A Guide to Using IRR for Real Estate Investments

Table of Content

- The Concept of IRR for Real Estate

- Why Investors Need to Know What is IRR in Real Estate?

- Factors That Affect Internal Rate of Return in Real Estate

- How to Calculate IRR for Real Estate

- Pros & Cons of Using Internal Rate of Return Calculation in Real Estate

- Other Methods than IRR to Evaluate Real Estate Investments

- Make better Investment Decisions by Understanding IRR

Investing in real estate can be a lucrative venture. It can also be risky if you don’t know what you’re doing. One of the best ways to ensure success is the internal rate of return calculation (IRR). The Internal Rate of Return, or IRR for Real Estate, is one of the most popular because it considers money’s profit and time value. Many real estate investments focus on buying an old property, renovating it, and selling it again. The IRR is often used to evaluate the potential profitability of a real estate investment over a given holding period.

While the IRR can help assess a real estate asset’s potential return on investment, it is only relevant in the context of an exit event. It is because it considers both the initial investment and the cash flows generated during the holding period. It can help decide whether to sell a property and determine the right sale price.

This guide will discuss what is IRR in real estate and how to use it when investing in real estate. We’ll also review some of the benefits of using IRR, such as improved cash flow management and lower risk. Finally, we’ll offer tips on optimizing your returns using IRR for real estate investments.

The Concept of IRR for Real Estate

Calculating the Internal Rate of Return (IRR) ensures you do the best with your properties, mainly when you intend to apply a buy-and-sell strategy. It is a measure represented as a percentage, telling investors the typical yearly return they can anticipate from a real estate investment over time. Using this metric, you can evaluate the expected investment’s profitability and what kind of return an investment in real estate might offer during its holding period.

In the context of real estate, IRR requires a forecast of the expected free cash flows to the owners of a property during its lifetime. These cash flows can be calculated as follows.

Rental Income

– Operating Expenses

= Net Operating Income

– Purchase Price

– Capital expenditures (Investments)

+ Exit Proceeds from the Sale of the Property

+ Debt Financing

– Interest

– Debt Repayment

– Income Taxes

= Free Cash Flow to Property Owners

The cash flow to the owner will be calculated on, e.g., an annual basis during an investor’s holding period starting with the purchase and ending with the sale of the property (the exit). The Internal Rate of Return can now be calculated based on these cash flows.

The IRR calculation is affected by the time value of money, meaning the less time it takes to obtain proceeds, the better the IRR and vice versa. A dollar received in year 1 is worth more than one received in five years.

Real estate investors typically have a return objective when investing in a project or property. This return objective is often expressed as a percentage rate of return the investor wants to achieve over a certain period. This rate of return is known as the hurdle rate, and it is often set at a level that reflects the investor’s required return on investment, given the risk associated with the investment.

When calculating an investment’s internal rate of return (IRR), real estate investors often compare the expected return to their hurdle rate. Suppose the IRR of an investment exceeds the hurdle rate. In that case, the investor may be more likely to invest in the project or business, as it is expected to generate returns that exceed the investor’s minimum required rate of return. On the other hand, if the IRR falls below the hurdle rate, the investor may decide that the investment does not meet their requirements for profitability and may choose not to invest.

It’s important to note that the IRR calculation is based on forward-looking estimations based on projections of future cash flows and not actual figures. It means there is always a degree of uncertainty associated with the IRR calculation, as forecasts may only sometimes match actual results. Using a hurdle rate in IRR calculations allows investors to evaluate an investment’s potential profitability and assess whether it meets its return objectives.

Why Investors Need to Know What is IRR in Real Estate?

Real estate investors need to know what the Internal Rate of Return (IRR) is because it is a crucial metric used to evaluate the potential profitability of a real estate investment. IRR aims to give investors an anticipated return based on varying cash flows and an exit value. The annual rate at which those cash flows’ net present value (NPV) equals zero is expressed as a single percentage through an internal rate of return calculation.

A real estate investment commonly involves a buy-and-exit scenario. It starts with buying a property, which the investor will improve or upgrade. After the renovation, the investor will rent out the property, typically within five years, before selling it. During such a holding period, the investor receives interim payments from tenants. At the final stage, he will also get a considerable lump when a property is sold.

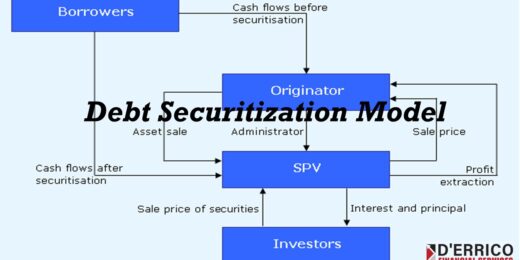

Furthermore, real estate investors need to understand the Internal Rate of Return (IRR) in debt financing because it measures an investment’s profitability over time. When an investor uses debt financing to purchase a real estate asset, they typically have to make regular payments on the debt and other expenses associated with the property. The cost of debt financing can significantly impact the IRR of the investment, as the interest payments reduce the cash flow available for other purposes.

Therefore, real estate investors can make more informed investment decisions by understanding the impact of debt financing on the IRR. They can evaluate whether the returns generated by the investment will be sufficient to cover the debt financing costs and generate a satisfactory return on their investment.

In addition, understanding IRR about debt financing can help real estate investors assess the risk associated with their investment. If the IRR is low or negative, it may indicate that the investment is too risky or that the terms of the debt financing are too onerous.

However, IRR may be irrelevant for buy-and-hold investors, as the exit proceeds are too far in the future and typically lower for more extended hold periods. Understanding IRR in real estate is essential for investors who want to make informed decisions about buying and selling properties and evaluating investment opportunities. It’s important to note that IRR is just one of many metrics investors should consider when assessing a potential investment. It should always be used with other financial and market analysis tools.

It is crucial to remember that the initial IRR for most real estate investments is merely an estimate based on several assumptions. Even so, it remains a valuable instrument for calculating the future annualized return of a real estate project. Looking at IRR allows investors to allocate their funds efficiently and use their capital best. After the investment is sold, the actual IRR may be determined.

No Downloads foundFactors That Affect Internal Rate of Return in Real Estate

Several other factors can influence your Internal Rate of Return calculation for real estate investment in addition to the purchase price and projected rental income:

- Purchase Price: Purchase price in real estate investments refers to the amount of money a buyer agrees to pay to acquire a property from a seller. This price typically includes the property’s value and any additional costs, such as closing costs or real estate agent fees. The purchase price is critical in determining the return on investment for a real estate transaction, as it affects the investor’s initial capital outlay and the potential for future appreciation or rental income.

- CAPEX: CAPEX, such as renovations or upgrades, can increase the property’s value and, therefore, later on can positively impact the IRR. However, these expenses also increase the initial investment and reduce the cash flow, which can lower the IRR.

- Financing Structure: When financing a real estate investment, two types of capital are typically used: equity and debt. Equity refers to the investor’s funds, while debt refers to borrowed funds. Using debt in a real estate investment can increase the investor’s potential return, as the investor can leverage their capital to finance a more significant investment. However, using debt also increases the investor’s risk. They must make regular interest payments on the borrowed funds, which can reduce their cash flow and potentially lead to default if the investment does not perform as expected. A real estate investment’s financing structure can significantly impact its internal rate of return (IRR). What affects return is how much debt financing you get. The more debt, the less equity you need to invest, and the more leverage and typically higher returns for equity investors.

- Initial Transaction Costs: These include real estate acquisition costs incurred upfronts, such as legal or lending fees, which must be considered when calculating IRR.

- Lease Terms: The lease terms, such as the rent amount, lease duration, and tenant creditworthiness, can affect the cash flow and, therefore, the IRR.

