Financial Modeling Basics – Building Financial Models in Excel

Table of Content

- What is Financial Modeling?

- Step by Step Guide in Building a Financial Model

- Step 1: Defining the Purpose of the Model

- Step 2: Format and Structure

- Step 3: Building the Operating Model

- Step 4: Building the Financial Statements and Financial Ratios

- Step 5: Building a DCF Valuation

- Step 6: Creating an Executive Summary

- Step 7: Conducting a Sensitivity Analysis

- Step 8: Check your Model for Errors

If you’re planning to build a financial model, then you should already know what financial modeling is and the significance of building a financial model for your own purpose be it for your business, potential investment, personal budget, a tool for valuation, etc. However, let us take a short review about the financial modeling basics and then we will start discussing each step in building financial models.

What is Financial Modeling?

Basically, Financial Modeling is the task of building a financial model which is a numerical representation expressed through the use of Accounting. Financial models forecast an asset’s or a business’s future financial performance based on a set of assumptions and rules that define their relationships. As a result, financial models can forecast profits, cash flows, balance sheets, financial ratios, and other ratios such as key performance indicators. Building Financial models in Excel today has become a common tool to understand how key financial metrics such as the Internal Rate of Return (IRR), Net Present Value (NPV), Payback Period, and Yield are calculated. They are excellent tools for better understanding investment propositions, business or asset valuations and are the foundation for financial decision-making. It is often designed and created in a spreadsheet form such as in Excel to fulfill the following:

- Structured layout – In Excel, it is easier to design a structured layout to set the inputs, outputs, calculations, scenario analysis, and projections in a logical manner as well as make it easier to understand and read for the users.

- Dynamic Model – In Excel, it is easier to update the financial model whenever the inputs or assumptions are modified to suit a use case scenario. Hence, giving the model flexibility to display dynamic results by simply changing key assumptions.

- Connected Variables – In Excel, it is easier to track connected variables as such giving the model transparency. Meaning, whenever a user updates the model, the user can track the chain reactions by simply tracing the precedents or dependents of the input cell as well as showing the formulas used to understand the logic behind each calculation result.

- Formulas and Functions – Excel is the most common tool used for building a financial model spreadsheet for a reason, and that is because of the convenience of its formulas and functions which makes forecasting and analysis easier to calculate.

By simply using Excel, building financial models for the different use case and objectives will be much easier, though this doesn’t mean that financial modeling is an easy task to do which anybody can just do without the right know-how. After all, it takes years of learning and many practices just to be able to effectively build experience as well as expertise in financial modeling. This is why financial modeling is considered as a highly-sought-after skill especially for those with careers targeting Finance positions.

Step by Step Guide in Building a Financial Model

The process of building a financial model can be complex at times since you need to consider each step and elements in order to build a working model. Basically, financial modeling consists of a complex series of analytical tasks which are logically combined to make sense of the results used for the purpose of the financial model. To better understand each task, we will go through it step by step below:

