Buy Now Pay Later ALL IN ONE Integrated Financial Model + Market Insights

This is a real cased based ALL IN ONE integrated financial model of a BNPL (Buy Now Pay Later) business plus business model explanation and market insights as to the added value of this model.

This is a real cased based ALL IN ONE integrated financial model of a BNPL (Buy Now Pay Later) business plus business model explanation and market insights as to the added value of this model.

This model is extremely useful for financial planning, and it is a perfect decision-making tool for investors since its real case-based characteristic and market insights provision. It includes detailed assumptions, revenue, cost, Capex, Debt, working capital, and cash flow forecast.

The model consists of four parts, Introduction, Inputs, calculations, and outputs.

The Introduction part includes the Executive summary, Market Insights, Explanation of how BNPL business makes money. This part provides basic and important information for users who have little experience of the industry and can be great helpful to see the big picture of the business and to understand the model.

The assumption part includes the hypothesis of initial investment, Scenarios, and other metrics for the performance of the model.

In the Calculation part, users can learn all the details of the mathematical logic from assumptions to outputs. The calculations are quite intuitive and easy to understand without any sophisticated formulas embedded. All users either from a finance background or other fields can easily follow up.

Outputs include 5-year forecasted Financial Statements (3 Statement Model- Profit and Loss, Balance Sheet, and Cash Flow), a comprehensive DCF valuation, and Ratios analysis. The results of ratios analysis are also being summarized in the executive summary. Users can easily get a picture of the performance of the profitability, liquidity, solvency, and leverage of the company.

This model is completely dynamic and flexible that allowing the users to modify the key-driven factors and to see the results based on distinct cases. The numbers in color BLUE could be adjusted and the outputs and analysis results will be automatically updated.

The structure of the template follows Financial Modeling Best Practices principles and is fully customizable.

Model Structure

Introduction

• Cover

• Executive Summary

• Market

• How BNPL makes money

Inputs

• Assumptions

• Scenarios

• Initial Investment

Calculations

• Capex & Depreciation

• Debt

• Balance Sheet

• Profit and Loss

• Cash Flow

Outputs

• Proforma Balance Sheet

• Proforma Profit and Loss

• Proforma Cash Flow

• Discounted Cash Flow (NPV, IRR, Payback)

• Financial Ratios (Liquidity, Efficiency, Leverage, and Profitability)

Users’ Support Service

To guarantee the user’s satisfaction, all the models have been built following the Best Financial Modeling Principles and considering the high level of flexibility and user-friendly in priority.

Even the users who have no finance or accounting background or have little experience in Microsoft Excel can easily handle them to assist in making better decisions.

Please feel no hesitate to contact us if you experience any problems when using the models provided.

In addition, if you need a customized model for your specific business, please just let us know and we would be happy to help you with this.

Similar Products

Other customers were also interested in...

Amortization Schedules Template (Loans, Mortgages,...

User friendly template including Amortization Schedules for Loans, Mortgages, Operating and Finance ... Read more

Private Equity Fund Model (Investor Cashflows)

Private Equity Financial Model to analyze fund cashflows and returns available to Limited Partners (... Read more

Crowdlending (P2P) Platform – 5 Year Financi...

Financial Model providing an advanced 5-year financial plan for a startup Crowdlending (Peer-to-Peer... Read more

