Guiding Principles of Financial Modelling

Core principles of building financial models

This is an attempt to list and explain the key concepts of developing financial models (also applicable to any other kinds of reports, budgets, or forecasts). I hope that after studying this guide and the accompanying Excel examples you will be able to start modelling on your own.

The publication serves two purposes:

1. Explain the general principles and demonstrate how to structure a model, set up the timeline, format cells by their purpose, make scenarios, create checks and controls, use flags.

The underlying Excel file contains a comprehensive demo model showing the most common working sheets (capital expenditure, funding, working capital, economic assumptions) and explaining how the income statement, balance sheet, and cash flow statement are built and tied together.

2. Give specific examples which cause complexities to many analysts. Such examples include circular calculations, proper demonstration of variances, calculating IRR and NPV with a few zero cashflow periods in the beginning, etc.

You will also find references to other publications I have posted. These publications dig deeper into various aspects of financial modelling and Excel and provide additional examples.

This publication is a work-in-constant-progress. Help me make it better – send me to word what else you think I should add.

Similar Products

Other customers were also interested in...

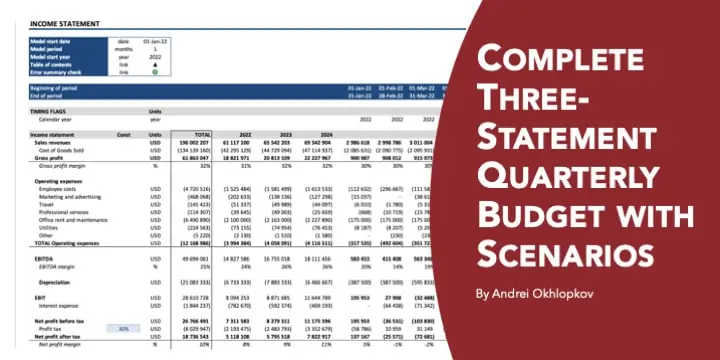

Complete Three-Statement Quarterly Budget with Sce...

This is a comprehensive set of templates that will help you build your budget. The templates are bui... Read more

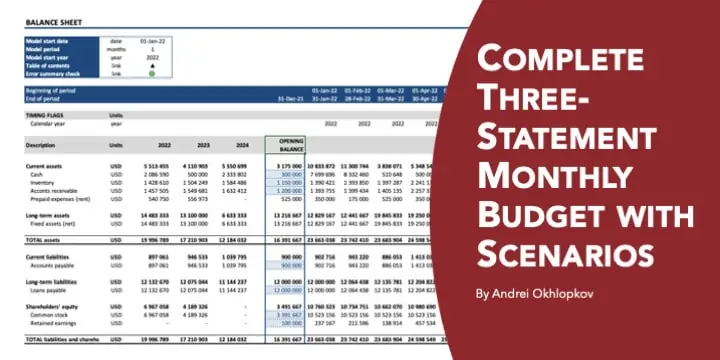

Complete Three-Statement Monthly Budget with Scena...

This is a comprehensive set of templates that will help you build your budget. The templates are bui... Read more

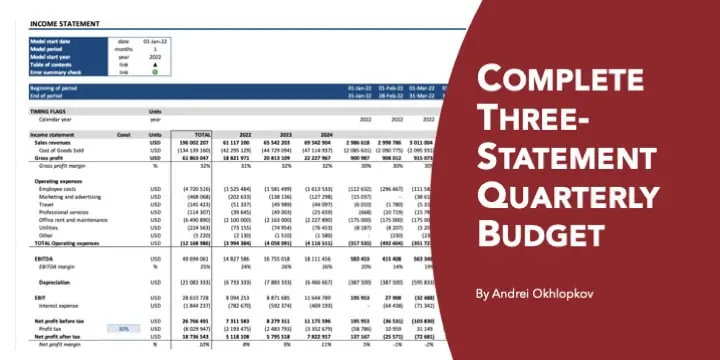

Complete Three-Statement Quarterly Budget

This is a comprehensive set of templates that will help you build your budget. The templates are bui... Read more

