Savings Bank Financial Model Excel Template

Savings Bank Budget Template There’s power in Cash Flow Projections and the insight they can provide your business . Buy Now Five-year financial model template in Excel for Savings Bank with prebuilt three statements – consolidated Income Statement Projection, balance sheet, and Startup Cash Flow Statement. Key financial charts, summaries, metrics, and funding forecasts built-in. Created with the mind of the Savings Bank business. Savings Bank financial model helps you evaluate your startup idea and/or plan a startup costs. Unlocked – edit all. Generates financial model for the Savings Bank, Startup Cash Flow Projection, sources and uses, and financial metrics in GAAP/IFRS formats automatically.

NOTE: Single-User pertains to a limited Single User License where the template can only be used by one single user, while Multi-User is a license for users sharing the template with up to 20 members. Please refer to Terms of Use and License and Permitted Use for clarification.

SAVINGS BANK MODEL KEY FEATURES

Video tutorial:

We do the math

Excel Spreadsheet has all the features above ready with no formula writing, no formatting, no programming, no charting, and no expensive external consultants!

Build your plan and pitch for funding

Impress bankers and investors with a proven, solid Savings Bank financial model that impresses every time.

Print-ready Reports

Solid package of print-ready reports, including a Profit And Loss Pro Forma, Pro Forma Cash Flow Projection, a balance sheet, and a complete set of financial ratios.

Prove You Can Pay Back the Loan You Requested

When you apply for a business loan, bankers will study your Projected Cash Flow Statement in an attempt to answer this question: Can this business pay back the loan? Requesting a loan without showing your Pro Forma Cash Flow Projection for paying it back is a common way to land in the rejection pile. It is exceptionally accurate if your current cash flow won’t cover all of your monthly operating expenses — plus your loan payment. Don’t fall into this kind of situation. Use Cash Flow Projection to strengthen your case by showing the banker exactly how you plan to use the loan and when you will start repaying the debt. This type of forecasting helps you create a road map that can impress a lender with the confidence they need to approve your loan.

Save time and money

Via the model, you can without effort and special education get all the necessary calculations and you will not need to spend money on expensive financial consultants. Your task is building a strategy, evolution, and creativity, and we have already done the routine calculations instead of you.

Manage surplus cash

Most companies don’t have excess cash in the bank. It is a well-known situation. But managing surplus cash for reinvestment in new market opportunities or debt repayments can be essential to keeping stay in the business. Managers are entirely ready to plan for what to do with the cash surplus if they have a forecast of when and where the business will have surplus cash in the bank account. Cash Flow Pro Forma will provide supplementary guidance on what to do with a cash surplus.

REPORTS and INPUTS

All in One Place

Get a generous and expandable Savings Bank excel spreadsheet. You can say that the investment business model is solid if it doesn’t separate when you change your speculations inside the valuation model excel. To make our investment business model amazing and expandable, we have shown anyway numerous circumstances as could be normal in light of the current situation. We have moreover anticipated that each business is surprising, and customers can add, delete, or change any financial information in the template.

Top Revenue

This valuation model template has a tab for a distinct analysis of the association’s revenue streams. With this template, customers can analyze the revenue moves by each product or organization class separately.

