Annual Recurring Revenue (ARR)

Our templates are meticulously designed to help you harness the power of ARR, enabling precise forecasting, revenue tracking, and strategic decision-making. Tailored for startups, scale-ups, and established companies alike, these templates simplify complex financial processes, offering customized options to fit your business needs.

Elevate your financial strategy, optimize your revenue streams, and unlock sustainable growth with our ARR financial model templates, your ultimate tool for navigating the intricacies of recurring revenue with confidence and clarity.

VC Startup Portfolio Financial Forecasting Model

Elevate your venture capital strategy with the VC Startup Portfolio…

Fast Food Restaurant Financial Model Template

Maximize fast food financials with our user-friendly financial model template.…

B2C eCommerce Financial Model & Valuation Model

Tailored ecommerce financial model Model for startups. Forecast revenue, integrate…

Pro Financial Forecast – Dynamic and Advanced Financial Projections

Unleash the power of precise, customizable forecasting with Pro Financial…

Cleaning Service Pro Forma Template (Commercial / Residential)

A pro forma template for any home service or general…

Function-as-a-Service (serverless computing) Financial Model

Create financial projections for a FaaS cloud computing services business.…

Data-as-a-Service Financial Feasibility Study

This model is built for data-as-a-service startups. If you have…

Cohort Modeling Framework for SaaS – Historical Data Analysis

A simple framework for any recurring revenue business (SaaS or…

Badminton Court and Club Dynamic Financial Model 10-years

Introducing the Badminton Court and Club Forecasting Model, a visionary…

VOD/OTT Streaming Platform – 10 Year Financial Model

Financial Model providing a 10-year financial plan for a startup…

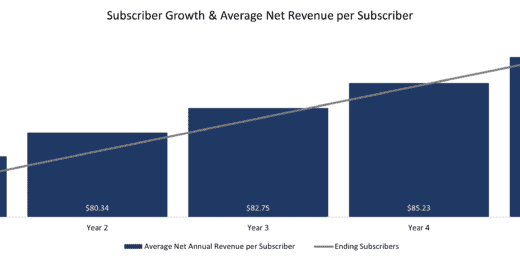

Subscription Box Financial Model – Up to 72 Months

Test many variables in this financial model for a subscription…

Social Media Platform – Dynamic 10 Year Financial Model

Financial Model providing a dynamic up to 10-year financial forecast…

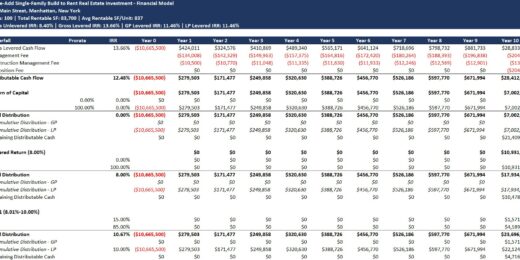

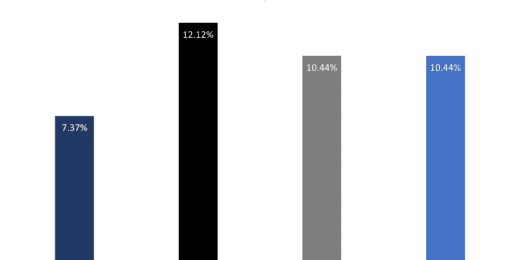

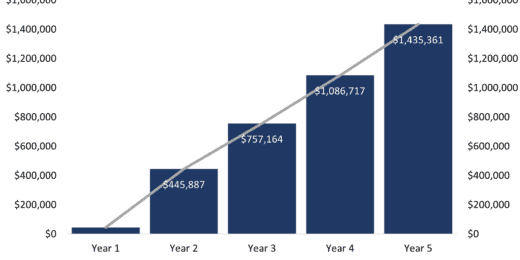

Value-Add Single-Family (SFR) Build to Rent (B2R) Real Estate Investment Model with Waterfall