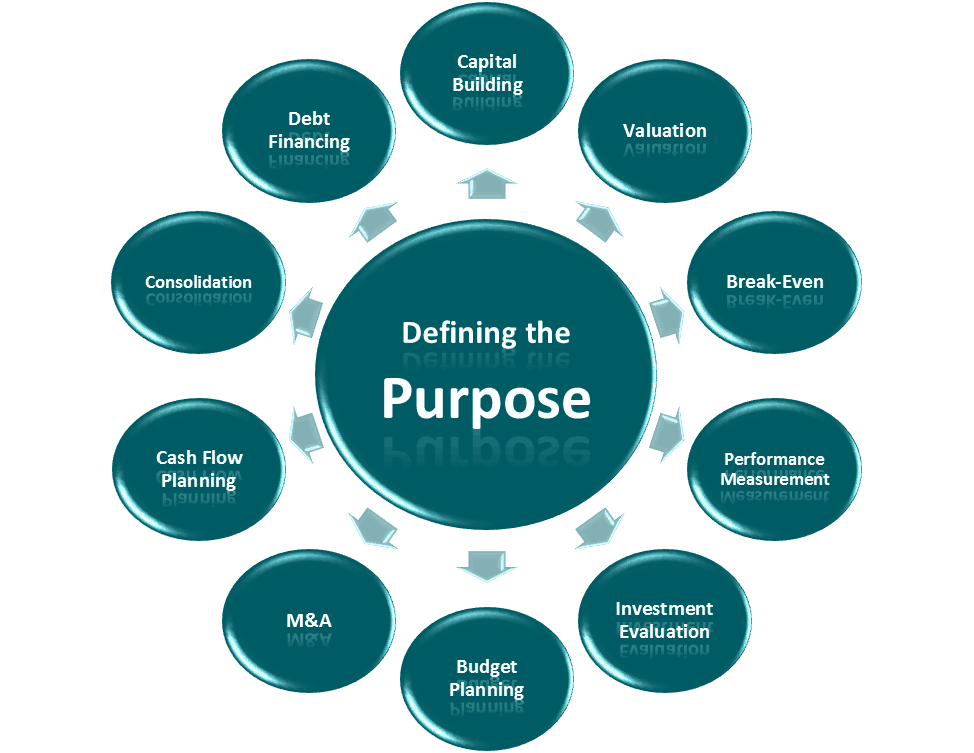

Step 1: Defining the Purpose of the Model

When building a financial model, you need to ensure that you build it optimally to suit its intended purpose. You might think that it is alright to use the same logic and know-how, but in fact, it will vary greatly depending on what you need the financial model to solve. It is critical that you will be clear for what specific use case your model is such as the following:

- Capital Building – to help raise capital for starting up a business

- Valuation – to determine the financial position of a business, its profitability, and feasibility, or for valuing property in the case for real estate transactions, and for determining profitable projects or investments

- Break-even – to determine when the business will be able to return its initial investment and reach break-even

- Performance Measurement – to track the key performance of a project, business, or employees

- Budget Planning – to build a systematic budget plan that will prioritize profitable and feasible projects or departments

- Mergers and Acquisitions – to conduct valuation and determine if such merger or acquisition is a profitable and feasible deal

- Liquidation – to properly liquidate the business and distribute its assets accordingly

- Debt Financing – to build a debt repayment schedule and keeping track of cash flows

- Etc.

For each use case, though some elements will likely be the same, the logic and know-how will be entirely different. It could vary from easy to complex calculations which will require you the need for a financial modeling expert to guide you as you build a financial model.

Step 2: Format and Structure

A very critical element that one needs to follow is to build the financial model with an easily readable format. Meaning, all assumptions or inputs must be separated from all outputs. This is so that any user will be able to quickly grasp the key parameters that can be changed to influence the whole model. As for the structure of the model, it is important to determine which model structure fits the use case. Such as in the most business case, building a three statement model showing the forecasted income statement, balance sheet, and cash flow statements as usual.

Step 3: Building the Operating Model

Once you acquire a template with the right structure for your use case, the next step would be to input all data and assumptions in the model. Depending on how complex the financial model is, it is always best to prepare the base of your financial model first before you further modify it to better fit your specifications. You need to take note though that it is important to break down the revenues, costs, and CAPEX to their key drivers as well as separate the assumptions for the Fixed Asset and Debt Schedules. This is so that you will have an easier time as you complete the model.

However, if you plan to build a model from scratch, it will surely take a long time and you will also need the help of a professional especially if you have no know-how and experience when it comes to financial modeling. Therefore, it is best to acquire a financial model template to use as a base or reference as you build your own model for your own purposes. If you need financial model templates for specific industries and use cases, please feel free to browse our selections: Financial Model Templates.

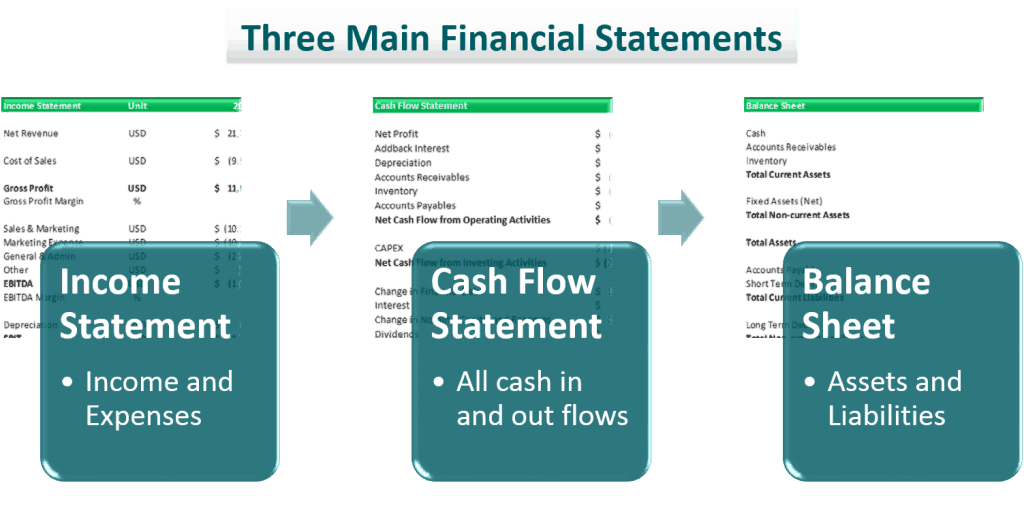

Step 4: Building the Financial Statements and Financial Ratios

After you are done building your operating model, the next step would be an easier task for you to do which is building the financial statements. Basically, all the data from the operating model will then be distributed accordingly in the three main financial statements – Income Statement, Cash Flow Statement, and the Balance Sheet.

