Creating a Budget Plan – Using the Best Excel Budget Template

“When it comes to money and so many other things in life, understanding your weaknesses and strengths can help you with your future plans.” ― Tagene Brown-McBean

Ever since from a young age, we are all told by the adults to save up money as much as we can, even encouraging us by giving us piggybanks as gifts. It was kind of ironic because they themselves spend money every time for certain things they don’t need and maybe only the adults have the right to spend money like that. But now that we’ve grown up, whether, in our personal or business operations, we’re still stuck with budgeting. What is budgeting? Why the need to create a budget? Why is it important?

Budget Planning and its Significance

Budgeting is creating a plan for how to spend your money wisely and efficiently. Basically, a budget plan is your spending plan which will allow you to determine in advance whether you will be able to finance the things you need to execute now and in the future. Budget planning for personal uses and business purposes works similarly but there are some important distinctions that need to be included.

In Personal Budget planning, it starts with determining your resources or income and taking account of your present and future expenses, ensuring that you will reach your financial goal – enough savings left after all expenses deducted. While in Business Budget planning, a need for a more sophisticated financial plan is critical to ensure that there is always sufficient liquidity in a business and the business produces profits on a sustainable basis.

Also, at the end date of the plan, businesses should always compare their initial budgets vs. the actual results and using the results, they will learn how to improve the accuracy of their forecast. The difference between the current budgeted amount and the actual result in terms of profits is called the budget variance. A budget variance can be manifested either in a solid figure or in a percentage format.

Here is a list of the benefits of creating a business budget:

- Managing your cash effectively

- Allocating resources wisely and profit oriented

- Setting clear financial objectives

- Use as well-structured performance monitor

- Improved decision-making

- Preparation for future expenses and other circumstances that need financing

Just like what is said in the quote, being strict in your budget is important but, certain circumstances like taking advantages of your strengths in your business, with proper budget adjustment, will help gain you more income and the same with areas that need the budget to be lowered. In other words, budget strategizing. An example would be cutting back on spending expenses for marketing and advertising when needed or changing temporary factors that will affect the business in a short period of time.

This is why businesses practice comparing their estimated budget vs. actual results to better evaluate their financial performance, find weaknesses and potential for improvement, forecasting income, and identifying operations, that are going against the expected flow. Thus, it’s concluded that it is critical to keep the finances on track and the forecasting accuracy.

But this doesn’t mean any individual is exempt from budgeting. Especially for those who are just making ends meet. Whether in a personal or family budget, balancing the source of income to all expenses is a must or it will be a problem to go over the budget. This is actually a common problem for many people who don’t realize that they’re spending more than they earn, sinking deeper into debt every year. The need for budget planning is clear and the sooner the better it will be for their future.

Creating a Master Budget and Financial Planning

A master budget is a formal statement of the user’s expectation regarding sales, expenses, volume, and other financial transactions of an organization for the coming period. It basically is a set of projected financial statements. A budget is a tool for both planning and control. At the beginning of the period, the budget is a plan or standard e.g. deciding the amount and the allocation of resources, and then at the end of the period, its function is to serve as a control device to help the user measure its actual performance against the projected plan so that the future performance may be improved.

With today’s technology, simply by utilizing the capabilities of existing computers, budgeting can be used as an effective tool for evaluation of “what-if” scenarios or in other words – scenario analysis. By conducting scenario analysis, the user will have an insight as to finding the best course of action among the various alternatives through multiple simulations. If the user came up with bad values stated on the budgeted financial statements especially the financial ratios such as liquidity, activity (turnover), leverage, profit margin, and market value ratios, the user can always alter the accompanying business plan. This process is very important since a tool is only a tool without a solid business plan.

The budget is classified broadly into two categories:

- Operating budget – where the budget reflects the results of operating decisions

- Financial budget – where the budget reflects the financial decisions of the firm

Example Operating Budget for a Manufacturing Company

To give you an overview of what a manufacturing company operating budget consists of, we simplified it below:

- Sales budget – considered as the starting point of any budget plan since the sales volume influences nearly all the variables included in the overall budget plan. It should show the expected total sales in quantity and value. Depending on the use case, the sales budget can be further analyzed by product, by location, by customer, and other trends which affects the expected sales. Also, it usually includes the calculation of expected cash collection from credit sales.

- Production budget – comes after the sales budget, since it considers first the sales budget, plant capacity on whether the stocks produced should be increased or decreased, and outside purchases. Basically, a production budget is a statement of the expected output by product which is generally expressed in units. The number of expected units to be manufactured met the expected budgeted sales and inventory capacity is then moved forward in the production budget. The formula applied to calculate the expected production volume (in units) is the addition of planned sales and desired ending inventory minus the beginning inventory.

- Purchase Budget – this budget plan applies more to a merchandising firm where instead of producing products, it purchases the goods instead. It has the same format as the production budget except, instead of showing the amount of goods to be produced, a purchase budget calculates the expected amount of goods to be purchased from its suppliers during the period.

For example:

Budgeted cost of goods sold (in units or dollars) $500,000

Add: Desired ending merchandise inventory 120,000

Total needs $620,000

Less: Beginning merchandise inventory (90,000)

Required purchases (in units or in dollars) $530,000

- Direct materials budget – once the level of production has been calculated, a direct materials budget is then built as to show how much material will be needed for production and how much material must be acquired to meet the production requirement. Basically, the direct materials budget depends on both the expected usage of materials and inventory levels. The formula to calculate the purchase is:

Purchase in units = Usage + Desired ending material inventory units – Beginning inventory units

The direct materials budget plan is also accompanied by a calculation of the expected cash payments for the materials purchased (schedule of expected cash disbursements).

- Direct labor budget – this budget is planned out in consideration of the production budget requirements. Basically, it uses the production requirements used in the production budget as its starting point. To calculate the direct labor requirements, first, you multiply the expected production volume for each period by the number of direct labor hours required to produce a single unit. Then, the result is multiplied by the direct labor cost per hour to obtain the total direct labor costs.

- Factory overhead budget – this budget is made to provide a schedule of all the manufacturing costs other than direct materials and direct labor. But it is important to take note that since depreciation does not entail a cash outlay, it must be deducted from the total factory overhead especially in calculating cash disbursement for factory overhead. The overhead budget consists of two sections:

- Variable overhead costs – manufacturing costs that vary roughly in relation to changes in production output. In other words, all expenses, other than labor, which fluctuate on a monthly basis depending on sales and costs.

- Fixed overhead costs – same amount every month and does not fluctuate with business activity e.g. rent and mortgage, insurance, taxes, salaries, etc.

For example:

Let’s assume the variable overhead per unit of Company XYZ during the 1st to 4th quarter is expected to be $10, $14, $16, $18 respectively according to the production budget. The company is expected to incur a depreciation of $2,500 and a monthly rent of $5,000 and an annual salary of $15,000. The other fixed costs were paid for.

- Ending Finished Goods Inventory Budget – this budget provides the information required for the construction of the budgeted financial statements. The said data is used to calculate the per unit manufacturing cost of the finished product. It is required to calculate such to help calculate the cost of goods sold on the income statement and give a dollar value to the ending finished goods inventory which is included in the balance sheet.

- Selling and administrative expense budget – lists the operating expenses involved in selling the products and in managing the business. This budget can be developed using the cost-volume formula (flexible budget). If the list of expense items is very long, categorizing or creating a separate budget may be needed.

- Budgeted Cash Flow Statement – prepared for the purpose of cash planning and management. It provides the expected cash flows (inflow and outflow) for a designated time period. It helps keep the cash balanced accordingly as well as helps avoid unnecessary unused cash and possible cash shortages. Usually consists of the following sections:

- Receipts – cash collected from customers and other cash receipts such as royalty income and investment income

- Disbursements – all cash payments made by purpose

- Surplus/ Deficit – shows the difference between the total cash available and the total cash needed including a minimum cash balance if required. This helps determine in case there is a surplus, certain loans may be repaid or can go forth with a temporary investment venture.

- Financing – detailed account of the loans, repayments, and interest payments expected during the budgeting period

- Investments – encompasses investment of excess cash and liquidation of investment of surplus cash

- Budgeted Income statement – summarizes the various component projections of revenue and expenses for the budgeting period. Depending on the need of the company, they can either divide the budget into monthly, quarterly, or annually.

For Example:

- Budgeted Balance Sheet – developed by beginning with the balance sheet for the year just ended and updating it by using all the activities that are expected to happen during the budgeting period.

It is important to prepare a budgeted balance sheet due to the following reasons:

- Discloses some unfavorable financial conditions

- Serves as a final check on all the calculations of the other schedules

- Performs a variety of ratio calculations

- Highlights future resources and obligations

For example:

Standard Financial Budget

The financial budget consists of:

- Cash Flow Statement

- Balance sheet

The major steps in preparing the budget are:

- Prepare a sales forecast.

- Determine the expected production volume.

- Estimate manufacturing costs and operating expenses.

- Determine cash flow and other financial effects.

- Formulate projected financial statements.