A financial model to help calculate and analyze the pro…

Core Single-Family (SFR) Build to Rent (B2R) Real Estate Investment Model with Waterfall

Pro Forma Models created this financial model to calculate and…

eCommerce Monthly 3-Statement Business Plan with Return Calculations

A model to prepare and analyze a start-up or existing…

Software as a Service (SaaS) Monthly 3-Statement Business Plan with Return Calculations

Pro Forma Models created this model to prepare and analyze…

Mobile Applications (App) Monthly 3-Statement Business Plan with Return Calculation

Pro Forma Models created this model to prepare and analyze…

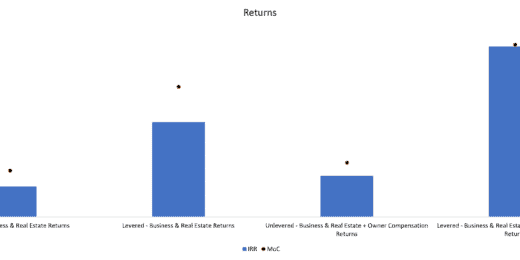

Real Estate Brokerage Business Plan with Return Calculation

Pro Forma Models created this model to analyze the financial return…

Dynamic Franchise Business Plan – 3 Statement Model with DCF & Returns

Pro Forma Models created this model to analyze the financial…

Equipment Leasing Company Financial Model – Dynamic 10 Year Forecast

Financial model providing a dynamic 10-Year Financial Plan for an…

SAAS Financial Model Template – Team Strategy FM

An easy-to-use and customizable financial modelling template that covers all…

Boutique Gym Financial Model – Dynamic 10 Year Forecast

Financial model providing a dynamic 10-Year Financial Plan for a…

Detailed 3-Statement SaaS Financial Model Template and SaaS Overview Presentation

This is a detailed and easy-to-use Software-as-a-Service (SaaS) financial model.…

SaaS Customer Feasibility and Margin Model

Design your ideal SaaS customer with all relevant terms configurable,…

Franchisor Business – 3 Statement Model with Return Calculations & DCF

This model can be used to analyze the financial return…

SaaS Startup Financial Model – Enterprise and User

Advanced Financial Model providing a dynamic up to 10-year financial…

Health & Fitness Club Financial Model – 5 Year Business Plan

5-Year Financial Model providing advanced financial & planning analysis for…

Due Diligence P&L – Exhaustive Revenue and Costs Analysis Template

Model for in depth understanding of high level profit and…

Catering and or Catering Equipment for HIRE 10 – year Business Model

This Catering and or Catering Equipment for HIRE Business and…

Plant & Equipment Hire Business Model – Three Statement Analysis

Analyse the Start or Expansion of a Building Equipment Hire…

5-Year Enterprise SaaS Financial Model – 3 Customer Configurations

A dynamic financial model to forecast monthly and annual customers/revenues/expenses…

The Development Property Valuation Calculator incorporating XIRR and XNPV

The Development Property Valuation calculator is suitable for accurately analysing…

The Realtors Quintessential ALL-IN-ONE Toolkit

Professional Realtors need a professional Toolkit which allows them to…

Online Classes Subscription Financial Model Excel Template

Order Your Online Classes Subscription Financial Plan. This well-tested, robust,…

House Cleaning Subscription Financial Model Excel Template

Get Your House Cleaning Subscription Pro-forma Template. Spend less time…

Vitamins Subscription Box Financial Model Excel Template

Try Vitamins Subscription Box Pro-forma Template. Spend less time on…

Beauty Subscription Box Financial Model Excel Template

Check Beauty Box Subscription Financial Plan. Use this Excel to…

SaaS Metrics Dashboard Template Excel

SaaS Dashboard Template created in Excel spreadsheet format to assist…

Monthly Recurring Revenue SaaS Financial Model Excel Template

Check Monthly Recurring Revenue SaaS Financial Model. This well-tested, robust,…

SaaS Application Freetrial Financial Model Excel Template

Check SaaS Application Freetrial Pro-forma Template. Enhance your pitches and…

Online Businesses Financial Model Bundle

This is a collection of financial model templates for businesses…

Website / App Financial Model (Recurring Revenue Services)

