Bonds

Engineered for accuracy and efficiency, our templates cater to the needs of seasoned experts and those new to financial modeling, ensuring seamless integration into various investment strategies. By leveraging our advanced modeling solutions, users can enhance their analytical capabilities, enabling precise forecasting and strategic decision-making in bond investments. Discover the essence of professional bond analysis with our comprehensive financial model templates and redefine your approach to the bond market.

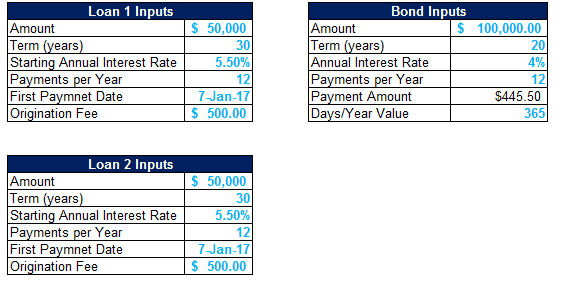

Amortization Schedules Template (Loans, Mortgages, LC, Bonds, Leases)

User friendly template including Amortization Schedules for Loans, Mortgages, Operating…

Comprehensive Financial Model and Valuation – Restaurant Business

Discover the Comprehensive Restaurant Company Financial Model and Valuation, an…

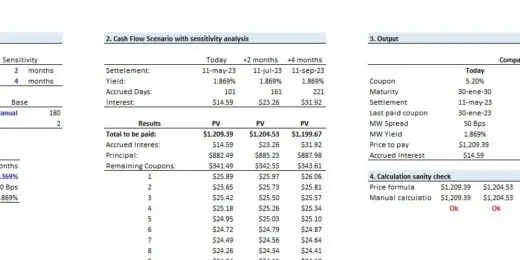

Bond, Loan or Note Make Whole Calculator

The model is designed to evaluate a make-whole calculator for…

Detailed Leveraged Buyout (LBO) Financial Model Template and Presentation

This is a detailed and easy-to-use Leveraged Buyout (LBO) financial…

The Realtors Quintessential ALL-IN-ONE Toolkit

Professional Realtors need a professional Toolkit which allows them to…

Projections Plan Template

Take control of your businesses, financial with this contracting, manufacturing…

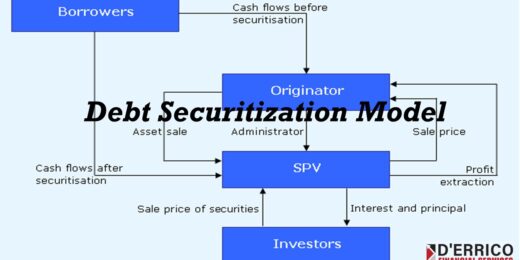

Collateralized Mortgage Obligations Model

Collateralized Mortgage Obligations Model presents a simple model where mortgage…

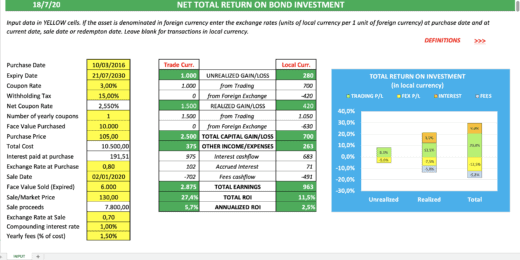

NET TOTAL RETURN ON BOND INVESTMENT CALCULATOR

CALCULATE NET TOTAL RETURN ON BOND INVESTMENT DENOMINATED IN ANY…

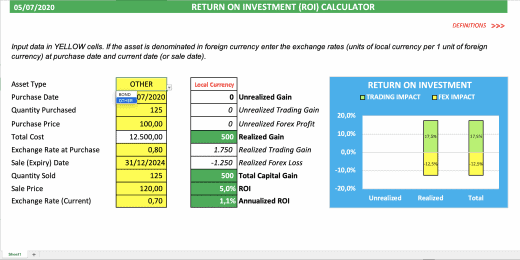

Analytical Return on Investment (ROI) Calculator

CALCULATE RETURN ON INVESTMENTS DENOMINATED IN FOREIGN CURRENCY, SPLIT BETWEEN…

Youtube Content Creator Financial Model Excel Template (Fully-Vetted and Ready-to-Use)

Fully-Vetted Comprehensive Youtube Content Creator Financial Model + Video Series…

Lead Generation Financial Model Excel Template (Fully-Vetted and Ready-to-Use)

Fully-Vetted Comprehensive Lead Generation Financial Model + Video Series +…

Cloud Services Financial Model Excel Template (Fully-Vetted and Ready-to-Use)

