Investment Return Monte Carlo Simulation Excel Model Template

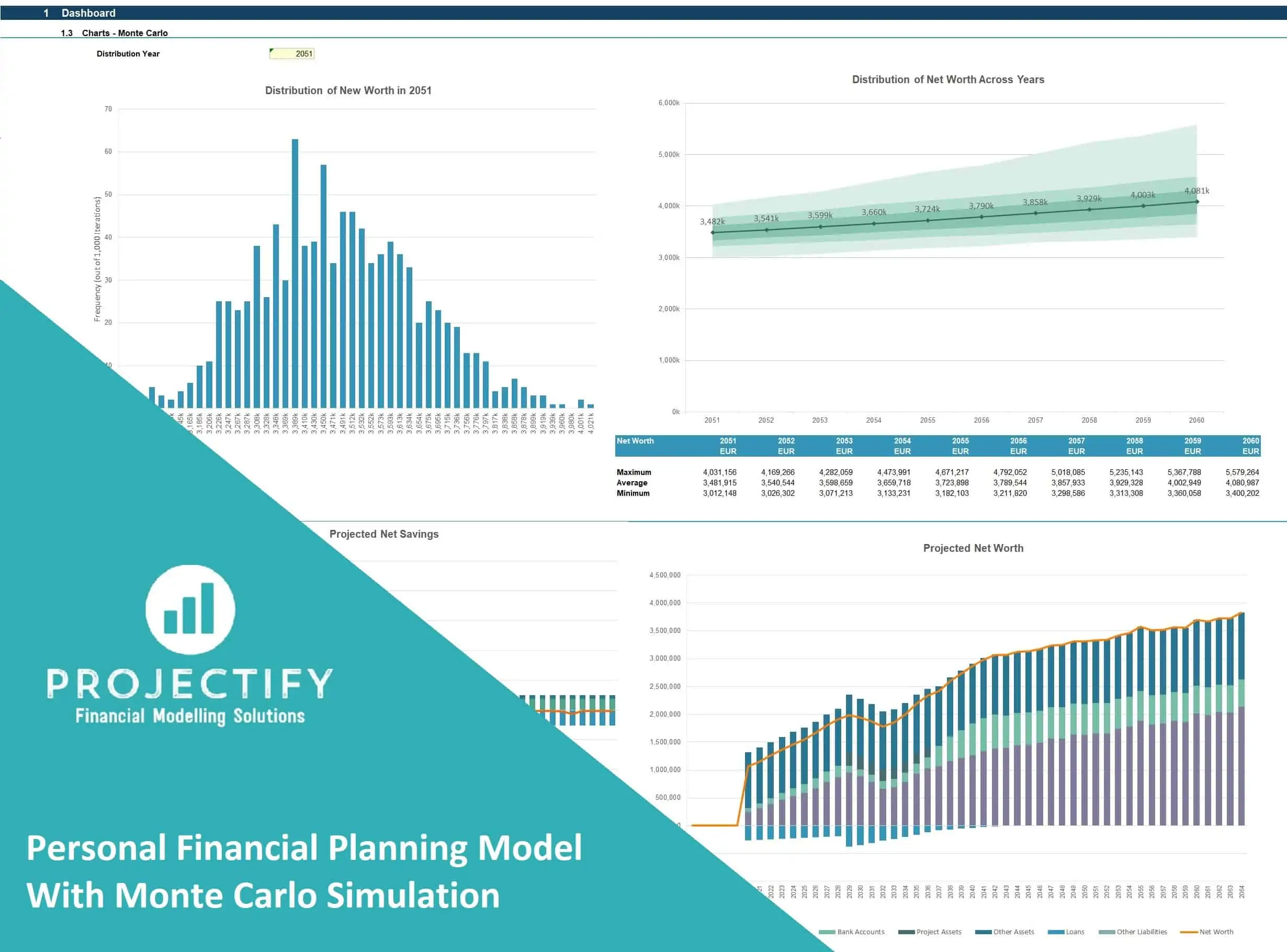

User-friendly Excel tool to calculate the expected value and return for an investment using Monte Carlo simulation analysis. The tool allows the user to specify the investment period and additions or redemptions over the investment period.

| Financial Model, General Excel Financial Models, Personal Finance |

| 10-year Financial Projections, Dashboard, Excel, Financial Model, Financial Planning, Forecast, Forecasting, Scenario Analysis |

PURPOSE OF TOOL

User-friendly Excel tool to calculate the expected value and return for an investment using Monte Carlo simulation analysis. The tool allows the user to specify the investment period and additions or redemptions over the investment period. The return and balance are calculated on a ‘real’ basis after removing the impact of inflation for a better measure of investment performance.