- Location: The location of the property can significantly impact its IRR. Properties in prime locations with high demand and limited supply will likely generate higher IRRs than those in less desirable locations.

- Market Conditions: Changes in the local or national economy, interest rates, inflation, and other macroeconomic factors can affect the supply and demand for real estate, affecting the IRR.

- Operating Expenses: The operating expenses of the property, such as maintenance, property taxes, and insurance, can affect the cash flows and, therefore, the IRR.

- Property Tax: Paying taxes is always a fact of life, but you need to calculate it in your analysis as you’ll lose out on potential profits.

- Repair and Maintenance Costs: Foreseen repairs can quickly deplete any potential return on investment. You must factor in as many repair costs as possible to calculate IRR accurately.

- Vacancy Rate: Whether due to low demand or tenant turnover, vacancies can eat into your profits if they need to be accounted for. Adjusting the vacancy rate until it reflects the actual performance gives you an accurate picture of your returns and risk profile.

- Exit Value: Exit value in real estate investment refers to the estimated market value of a property when the investor plans to sell or exit the investment. It is the price that an investor expects to receive from selling the property after holding it for a certain period and making any necessary improvements or renovations. The exit value is critical in determining a real estate transaction’s potential profit or returns on investment. It is typically calculated by analyzing market trends, comparable property sales, and other factors that may impact the property’s value in the future.

It’s important to note that these factors do not operate in isolation, and their impact on the IRR can vary depending on the specific investment scenario. Therefore, conducting a thorough analysis of these and other factors is essential when evaluating real estate investment opportunities. By correctly calculating these various components through IRR analysis, you can ensure that your real estate investments will be profitable for years.

How to Calculate IRR for Real Estate

To use IRR to determine the exit value of a real estate property, you would first need to make a set of assumptions about the expected cash flows from the property, including projected rental income, operating expenses, capital expenditures, and financing costs. You would also need to estimate the predicted sale price of the property at the end of the investment period.

Once you have these assumptions, you can calculate the IRR for the investment, which represents the discount rate at which the net present value of the expected cash flows equals the initial investment. Suppose the calculated IRR meets or exceeds the required rate of return for the acquisition. In that case, the property is considered profitable, and the expected exit value is the sale price that would result in the required IRR.

Sample IRR Calculation

Here are some examples of IRR calculations. Please note that we have used different scenarios to highlight the strengths and weaknesses of IRR analysis for real estate investing.

Sample No. 1 – IRR & Cash Yield for Unlevered Cash Flows

Suppose an investor purchases a property for $500,000 and expects to hold it for five years before selling it for $625,000. The investor estimates an annual net income of $50,000. Here’s the unlevered computation for the annual IRR and cash yield for Year 1:

As you can see, the average cash yield is 10% and the levered IRR for the property is 13.8%, making it a worthy investment. Please note that the cash flow in Year 1 is negative because that money was leaving your pocket when you bought the property. While the cash flow in Year 5 is the sum of the annual net income and sale price. To calculate the IRR, we used the IRR Excel function multiplied by the cash flows from Year 0 to Year 5.

Sample No. 2 – IRR & Cash Yield for Levered Cash Flows (LTV = 75%)

Now, let us use the same data for calculating levered IRR and cash yield in Sample No. 1. The added assumptions we have are as follows:

- Loan to Value Ratio (LTV) = 75% debt

- Interest Rate = 6%

- Term = 20 years

- Payment = To calculate the monthly payment amount, you can use the Excel payment function multiplied by (interest rate/12, term*12, LTV,0)

- Annual Debt Service = This equals the monthly payment amount multiplied by 12.

- Ending Balance in Year 5 = $342,994.55 (Here, we assumed the ending balance value instead of using

(Note: We need an amortization table to get the ending balance in Year 5. In this example, we just assumed that the ending balance in Year 5 is $342,995)

Notice that the levered cash flows from years 0 to 5 are smaller than those of unlevered. We must deduct the LTV amount in Year 0 and the annual debt service in Years 1 to 4. For Year 5, we removed the yearly debt service from the unlevered cash flow and added the sale price. As you can see, the cash yield is 3.6%, and the unlevered IRR is 28.5%. Due to the debt repayment, the cash yield value for levered cash flows is lower than the unlevered cash flows. But the IRR is expected to be higher than the levered calculation because of the debt risk on the said investment.

Sample No. 3 – IRR & Cash Yield for Levered Cash Flows (LTV = 90%)

Let us take another example by changing the LTV to 90%.

Note that at 90% LTV, the cash yield decreases to 2.3%, and the IRR goes up to 54.8%. It just showed that the higher the leverage or borrowed funds, the lower the cash flows and the higher the risks.

Sample No. 4 – IRR & Cash Yield Without Exit

As mentioned, IRR for real estate is only reliable to use with an exit event. Let us use the above assumptions in Samples 1, 2, & 3. Then, let us remove selling the property in Year 5. That means that we will also remove the ending balance in Year 5.

As you can see, unlevered and levered IRR values turned negative in Samples No. 1 & 2, implying that the property investment is unworthy as long as we exclude the exit value. It is only in Sample No. 3 where the IRR value is positive because of the high LTV ratio. Yet, all the cash yields remain the same, meaning the property still earns a profit.

A high LTV ratio is generally considered riskier than a low LTV ratio, as it means that the investor has less equity in the property and is more vulnerable to market fluctuations. However, a high LTV ratio may result in a higher IRR if the property appreciates and generates significant returns. It is because the investor is using leverage to increase their potential profits. So, it is essential for investors to carefully evaluate the risks and potential rewards of high LTV investments before making a decision.

Pros & Cons of Using Internal Rate of Return Calculation in Real Estate

IRR can be useful when evaluating the profitability of potential real estate investments; however, there are a few drawbacks to using the internal rate of return in real estate that investors need to consider.

Pros of IRR

- Accounts for Time Value of Money: The IRR calculation considers the time value of money, which means that it believes that a dollar today is worth more than a dollar in the future. It is essential in real estate investment analysis because investments typically involve cash flows and exit values over an extended period.

- Considers the Timing of Cash Flows: The IRR calculation considers the timing of cash flows. It is important because real estate investments typically involve irregular cash flows over time. The IRR calculation helps investors understand how the timing of these cash flows affects the overall return on investment.

- Helps in Decision Making: The IRR is a powerful tool for making investment decisions. It helps investors understand the expected returns from an investment and allows them to compare different investment opportunities. By using IRR to evaluate real estate investments, investors can make better-informed decisions and choose investments most likely to generate the returns they seek.

- Helps Measure Investment Returns: The IRR is a powerful tool for measuring the performance of real estate investments. It helps investors understand the expected returns from an investment and allows them to compare different investment opportunities.

- Measures Cash Flows: The IRR is based on cash flows and does not account for profits. It means that it considers the actual cash flows that an investment generates, which is essential because cash flows ultimately determine an investment’s success or failure.

Cons of IRR

- Applicable only for exit events: IRR for real estate is only reliable to use with an exit event. It is because real estate investments are typically long-term, illiquid investments. Illiquidity is the difficulty of quickly buying or selling an asset without incurring a high cost or loss. With a clear exit strategy, it can be tricky to estimate the IRR of an investment accurately. An exit event, such as the sale of the property or refinancing, provides a clear endpoint for calculating the IRR.

- Does Not Account for Investment Size: IRR needs to account for the investment size, which can be a disadvantage when comparing investments of different sizes. For example, two real estate properties may have the same IRR, but one may require a more significant initial investment, resulting in lower returns in absolute terms.

- Does Not Consider the Timing of Cash Flows: IRR assumes that all cash flows are reinvested at the same rate, which may not be accurate in real life. Also, IRR does not take into account the timing of cash flows, which can affect the risk and profitability of a real estate investment. An investment with a higher IRR may not be the best option if it generates cash flows later than another investment with a lower IRR.