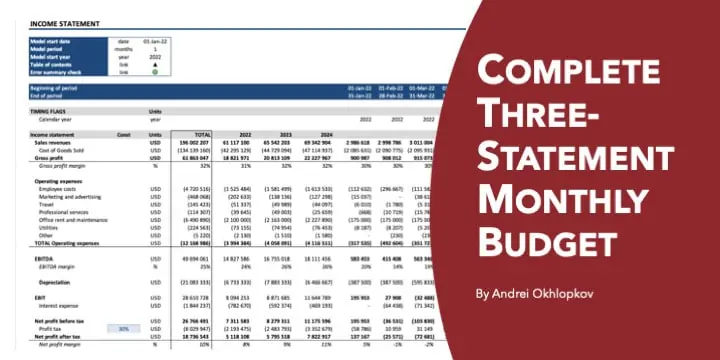

Complete Three-Statement Monthly Budget

This is a comprehensive set of templates that will help you build your budget. The templates are bui... Read more

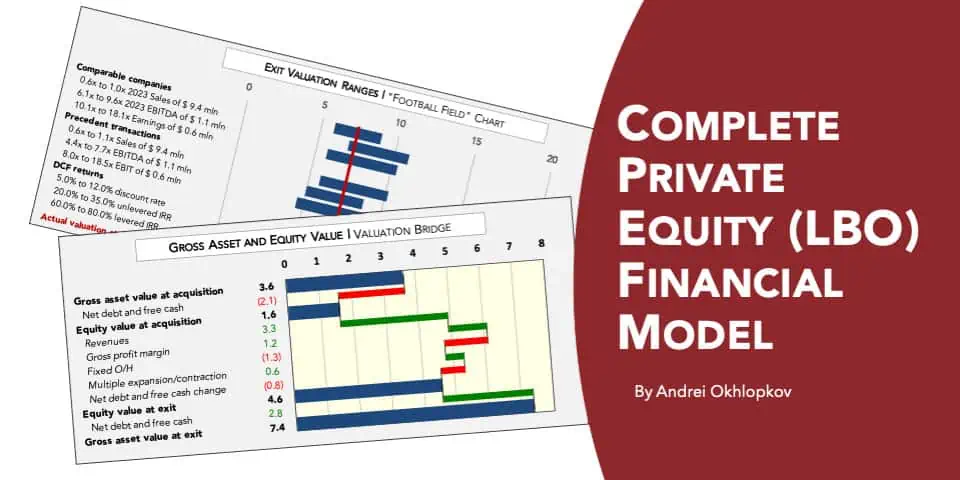

Complete Private Equity (LBO) Financial Model

This is a professional financial model which performs a thorough assessment of a private equity proj... Read more

Private Equity Fund Model (Investor Cashflows)

Private Equity Financial Model to analyze fund cashflows and returns available to Limited Partners (... Read more

All My Financial Models, Spreadsheets, Templates, ...

Lifetime access to all future templates as well! Here is a set of spreadsheets that have some of the... Read more

Franchisor Licensing: Financial Model with Cap Tab...

Build up to a 10 year financial forecast with assumptions directly related to the startup and operat... Read more

Startup Company Financial Model – 5 Year Fin...

Highly-sophisticated and user-friendly financial model for Startup Companies providing a 5-Year adva... Read more

Joint Venture and Fund Cash Flow Waterfall Templat...

Here are all the spreadsheets I've built that involve cash flow distributions between GP/LP. Include... Read more

Reviews

Excellent tool as a guide. From the Excel perspective it explain the general principles and demonstrate how to structure a model. Thumbs up

20 of 42 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

I left a review for this product a few days ago thinking it was just the guide with no model. I thought no-one would read the review but customer services got back to me very quickly and pointed me in the right direction of what I had to do to download the complete product. Very helpful and efficient after-sales service. Thank you very much.

23 of 42 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

The guide looks helpful but surely it’s supposed to come with an underlying excel file as indicated in the description. I only see the pdf guide to download, not the model and the guide is not so helpful when you don’t have the underlying model.

21 of 40 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

-

Dear Bryan, After checking your purchase history, you only downloaded the Free Guide; hence, you were only able to get the PDF guide. If you also downloaded the Free Materials, you will get the Excel file as mentioned in the description. Please feel free to download the Free Materials so that you can fully enjoy this Free Tool.

22 of 42 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

You must log in to submit a review.