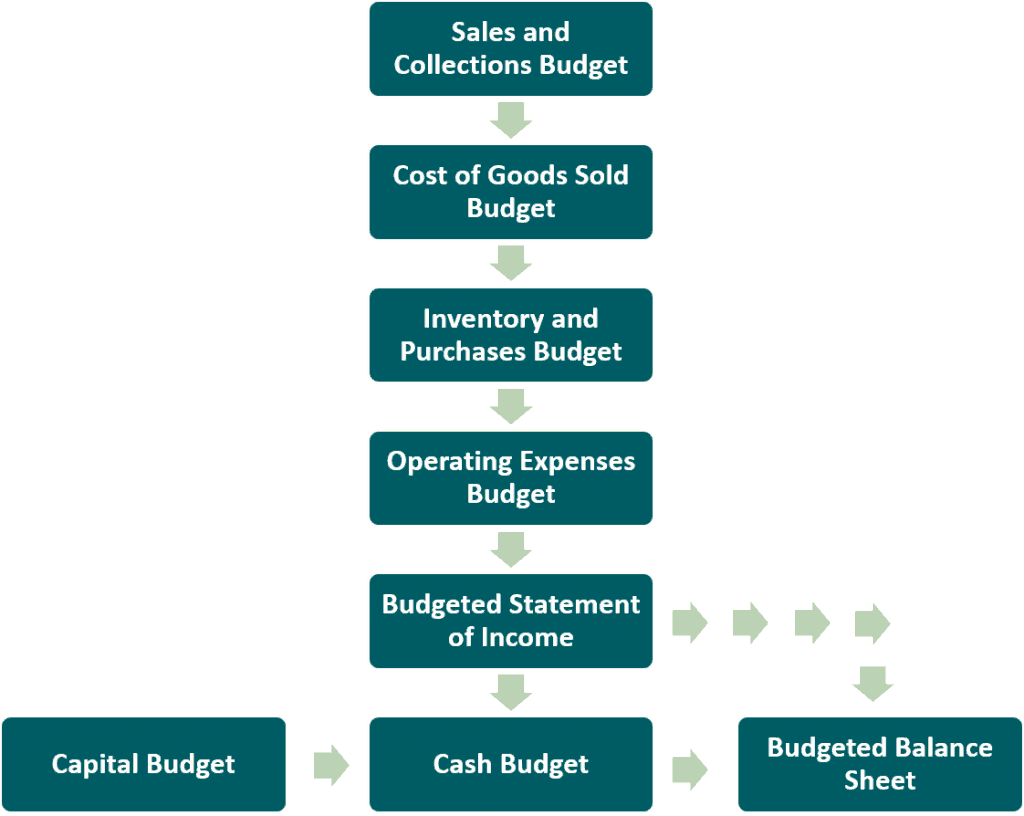

Below is a simplified diagram of the various parts of a detailed master budget plan of an organization:

More and more companies are developing computer-based models for financial planning and budgeting. The models help not only build a budget for profit planning but answer a variety of “what-if” scenarios. The resultant calculations provide a basis for choosing among alternatives under conditions of uncertainty. Furthermore, budget modeling can also be accomplished using spreadsheet programs such as Microsoft’s Excel which is commonly used by financial modelers. Due to Excels flexibility and numerous functionalities that are related to financial modeling, it became a preferred tool when budget modeling.

How to Create a Budget Plan

For businesses, being not in debt and continuously gathering more funds for further expenditures is the best thing to know. Hence, creating a budget plan is always a part of their business plans.

To create a budget plan, the following steps need to be realized:

- Determine your income, sales or profits – Calculating your earnings or revenue in your business is the first thing you need to do. Including all sources of your business’ income and other areas that yield you a profit. Be realistic as much as you can and be careful with overestimating in your forecast to have a more accurate result in the end.

- Determine your direct expenses – The next important thing to do is listing out all your direct expenses. For example: the cost of materials, components, subcontractors and other professional service fees. No matter how small or inconsequential the value is, it is important to note down because little things will slowly grow as you keep on ignoring it. Proper and strict discipline is needed to ensure the accuracy of your budget. Thus, you need to calculate the amount spent on every expense.

- Determine your fixed costs and overheads – You need to list down things that your business will spend money on. Certain expenses like building or assets rent, utilities, travel expenses, insurance, etc. Calculating a forecasted expenditure is needed to be taken note of.

- Determine your debt payment – It is, of course, one thing that needs to be kept on track. To make sure nothing is left behind. This includes the total debt and its interest that needs to be paid.

- Update and Review budget to readjust the figures – Based on your profits and cash flow, estimations will be made. Hence, the need to take a look back and readjust your estimates to ensure that you will reach your target. Factor in all the adjustments no matter how small, then run the numbers again. This will ensure and help you figure out whether your business will have any money left over for capital improvements or capital expenses.

Conducted yearly, budget planning for your business takes account the expected need for funds and the potential of saving money for future use. Thus, giving you a clear way on how your business will grow.

Budget planning for personal purposes will help maintain your standard of living post-retirement. And the best thing of all is, it puts checks and balances in order to prevent you from overspending and in debt in the future. It may affect the quality of life you wanted, especially if you planned too tight and it may become an issue. But this is something that you need to risk for. Just be patient, budget planning is worth it.