A great tool to model out any recurring revenue service…

SaaS & E-Commerce Financial Models Bundle

This bundle of financial model templates provides you a package…

Annual Recurring Revenue: Achieving Financial Stability

In the dynamic landscape of modern business, the quest for financial stability often resembles a high-stakes voyage across tumultuous seas. Picture two vessels: Company A, navigating by the stars without a compass, and Company B, steering with the precision of Annual Recurring Revenue (ARR) as its guide. This tale of two companies unveils the transformative power of ARR — a beacon of predictability in the unpredictable waters of revenue generation.

Calculating Annual Recurring Revenue (ARR) emerges as the secret weapon for Company B, aiming for the zenith of financial stability. Armed with ARR's insights, carve its path toward enduring success. Through the lens of ARR, we reveal the alchemy of turning regular income into a fortified stronghold, ensuring that companies not only withstand the ebbs and flows of market tides but also sail ahead with confidence and precision.

What is Annual Recurring Revenue (ARR)?

Now, let's comprehensively answer the question of what is annual recurring revenue. Annual Recurring Revenue (ARR) is a critical financial metric used primarily by companies operating on a subscription-based model, such as Software as a Service (SaaS). It represents the yearly revenue value generated from subscriptions, contracts, and other recurring billing cycles.

What is annual recurring revenue as a financial metric? It is a predictable measure of revenue that a company can expect to receive every year from its current customers, assuming no changes to the subscription plans. This predictability comes from the nature of the recurring revenue models, where customers are billed regularly (monthly, quarterly, or annually).

What is annual recurring revenue in terms of perspective? ARR is a forward-looking perspective vital for strategic planning and attracting investment. Because ARR accounts for revenue that is expected to be recurring, it allows businesses to forecast future revenue more accurately and make informed decisions regarding investments, budgeting, and resource allocation.

What is annual recurring revenue when it comes to valuation? ARR is more than just a snapshot of current revenue; it's a dynamic metric that reflects the stability and potential of a business in the subscription economy. A growing ARR suggests that the company is acquiring new customers, retaining existing ones, and benefiting from additional revenue through upselling or cross-selling. So, it results in a higher annual recurring revenue valuation.

Annual Recurring Revenue vs. Monthly Recurring Revenue

Annual Recurring Revenue (ARR) and Monthly Recurring Revenue (MRR) are critical metrics subscription-based businesses use to measure predictable and stable revenue streams. Still, they differ primarily in their period of calculation. ARR is the yearly value of recurring revenue from subscriptions, contracts, or any other regular income, providing a high-level view of financial health and long-term stability. In contrast, MRR is calculated monthly and offers a more granular look at the company's financial performance, allowing for immediate adjustments and more detailed month-to-month tracking. While ARR gives a broad picture of annual financial expectations and growth trends, MRR is pivotal for operational planning, cash flow management, and short-term financial analysis, making both metrics indispensable for comprehensive revenue tracking and strategic planning in recurring revenue business models.

What is a Good ARR?

The answer to what is a good ARR figure is subjective and varies widely depending on the size of the company, the industry it operates in, and its stage of growth. However, several factors can indicate what is a good ARR:

- Customer Acquisition Costs (CAC): A good ARR should be sustainable and profitable. So, what is a good ARR means the cost of acquiring new customers (CAC) should be significantly less than those customers' lifetime value (LTV). An LTV: CAC ratio of 3:1 or higher is often cited as healthy, indicating that the revenue generated from a customer is three times the cost of acquiring them.