As you build the financial statements, you will then be able to calculate the important financial ratios depending on the use case and need. This will further allow you to conduct a cross-check if your projected data looks realistic and accurate.

What are Financial Ratios?

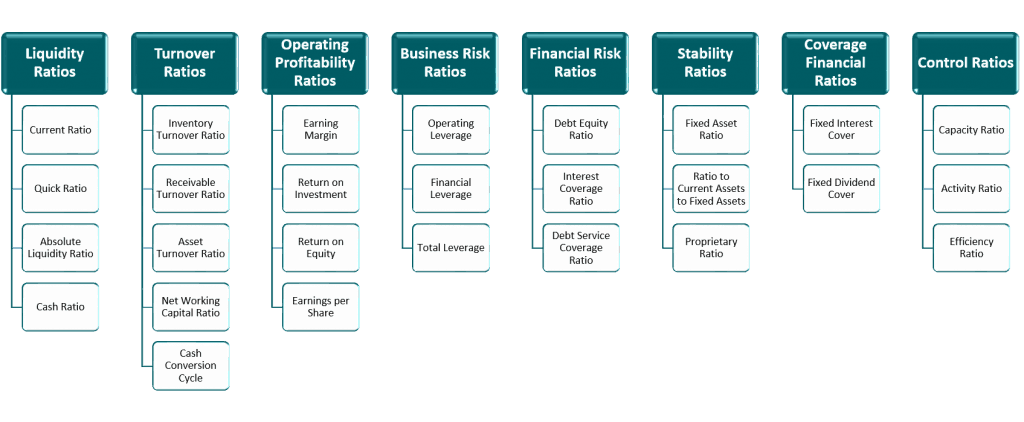

Here’s a short discussion about the financial ratio. Financial ratios are known as key indicators of the financial performance of a business and are usually derived from the three main financial statements. These financial ratios are used to help analyze the profitability, liquidity, assumed risks, as well as feasibility.

There are 8 main financial ratios used in financial modeling such as the following:

- Liquidity Financial Ratio – to determine the ability of a business to meet its financial needs during short-term and be able to maintain such a case. It can be calculated in multiple ways such as:

- Current Ratio – often referred to as a working capital ratio or banker’s ratio which expresses the relationship of a current asset to current liabilities.

- Quick Ratio – also known as the acid test ratio which is used to evaluate a business’ overall short-term solvency directly

- Absolute Liquidity Ratio – used to help calculate actual liquidity by excluding inventory and receivables from the current assets

- Cash Ratio – helps determine the underutilization of resources and most often used by businesses undergoing financial troubles.

- Turnover Financial Ratio – also known as the activity ratio which indicates the utilization efficiency of a business’ resources. It can be calculated in multiple ways such as:

- Inventory Turnover Ratio – measures the relative size of inventory and heavily influences the liquid cash to settle liabilities

- Receivable Turnover Ratio – also known as the debtor’s turnover ratio which shows how many times the receivable was turned into cash during the period

- Capital Turnover Ratio – measures the effectivity of the business’ strategy when using its financial resources

- Asset Turnover Ratio – helps determine the number of times the net tangible assets are turned over during a year

- Net Working Capital Turnover Ratio – helps indicate whether the working capital has been effectively used for sales conversion

- Cash Conversion Cycle – considered as the total time taken by the company to convert all expenses into returns

- Operating Profitability Financial Ratio – helps measure the profitability of a business through the efficiency of business activity. It can be calculated in multiple ways such as:

- Earning Margin – known as the ratio of net income to turnover which is usually expressed in percentage form

- Return on Investment – also known as return on capital employed which helps measure profitability in relation to the total capital used

- Return on Equity – calculated by taking the net income and dividing it by shareholder’s equity, it is often used to determine the return from the shareholder’s equity

- Earnings Per Share – mostly known as the profit or net earnings which can be calculated by dividing the profit of the business by the total number of shares outstanding

- Business Risk Financial Ratio – helps measure how sensitive a business’s earnings with respect to its fixed costs as well as the assumed liabilities on the balance sheet. It can be calculated in multiple ways such as:

- Operating Leverage – measures how sensitive the operating income is to the changes in revenues

- Financial Leverage – measures how sensitive the Net Income is to the change in Operating Income

- Total Leverage – measures how sensitive the Net Income is to the change in Sales

- Financial Risk Financial Ratio – helps measure how leveraged is the business and how it is placed with respect to its debt repayment capacity. It can be calculated in multiple ways such as:

- Debt Equity Ratio – most often used for long-term calculation, it helps measure the extent of equity to repay debt

- Interest Coverage Ratio – determines the ability of the business to pay interest

- Debt Service Coverage Ratio – or also known as DSCR which helps determine if the operating income is sufficient to pay off all liabilities in a year

- Stability Financial Ratio – ideal for long-term projections, it is often used to determine whether the business is stable in the long run. It can be calculated in multiple ways such as:

- Fixed Asset Ratio – helps determine whether the company have enough funds to meet the business requirement for the long-term

- Ratio to Current Assets to Fixed Assets – helps determine whether the company is expanding or if the trading is loose

- Proprietary Ratio – helps measure the financial strength of a company

- Coverage Financial Ratio – most often used to calculate the dividend which needs to be paid to investors or interests paid to lenders

- Fixed Interest Cover – measures the business profitability and its ability to repay the loan

- Fixed Dividend Cover – measures the dividend needed to pay to the investor

- Control Financial Ratio – helps the management to determine the favorable or unfavorable performance

- Capacity Ratio – measures whether the total direct labor hours worked in a period was greater than what was allocated in the budget

- Activity Ratio – usually used to calculate a measure of activity in a business

- Efficiency Ratio – used to calculate the productivity of a business

Though each financial ratio is significant on its own, it is best to use multiple financial ratios which are relevant to your business model to ensure that you are covering all bases and be able to measure as accurately as possible.

Step 5: Building a DCF Valuation

Though it is not always the case to use the discounted cash flow valuation method, it is still the most commonly used valuation method used to build a model. Now that you have built your operating model as well as financial statements with financial ratios, the next step is to conduct a valuation. For this, you will need to calculate for the discount rate or also known as the Weighted Average Cost of Capital (WACC) and then conduct a projection of the Free Cash Flows to Firm by discounting it, as well as considering the Terminal Value to arrive with the Net Present Value of your DCF valuation. To help you calculate the WACC, here you can download a WACC calculator that you can use for reference. You can also download a full DCF Model template which you can use as a base for your DCF Valuation Model.

Step 6: Creating an Executive Summary

An Executive Summary is actually the most important section of your worksheet. When building financial models, it is most often used for analysis to make better financial decision-making. As such, looking throughout the model can become tedious with all the calculations and data within it. By simply creating an Executive Summary, it will serve as a guide sheet of what are important sections as well as data results. Basically, it summarizes all the key figures of your model which are the first things what the user of the model will want to look at and understand before going through the logic of the calculations and results. After all, it is better to be systematic when it comes to conducting analysis by using a financial model.

Step 7: Conducting a Sensitivity Analysis

Adding a sensitivity analysis in your model is not mandatory but more of an option to further test the accuracy and realism of the data as well as your business plan. By building sensitivity tables, you will be able to check each parameter used in the sheets flows correctly through the entire model. Actually, most experienced practitioners often look at the result of the sensitivity analysis. This process will further allow you to check your model in an analytical way and fine-tune the calculations to be as reliable and realistic.

Step 8: Check your Model for Errors

If you’re confident enough with your financial model and feel like there is no need to check for errors, then you are very wrong. One of the best practices in financial modeling is to always conduct a check of your model for errors. Good thing that Excel makes it easier due to its error check feature. But still, one can never get too complacent and must always exercise caution especially when each data is critical for decision-making. Therefore, always check the model for any errors or inconsistencies. The following are the 3 standard checks which you can take a look-through first:

- The Balance Sheet’s Total Assets should equal the Total Liabilities and Shareholder’s Equity.

- The cash position at year-end as per Cash Flow Statement should equal to the cash position on the Balance Sheet.

- All financial breakdowns such as revenue and relative breakdown should add up again to 100%.

By further checking your model, the logic will become more solid, making the model easier to update with changes to assumptions, and making your model easier to understand inside and out.

Building Financial Models is easier with a Financial Model Template in Excel

Financial modeling is a skill that is highly sought after for a reason. It is not easy to acquire nor is it a simple skill that can be half-heartedly learned. It takes years and years of learning and experience, thus, not all are able to learn financial modeling nor have the time to acquire such skill.

The task of building financial models can become very complex as well as time-consuming. Most often, people even hire a financial modeling expert to do the task for them but this option costs a lot, therefore, it is always best to rely on ready-made tools such as a financial model template to help you build a financial model on your own.

If you are looking for ready-made and industry-specific financial model templates, please have a look through our collection and choose which template fits your needs and business model. These templates are designed by financial modeling experts and are ready-made for any kind of user to use as a base or a reference to build a financial model on your own. Also, these templates are used by CFOs, CEOs, financial advisers, brokers, entrepreneurs, students, and many more from all over the world such as the USA, UK, Australia, Canada, Japan, etc.

Whether you’re a beginner or an expert, it is always convenient to have a ready-made base to start building a financial model. Save your time and money today and start downloading financial model templates!