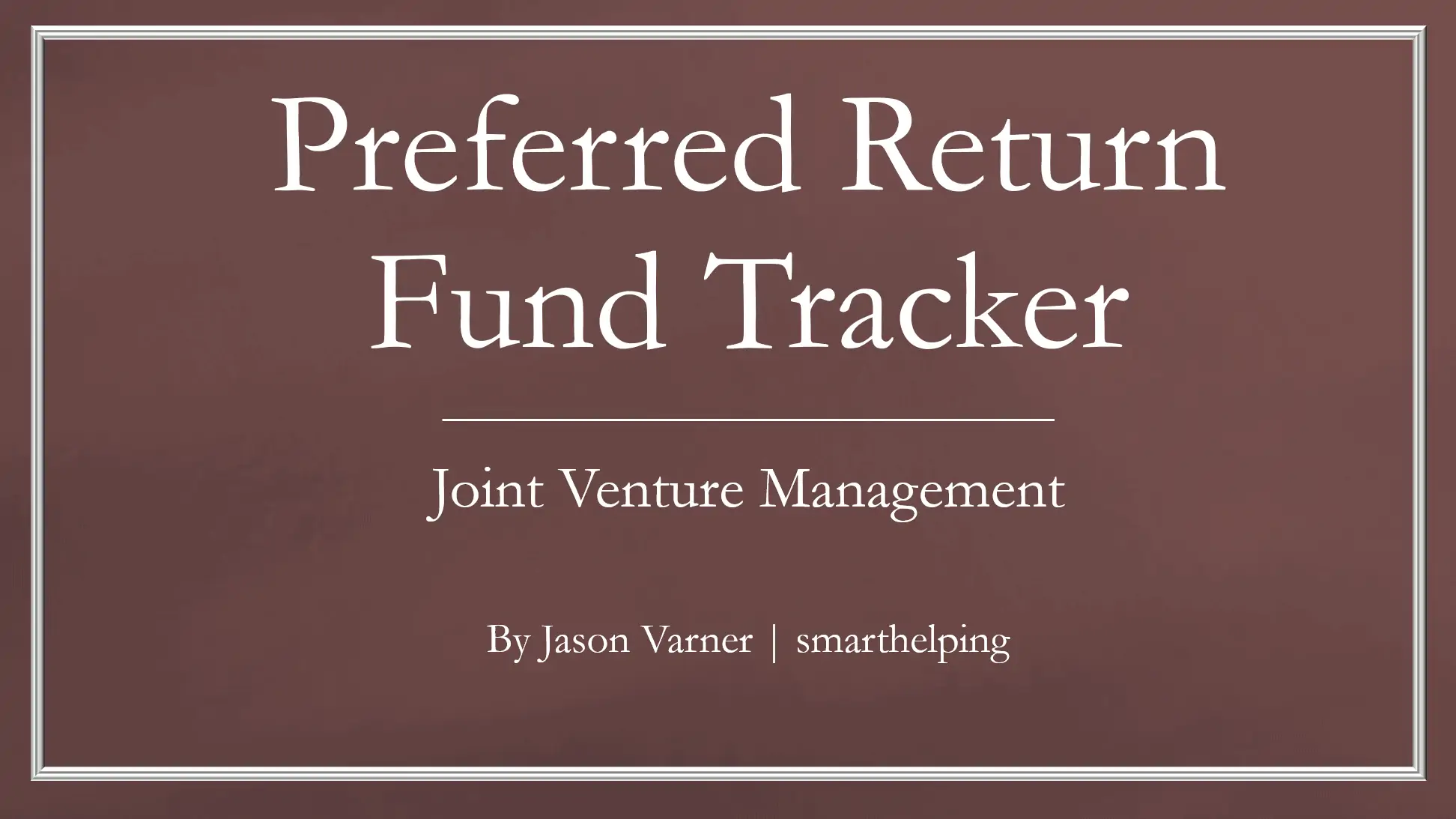

Investment Fund Preferred Return Tracker: Up to 30...

Track preferred returns for investors in a fund with this template. Premium joint venture tracking t... Read more

Investment Metrics to Compare Multiple Stocks / Cr...

A general set of models that come with explainers on how you derive various financial ratios from a ... Read more

Private Equity Fund Model (Investor Cashflows)

Private Equity Financial Model to analyze fund cashflows and returns available to Limited Partners (... Read more

Debt Fund Excel Model

Explore the Debt Fund Excel Model, a comprehensive tool for evaluating new credit fund opportunities... Read more

Leveraged Buyout (LBO) Financial Projection Model

User-friendly financial model to project and analyse the financial outcomes (IRR, projected financia... Read more

Collateralized Mortgage Obligations Model

Collateralized Mortgage Obligations Model presents a simple model where mortgage backed securities a... Read more

Amortization Schedules Template (Loans, Mortgages,...

User friendly template including Amortization Schedules for Loans, Mortgages, Operating and Finance ... Read more

Asset Management Company – Closed End Fund M...

Financial Model presenting a scenario of a Closed-End Fund managed by an Asset Management Compan... Read more

Investment Holding Company 3 Statement Financial P...

3 statement 5 or 8 year rolling financial projection Excel model for an investment holding company h... Read more

Mergers and Acquisition (M&A) Financial Projec...

User-friendly financial model to project and analyze the financial outcomes and feasibility of an Me... Read more

You must log in to submit a review.