- Customer Churn Rate: A low churn rate indicates that a business is retaining its customers, which is crucial for maintaining and increasing ARR. An annual customer churn rate of less than 5% to 7% is generally considered good, though this can vary by industry. That affects typically what is a good ARR.

- Expansion Revenue: For subscription-based businesses, the ability to upsell or cross-sell to existing customers and thus increase ARR from the current customer base is a positive sign. What is A good ARR will have a significant portion of its growth coming from expansion revenue, indicating a strong product-market fit and customer satisfaction.

- Growth Rate: What is a good ARR is not just about the current figure but also about the growth rate over time. High-growth companies, especially in the tech and SaaS sectors, often see ARR growth rates of 30% to 40% year-over-year or even higher for early-stage startups. A 10% to 20% growth rate can be considered healthy for more established companies.

- Profitability Growth: While not all companies prioritize profitability in the growth stages, what is a good ARR should eventually lead to profitability growth. It means managing operating expenses so that the business can sustain itself on its recurring revenue.

Ultimately, what is a good ARR demonstrates healthy growth, low churn, efficient customer acquisition, and the potential for profitability. Comparing your ARR to industry benchmarks can provide context on what is considered "good" in your specific market.

Why is Annual Recurring Revenue Important?

Annual Recurring Revenue (ARR) is the financial backbone for subscription-based businesses, providing a reliable measure of the steady income expected yearly. It plays a pivotal role in strategic planning, investment attraction, and the overall assessment of a company's market position and potential for expansion.

Concrete Measure of Growth

Annual Recurring Revenue (ARR) offers businesses a concrete measure of growth, especially for those operating on subscription-based models. Unlike one-time sales, ARR provides a precise and continuous gauge of financial expansion by tracking the yearly value of all subscription agreements. This metric allows companies to monitor their growth trajectory in real time, making it easier to compare year-over-year performance. By understanding how ARR changes over time, businesses can identify trends, adjust strategies, and focus on what works best for scaling their operations.

Enable Revenue Forecasting

ARR is instrumental in enabling accurate revenue forecasting, a crucial aspect of financial planning. With a predictable income stream, companies can project future revenues more confidently, aiding in budget allocation, resource planning, and investment strategies. This foresight is essential for maintaining a healthy cash flow, navigating market fluctuations, and making informed decisions about future projects or expansions. Revenue forecasting based on ARR also reassures investors and stakeholders of the company's financial stability and growth prospects.

Facilitates Goal Setting

Setting realistic and achievable goals is fundamental to the success of any business, and ARR plays a vital role in this process. By analyzing ARR data, companies can set specific, measurable customer acquisition, retention, and revenue growth objectives. This metric provides a benchmark against which to measure progress, helping teams stay aligned and focused on long-term strategies. Furthermore, ARR-driven goal setting encourages continuous improvement and innovation as businesses strive to increase their recurring revenue and enhance customer value.

Identify Success and Failure

ARR is a critical tool for identifying areas of success and failure within a business. By examining the components contributing to ARR, such as new sales, renewals, upgrades, and churn, companies can pinpoint precisely where they are performing well and where improvements are needed. This level of insight is invaluable for refining product offerings, enhancing customer experiences, and optimizing sales and marketing strategies. Identifying these success and failure points allows businesses to make data-driven decisions that foster growth and sustainability.

Leads to High Valuation

A strong ARR can lead to a higher valuation for companies seeking investment or considering a sale. Investors and acquirers often view ARR as a testament to a company's ability to generate stable, predictable revenue, which is highly attractive in the volatile business world. A robust ARR indicates a loyal customer base, a scalable business model, and the potential for future growth—all critical factors in determining a company's market value. Therefore, focusing on growing ARR improves current financial health and sets the stage for future financial success.

The Annual Recurring Revenue Formula

The annual recurring revenue formula encompasses the total yearly value of all subscription agreements, factoring in additional recurring revenues from add-ons or upgrades and subtracting the revenue losses due to cancellations or downgrades. It helps businesses understand their steady income stream over a year, essential for forecasting, planning, and valuation purposes. The annual recurring revenue formula is straightforward. It is the sum of the subscription revenue for the year and the recurring revenue from add-ons minus the revenue lost from cancellations, churns, and downgrades.