The model follows best practice financial modeling principles and includes instructions, line item explanations, checks, and input validations

KEY OUTPUTS

The key outputs include:

– Distribution chart of investment balances at end of investment period;

– Distribution chart of the total investment return over the investment period;

– Key results/ratios including average investment balance, average investment return, average total additions/redemptions;

– Table showing total investment balance, the investment return, and additions/redemptions across percentiles in intervals of 5%.

KEY INPUTS

The key inputs include

– Investment Name

– Currency

– Calculation Year

– Balance at Start

– Investment period in years

– Additions/redemptions per annum

– Average return per annum

– Inflation rate

– Standard deviation of return

MODEL STRUCTURE

The model contains, 5 tabs split into input (‘i_’), calculation (‘c_’), output (‘o_’) and system tabs. The tabs to be populated by the user is the input tab (‘i_Assumptions’). The calculation tab uses the user-defined inputs to calculate and produce the project outputs which are presented in ‘o_Results’

System tabs include:

– A ‘Front Sheet’ containing a disclaimer, instructions, and contents;

– A Checks dashboard containing a summary of checks by a tab.

KEY FEATURES

Other key features of this model include the following:

– The model follows best practice financial modeling guidelines and includes instructions, line item explanations, checks, and input validations;

– The model allows for a maximum remaining investment period of 100 years;

– The model uses Monte Carlo analysis to simulate the investment return and balances for up to 1,000 iterations;

– Investment Name, currency, calculation year are fully customizable;

– The model includes instructions, line item explanations, checks, and input validations to help ensure input fields are populated accurately;

– The model includes a checks dashboard that summarises all the checks included in the various tabs making it easier to identify any errors.

ABOUT PROJECTIFY

We are a small team of financial modeling professionals with experience working in Big 4 Business Modelling teams and strong experience supporting businesses with their financial planning and decision support needs. Our aim is to provide robust and easy-to-use tools that follow best practice financial modeling guidelines and assist individuals and businesses with common financial planning and analysis processes.

We are keen to make sure our customers are fully satisfied with the tools/models they purchase and will be more than happy to assist with any questions or support required following or in advance of purchase.

We are also always keen to receive feedback so please do let us know what you think of our products/offering by sending us a message or submitting a review.

This model template comes as a TRIAL or PREMIUM version in .xlsx and .pdf file type which can be open using MS Excel and any PDF File Viewer.

Similar Products

Other customers were also interested in...

Top 16 Google Sheet Templates

This is a bundle of all the most useful and efficient google sheet templates I have built over the y... Read more

Accounting Financial Model Bundle

This is a combined collection of Excel and Google Sheets financial model templates for Accounting an... Read more

Amortization Schedules Template (Loans, Mortgages,...

User friendly template including Amortization Schedules for Loans, Mortgages, Operating and Finance ... Read more

Generic 5-Year Monthy Rolling Financial Projection...

PURPOSE OF TOOL Highly versatile and user-friendly Excel model for the preparation of a 5-year rol... Read more

Investment Holding Company 3 Statement Financial P...

3 statement 5 or 8 year rolling financial projection Excel model for an investment holding company h... Read more

Multi-Entity Group Generic Monthly 5-Year 3 Statem...

User-friendly 3 statement 5 year rolling financial projection Excel model for a Multi-entity Group (... Read more

Leveraged Buyout (LBO) Financial Projection Model

User-friendly financial model to project and analyse the financial outcomes (IRR, projected financia... Read more

Divestiture (Cash Sale) Financial Projection Model

User-friendly financial model to project and analyse the financial outcomes (valuation, projected fi... Read more

Management Buyout (MBO) Financial Projection Model

User-friendly financial model to project and analyse the financial outcomes of a management buyout (... Read more

Personal Financial Planning Model with Monte Carlo...

User-friendly excel model to project personal or family cash flow and net worth across a 50-year tim... Read more

You must log in to submit a review.