Gordon Growth Model and Terminal Value

Usually taught first in business schools, the Gordon Growth Model is one of the most widely used methods in company valuations. It is used to determine the intrinsic value of a company’s stock based on its rate of return and dividend growth and also for estimating a business’s terminal value in a Discounted Cash Flow (DCF) Valuation with consistent free cash flows.

This article’s main focus is to explain how to calculate Terminal Value using the Gordon Growth Model. Terminal value emphasizes the increase of free cash flows indefinitely and refers to the estimated value of a business beyond the projected forecast period of Discounted Cash Flow (DCF) Valuation.

A standard Discounted Cash Flow (DCF) Valuation Method typically derives a Terminal Value of 60% – 75% of the enterprise value. Since Terminal value can drive a large portion of the enterprise value and should therefore be evaluated carefully, selecting which Terminal Value model to use for its estimation is essential.

The fundamental concept of the Gordon Growth Model is that it illustrates the relationship between free cash flows, discount rate (WACC), and growth rate. This method assumes that the company will operate steadily with normalized Free Cash Flows and that the growth will continue indefinitely even after the forecasting period.

To understand the discussion in this article on how terminal value is estimated, you may download our Free DCF Valuation model template, which – among other Terminal Value models – includes the Gordon Growth Model – for calculating Terminal Value.

How to Estimate Terminal Value Using Gordon Growth Model

To clearly illustrate the estimation of the terminal value using the Gordon Growth Model, elements that significantly impact terminal value are explained, and steps are demonstrated below:

1) Forecast the Free Cash Flows

The first step is to project the company’s future Free Cash Flows until its financial performance has reached a normalized “steady state”, which subsequently serves as the basis of the terminal value under the Gordon Growth Model.

2) Use the Discount Rate from the DCF Valuation Model

In this article’s illustration, WACC is used as the discount rate since it determines the value of future free cash flows of an enterprise or firm. If the projected cash flows are unlevered free cash flows, then the proper discount rate would be the weighted average cost of capital (WACC), resulting in the enterprise value. But if the cash flows are levered FCFs, the discount rate should be the cost of equity, and the equity value is the resulting output.

Understand WACC further by reading more in this link: Calculating the discount rate for Discounted Cash Flow Analysis

3) Estimate a long-term Growth Rate

Growth rate is an important factor in the Gordon Growth Model, as it is attached to the forecasted cash flows of a company after the explicit forecast period to determine how these cash flows are expected to grow in all future years. The long-term growth rate assumption should generally range between 2% to 4% to reflect a realistic, sustainable rate.

4) Estimate Terminal Value

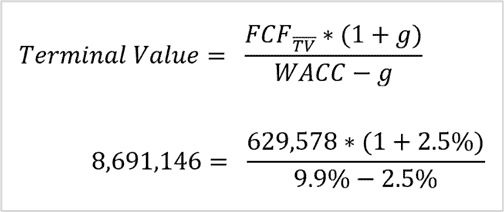

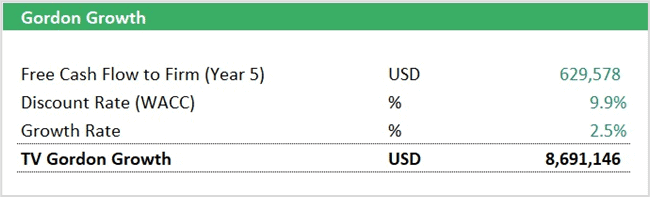

Below are the values you need to be familiar with to calculate the Terminal Value in a Discounted Cash Flow:

FCFTV – Free Cash Flows at year-end of the forecast period (Year 5)

WACC – Weighted Average Cost of Capital or the discount rate

g – Constant growth rate of FCF

The terminal value formula used in the Gordon Growth Model and the detailed computation of terminal value using the Gordon Growth Model assumptions mentioned above are presented in the formula and example:

To summarize, below are the parameters and the resulting Terminal Value based on the Gordon Growth Model:

For the calculation of Discounted Cash Flow (DCF) Valuation, the Terminal Value is discounted to its present value using a discount factor.

The Simplest yet Restricted Method in Estimating Terminal Value

The Gordon Growth model offers a quick and simple method, requiring only a few parameters for determining the terminal value. This terminal value method is easiest to apply and works best for mature, stable organizations or enterprises with consistent and robust cash flows and reliable growth patterns.

This model assumes that free cash flows will continue to grow indefinitely, which restricts its accuracy. It ignores key value drivers such as duration of competitive advantage and returns on invested capital, all of which add to a business’s overall worth. Therefore, the underlying assumption of eternal consistent growth in most cases results in erratic cash flows that are not suitable nor realistic for businesses. In this case, preference must be given to alternative valuation methods. So, while the Gordon growth model formula has its merits, the key is to know when to use the Gordon Growth Model and when not.

Another alternative approach is the Two-Stage Value Driver Model, which captures the duration of competitive advantage and returns on investment capital, reflecting a more realistic estimation of the terminal value.

Download eFinancialModels’ sophisticated version of the Free DCF Valuation model template in Excel, which includes a variety of advanced Terminal Value Formulas, including the Gordon Growth Model. Downloading this spreadsheet template allows you to compare the results using different Terminal Value Formulas and see their contribution to the overall Enterprise Value in a DCF Valuation result (typically between 60% to 70%). Surprise your investors and stakeholders using one of the advanced Terminal Value methods.

If you’re looking for financial model templates that include a DCF Valuation, please feel free to check out our full list of DCF Model templates here: