Website / App Financial Model (Recurring Revenue Services)

A great tool to model out any recurring revenue service that acquires users through a website or app.

Video Tutorial:

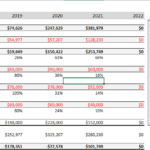

Latest Update: Fully integrated 3-statement model (Income Statement, Balance Sheet, Cash Flow Statement), Capitalization Table, and updated Executive Summary / DCF Analysis / NPV, Distributions, and general formatting convention syncs.

You have revenue and cost assumptions. There is a global sensitivity up and down in 15% increments.

You can pick the month revenue/costs start as well as their monthly values per year (up to 5 years).

There is exit value logic along with a monthly/annual detail, an overall financial summary, and a distribution summary if you have investors owning a share of the future cash flows. This area shows DCF/NPV as well as IRR.

There are up to 5 pricing tiers and users are modeled to come in through to a free account first and then a % of those go to paid. From the paid pool you can assign %’s of users to each tier. Each tier has its own growth/churn. Users may also go from traffic direct to paid and that has its own % assumption by year.

Plenty of charts to get an idea of what is going on.

Similar Products

Other customers were also interested in...

SaaS Financial Model Bundle

This is a bundle of Financial Model Templates for SaaS businesses and their related sectors such as ... Read more

Subscription Business – 10 Year Financial Model

Financial Model providing a 10-year financial plan for a startup or operating Subscription Business.... Read more

Monthly Recurring Revenue SaaS Financial Model Exc...

Check Monthly Recurring Revenue SaaS Financial Model. This well-tested, robust, and powerful templat... Read more

SaaS Application Freetrial Financial Model Excel T...

Check SaaS Application Freetrial Pro-forma Template. Enhance your pitches and impress potential inve... Read more

Online Businesses Bundle (6 Models)

This is a collection of selected financial model templates for projects or ventures in the Online Bu... Read more

Online Businesses Financial Model Bundle

This is a collection of financial model templates for businesses in the Information technology Indus... Read more

SaaS Model Templates – Small Bundle Version

Since you are planning to start your very own SaaS business, you will certainly need to prepare a ... Read more

SaaS Model Templates – Big Bundle Version

Since you are planning to start your very own SaaS business, you will certainly need to prepare a ... Read more

Online Business Financial Models Bundle

A collection of six Online Business Financial Models offered at a discounted price you can’t miss!... Read more

5-Year Enterprise SaaS Financial Model – 3 C...

A dynamic financial model to forecast monthly and annual customers/revenues/expenses for a SaaS comp... Read more

You must log in to submit a review.