Real Estate Brokerage Firm Financial Model Template

Financial model template for a high-level real estate brokerage firm that facilitates the buying and selling of real estate properties between buyers and sellers. Providing a sound financial plan and 5-yrs worth of financial projections while applying projections based on bottom-up assumptions as well as calculating the key financial ratios (IRR | Payback Period) allow to establish a solid real estate brokerage business. There’s also a DCF Valuation and a sensitivity analysis included.

This is a financial model template specially tailored for a real estate brokerage firm that facilitates the buying and selling of real estate properties between buyers and sellers. This financial model can be used to determine the financial feasibility of a new real estate brokerage firm and obtain clarity on expected cash flows. Providing a sound financial plan and 5-yrs worth of financial projections while applying bottom-up assumptions based on key value drivers as well as calculating the key financial ratios. The model includes a valuation using the DCF method and then it also calculates the IRR and Payback Period. To understand the risks in more detail, a sensitivity analysis is also included.

The highlights of the financial model template are the following:

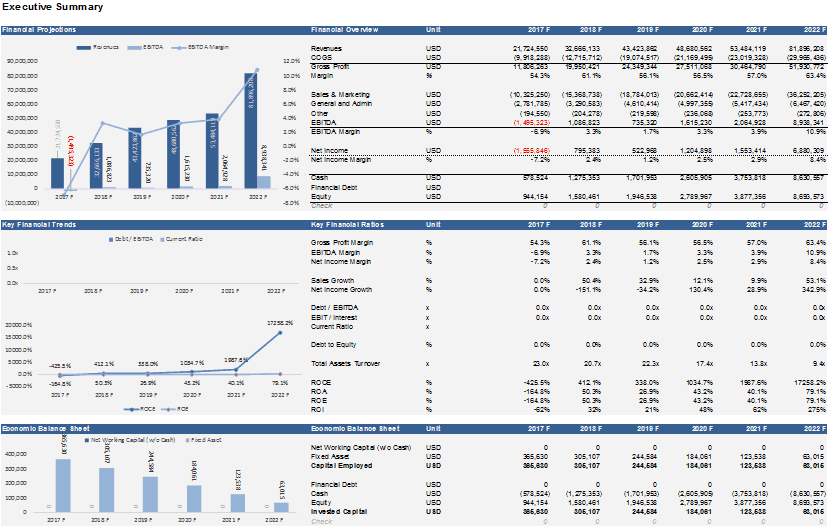

- Executive Summary with key charts of the financial projections, financial trends, economic balance sheet, as well as an overview of the financials and the key financial ratios

- Yearly Financial Projections for 5 years

- Assumptions

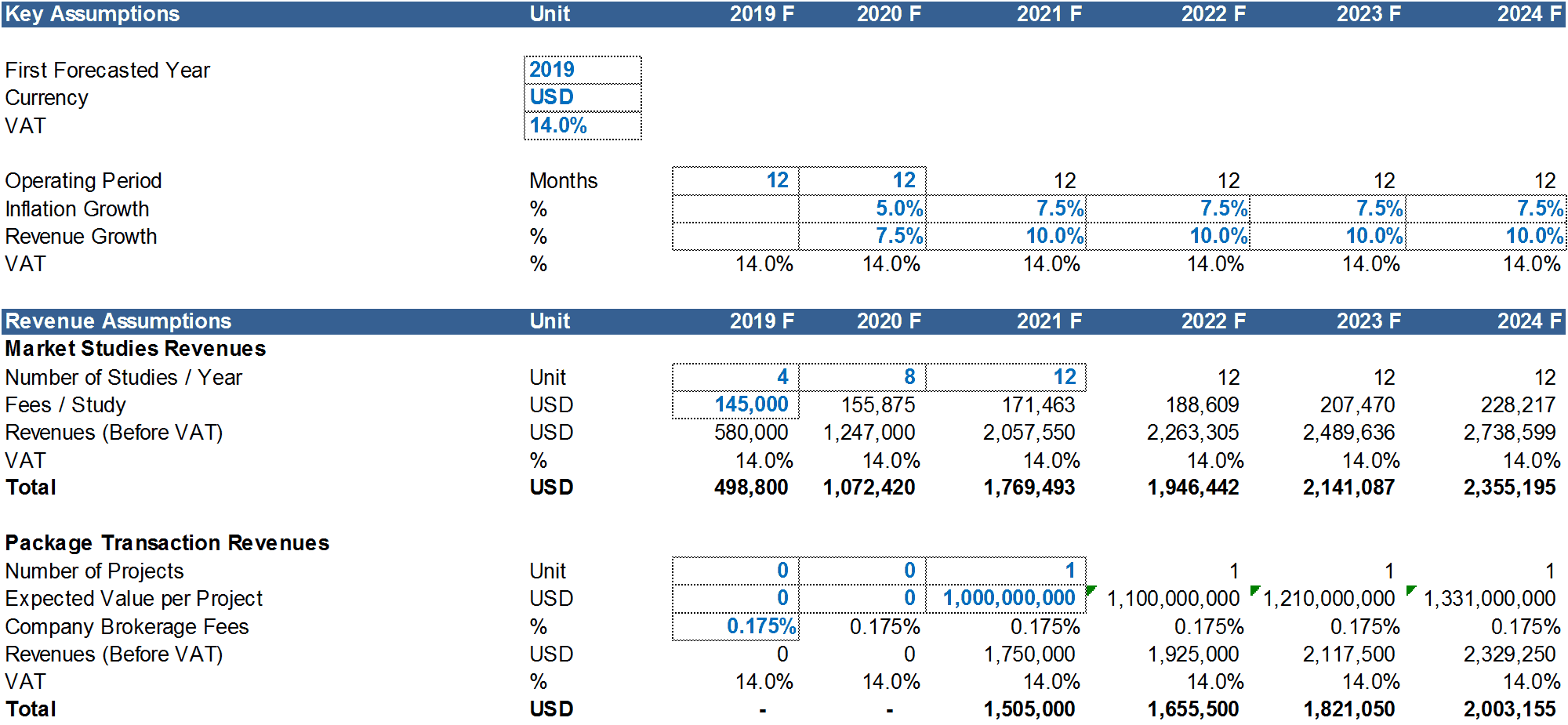

- Key Assumptions

- Number of Employees (by Department)

- CAPEX Units

- Revenue Assumptions

- Market Studies Revenues

- Package Transaction Revenues

- Awarded Projects

- Commissions

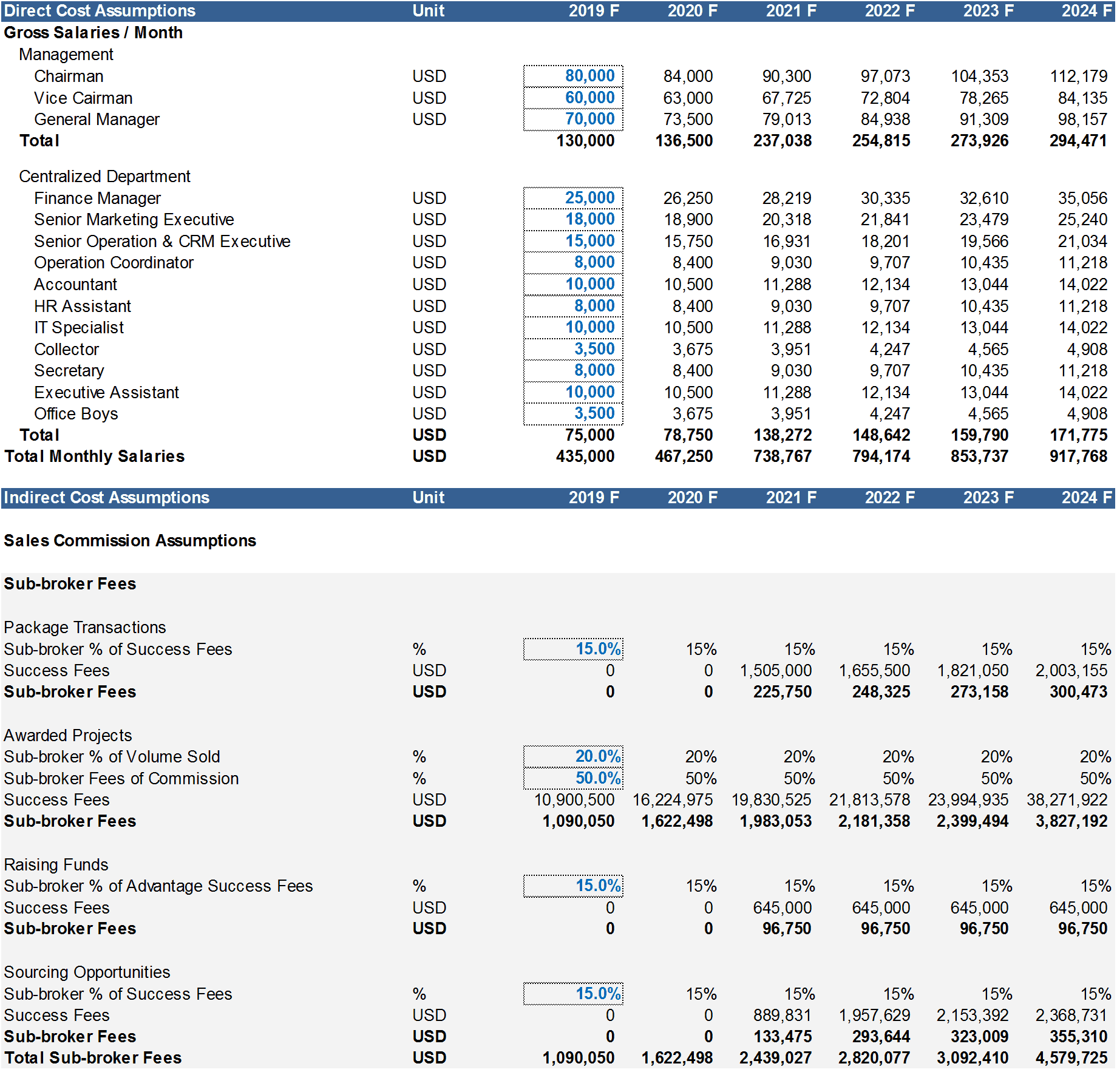

- Direct Cost Assumptions (salaries)

- Indirect Cost Assumptions

- Sales Commission Assumptions

- Gross Commission Distribution Scheme

- Other non-operating Expenses (rent, bills, misc. fees, etc.)

- Balance Sheet Assumptions (Accounts Receivables/Accounts Payables)