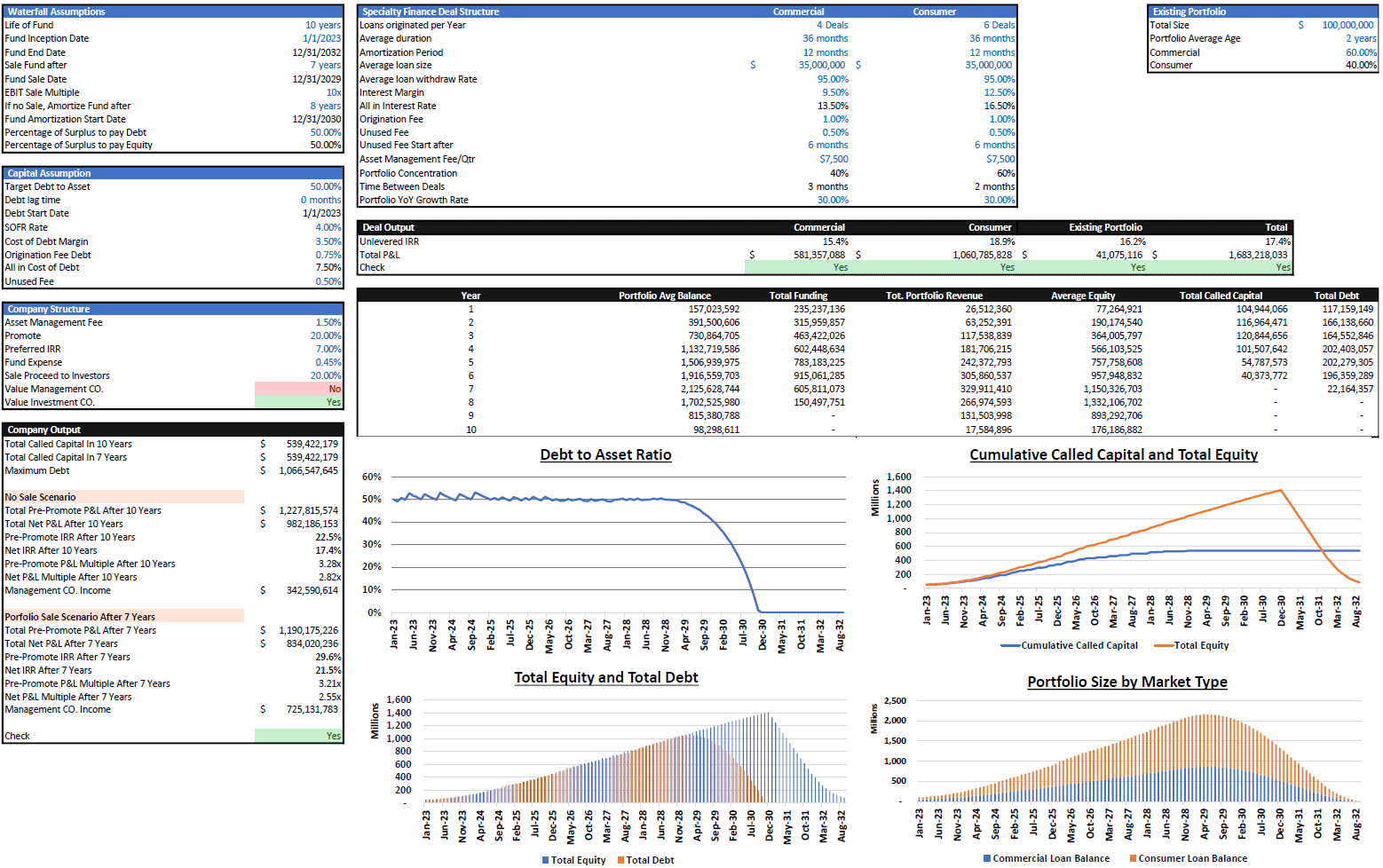

Debt Fund Excel Model

Explore the Debt Fund Excel Model, a comprehensive tool for evaluating new credit fund opportunities... Read more

Leveraged Buyout (LBO) Financial Projection Model

User-friendly financial model to project and analyse the financial outcomes (IRR, projected financia... Read more

Top 16 Google Sheet Templates

This is a bundle of all the most useful and efficient google sheet templates I have built over the y... Read more

Investment Holding Company 3 Statement Financial P...

3 statement 5 or 8 year rolling financial projection Excel model for an investment holding company h... Read more

Lending Company Financial Model – 5 Year Forecas...

This Financial model template presents a business scenario of a corporation engaged in granting loan... Read more

Mergers and Acquisition (M&A) Financial Projec...

User-friendly financial model to project and analyze the financial outcomes and feasibility of an Me... Read more

Multi-Member Investment Fund Portfolio and Distrib...

A fund management tool to track many positions over time as well as distributions to up to 20 member... Read more

Reviews

Thanks for the response. Using a listed BNPL for reference (e.g. ZipCo), you would generally see a customer receivable that is roughly 25-30% of the Transaction Value. In year 5, the transaction value was $391m which would roughly translate to a receivable of $100m (on average). However the receivables in the BS are only $2m. Similarly, the borrowings seem unusually small. You have modelled finance costs as a % of TV – $782k in Y5. However, the debt is only $1m in Y5.

33 of 70 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

Hi Jill

Thanks for sharing this model.

Regarding the balance sheet “Accounts Receivable” – technically a BNPL does not have any AR driven by revenue. This is because the BNPL receives revenue upfront from the retailers (amortised using EIR). The accounts receivable would be more sensibly based on total transaction value and one would expect that the AR would be quite a lot larger than what has been currently projected in the model. Do you have any thoughts on this? Thanks

40 of 81 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

-

Hi Sam

Great thanks for your comments.

You mean account receivable or account payable?

I understand the AR should be collected from the bank of the consumer which will be depends on the contract of the platform and the bank. Let me know your opiniones. Happy to dicuss.Regards Jill

39 of 79 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

You must log in to submit a review.