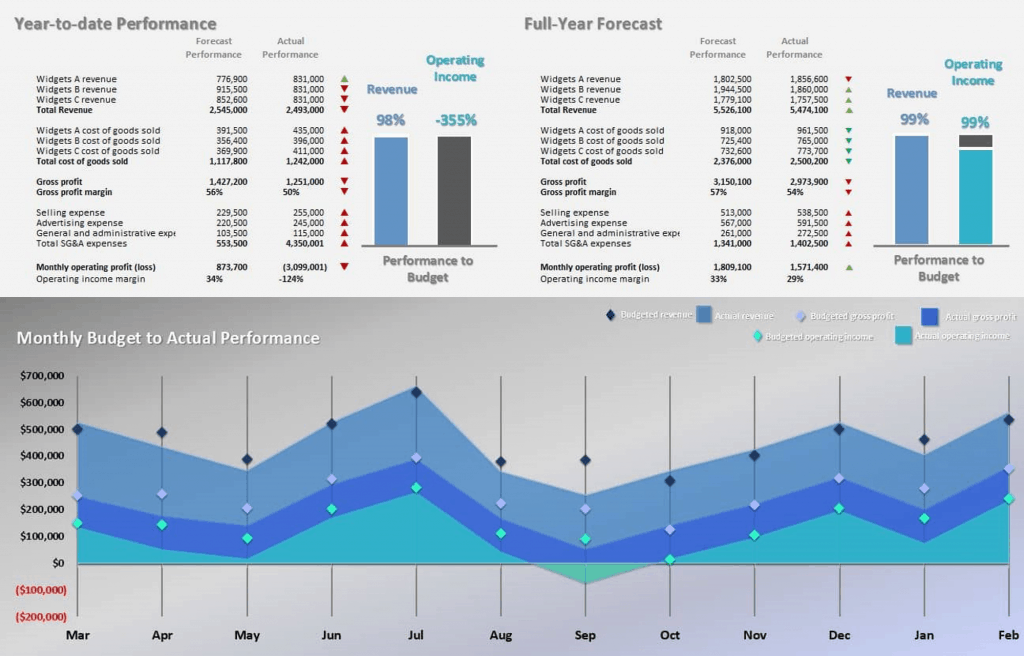

Budget to Actual Comparison

The difference between the budgeted amount of expense or revenue and the actual amount is what we call a budget variance. The budget variance is when the actual revenue is higher compared to the budget or when the actual expense is lesser than what was stated in the budget. It is usually caused by bad assumptions or wrong budgeting, trends, market, economy, etc. Hence, the baseline used to measure the actual results is not precise and sometimes unrealistic. Basically, it is due to factors that are unpredictable especially when changes often happen as time passes by. Though unpredictable, it is still best to anticipate such cases ahead of time by adjusting the budget plan in a timely manner with the help of a budget to actual comparison analysis.

Budget to actual comparison analysis is a process that involves the use of financial data to help determine how closely a company’s spending and generated revenue meets the financial projections included in the budget plan. By building such a model, users can determine:

- Identify weaknesses and find opportunities to improve profits

- Determining the areas that need more funding or simply improving the budgets for certain areas

- Determining if the budget is realistic or accurate

- Determining if the business is on track on meeting the long-term objectives

- Able to alter future financial forecasts based on the results collected

If you’re looking for a template of a budget to actual comparison analysis, we have a great model which you can download here: Budget to Actual Comparison Financial Model.

A Shortcut in Creating a Budget Plan – Excel Budget Templates

If you are in need of a budget plan but don’t have the time to create all the needed calculations and details that you need to note down, downloading the best excel budget template is the answer for you. Especially for businesses, a touch of a professional or an expert is needed in their budget planning to ensure the estimations and forecasted figures will be as accurate as possible.

Instead of hiring and paying high service fees, whether personal savings plan or for businesses in different specific industries, you can simply take advantage and acquire a budget template, which cost only for a little, where you can edit and implement the figures you gathered and complete the plan for you.

These Excel spreadsheet budget templates will offer a systematic budgeting framework together with charts for a better view of the figures shown in the template. No worries about how to start and edit the template, for there will be additional instructions guiding you in completing the budget model. How awesome is that?

Rest assured that these excel budget templates are made by financial modeling professionals and experts. So, aside from saving your time, your budget plan’s framework will look more manageable and easier to understand. If you’re looking for where you can get these Excel budget templates, you can check our website for the best excel budget template that fits your needs.

These Excel spreadsheet budget templates are available for download for users all over the world such as in the USA, UK, Canada, Australia, Japan, and many more, especially for those who are in need of assistance with their financial modeling tasks and other finance-related matters.