Sample Calculation

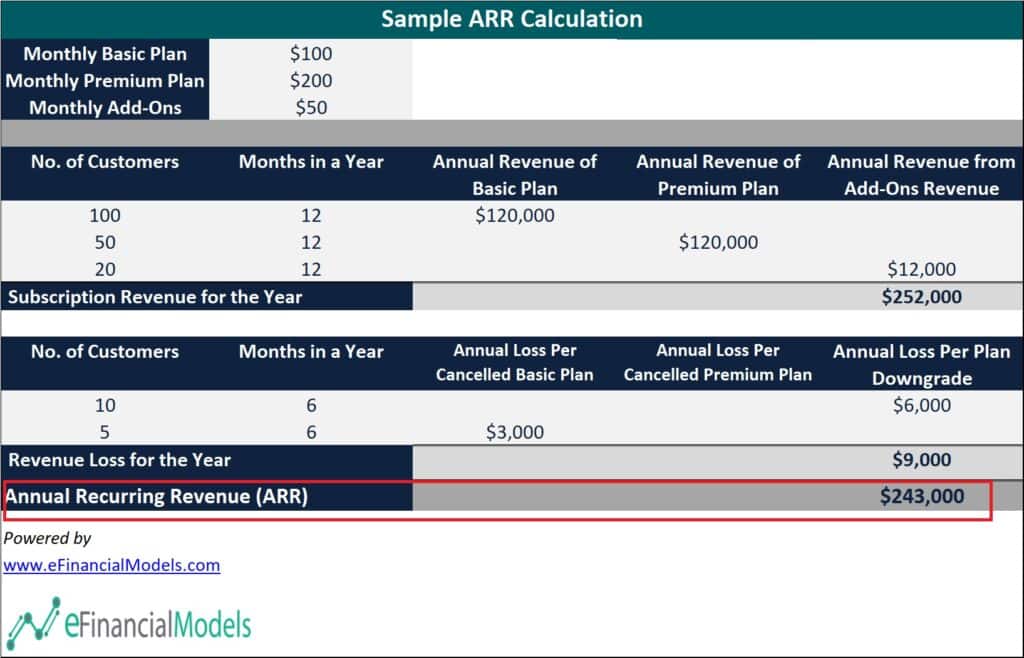

To illustrate the annual recurring revenue formula with a realistic example, let's assume a software company offers a basic subscription plan for $100 monthly and an upgraded plan for $200 monthly. In a particular year, the company has:

- 100 customers on the basic plan

- 50 customers on the upgraded plan

- 20 customers purchase add-ons amounting to $50 per month each

- 10 customers downgraded from the upgraded plan to the basic plan halfway through the year

- 5 customers canceled their basic plan subscriptions halfway through the year

Using the annual recurring revenue formula, our annual recurring revenue calculation is as follows:

So, the company's annual recurring revenue calculation from these subscriptions and add-ons, considering the downgrades and cancellations, is $243,000. This example demonstrates how to use the annual recurring revenue formula by considering various factors contributing to or detracting from the recurring revenue over a year.

What to Include and Not to Include in Annual Recurring Revenue Calculation?

What to Include and Not to Include in Annual Recurring Revenue Calculation?

The key to accurate ARR calculation is knowing what to include in the subscription revenue for the year and annual subscription revenue for the year.