Fully-Vetted Comprehensive Cloud Services Financial Model + Video Series +…

Online Classified Financial Model Excel Template (Fully-Vetted and Ready-to-Use)

Fully-Vetted Comprehensive Online classified Financial Model + Video Series +…

Data Sales Financial Model Excel Template (Fully-Vetted and Ready-to-Use)

Fully-Vetted Comprehensive Data Sales Financial Model + Video Series +…

Video Streaming Financial Model Excel Template (Fully-Vetted and Ready-to-Use)

Fully-Vetted Comprehensive Video Streaming Financial Model + Video Streaming Guide…

Online Marketplace Financial Model Excel Template (Fully-Vetted and Ready-to-Use)

Fully-Vetted Comprehensive Online Marketplace Financial Model + Video Series +…

SAAS Financial Model Excel Template (Fully-Vetted and Ready-to-Use)

Fully-Vetted Comprehensive SAAS Financial Model + Video Series + Pocket…

eCommerce Financial Model Excel Template (Fully-Vetted and Ready-to-Use)

Fully-Vetted Comprehensive eCommerce Financial Model + Video Series

Coworking Financial Model Excel Template (Fully-Vetted and Ready-to-Use)

Fully-Vetted Comprehensive Coworking Financial Model + Video Series + eBook

Interest Rate Swap Valuation and Payment Schedule

Compare fixed and variable legs of an interest rate swap.

A Beginner’s Guide to Bond Investing

Bond investing might seem like navigating an arcane realm reserved for the financial elite, but it's a fundamental aspect of the global economy accessible to everyone. Bonds are the building blocks of financial stability, not just for individuals but for entire countries. At their core, bonds are loans from investors to governments or corporations, which promise to pay back the principal amount with interest at predetermined intervals. This mechanism makes bonds a beacon of stability in the turbulent seas of investment options.

The allure of bond investing lies in its ability to provide regular income through interest payments, making it an attractive investment for those who seek a steady cash flow or wish to preserve their capital with minimal risk. Furthermore, bonds are crucial in diversifying investment portfolios and mitigating market volatility risks. Bonds are significant beyond individual investment portfolios to the very fabric of economies. They are instrumental in financing public infrastructures, such as roads and schools, and supporting corporate initiatives that drive innovation and job creation.

Thus, knowing what bond investing is is not just an exercise in financial acumen but a step towards understanding the intricate dynamics that govern economies and the opportunities for growth, stability, and contribution to the greater good.

What is Bond Investing?

What is bond investing involves purchasing debt securities to earn interest income over time and benefit from capital appreciation. When you buy a bond, you essentially loan the issuer for a predetermined period. In return, the issuer agrees to pay you regular interest rate payments at a fixed or variable rate until the bond reaches its maturity date. The issuer also agrees to repay the principal amount (the initial investment) on the specified maturity date.

Bonds are considered fixed-income investments because they typically provide steady income through interest payments. This makes them an attractive option for investors seeking regular income or diversifying their investment portfolio. Bond investments' risk and return profiles vary widely, depending on the issuer's creditworthiness and the bond's duration, interest rate, and market conditions.

Key Components of Bond Investing

To further define what is bond investing, we need to understand its key components – the principal (face value), coupon rate, issuer, maturity date, and yield to maturity. These components affect the types of bonds in finance.

- Principal (Face Value): The bond principal, or face value, is the amount of money the issuer agrees to repay the bondholder upon the bond's maturity. It represents the initial investment made by the bond purchaser and does not fluctuate over the bond's life. This principal amount is crucial because it determines the interest payments the bondholder receives, as the coupon rate is applied to the principal to calculate the periodic interest payments. Upon maturity, the bondholder is entitled to receive back this original sum, making it a critical element of the bond's overall value and investment return.

- Coupon Rate: It is the interest rate that the issuer agrees to pay the bondholder annually, expressed as a percentage of the bond's face value. A bond's coupon rate can align with its par value, be priced at a premium, or be issued at a discount. When a bond is issued at par, its coupon rate equals the market interest rate; a premium bond has a coupon rate higher than the market rate, and a discount bond's coupon rate is lower, affecting the bond's selling price.

- Issuer: The bond issuer is the entity, such as a corporation, government, or municipality, that borrows money by selling the bond and is obligated to repay the principal and interest to bondholders. The riskier investors perceive the issuer, the higher the coupon rate offered to compensate investors for that additional risk. Credit rating agencies assess and assign credit ratings to companies and their bonds. The highest quality bonds are called "investment grade," encompassing debt from the U.S. government and highly stable firms, including numerous utilities. A bond issuer determines the types of bonds in finance.

- Maturity Date: This is the time when the bond expires, and the issuer will repay the bond's face value to the bondholder. A bond's maturity date can range from short-term (a few years or less) to medium-term (several years), long-term (decades), or even perpetual, meaning it has no set expiration date. Bonds with a significantly extended maturity period typically offer a higher interest rate to compensate for the increased exposure to interest rate and inflation risks over a longer duration.

- Yield to Maturity: This is the rate of return received from investing in the bond. It considers the coupon payments, the bond's price, and the time remaining until maturity. Yield to Maturity (YTM) is a critical factor in bond investing, as it helps investors assess the return they can expect from their investment relative to its risk.

The Types of Bonds in Finance According to the Issuer

What is bond investing involves debt securities that entities issue to raise capital, and the issuer plays a critical role in defining types of bonds in finance. The different types of bonds in finance, according to the issuer, directly influence the bond's risk profile, interest rates, maturity dates, yield, and how they're treated for tax purposes, thus affecting their attractiveness to different types of investors based on their investment strategies, risk tolerance, and tax considerations.

Corporate Bond Investing

Corporate bond investing involves purchasing bonds issued by corporations. These bonds are used to raise funds for various purposes, such as expanding operations or refinancing existing debts. Corporate bond investing generally offers higher coupon rates compared to government and municipal bonds, reflecting the higher risk associated with the potential for corporate default. Their interest payments and principal repayment are subject to the issuing company's financial health, affecting the bond's yield and the risk to the principal invested. Corporate bonds' maturity dates can vary widely, offering options for both short-term and long-term investors. Corporations commonly issued include secured and unsecured, convertible, callable, and high-yield (junk) bonds.

Government Bond Investing

Government bond investing refers to the purchase of securities issued by national governments. These bonds are considered among the safest investments, primarily when issued by stable, developed countries, as the full faith and credit of the issuing government back them. Due to their lower risk, government bond investing typically yields lower than corporate bond investing. The issuing country's economic policies and financial health influence the coupon rate, maturity date, and yield of government bonds. Investors often use government bonds to preserve capital and generate steady, albeit lower, income. Common types of government bonds include Treasury bonds (T-bonds), Treasury notes (T-notes), Treasury bills (T-bills), and savings bonds.

Municipal Bond Investing

Municipal bond investing involves buying bonds issued by states, cities, counties, and other municipal entities. The primary appeal of municipal bonds is their tax-advantaged status, as interest income from these bonds is often exempt from federal income tax and sometimes state and local taxes if the investor resides in the state of issuance. While generally safer than corporate bonds, the risk, coupon rate, and yield of municipal bond investing can vary depending on the financial health of the issuing municipality. Maturity dates for municipal bonds can range widely, offering flexibility for investors. Municipal bonds commonly include general obligation bonds, backed by the issuer's credit and taxing power, and revenue bonds, which are repaid from specific revenue sources.

Agency Bond Investing

Agency bond investing focuses on securities issued by government-sponsored enterprises (GSEs) and federal agencies. While not technically backed by the full faith and credit of the U.S. government (with some exceptions), these bonds are considered low-risk due to their government affiliation. Agency bonds typically offer slightly higher yields than Treasury securities but lower yields than corporate and some municipal bonds. The interest income from some agency bonds may be exempt from state and local taxes. The risk to the principal is low, and the maturity dates can vary, allowing investors to choose according to their time horizon. Global agency bonds commonly include those issued by international organizations such as the World Bank, the European Investment Bank, and the Asian Development Bank. In the United States, they include those from government-sponsored enterprises such as Fannie Mae, Freddie Mac, the Federal Home Loan Banks, and the Federal Farm Credit Banks.

Pros & Cons of Bond Investing

Bond investing offers the benefit of predictable income through regular interest payments, appealing to those seeking a lower-risk investment option than stocks. However, it also presents drawbacks, such as lower potential returns and sensitivity to interest rate changes, which can affect bond values.

Pros

- Predictable Income Stream: One of the primary advantages of investing in bonds is their predictable income stream. Bonds typically pay interest at regular intervals, such as semi-annually or annually, offering steady investor cash flows. This predictability particularly appeals to retirees and others who rely on their investments for living expenses, as it allows for better financial planning and stability.

- Preserve Capital Investment: Bonds are often considered safer investments than stocks, as they have a lower risk of losing the principal amount invested. When a bond is held to maturity, the investor is expected to receive back the total principal amount and the interest earned during the bond's term. This preservation of capital is a significant benefit for those who are risk-averse or looking to protect their investment in volatile markets.