- CAPEX Assumptions

- Key Assumptions

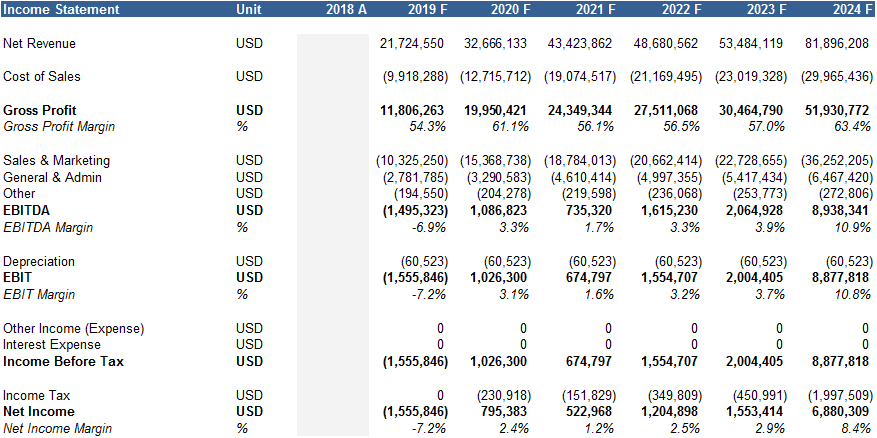

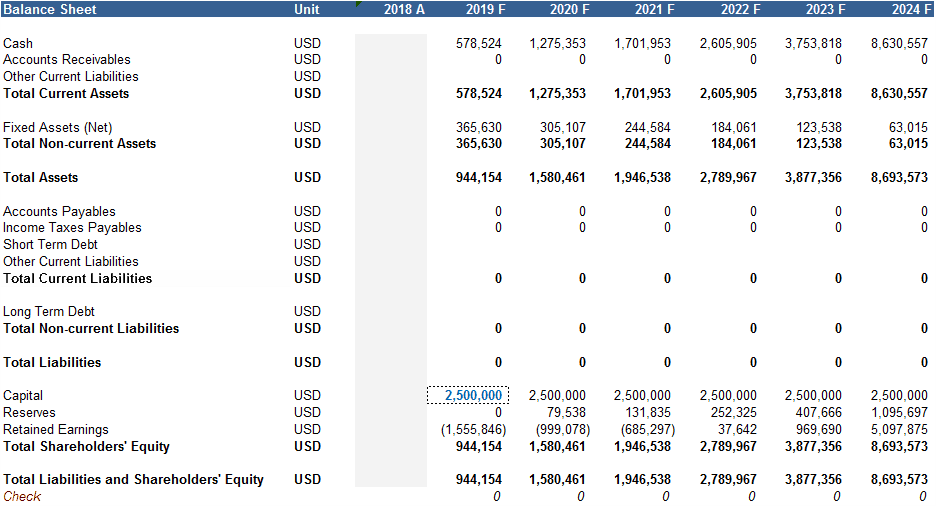

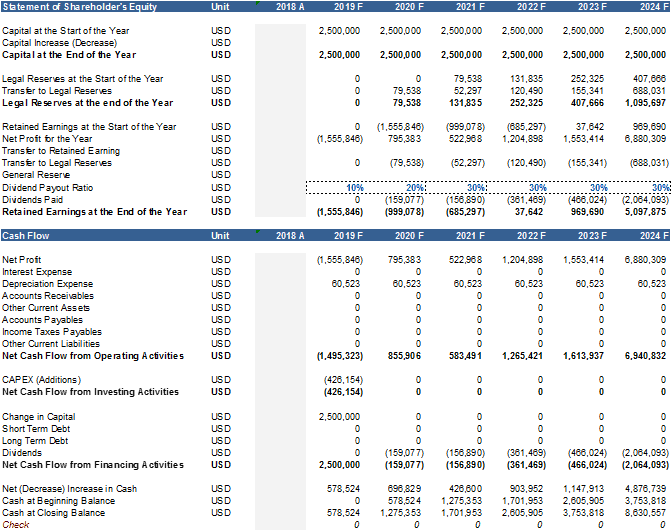

- Yearly Financial Statements

- Income Statement

- Balance Sheet

- Statement of Shareholder’s Equity

- Cash Flow Statement

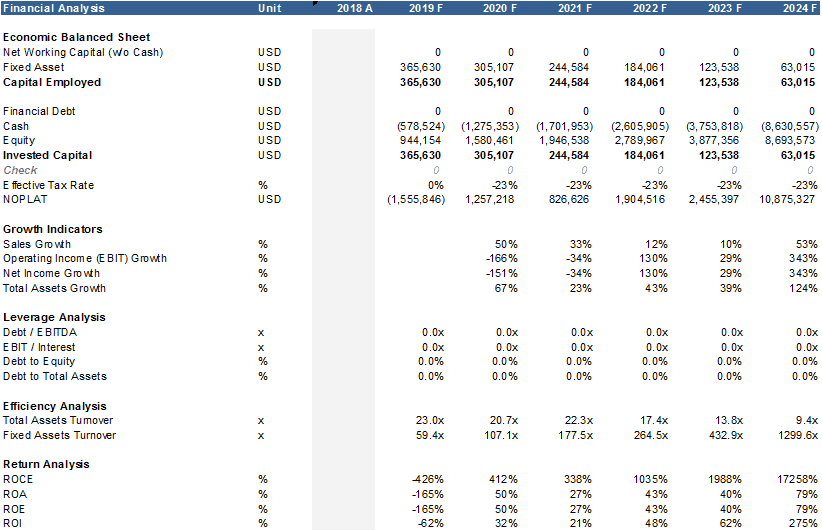

- Financial Analysis including Economic Balance Sheet

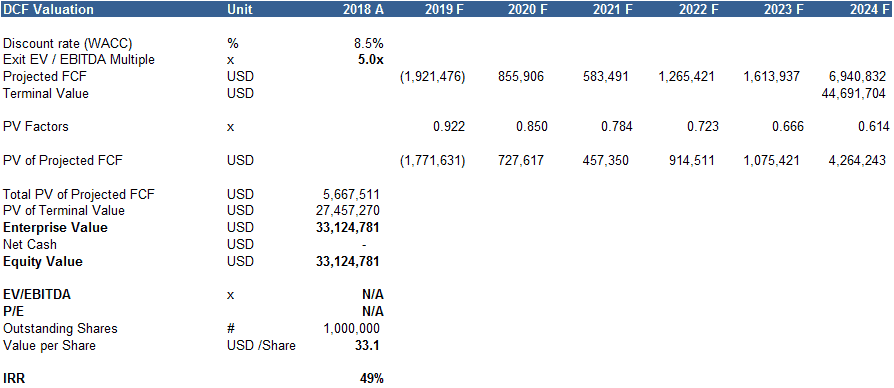

- DCF Valuation

- Sensitivity Analysis of Equity Value

- WACC

- Exit Enterprise Value/ EBITDA Multiple

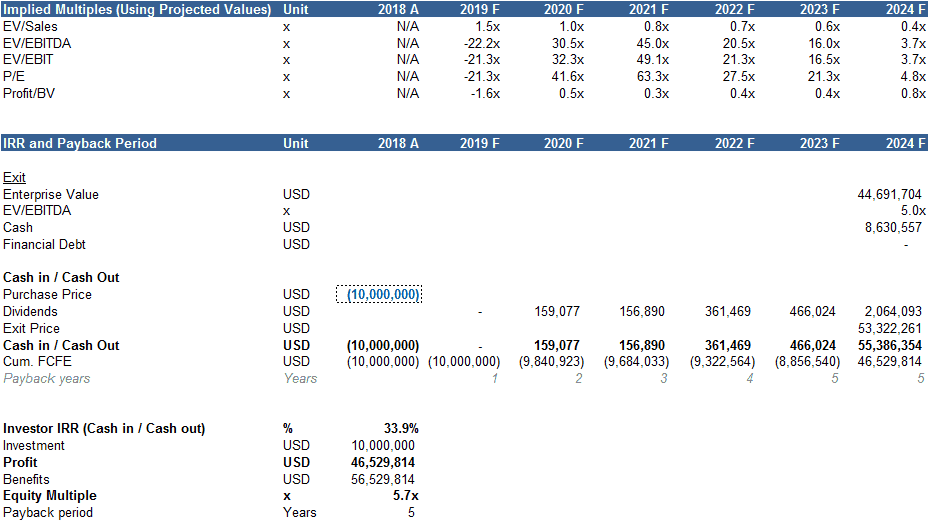

- Calculation of Implied Multiples using the Projected Values

- IRR and Payback Period

This financial model template for a Real Estate Brokerage Firm comes in Excel and in two versions:

- Full Excel Model – Paid Version

- PDF Demo – Free Version

Please refer to the following screenshots to see what is included in the model and feel free to download the free PDF demo version.

Similar Products

Other customers were also interested in...

Commercial Real Estate Valuation Model Template

A commercial real estate valuation model template assists in running a professional DCF Valuation fo... Read more

Real Estate Portfolio Template – Excel Spreadshe...

The Real Estate Portfolio Template forecasts the financial performance when building a real estate p... Read more

Hotel Development Financial Model (Construction, O...

Financial model presenting a development scenario for a Hotel including construction, operation, and... Read more

Shopping Mall Financial Model

Shopping Mall Financial Model presents the case of an investment into a shopping mall and its operat... Read more

Real Estate Financial Model Bundle

This is a collection of financial model templates that provides the financial projections and valuat... Read more

Commercial Real Estate – Lease or Sell Quart...

Commercial Real Estate - Lease or Sell Quarterly Excel Model with 3 Statements, Valuation, and Devel... Read more

Airbnb Financial Model

Air BnB Financial Model Template presents the business case of the purchase of up to 5 properties wi... Read more

Multi Sports Complex Financial Model – Dynam...

Financial Model presenting a development and operating scenario of an Indoor Multi-Sports & Fitn... Read more

Mobile Home Park / Community Financial Feasibility...

Plan out all aspects of starting up to 40 mobile home communities or parks. End to end from assumpti... Read more

Industrial Building Development Financial Model (C...

Financial model presenting a development scenario for an Industrial Building including construction,... Read more

You must log in to submit a review.