What to Include

The figures you need to include are metrics that directly affect the annual recurring revenue calculation. These include:

- Recurring Subscription Revenues

- Product Add-Ons

- Account Upgrades

- Account Downgrades

- Subscription Cancellations

What Not to Include

The annual recurring revenue calculation focuses solely on the recurring elements of your revenue model, including the impacts of churn and downgrades. You must be vigilant and ensure that "non-recurring" items are not inadvertently included in your calculation. Examples of items to leave out are:

- Set-Up Fees

- One-Time Charges

- Non-Recurring Add-Ons

- Credit Adjustments

How to Improve Your ARR

To enhance a business's Annual Recurring Revenue (ARR), adopting multifaceted strategies targeting different revenue cycle aspects is crucial. Let's break down some strategies that contribute to increasing ARR:

- Expand Your Audience: To enhance ARR, businesses should focus on expanding their customer base. It involves identifying and tapping into new market segments or demographics that have yet to be previously targeted. Strategies such as marketing campaigns, partnerships, and broadening the product or service offerings can attract new customers. By increasing the total number of customers, the business effectively increases its recurring revenue base, contributing to a higher ARR.

- Focus on Retaining Customers: Customer retention is as crucial as acquiring new customers because it's generally more cost-effective to keep an existing customer than to obtain a new one. Improving the onboarding process ensures that new customers understand the product or service's value from the beginning, increasing their likelihood of staying. Furthermore, implementing retention strategies such as loyalty programs, personalized communication, and incentives for renewals can significantly reduce churn rates. Lower churn rates directly contribute to maintaining or increasing ARR, as the business retains more of its recurring revenue.

- Optimize Pricing: Regularly revising and optimizing the pricing model is essential to adapt to market changes, competition, and customer feedback. It could involve introducing new pricing tiers, adjusting prices based on product value perception, or offering promotional discounts to lock in longer-term subscriptions. Effective pricing strategies can attract more customers or encourage existing customers to move to higher-value plans, increasing the average revenue per user (ARPU) and, consequently, the ARR.

- Track ARR Metrics: Monitoring and analyzing ARR and related metrics allow businesses to understand their financial health and growth trajectory. By using financial model templates for benchmarking, companies can compare their performance against industry standards or historical data, identifying areas for improvement. Tracking metrics such as customer acquisition cost (CAC), customer lifetime value (CLTV), churn rate, and ARR growth rate helps make informed decisions to refine strategies for revenue growth.

- Upselling: Encouraging existing customers to purchase additional features, products, or higher-tier plans is an effective way to increase ARR. Upselling can be achieved by strategically marketing add-ons, bundles, or premium features that complement the core offering. Cross-selling related products or services to existing customers and encouraging upgrades to more premium packages enhances the customer's value and increases the revenue generated from each customer. This approach boosts ARR and improves customer satisfaction by providing solutions that better meet their needs.

By implementing these strategies, businesses can significantly improve their ARR, ensuring a stable and growing revenue stream vital for long-term success.

Achieve Success Through ARR Growth

Understanding and calculating Annual Recurring Revenue (ARR) is paramount for any subscription-based business to achieve financial stability. This metric provides a clear view of predictable revenue streams and allows organizations to make informed decisions about investments, budget allocations, and growth strategies. By accurately calculating ARR, companies can identify trends in customer behavior, forecast future revenue, and adjust their business models accordingly.

Financial modeling plays a crucial role in enhancing the analysis of ARR by incorporating various financial scenarios and projections into the planning process. This approach allows businesses to simulate different future scenarios based on current ARR figures, enabling them to prepare for a range of outcomes. By integrating ARR data with financial models, companies can assess the impact of strategic decisions on future revenue, evaluate the profitability of different customer segments, and identify opportunities for reducing churn and increasing customer lifetime value. This level of analysis and planning is critical for maximizing ARR and ensuring sustainable growth.

In conclusion, focusing on calculating and analyzing Annual Recurring Revenue through sophisticated financial modeling is essential for achieving financial stability in the subscription-based business landscape. Companies that excel in these areas are well-equipped to navigate the complexities of recurring revenue, anticipate market changes, and position themselves for long-term success. Let this be a call to action for all subscription-based businesses: invest in understanding and optimizing your ARR today for a more financially stable tomorrow.