What Is The Internal Rate of Return (IRR)?

The Internal Rate of Return (IRR) is used in financial analysis to determine the profitability of a potential investment. It provides a view of the attractiveness of an investment, this means the higher the IRR the more attractive it is. It will give an insight into the rate of return of each dollar invested over a period of time.

To give you a refresher, this article will help you learn more about what is the internal rate of return.

Who Invented the IRR?

John Maynard Keynes had the idea of IRR back in 1953, he defined IRR as “I define the marginal efficiency of capital as being equal to that rate of discount which would make the present value of the series of annuities given by the returns expected from the capital-asset during its life just equal to its supply price”. But some authors dispute this and state that either Armen Alchian (1955), Irving Fisher (1930), or Joel Dean (1954) was the original proponents of IRR.

What is the definition of IRR?

In discounted cash flow analysis, the IRR is the discount rate that makes the Net Present Value (NPV) of all cash flow zero. This means that IRR is the rate at which the Future Value of the Net Cash Flows is equal to the Initial Investment amount.

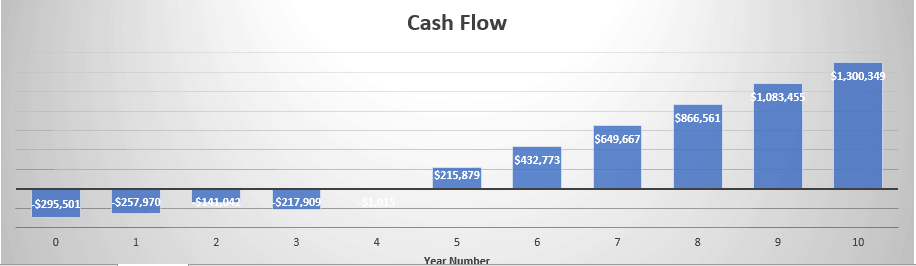

In the above example, In the 5-year Cash flow of the $200,000 investment yielded 20.5% IRR. To check that the IRR is 20.5%, we computed the NPV of the investment and it ended up with zero. As mentioned, the NPV in IRR Analysis is always zero.

Why use IRR?

Generally, if the IRR is lower than the Weighted Average Cost of Capital (WACC) or the hurdle rate, we should reject the investment or project and accept if otherwise.

IRR is mainly used to assess the financial feasibility of a project. If a company is considering purchasing a piece of equipment to increase its production, thus producing more products, IRR will be used to determine if the equipment is worth purchasing.

A broader example will be; if an investor is planning to buy a company now and later sell it. What is the forecasted value of the company in 5, 10, or 15 years? What is the IRR on those forecasts? Should the investor buy it or not?

Let’s go a little simpler, you are planning to buy a car on a loan for you to save on your transportation costs. You will then determine how much interest rate can you afford from the car loan for your plan of buying a car a good financial decision.

How to calculate IRR for a new Pizza Place?

DDN Pizza is planning to expand and purchase a new store, the store will cost $50,000 and will generate $70,000 of revenue and EBITDA of $15,000 for the next 5 years. The store is to be sold after 5 years at $75,000. WACC is assumed at 10%.

The IRR of this investment is 22.4%, which is higher than the assumed WACC of 10%. Therefore, we should accept this investment.

IRR is also being used by business owners to compare different scenarios; this will help them determine which proposal will generate a higher return. A Comparative Analysis of the IRR of all proposals will help in determining this.

Comparing 2 proposals via IRR Analysis:

DDN Pizza is planning to expand and purchase a new store, there are two locations they are looking at. The 1st location will cost $50,000 and will generate $70,000 of revenue and EBITDA of $12,000 for the next 5 years. The store is to be sold after 5 years at $60,000.

The 2nd location will cost $80,000 and will generate $95,000 of revenue and $20,000 of EBITDA for 5 years. This store is projected to be sold at $100,000 after 5 years.

Based on the IRR of the two locations, location 1 gives a higher IRR of 22.4% compared to Location 2 of 17.3% and they are both above the 10% WACC. Based on the results, we will choose Location 1 since it generated 22.4% IRR.

How does leverage affect the IRR?

There are two types of IRR, the Project Level, and the Equity Level. The Project Level IRR (Unlevered IRR) is only considering the project or investment’s cash flow. We do not consider the impact of the source of financing of the investment.

While Equity Level IRR (Levered IRR), the investment or project is funded by debt AND equity. If it is only funded by equity, Project and Equity Level IRR will be the same, and if only funded by debt, Equity IRR does not exist.

Investors leverage on the use of debt as a part source of financing of the investment. Thus, Leverage Effect takes place.

The Leverage Effect is the effect of debt on the return on equity. The Leverage Effect allows an investor to produce a better return with less equity by using debt.

Unlevered IRR calculates the Financial Feasibility of the Project

As mentioned, Project Level IRR (Unlevered IRR) does not take into consideration the financing factor of the project, therefore, assumes all the finances come from equity.

Since Project Level IRR is fully financed by equity, there is no leverage effect or it is Unlevered, thus the other term for it is Unlevered IRR. Though most investments are partly financed by debt, it is best to use Project Level IRR first to determine the financial feasibility of the investment.

Let us take DDN Pizza as an example. In that scenario, the CAPEX all came from equity financing. Upon calculation of its IRR and comparing it to the WACC, we then determined that we should accept and proceed with the investment.

Using the Unlevered IRR, we can determine that the proposed store location will yield an IRR above the WACC. Therefore, we should proceed with the investment.

Levered IRR Benefits from Financial Engineering (Leverage)

In Equity Level IRR, as stated, the project or investment is financed by Equity AND Debt. Financing a project partly through debt capital, the leverage effect occurs, and it theoretically increases the equity return.

Let us then take DDN Pizza as an example, let us assume that the source of financing is 60% from Debt and 40% from Equity. And the Debt Interest Rate is 5%.

With this scenario, Levered IRR has yielded a higher IRR compared to Unlevered IRR. The business owner only invested $20,000 but yielded a 35.2% IRR compared to the 22.6% Unlevered IRR.

What if we assume a higher Debt Financing, let’s say 80%? What will happen to the Levered IRR? Assuming all other assumptions remain the same.

The Levered IRR increased to 46.3% while the Unlevered IRR remains the same. This means, that the higher the debt financing, the higher the Levered IRR.

That is Financial Leveraging, investors take debts to finance the projects and will provide a higher return over a period of time.

When to use Levered and Unlevered IRR?

Using the correct type of IRR is important in financial analysis. However, it is actually beneficial to calculate both Levered and Unlevered IRR to ensure the following:

- that the project generates excess return and does not destroy value

- to meet our own specific return target

Doing so shows how meticulous you are against risks and helps determine which projects are feasible and profitable as well as avoid bad projects with excessive risks.

When calculating the IRR, use first the Unlevered IRR and compare it to the WACC to determine the financial feasibility of the project. Once we established that the project is financially feasible, we will use Levered IRR to determine how much debt financing our project can obtain and how much our IRR can be enhanced further by using debt financing.

Limitations of IRR

While using IRR is great for financial decision-making, there are some limitations to its use.

Assumes all positive cash flow will be reinvested

IRR allows us to calculate the value of future cash flows, but it implicitly assumes that those future cash flows will be reinvested at the same rate as the IRR. Unfortunately, in reality, the number generated in IRR is high and there are a limited number of opportunities that will yield the same rate.

IRR cannot be used with a negative cash flow

IRR calculations assume that all future cash flows are positive. If there is a negative cash flow, the IRR might be inconclusive.

Mutually Exclusive Projects

Though we can use IRR to compare different projects, it does not account for the difference in the timing of the cash flow of each of the projects. The timing issue will give us a conflicting result, thus giving a ranking problem.

Ignores Future Costs

The main component to determine the IRR is the Cash inflow and outflow, but it does not account for the potential increase or decrease of costs that will affect the profits in the future. Many operating costs such as fuel, electricity, and maintenance are variable and may affect the business over time. With this being ignored, the IRR computed may be inaccurate.

Ignores the overall size and scope of projects

When analyzing projects, it does not take into account the size and scope of the projects. This will limit the business to short-term investments and avoid long-term investments.

Decisions will be based on estimates

Almost all numbers used in computing IRR are estimates except the cash outflow now. This may lead to unsuccessful projects in the future.

What are the Alternatives to using IRR?

With these limitations, there are other alternative financial metrics we could use for making financial decisions.

Return of Investment (ROI)

Return of Investment (ROI) is the percentage of change of an investment over a set period. It is determined by dividing the profit earned on an investment by the cost of that investment. To illustrate, here is the formula for ROI:

Modified Internal Rate of Return (MIRR)

The Modified Internal Rate of Return (MIRR) strives to improve the original IRR. The main difference is that MIRR incorporates the future value of positive cash flows and the present value of cash flows using different discount rates. It also incorporates the company’s cost of capital. To calculate it, assume the positive cash flows are reinvested at the company’s cost of capital and then the initial outlays are financed by the company’s financing cost. Here is the formula for MIRR to illustrate:

You can also use the Excel formula for MIRR for easier computation.

Cash on Cash Return

Cash on Cash Return is a direct calculation of the investment and the cash return on a given year. The Cash on Cash Return varies each year depending on the net cash flow of the investment. It is calculated by taking the cash flow before tax in a given period and then dividing it by the investment amount as of the end of that given period. Here is the formula:

Net Present Value (NPV)

Net Present Value is the difference between the Present Value of Cash Inflows and the Present Value of Cash Outflows over a period of time. It considers all projected cash flows and the time value of money to determine whether an investment is likely to generate gains or losses. Basically, a positive NPV suggests that the project is profitable and we should accept it. To determine the NPV here is the formula:

To learn more about NPV in detail, here is an article about How to Calculate the Net Asset Value.

When to use and not to use IRR?

IRR helps determine the Feasibility of a Project

Internal Rate of Return (IRR) might have some limitations, but this gives a quick insight into how successful a project or investment can be. Whether Personal, Business or Investment Opportunity, IRR can be used. IRR leads us to a systematic approach to business decision-making. We could use IRR along with different financial metrics to better our business decisions.

Using IRR helps us determine the financial feasibility of a project. To make it easier for you, we have created IRR Analysis files to help you better understand and apply IRR in real-life scenarios.

Now that we’ve given you an example, do you want to try calculating the IRR on your own? Here is a free-to-download IRR Calculator: IRR Calculator – 15 years and another for IRR Project Finance Analysis.

Feel free to also browse our whole selection of financial model templates (industry-specific and general models) that includes the calculation of IRR: