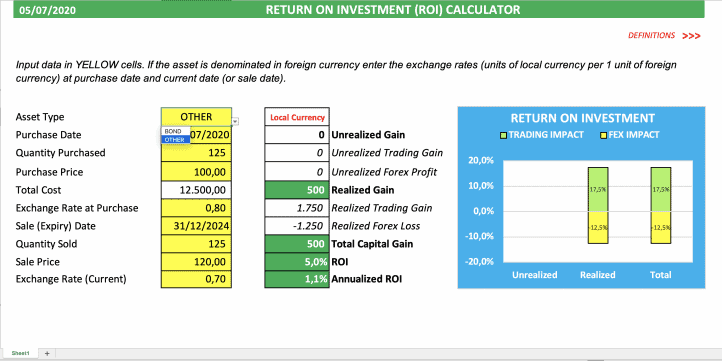

Analytical Return on Investment (ROI) Calculator

CALCULATE RETURN ON INVESTMENTS DENOMINATED IN FOREIGN CURRENCY, SPLIT BETWEEN REALISED AND UNREALISED, SHOWING IMPACT OF EXCHANGE RATE DIFFERENCES.

This tool calculates a return of an investment denominated in any currency, split between Realized and Unrealized and further dissected into Trading and Foreign Exchange Gains or Losses.

Gains or losses are said to be “realized” when an asset owned (stock or other investment) is actually sold. An unrealized loss occurs when an asset’s market value decreases after an investor buys it, but has yet to sell it. If the value rises above the original purchase price, the investor would have an unrealized gain for the time they hold onto the stock.

When buying an asset denominated in foreign currency, there are 2 components to be kept under control:

• Trading gains/losses (the difference between purchase price and sale price)

• Foreign Exchange gains/losses (delta between exchange rates at purchase and at the sale)

If, for example, you invest €10.000 to buy stocks denominated in USD at a price of say $100 per share and the exchange rate USD/EUR is say 0,80 (Euros for 1 Dollar), converting your €10.000 into $12.500 (10.000/0,80) you will be able to buy 125 shares.

Suppose you sell your 125 shares after 3 years, at a price of $120 per share, generating $15.000. Suppose in the meantime the Euro appreciated vis-à-vis the dollar, the exchange rate now is 0,70. Your sales proceeds converted to Euro will, therefore, generate €10.500 (15.000*0,70). Since you originally invested €10.000, you realize a net capital gain of €500.

Now let’s analyze where this comes from:

• you realized a Trading Gain of $2.500 [(125 * ($120-$100)] which converted at 0,70 will generate €1.750

• you realized a Forex Loss of €1.250 [($12.500*(0,80-0,70)], due to the USD devaluing

• in net terms you realized a capital gain of €500 (1.750-1.250)

Your return on investment (ROI) will be 5% in Euros [(500/10.000)*100] and 20% in USD (2500/12.500*100).

Similar Products

Other customers were also interested in...

Multi-Member Investment Fund Portfolio and Distrib...

A fund management tool to track many positions over time as well as distributions to up to 20 member... Read more

Amortization Schedules Template (Loans, Mortgages,...

User friendly template including Amortization Schedules for Loans, Mortgages, Operating and Finance ... Read more

Savings Bank Financial Model Excel Template

Savings Bank Budget Template There's power in Cash Flow Projections and the insight they can provide... Read more

Private Equity Fund Model (Investor Cashflows)

Private Equity Financial Model to analyze fund cashflows and returns available to Limited Partners (... Read more

Top 16 Google Sheet Templates

This is a bundle of all the most useful and efficient google sheet templates I have built over the y... Read more

Crowdlending (P2P) Platform – 5 Year Financi...

Financial Model providing an advanced 5-year financial plan for a startup Crowdlending (Peer-to-Peer... Read more

Crowdfunding Platform/Marketplace Financial Model ...

This Crowdfunding Platform Business Plan Model is a perfect tool for a financial feasibility study o... Read more

Asset Management Company – Closed End Fund M...

Financial Model presenting a scenario of a Closed-End Fund managed by an Asset Management Compan... Read more

Investment Fund Preferred Return Tracker: Up to 30...

Track preferred returns for investors in a fund with this template. Premium joint venture tracking t... Read more

The Realtors Quintessential ALL-IN-ONE Toolkit

Professional Realtors need a professional Toolkit which allows them to operate at a higher level. Th... Read more

You must log in to submit a review.