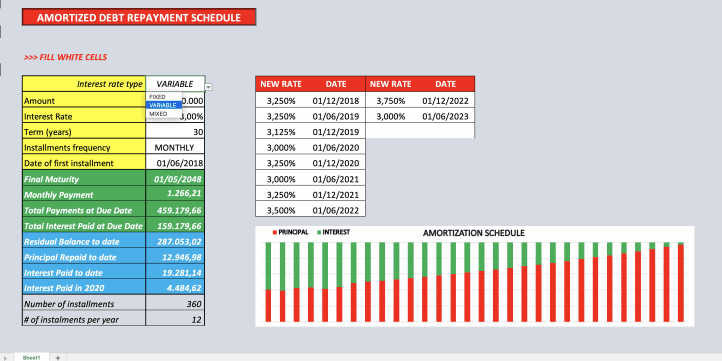

Amortized Debt Repayment Schedule Calculator

CALCULATE THE AMORTISATION SCHEDULE OF A MORTGAGE OR CONSUMER LOAN, EITHER AT FIXED OR VARIABLE INTEREST RATE OR BOTH (most online calculators only accept fixed interest rates)

This calculator will compute a mortgage or an amortized loan’s periodic payment amount at the defined payment intervals based on the principal amount borrowed, the term’s length, and the annual interest rate (fixed or variable), generating an amortization schedule for the full term, also in chart form.

An amortization schedule is a complete table of periodic payments, showing the amount of principal and the amount of interest that comprise each payment until the loan is paid off at the end of its term. While each periodic payment is the same amount early in the schedule, the majority of each payment is what is owed in terms of interest, while later in the schedule, the majority relates to the loan’s principal. Thus, the shorter the term of the loan, the lower the interest paid.

The model requires the following data inputs:

• Loan amount

• Interest rate type (fixed, variable, mixed)

• Interest rate

• Term (number of years)

• Installments frequency (monthly, quarterly, semi-annual, annual)

• Date of the first installment

Based on the above, the following information will be automatically generated:

• Amount of periodic payment

• Total payments at the due date

• Total interest payment at the due date

• Residual balance to date

• Principal repaid to date

• Interest paid to date

• Interest paid in the current year

• full amortization schedule

Similar Products

Other customers were also interested in...

Amortization Schedules Template (Loans, Mortgages,...

User friendly template including Amortization Schedules for Loans, Mortgages, Operating and Finance ... Read more

Lending Company Financial Model – 5 Year Forecas...

This Financial model template presents a business scenario of a corporation engaged in granting loan... Read more

Crowdlending (P2P) Platform – 5 Year Financi...

Financial Model providing an advanced 5-year financial plan for a startup Crowdlending (Peer-to-Peer... Read more

The Realtors Quintessential ALL-IN-ONE Toolkit

Professional Realtors need a professional Toolkit which allows them to operate at a higher level. Th... Read more

Discounted Big Bundle Real Estate Valuation and Fi...

One Excel file for this bundle of Valuation and Financial forecasting models. Storage Parks, Hotels,... Read more

Top 16 Google Sheet Templates

This is a bundle of all the most useful and efficient google sheet templates I have built over the y... Read more

Accounting Financial Model Bundle

This is a combined collection of Excel and Google Sheets financial model templates for Accounting an... Read more

Private Equity Fund Model (Investor Cashflows)

Private Equity Financial Model to analyze fund cashflows and returns available to Limited Partners (... Read more

All My Financial Models, Spreadsheets, Templates, ...

Lifetime access to all future templates as well! Here is a set of spreadsheets that have some of the... Read more

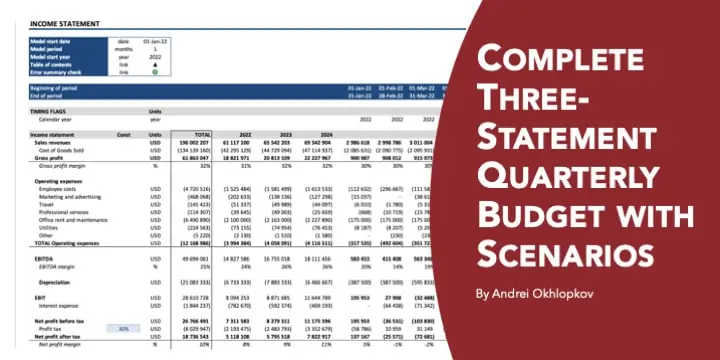

Complete Three-Statement Quarterly Budget with Sce...

This is a comprehensive set of templates that will help you build your budget. The templates are bui... Read more

You must log in to submit a review.