Full Service Hospital Financial Model

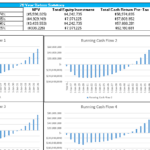

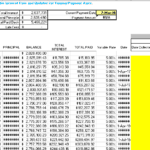

This financial model attempts to give the user a full scope of starting a 250 bed (adjustable) hospital. It will allow for all revenue and cost assumptions at a very complex level that is fully dynamic as well as show effects of a loan as % of startup costs and sale of building with leaseback.

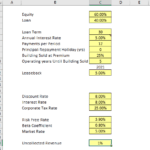

The easiest way to describe what you are getting with this is to start with the assumptions that will drive monthly/annual profit/loss summaries and a 20-year return sheet with IRR/ROI leveraged and un-leveraged.

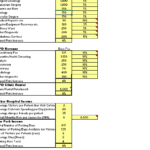

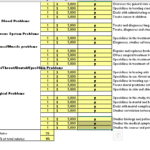

Income Assumptions Include:

1. Bed occupancy % by year.

2. Inpatient/Outpatients count per month by year.

3. Revenue: patient room (various sizes), specialty services, surgical theaters (various sizes), cafeteria, rental space, and parking garage.

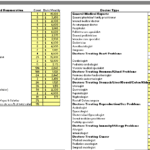

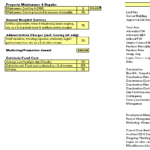

4. Expenses: Possibility of a % of fees going to doctor, regular doctor salary (choose if they get a fee/salary or one or the other, clinical salaries, admin salaries, property & maintenance, building/construction, medical record charges.

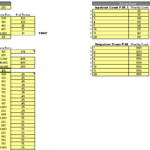

5. Financing: choose loan, term, possible holiday on debt payment, interest rate, and leaseback.

6. Pick a discount rate for NPV analysis.

All revenue and expenses give the option to adjust for rising prices at an annual rate per category.

Disclaimer: Note that you will have to go through and adjust all the cells in yellow across this model in order to fit your own assumptions.

*Revenue calculation of ancillary services: You will assign a % of total monthly patients (in/out) to each type of service, and the fee on those services represents what you expect to make on average per patient that receives those services.

Similar Products

Other customers were also interested in...

Assisted Living Facility: 10 Year Financial Model

Full stack financial model, including financial statement outputs, cap table, and bottom-up assumpti... Read more

HOSPITAL Financial Model Template

A comprehensive and customizable financial template that captures all the key aspects of the hospita... Read more

General Hospital Financial Model

General Hospital Financial Model consists of a financial model related to the start-up and operation... Read more

Medical Practice Financial Model Excel Template

Check Our Medical Practice Financial Projection. Simple-to-use yet very sophisticated planning tool.... Read more

Ophthalmology Financial Model Excel Template

Download Ophthalmic Center Pro Forma Projection. Creates a financial summary formatted for your Pitc... Read more

Dental Practice Financial Model Excel Template

Check Dental Practice Financial Model. Fortunately, you can solve Cash Flow shortfalls with a bit of... Read more

Clinic Financial Model Excel Template

Shop Clinic Financial Plan. Create fully-integrated financial projection for 5 years. With 3 way fin... Read more

Discounted Big Bundle Real Estate Valuation and Fi...

One Excel file for this bundle of Valuation and Financial forecasting models. Storage Parks, Hotels,... Read more

Outpatient Clinic Financial Model Excel Template

Shop Outpatient Clinic Financial Model Template. Enhance your pitches and impress potential investor... Read more

Clinical Lab Financial Model Excel Template

Order Clinical Lab Financial Projection Template. This well-tested, robust, and powerful template is... Read more

Reviews

HI how about Hospital Equipments and machineries? It was not included? and can i have projected balance sheet. Thanks

315 of 587 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

-

This does not include a balance sheet.

290 of 576 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

very useful website

279 of 561 people found this review helpful.

Help other customers find the most helpful reviews

Did you find this review helpful?

You must log in to submit a review.