- Reduce Investment Risks: Investing in bonds can help diversify an investment portfolio, reducing overall investment risk. Bonds often move inversely to stocks; when stock prices fall, bond prices can increase or remain stable, providing a cushion against market volatility. By including bonds in a portfolio, investors can achieve a more balanced investment approach, mitigating the impact of stock market downturns and smoothing out returns over time.

Cons

- Credit Default Risk: Despite being considered safer than stocks, bonds are not without risks, and one of the main concerns is credit default risk. This risk refers to the possibility that the bond issuer may fail to make timely interest payments or return the principal at maturity, leading to financial losses for the investor. Credit default risk varies among issuers, with corporate bonds generally carrying a higher risk than government bonds.

- Inflation Risk: Another downside of bond investing is inflation risk. If the inflation rate exceeds the interest rate earned on bonds, the purchasing power of the interest payments and the principal can erode over time. This risk is particularly relevant in long-term bonds, as inflation can significantly impact the actual value of the returns over an extended period.

- Low-Interest Rate: In environments with low-interest rates, bond returns can be modest, making them less attractive compared to other investment options. Additionally, when interest rates rise, existing bonds with lower interest rates become less desirable, decreasing their market value. This interest rate risk can affect the performance of a bond investment, especially if the investor needs to sell the bond before maturity.

How Bonds Work

Understanding how bonds work is essential for investors looking to diversify their portfolios and manage risk. Here's a step-by-step guide to understanding how bonds work:

Step 1: The Issuance of Bonds

The process of how bonds work begins when an entity, such as a government, municipality, or corporation, needs to raise funds for various purposes like infrastructure projects, business expansion, or refinancing existing debt. To do this, the issuer creates bonds that outline the loan's terms, including the interest rate (coupon rate), the maturity date (when the principal is due to be repaid), and the face value (the amount paid back at maturity). These bonds are then offered to investors, effectively borrowing money from those who purchase them.

Step 2: Purchasing Bonds

Investors buy bonds for various reasons, including income generation, preservation of capital, and portfolio diversification. When purchasing a bond, investors agree to lend the issuer a specific amount for a period. In exchange, the issuer promises to pay periodic interest payments, typically semi-annually, and return the bond's face value on maturity. Bonds can be purchased through public offerings or on the secondary market, where previously issued bonds are bought and sold.

Step 3: Interest Payments

After purchasing a bond, the investor receives regular interest payments over its life. The interest rate, or coupon rate, is determined at issuance and is based on various factors, including the issuer's creditworthiness, prevailing market interest rates, and the bond's maturity. These payments are a primary reason investors choose to include bonds in their investment portfolios, as they provide a predictable income stream.

Step 4: Maturity Repayment

Upon maturity, the bond's principal amount (face value) is repaid to the investor. This repayment marks the end of the bond contract. The investor's return consists of the total interest payments received over the bond's life and the return of the principal. The total return depends on the bond's coupon rate, the price paid for the bond, and whether it is held to maturity or sold earlier.

Step 5: Risks and Considerations

While bonds are generally considered safer investments than stocks, they are not without risk. Credit risk (the issuer's ability to make interest payments and repay the principal), interest rate risk (the risk of bond prices falling due to rising market interest rates), and inflation risk (the risk that inflation will erode the purchasing power of the interest payments) are essential considerations. Investors should assess these risks and conduct thorough research or consult with financial advisors to make informed investment decisions.

Understanding the mechanics of how bonds work and the roles they can play in an investment portfolio allows investors to make more informed decisions and better manage their financial risks.

Bond Investing Simplified: The Key Role of Financial Modeling

What is bond investing involves purchasing debt securities issued by entities such as corporations or governments, expecting to earn a return through periodic interest payments and the eventual return of the bond's face value at maturity. This investment strategy's key components include understanding the bond's yield, maturity date, and the issuer's credit quality. These factors help investors assess a bond's risk and potential return, guiding their investment decisions to balance risk and reward.

In finance, bonds can be categorized based on their issuer, each offering unique risk and return profiles. Government bond investing is considered the safest, and national treasuries back it, including U.S. Treasury bonds. Municipal bond investing is issued by states, cities, or other local government entities and often offers tax-exempt interest. Corporate bond investing that companies issue carries higher risk but potentially higher returns than government securities. International bonds issued by foreign governments or corporations introduce currency risk but offer diversification.

The pivotal role of financial modeling in all types of bonds in finance cannot be overstated. Great financial models enable investors to simulate various scenarios and assess the impact of market conditions on bond performance. By leveraging financial modeling, investors can make informed decisions, tailor their investment strategies to their risk tolerance, and optimize their bond portfolios for better outcomes.