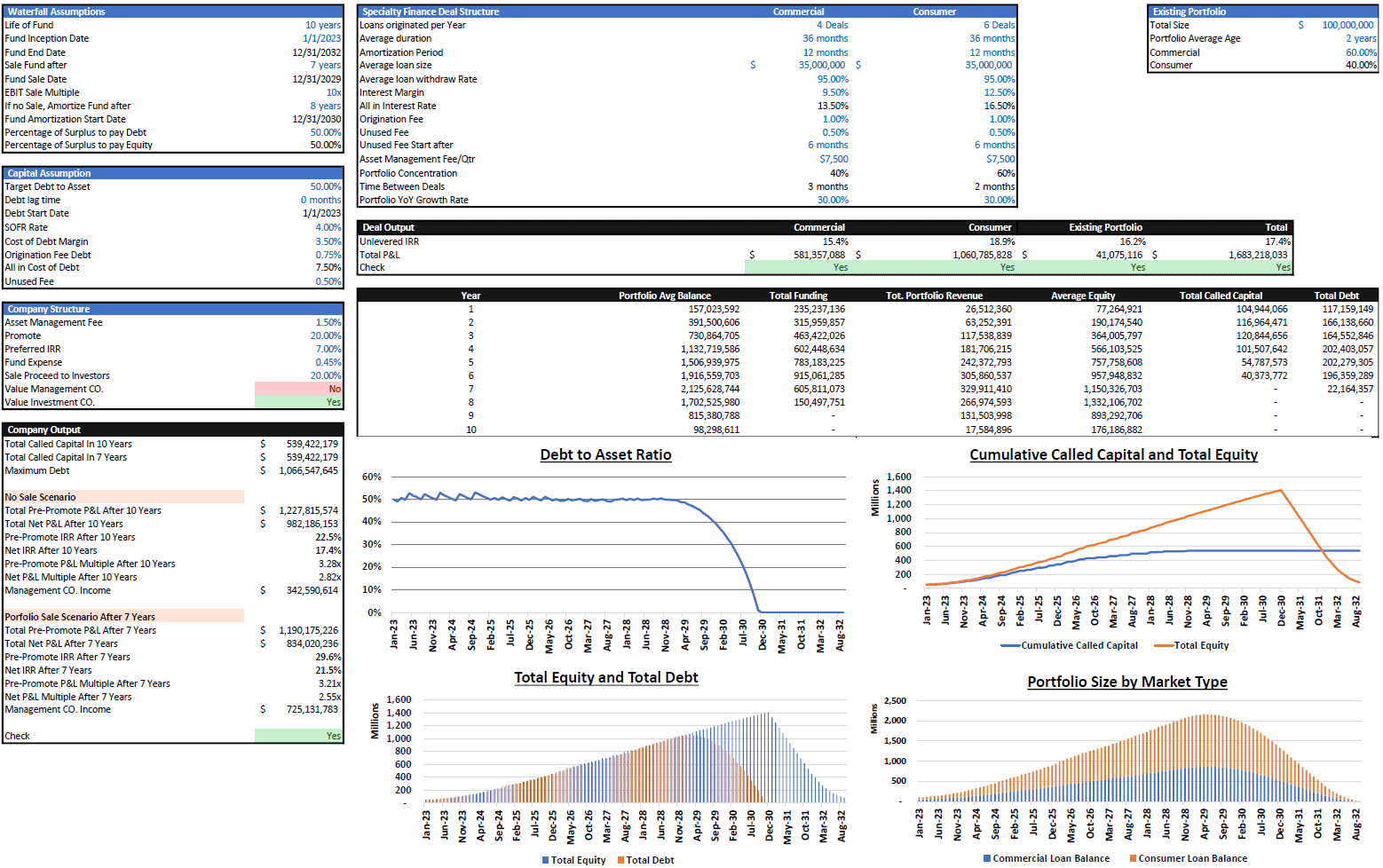

Dashboard

Our Savings Bank financial model has an integrated all-in-one dashboard. This dashboard consists of Cash Flow Projection, Balance Sheet, and Cash Flow Statement Forecast, and users can perform the monthly or annual breakdown for these statements. Users can also obtain information from the dashboard, both in the form of figures and charts.

Top Expenses

In the expenses that are on top of our Savings Bank model, you can track your more significant expenses divided into four categories. The model also has an ‘other’ category, and you can expand or change this table according to your needs. You can reflect your company’s historical data or make a Financial Model Excel Template for the five years.

Financial Statements

The Savings Bank model has a pre-built integrated financial statement structure. It has pre-built templates for the primary financial statements: Balance sheet, Profit And Loss Proforma, Cash Flow Forecast, and Statement of Shareholders’ Capital. All these financial statements are precisely defined and interconnected with the inputs and other spreadsheets within the model.

Valuation

This Savings Bank investment business model contains a valuation analysis template that will allow customers to play out a Discounted Cash Flow valuation (DCF). It will similarly help customers with dismembering financial estimations such as outstanding value, replacement costs, market comparables, progressing trade comparables, etc

Benchmarks

A benchmarking concentration as the segment of the model is, for the most part, used to evaluate a business’s performance by focusing on any event with one explicit pointer and differentiating them and relative markers of various associations in the business.

Regarding the financial benchmarking study, these pointers could be profit margins, cost margins, cost per unit, productivity margins, or others. Later the association’s performance markers should be stood out from that of various associations inside a comparable industry. Benchmarking is a useful strategic organization instrument, which is fundamental for start-ups.

Associations can evaluate any money-related, business, or financial estimation or process and differentiation them with the processes of ‘best practice’ associations inside a comparable field or industry.

Similar Products

Other customers were also interested in...

Multi-Member Investment Fund Portfolio and Distrib...

A fund management tool to track many positions over time as well as distributions to up to 20 member... Read more

Legal Services Financial Model Excel Template

Buy Legal Services Financial Plan. Based on years of experience at an affordable price. Generates 5-... Read more

Mortgage Bank Financial Model Excel Template

Mortgage Bank Budget Template Create fully-integrated financial projection for 5 years With 3 way fi... Read more

Offshore Bank Financial Model Excel Template

Offshore Bank Financial Model Enhance your pitches and impress potential investors with the expected... Read more

Alternative Investment Company Valuation Template

Alternative Investment Company Valuation: All-In-One Model for Private Equity, Asset Management, and... Read more

Crowdlending (P2P) Platform – 5 Year Financi...

Financial Model providing an advanced 5-year financial plan for a startup Crowdlending (Peer-to-Peer... Read more

Debt Fund Excel Model

Explore the Debt Fund Excel Model, a comprehensive tool for evaluating new credit fund opportunities... Read more

Amortization Schedules Template (Loans, Mortgages,...

User friendly template including Amortization Schedules for Loans, Mortgages, Operating and Finance ... Read more

Online Bank Financial Model Excel Template

Get Online Bank Financial Model. Based on years of experience at an affordable price. The online ban... Read more

Auditor Financial Model Excel Template

Discover Auditor Pro-forma Template. Allows you to start planning with no fuss and maximum of help C... Read more

You must log in to submit a review.