- Ignores the Costs of Capital: IRR assumes that all cash flows generated by the investment are reinvested at the same rate, which may need to be revised. For example, an investor may have different capital costs for different investments, which can affect the profitability of the investment. IRR must consider the cost of capital, which can be a disadvantage when comparing investments with different financing structures.

- Sensitive to Assumptions: IRR is sensitive to the assumptions made by the investor, including projections for future cash flows, market conditions, and interest rates. Slight variations in these assumptions can lead to significant changes in the calculated IRR, making it difficult to compare different investments accurately.

In summary, while IRR is a valuable tool for evaluating real estate investments, it has some limitations that investors should consider when using it as a sole criterion for decision-making. Investors should always use multiple metrics and thoroughly analyze them before making an investment decision.

Other Methods than IRR to Evaluate Real Estate Investments

As an alternative to using the Internal Rate of Return (IRR), several other methods exist to evaluate real estate investments. Some of these methods include the following:

Cash on Cash Multiple

Cash on Cash (CoC) multiple is a popular metric used in real estate investment analysis to evaluate a property’s potential return on investment (ROI). The CoC multiple measures the lifetime cash flow generated by an investment property relative to the amount invested. It provides a simple and easy-to-understand measure of the potential return on investment. Unlike IRR, which can be complex and difficult to calculate, the CoC multiple is a straightforward calculation that investors can easily understand.

Cash on Cash multiple focuses on the actual cash returns generated by a property relative to the amount invested by the investor rather than potential returns or estimates based on assumptions. If the CoC multiple is high, the investment will likely generate solid returns and may be worth pursuing further. Furthermore, it can also be used to compare the potential returns of different real estate investments. By comparing the CoC multiple of different properties, investors can identify which investment opportunities will likely provide the best returns for their money.

However, it’s important to note that the CoC multiple is just one of many metrics used to evaluate real estate investments. It should be used with other metrics, like the internal rate of return, to get a more accurate picture of a real estate investment, both short-term and long-term.

Cash on Cash Yield

Like cash on cash multiple, this method calculates the lifetime return on investment by dividing the yearly before-tax cash flow by the total amount of money invested. The result represents the rate of return (percentage) on the cash invested in the property.

While the internal rate of return in real estate is also a valuable metric for evaluating the overall profitability of property investment, it may be less relevant if the investor does not plan to refinance or sell the property. IRR considers the timing and amount of cash flows over the life of the investment, assuming that the investor receives an exit value in the future. However, if there is no exit strategy, IRR may provide less insight into the ongoing performance of the investment. Instead, cash yield can be a valuable metric for evaluating the annual cash flow return on investment for real estate, regardless of whether the investor plans to refinance or sell the property. Even without an exit strategy, understanding the cash flow generated by the investment on an annual basis can be necessary for evaluating the ongoing profitability of the investment.

Using multiple methods to evaluate a real estate investment is recommended to get a well-rounded understanding of its potential returns. Each method has strengths and weaknesses, and using various scenarios can help investors make more informed decisions. Alternatively, you can use real estate financial model templates to assess more complex real estate-related scenarios.

Make better Investment Decisions by Understanding IRR

Investing in real estate can be a profitable venture, but it requires a good understanding of the financial metrics that determine the viability of a real estate investment. One important metric is the Internal Rate of Return (IRR), which measures the profitability of an investment over a certain period. By considering the timing and amount of cash flows, investors can determine the profitability of a potential investment and compare it to other investment opportunities.

However, IRR has its limitations. It would be best to use it with other metrics. Cash on cash multiple can complement IRR when evaluating real estate property. It provides a more accurate picture of how much cash flow an investor can expect to receive relative to their initial investment. If you don’t plan to refinance or sell the property, you may need to calculate cash yield with IRR to study investment scenarios flexibly.

Furthermore, IRR calculation is challenging and time-consuming. It is an iterative trial-and-error procedure. It can best be carried out using an IRR Excel template.